2021W10 - WTF has happened in bitcoin this week?

Bitcoin is in price discovery

TLDR: Bitcoin reaches $60,000, Oil Companies start to make a move towards the bitcoin space, and Michael Saylor stack sats.

Hey there niblings, its uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

It just seems that each week gets more and more bullish. First thing to address is, of course, the price. This week is a special one, we reach new highs, bitcoin sees $60,000 for the first time. It is interesting how high it can be, just when exactly a year ago, we were trading under $4,000, it we had over 60% dump in a matter of days, being March 12, the reddest day in bitcoin history.

It all can be a matter of perspective. The “dumb” investors throwing their money into a “speculative asset” are now the “lucky” ones who got into bitcoin early.

Well one thing is clear, experiencing those downturns, that immense volatility, and having held or even stacked, is not called luck, but conviction. The truth is that it has never been easier than nowadays. Every other week we get validation from different investors around the world, and this week was no different.

This week Kjell Inge Rokke, chairman of Aker ASA, an Oil Billionaire and the 9th richest man in Norway, wrote a letter to their shareholders announcing an investment of ~$60 million in bitcoin and the establishment of Seete. The company has 3 objectives:

- Be a ‘hodler’, but in an additive way.

- Establish mining operations with renewable energy – wind, solar, hydro power.

- Build and invest in projects and companies in the Bitcoin ecosystem.

Rokke, basically is not coming to the space as an investor only, he and his partners find long-term value in bitcoin as a hard money asset, and believe that in five years, there will be countless of companies operating in the space, generating value, and that the network’s value is basically a Stairway to Heaven.

And this is how the f*#$ing week started:

1. Norwegian Oil Company, Aker ASA, joins the bitcoin bet. The Oil company, announced to have established Seetee, and purchased close to ~$60 million in bitcoin, expecting to increase the position significantly over time.

Kjell Inge Rokke, chairman of Aker ASA, released a letter to the shareholders explaining the value they see in bitcoin, and the possible future of the asset.

“The direction is clear: finance will be disrupted as surely as fossil fuels will be. The question is not if, but when” – Kjell Inge Rokke

2. Michael Saylor has purchased an additional 262 bitcoins for ~15 million, at an average price of ~57,146 per bitcoin. The company now holds ~91,326 bitcoins acquired for ~$2.211 billion at an average price of ~24,214 per bitcoin.

“In other words, MicroStrategy is just stacking sats, regardless of the price” – Bam

3. Meitu, a chinese photo editing app, has purchased $17.9 million worth of bitcoin for their balance sheet. They became the first Chinese public traded company to invest in bitcoin.

4. Paypal is acquiring the crypto security company Curv, for less than $200 million.

“The acquisition of Curv is part of our effort to invest in the talent and technology to realize our vision for a more inclusive financial system.” - Jose Fernandez da Ponte, PayPal vice president

5. Jack Dorsey tokenized and auctioned his first tweet. The bidding will close this march 21st, 2021. The highest offer is of $2.5 million up until now.

Jack announced the proceeds will be converted into bitcoin and donated to GiveDirectly Africa Response.

6. Israeli pension company, Altshuler Shaham reported to have sunk $100 million into the Grayscale Bitcoin Trust, back when the asset was trading around $21,000.

7. BlockFi has taken on $350 million in Series D venture capital funding - one of the largest to date among blockchain and cryptocurrency startups. The deal increases the company's private valuation to $3 billion, up from a $435 million valuation when it raised $50 million in Series C funding just six months ago. – Forbes

8. Almost 1% of the total bitcoin supply is now being held by public companies as treasury reserve. 25 public traded companies own a little over 195000 bitcoins.

FUNDAMENTALS

The great part of this week is the solid metrics being displayed by on-chain bitcoin analysis, in general, we can find bullish and healthy signals on the bitcoin network.

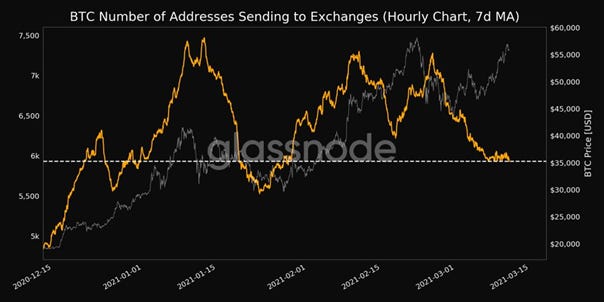

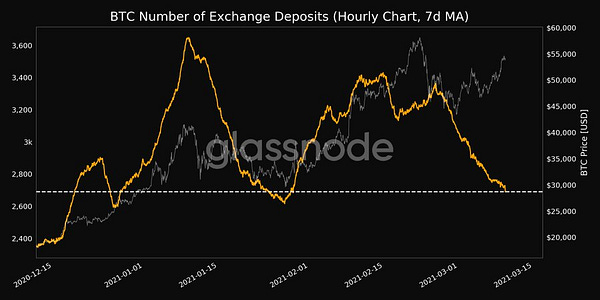

9. William Clemente shows us this week a chart displaying the number of bitcoin deposits on exchanges. By the looks if it, we could see the trend going down. As we see big purchases from entities and no bitcoins entering exchange, it basically indicates supply suffocation.

10. The distribution seems to continue to “even out”. As the “Humpbacks” holding more than 10000 bitcoins realize gains, institutions and individuals continue to stack, and new holders are created.

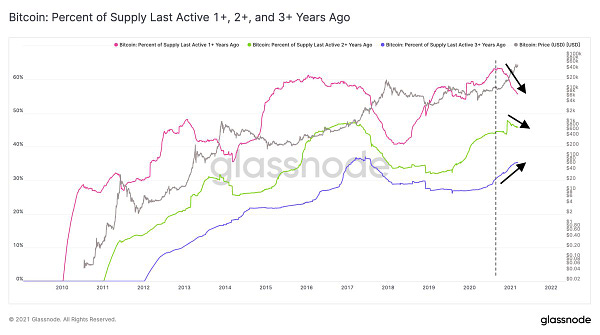

11. Rafael Schultze-Kraft, shows us the trend of the hodlers. By analyzing the addresses, he summarizes the following chart with the following:

“1+ year hodlers: selling

2+ year hodlers: selling

3+ year hodlers aka "been in a bull market before and know how this works": stacking sats” – Rafael

If we all learn from experience, perhaps we all would be stacking in these moments.

As a summary note…

Ok niblings, I guess we can say, bitcoin is undefeated.

The fundamentals are clear, we see price suffocation, long term hodlers increasing their positions, and bitcoin being distributed in more hands than before. Here in WTFBitcoin, we think we will see prices above $150K per bitcoin this year. Yes, we said it last week, but now we are a bit closer than before.

The most important thing to remember that the space is developing, the network effect is increasing, and maintaining a high conviction comes in handy when the price is not representing the pace of the development we experience weekly.

Congratulations all of you who have been holding strong to your investments, stacking and also to all of you niblings who are new in the space and have reached this beautiful milestone. Bitcoin touches for the first time in history $60,000. With patience, $70,000, $80,000 will follow.

It is only a matter of time.

Bitcoin is artificially designed to appreciate forever.

Stay humble & stack sats.

…

You want to contribute to WTFBitcoin?

Feel free to donate.

References:

1. https://financialpost.com/pmn/business-pmn/norwegian-oil-billionaire-joins-the-bets-on-bitcoin

Shareholder letter: https://www.seetee.io/

2.

4.https://www.cnbc.com/2021/03/08/paypal-to-acquire-crypto-security-company-curv.html

6.https://www.coindesk.com/israeli-pension-giant-put-100m-into-grayscale-bitcoin-trust-report

8.https://bitcointreasuries.org/

9.

11.

+-_.*ThE sTar Of hoPe*._-+