2021W1 - WTF happened in bitcoin this week?

Nothing can stop the hodlers.

TLDR: More whales, more hodlers, less bitcoin on exchanges, bitcoin surging.

The year started with bitcoin crushing over $30K and rushing all the way piercing $40K.

People start wondering, is this sustainable? The answer to this question in the short term is irrelevant. But long term, we are looking bullish boys and girls.

1. JP Morgan forecasts that the long-term price of bitcoin could lead all the way up to $146,000. (This comes from a company who said it was a scam and would fire any employee who was found trading it).

2. SkyBridge made public their Nov/Dec 2020 position worth ~300M (10% position) as of January 2021. Opening doors of their fund for accredited investors in the US.

“We believe we’re in the early innings of a new asset class with tremendous upside.”

“Imagine every model portfolio where gold has become an accepted asset class, every model portfolio has a 1% exposure to bitcoin and you can see the magnitude of where bitcoin could be” – Scaramucci.

3. The OCC regulation allows US banks to use public blockchains and dollar stable-coins as settlement infrastructure in the US financial system. *This could help integrate economies from different countries and achieve faster settlements.

4. Coincidentally the amount of bitcoin whales has increased since the OCC[3] announcement.

5. Nations start/continue to announce their mining operations: Gazpromneft, a Russian company, began a cryptocurrency mining operation based in one of its Siberian oil drilling sites, “unlocking the power of Russia’s oil and gas resources for the needs of bitcoin mining”.

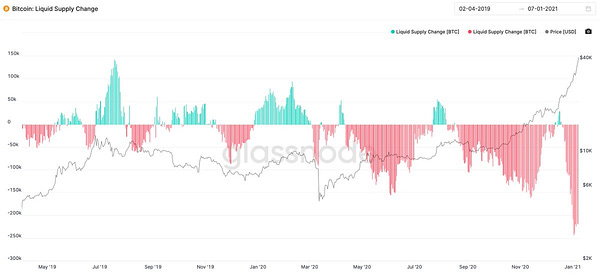

6. “Dormancy Flow has reached the bull/bear threshold” – Glassnode. The amount of value of bitcoins being dormant (or not moved in at least a year) is increasing. Basically, people are holding, if less people are selling, then the availability of bitcoins for purchase is not enough to meet the demand. (Bullish)

7. This market is led by Hodlers. “Not your keys, not your coins”

8. Strike goes global. “Send money anywhere, any time, in seconds, and at no cost”.

9. Bitcoin is getting more and more distributed between players. Even though the amount of whales has been increasing (21% of the Network), 56% of the network belongs to non-whale HODLers. Miners hold 10%, a number which is increasing since 2019, also an indication of a bull market. Finally number of wallets with more than 100K Bitcoin, has been decreasing, another point in favour of distribution between players.

Podcast of the week:

Jack Mallers is changing the world by building an inclusive monetary network, Strike.

Allowing people get pay and get paid in bitcon/fiat while the sender sends bitcoin/fiat.

#222 Beefing with the NFL with Jack Mallers – Tales from the Crypt: A Bitcoin Podcast

As a summary note…

Adoption is increasing, whales are increasing, bitcoins are mostly going to wallets from exchanges, so people are mostly buying, and building longer term positions. The horizons and sentiments are looking optimistic. The sell offs have been of 10%-20% throughout this bull market, and people (the plebs) keep stacking, and exercising their monetary sovereignty.

Stay humble & stack sats.

Reference:

1.

2.

2.1

3.

4.

5. https://www.zerohedge.com/energy/russian-energy-giant-mining-bitcoin-virtually-free-energy

6.

7.

8.

9.

Podcast:

?si=Kj3wPB_6R_mE4nHw__-Rdg&context=spotify%3Ashow%3A0Vd8E5vWnCfB4xucu87WNZ