2021W14 - WTF has happened in bitcoin this week?

Bitcoin is being accepted as medium of exchange

TLDR: Bitcoin is back to $60,000. Bullish predictions from institutions. Corporations accepting it as payment.

Hey there niblings, its uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

This week ends up being an exciting one again. With the price of bitcoin reaching levels close to all time highs, more companies joining the space the euphoria continues.

Where do we stand now? Well, we see the price of bitcoin oscillating around ~$60,000, and it is naturally for many to think whether this will continue going or it has reached a peak. The truth is that in the short term, it is hard to tell, in the longer term, we believe bitcoin is design to appreciate forever.

History does not necessarily repeat itself but certainly could rhyme. The most unbelievable part of this cycle is seeing big names throwing out their forecast and putting their reputation on the line, few examples are the following:

Institutional forecasts for the current bitcoin bull-run:

JPMorgan $ 130,000

CitiBank $ 318,000

Guggenheim $ 600,000

Bloomberg $ 400,000

Now, how is this be possible? Well, bitcoin has gone through a supply shock we all call “the halving”. This basically reduces the mining supply by half every four years, and if we consider the demand to be constantly or exponentially increasing, then the price goes through a parabolic appreciation. Mat Odell shared with us a chart from The Block, where this comparison is made with the previous cycles:

The price at the halving was around $9,000. If we have an appreciation anywhere from 2000% to 8000%, we could experience a top anywhere from $180,000 - $720,000 in this cycle. But don’t take this numbers seriously, as we know anything can happen, it is just a way to display the possibilities and to show that it is still early, and “the halvings” will continue to occur every 4 years.

And this is how the f*#$ing week started:

1. Michael Saylor bought bitcoin again! MicroStrategy has purchased an additional ~253 bitcoins for $15.0 million in cash at an average price of ~$59,339 per bitcoin. They now hold ~91,579 bitcoins acquired for ~$2.226 billion at an average price of ~$24,311 per bitcoin.

2. Sacramento Kings will offer to everyone in their organization to get paid as much of their salary in bitcoin as they want. This statement was said by Ranadivé, the CEO, via clubhouse.

3. Fortress Technologies, will invest $15 million in mining equipment through Great American Mining, a mining company that converts stranded gas into bitcoin, with the hopes of capturing more hash rate in Americas.

“I believe the future of bitcoin mining will need to be environmentally conscious, seeking out stranded energy sources..” Roy Sebag, Fortress Chairman.

4. The Lightning network, a bitcoin second layer protocol, has now over 10,000 public nodes compared to just over 5,000 nodes last year, this is now over $69 million dollars in value being locked in the second layer, for it to be used with minimal fees. Exchanges such as River Financial, Bitfinex are now accepting lightning deposits and withdrawals, and others like Kraken, announced to do so too.

5. Ukranian public official reported owning 46,351 bitcoin, or $2.67 billion at Wednesdays price. Mishalov, a member of the Dnipro city council, reported owning 18,000 bitcoin. Let that sink in, this can be consider a reflection of the understanding of the Bitcoin protocol, or a lack of belief in their own local currency.

6. Riot Blockchain, announces a milestone purchase of 42,000 S19j Antminers, to grow their total hash rate to 7.7 EH/s upon next year. Riot is an American public traded company in the NASDAQ.

7. Caurso, a California billionaire real estate firm, partnered up with Gemini, a cryptocurrency exchange, and announced to begin allowing tenants to pay rent in bitcoin.

“It is not about the next year or five years, but rather a long term bet” - Rick Caruso, CEO

The company additionally placed 1% of their balance sheet into bitcoin, and expect this number to grow while accepting it as a medium of exchange

8. Bloomberg released the April edition of its ”Crypto Outlook” where it outlines the bullish narratives around bitcoin. One of the highlights is their analysis of the previous bitcoin cycles and their prediction of the asset reaching highs up to $400,000 in 2021. “To reach price extremes akin to those years in 2021, the crypto would approach $400,000, based on the regression since the 2011 high.” – Bloomberg

9. Michael Saylor while preparing for his debate of Bitcoin vs Gold against Frank Giustra, shared this marvelous chart comparing the Compounded annual growth rates for the last 10 years of distinct asset classes, having bitcoin outperform every single one of them.

FUNDAMENTALS.

On-chain Analysis continues to be exciting. The following three charts have could be used as an argument for the following question…

“Are we on the top?” The answer is probably.. no, we are not.

10. The 7th of April, 45,000 bitcoin were withdrawn from exchanges. The last time this happened in a single day was in June 2017. This was not the end of the bull market. It is an indication that institutions, or big players are still accumulating and not willing to sell, shared by IIICapital.

11. Rafael Schultz shares with us the 3-month coin days destroyed adjusted by age. You can find the definition here, but overall, we can see that this metric hit high values when we could consider a bitcoin top. Now, it seems to have retraced close to where we could call an “accumulation phase”.

12. William Clemente, shares with us an interesting correlation. Bitcoin seemed to have been approaching to a top, if we considered how much bitcoin was being sent into exchanges, the metric was increasing, and now it seems to be decreasing rapidly. We can’t clearly attribute this to being Tesla’s effect, but it was probably a game changer to see one of the companies of the second richest man in the world, to acquire bitcoin for their balance sheet. It puts pressure on everyone else to accumulate bitcoin.

As a summary note…

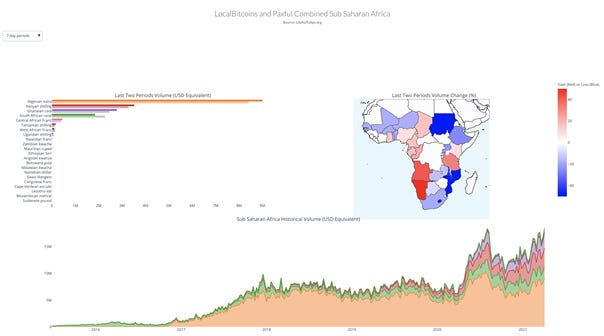

The bitcoin network continues to grow, there is no denial on that. It is easy to advocate against it when you are living in your own first world country bubble, and do not open your eyes. But hey niblings, be aware of what is happening in the world around you. The demand for owning the asset is frantically increasing in the African continent. It might not even be that they understand the value proposition early, they might not see any better option out of their financial oppressive regime. Matt Alborg shares us this incredible infographic from his website usefultulips.org.

At this point in time it is hard to deny the growing network effect of bitcoin, and as @BitcoinTina says: “If you hate Bitcoin just buy a 1% position. You can still hate Bitcoin, but at least you won't hate yourself.”

Have a great weekend niblings.

Bitcoin is artificially designed to appreciate forever.

Stay humble & stack sats.

…

You want to contribute to WTFBitcoin?

Feel free to donate. But more importantly, share this with your friends and family..

References:

1.

3.https://www.coindesk.com/oil-gas-miner-canadian-tech-firm-green-bitcoin-mining

4. https://www.nasdaq.com/articles/bitcoins-lightning-network-now-has-10k-active-nodes-and-%2469m-in-locked-value-2021-04-05

5. https://www.coindesk.com/crypto-whale-watching-may-become-popular-at-ukrainian-town-council-meetings