TLDR: Bitcoin consolidated in $60,000. Rai Dalio says bitcoin has value. The bull run is not over yet.

Hey there niblings, its uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

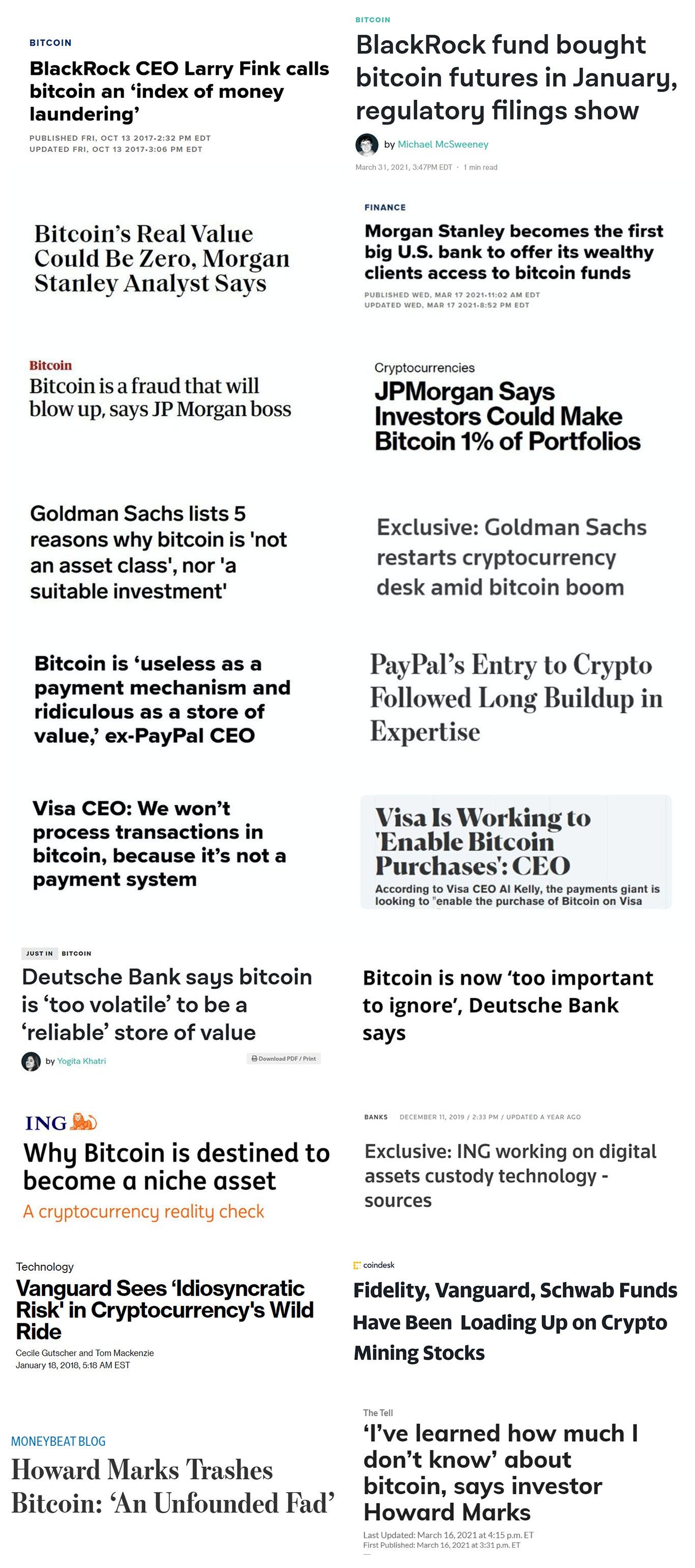

Bitcoin humbles you. Throughout the time, we have seen different personalities/entities/“experts” in the mainstream media telling us that bitcoin does not have “intrinsic value”, that bitcoin is not going to make it, bitcoin is boiling the oceans, bitcoin this and bitcoin that. Well let me tell you, it doesn’t matter, bitcoin does not cares.

by Documenting_BTC

Now we can see institutions changing their minds. It clearly didn’t matter what their “expert” opinion was about bitcoin a couple of years ago, bitcoin humbled them and now they see the potential, or at least we hope so, for their own sake, or else they will end up selling too soon.

This week we have seen Ray Dalio, who used to be a skeptic about bitcoin, change his mind and not only recognizing its value, but declaring that we should be striving to have bitcoin as a portfolio diversifier.

”Bitcoin has proven itself... as money with imputed value.” - Ray Dalio.

At the end of the day bitcoin does not care. Bitcoin is only a protocol, an open monetary network, a monetary tool allowing every single individual to easily be part of it, interact with other users through the transfer of value and have personal custody of his/her own funds.

Bitcoin has value because every single member of the network believes so. Because we, the “hodlers”, are willing to put our trust into a decentralized system based on math. We believe in this finite scarce asset knowing that our value won’t be debased 2% on a yearly basis. Because it is our insurance, and we find safety in sats.

And this is how the week started.

Bitcoin trades comfortably over $60,000 for a week.

Michael Saylor announced that the board of directors of MicroStrategy will now be paid in Bitcoin.

Grayscale will be teaming up with Time magazine, for a video series, where Time agreed to be paid in Bitcoin and to hold it in their balance sheet.

Jack Mallers continues onboarding people on the opportunity to earn part of their salaries in bitcoin via Strike (or even fully).

Southampton FC have signed a shirt sponsorship deal with Sportsbet.io that will allow the club to receive performance bonuses in Bitcoin.

Michael Morell, the former CIA Director, published an independent paper where he stated that there is less illicit activity on bitcoin than in traditional banking system.

Jurrien Timmer, the Director of Global Macro in Fidelity, is now even publishing twitter threads about bitcoin’s two unique properties: asymptotic supply curve and exponential demand curve.

“I think Bitcoin is on an inevitable path to have the same market capitalization and then a higher than gold “ - David Solomon, Goldman Sachs CEO, on CNBC.

Insurance giant AXA Switzerland now allows customers to pay premiums in Bitcoin.

Greg Abbott, the governor of Texas, welcomes the Headquares of Blockcap, as they announced to be moving to Austin, Texas.

Brevan Howard Asset Management, a hedge fund with $5.6 billion in assets under management, will start buying bitcoin and cryptocurrencies with 1.5% of its portfolio.

Ray Dalio talked in Texas A&Ms Bitcoin Conference saying “Bitcoin has proven itself… as money with imputed value”

Real Estate is now being sold in bitcoin in distinct coutnries.

Britain's most expensive apartment is on sale for $240m - #Bitcoin accepted as payment! 😂 the world is changing...

Britain's most expensive apartment is on sale for $240m - #Bitcoin accepted as payment! 😂 the world is changing...

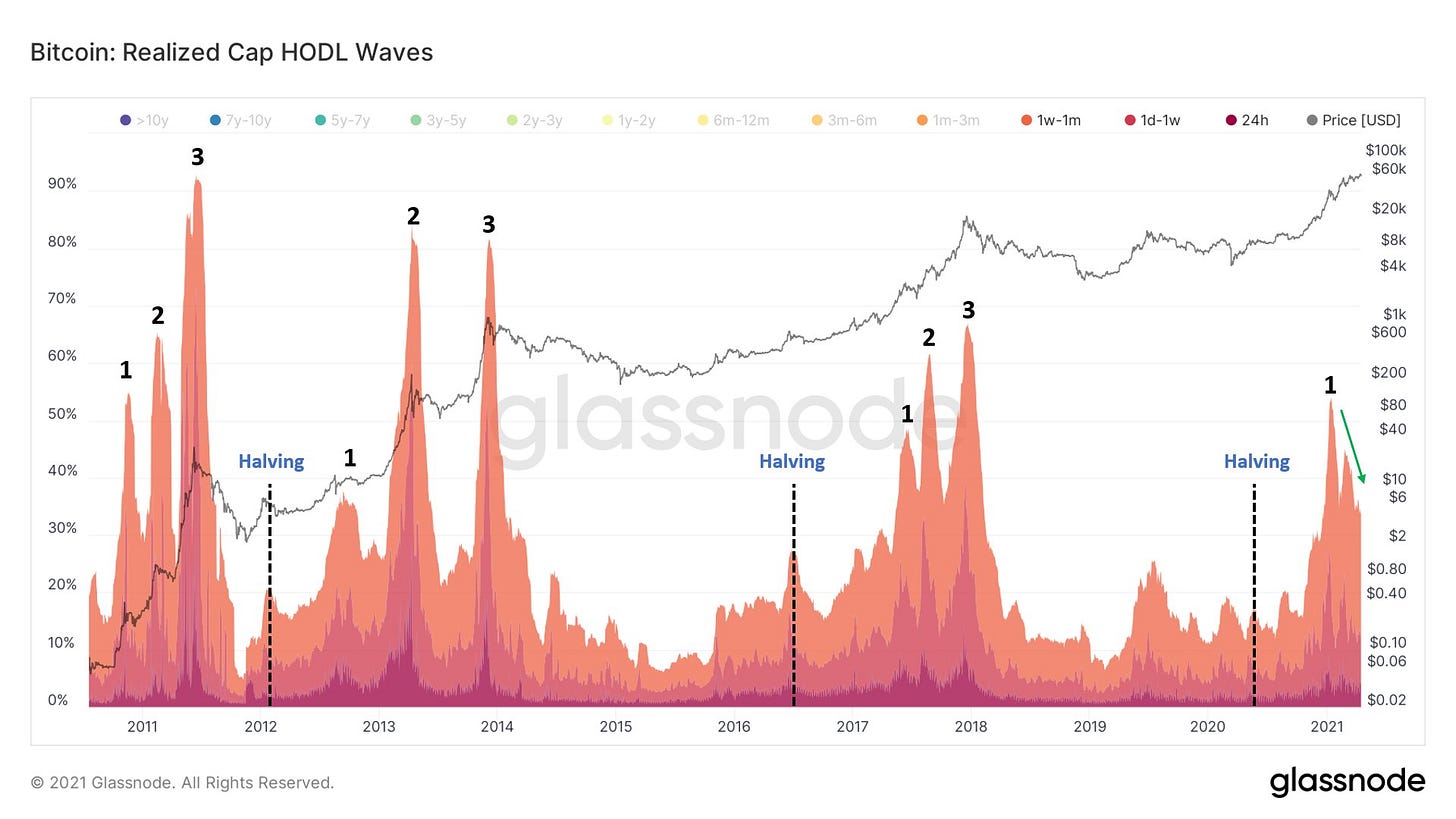

FUNDAMENTALSI have increasingly heard people worried about where we are in this bull market. Have we peaked? Is it true that a crash is incoming? Well nibblings, the truth is that nothing is guaranteed, the best we can do is to utilize the blockchain data on our favor, and continue stacking. Because for all we know, bitcoin is going up forever.

William Clemente shares with us an update of the Realized Cap HODL waves, that we shared in WTFBitcoin W9. And back then we told you that this is bullish, and it continues to be so. It seems that the first wave is cooling off, and we might get ready for a second one. Is it going to be three again? Well all we can say, is that history does not repeat itself, but often rhymes.

As a summary note…

This week we saw Turkey’s Central Bank declared war against bitcoin. From April 30th it will be banned for its citizens to use cryptocurrencies to purchase goods and services, directly or indirectly. Interestingly as it was, it is not banned to buy or sell bitcoin.

In any case, this is detrimental for the country’s economic development. What Turkey should be doing is harnessing the opportunity and leverage the innovation that bitcoin brings to the future of our digital economies, or at least that is uncle Bam’s opinion.

But it is what it is.. at the end of the day, the beauty of bitcoin lies on its decentralized nature, censorship resistant and that it is hard to confiscate. They could take away our rights to buy and sell bitcoin, but they can’t take our keys from us.

Have a great weekend niblings.

Bitcoin is artificially designed to appreciate forever.

Stay humble & stack sats.

…

You want to contribute to WTFBitcoin?

Feel free to donate. But more importantly, share this with your friends and family..

References:

1.

2.

3.

4. https://www.cityam.com/saints-pen-deal-with-bitcoin-performance-bonus/

5. https://www.bitcoininsider.org/article/110601/less-illicit-activity-bitcoin-traditional-banking-system-former-cia-director

6.

7.

8. https://www.theblockcrypto.com/linked/101751/insurance-giant-axa-switzerland-allows-bitcoin-btc-payments

9.

10. https://www.bloomberg.com/news/articles/2021-04-15/brevan-howard-s-main-hedge-fund-to-start-buying-cryptocurrencies

11. https://u.today/bridgewaters-ray-dalio-makes-case-for-diversifying-portfolios-with-bitcoin