2021W13 - WTF has happened in bitcoin this week?

Bitcoin is becoming a pristine collateral

TLDR: Bitcoin is a pristine collateral, the banks are fighting to be the first to adopt it, and it becomes a way to do remittances at zero cost.

Hey there niblings, its uncle ₿am again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

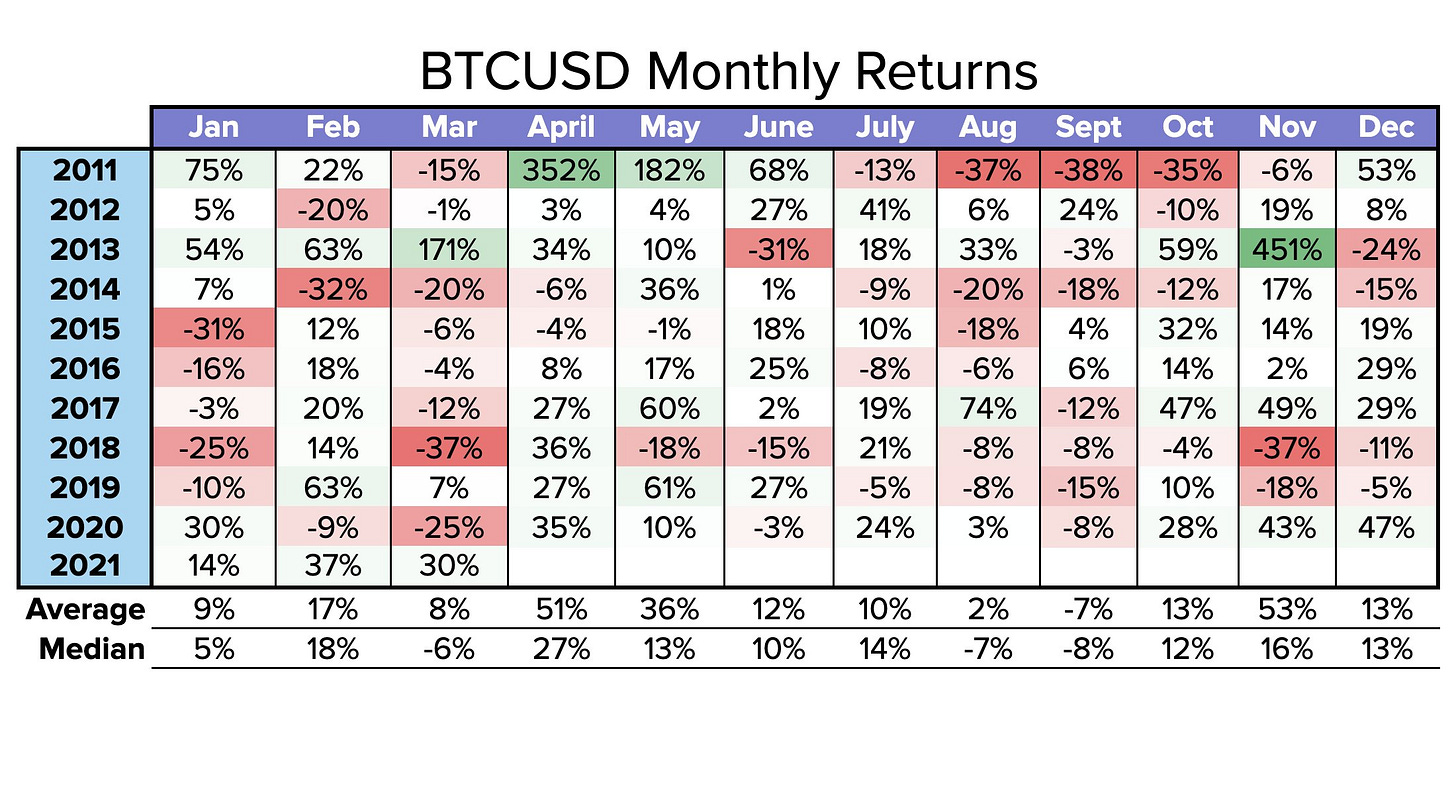

I’m sure this week got us all excited in terms of price. Bitcoin came back from the “lows” and pushed all the way to $59,000 at the moment of writing. At the beginning of this month you could see many of the day-traders warning their followers of March due to its reputation of being a red month, but we ended up experiencing a 30% return this march of 2021, the highest return since 2013.

Here is a picture by Pete Humiston showing us the returns bitcoin has had throughout history. If you look carefully, we just had 6 positive months in a row, that is a new record.

But let us speak about the news for a moment, with the one I think is one of the most interesting one this week: “Fidelity extends bitcoin-backed loans through Silvergate Bank”. This is a big step towards normalization of banks being involved in the space and offering loans using your bitcoin as a collateral is a path of never paying taxes on your returns on bitcoin. What does this mean uncle Bam is this ilegal?

You might ask..

Simple, it basically means that in the future, you won’t be needing to sell your bitcoin, ever.

Right now, holding bitcoin means to have an appreciating asset with a compound annual growth rate (CAGR) of over 200%. If you could get a loan with a low interest rate, (1-3%) by using your bitcoin as a collateral, that means you do not have to pay taxes on the returns, since you would never realize them. Every year you could get more loan for your collateral, and while your debt increases, the value of your collateral is increasing an order of magnitude higher.

Bitcoin is becoming a pristine collateral.

And this is how the f*#$ing week started:

1. Visa Inc. will allow the use of the cryptocurrency USD Coin (stablecoin) to settle transactions on its payment network.

“We see increasing demand from consumers across the world to be able to access, hold and use digital currencies and we’re seeing demand from our clients to be able to build products that provide that access for consumers” - Cuy Sheffield, head of crypto at Visa

2. Bank of New York (BNY) releases a report about Bitcoin’s value proposition, declaring it an emerging currency with properties similar to gold. They make reference to @100trillionUSD´s stock-to-flow model, which suggests that the price could skyrocket to the market capitalization similar to gold due to its continues demand and verifiable scarcity.

3. Suarez, Miami mayor, mentioned in an interview the possibility of Miami to set up a Bitcoin mining hub as part of this national security/environmental conservation goal, with objective to mine Bitcoin with cleaner energy, contribute in securing the network, and changing the narrative to a more positive one.

4. During a panel discussion hosted by the Chicago Board Options Exchange (CBOE last week, CEO of investment management firm Ark Investment Management, Cathie Woods, shared her bullish sentiment.

“If we add up the potential demand relative to the limited supply, we come up with incredible numbers over the long term… We have just begun. $1 trillion is nothing compared to where this ultimately will be.”

5. Oakland’s A team announced their plan hold the bitcoin obtained from ticket sales.

6. Texas chases after Wyoming in terms of Bitcoin regulations. And the governor Greg Abbot, gives his full support towards the remaining challenges.

7. Silvergate Bank will be the second lender to extend bitcoin-backed loans to investors who custody their crypto with Fidelity.

“Like Silvergate, we recognize the opportunity to create a more seamless investor experience by helping institutions maximize capital efficiency, as well as the opportunity to strengthen the digital assets ecosystem through greater integration and collaborations like this,” Christine Sandler, head of sales and marketing at Fidelity Digital Assets

8. CME announces its future introduction of micro Bitcoin futures. The futures are 1/10th a bitcoin.

9. Less than two weeks after Morgan Stanley said it will start offering bitcoin exposure to its wealthy clients, banking powerhouse Goldman Sachs is also pushing deeper into the space, telling CNBC this week that it’s looking to offer a “full spectrum” of cryptocurrency investments for its private wealth clients within the next few months.

10. Strike launches in El Salvador. From now on, people could send remittance from the US to el Salvador for no cost. Europe will follow with its launch, allowing users to convert their salaries into bitcoin.

FUNDAMENTALS

11. BTC_Archive shares with us the declining supply of bitcoin in exchanges. Even at record prices in this bull market, the supply in exchanges continues to constantly plunge in the last 13 months. In other words, even if not reported, institutions or big entities continue to purchase, claim, and hold their bitcoin investments.

As a summary note…

The space keeps evolving and adoption continues to increase at a constant rate. It is indeed a bliss to see all this development going on, and the price supporting all the good news we have been sharing with you here at WTFBitcoin, while we enjoy this long easter weekend with our families or friends. It is easy to get carried away by the wild swings of this bitcoin beast, but remember that family comes first.

Happy Easter! Stay humble and stack sats!

Oh yes, and Paris Hilton is one of us, she just made it public and Michael Saylor officially welcomed her to Bitcoin Twitter.

Bitcoin is artificially designed to appreciate forever.

…

You want to contribute to WTFBitcoin?

Feel free to donate. But more importantly, share this with your friends and family..

Reference:

1. https://www.reuters.com/article/crypto-currency-visa-idUSB8N27V00M

2. https://www.mellon.com/documents/264414/269919/blending-art-and-science-bitcoin-valuations.pdf/6739cd1d-5fa5-9c29-ce93-ac46320547c0?t=1615498375904

3. https://cointelegraph.com/news/90-of-bitcoin-mining-comes-from-dirty-energy-miami-mayor-says

4. https://www.nasdaq.com/articles/ark-invest-ceo-cathie-wood-on-bitcoin%3A-%241-trillion-is-nothing-2021-03-29?amp

5. https://news.bitcoin.com/pro-baseball-team-the-oakland-as-plans-to-hold-bitcoin-obtained-from-ticket-sales/

6. https://cointelegraph.com/news/texas-chases-after-wyoming-with-crypto-law-proposal-but-challenges-remain/amp

7. https://finance.yahoo.com/news/fidelity-now-extends-bitcoin-backed-140815980.html#:~:text=Silvergate%20Bank%20will%20be%20the,partnering%20with%20crypto%20lender%20BlockFi

8. https://finance.yahoo.com/news/cme-group-cme-introduce-micro-125612608.html

9. https://www.forbes.com/sites/jonathanponciano/2021/03/31/goldman-sachs-to-become-second-big-bank-offering-bitcoin-to-wealthy-clients/

10. https://www.coindesk.com/strike-launches-bitcoin-lightning-payment-app-in-el-salvador-full-eu-support-is-next

11.