2021W19 - WTF has happened in bitcoin this week?

Bitcoin is designed to pump forever

TLDR: Bitcoin has continue to consolidate, Elon moves the markets, MicroStrategy continues stacking, bitcoin is considered store of value by Central Banks.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

This past week was a controversial one indeed. Bitcoin has been consolidating in the $50,000 - $60,000 price range for about the last 10 weeks. Regardless of the volatility, we have talked in the previous issues, in WTFBitcoin, how bullish the fundamentals of the space are, and right now is no different. And this one we saw the price plunge from $59,000 to a minimum of $46,200. The big drop came specially after a specific tweet from Elon Musk, which could have created some fear in the markets, but be aware, institutions kept buying the dip.

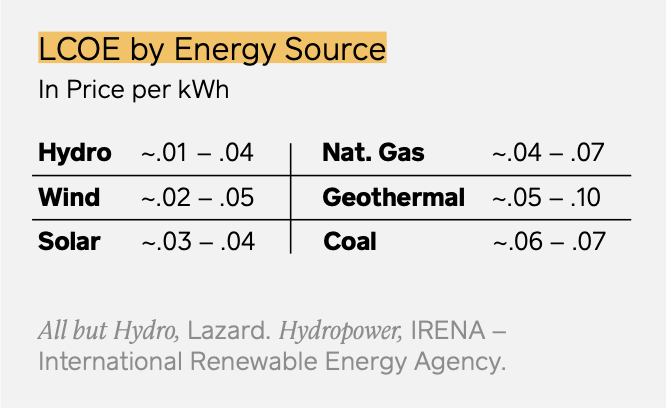

What can we learn from this? First of all, Tesla didn’t sell bitcoin. But what about the increasing use of fossil fuels for mining? Well it doesn’t seem to be the most profitable way of mining, according to Square and Ark Investment publication.

We have seen publications about Bitcoin using more than 70% of the mining energy from renewable energy. Bitcoin incentivizes the use of renewable energy all the way from the use of hydroelectric power plants while helping stabilizing the grid, using the stranded gas for mining energy, produced as a byproduct by oil extraction, while avoiding the flaring and venting of it and reducing emissions, and even incentivizing the investment in solar and wind energy plants which nowadays due to their intermittent energy production of these medium, it is inefficient until the battery technology develops further. All in all, Bitcoin is the buyer of energy of last resort, and while there is vast amount of energy being wasted, bitcoin incentives the investment on it, and the further development of human society.

I guess the main point to take from here is: The bitcoin & energy rabbit hole is a deep one, and it dangerous to go into harsh conclusions due to a single tweet which doesn’t captures the whole picture, and may or not have a hidden motive.

But let us keep to the bullish news, this is how the week started:

0. MicroStrategy has purchased an additional 271 bitcoins for $15.0 million in cash

at an average price of ~$55,387 per bitcoin. As of 5/13/2021, Micro strategy owns

~91,850 bitcoins acquired for ~$2.241 billion at an average price of ~24,403 per

bitcoin.

UBS Group AG, a Swiss multinational investment bank and financial services company, with $1.1 trillion of invested assets, plans to offer its wealthy clients exposure to Bitcoin.

Canadian Bitcoin ETF, managed by Ninepoint Partners, is purchasing carbon credits to offset its carbon footprint, and become carbon-neutral.

Mark Zuckerberg, founder of Facebook, name one of his goats “Bitcoin”. Is Mark a bitcoin maximalist?

Tom Brady indirectly declares himself a Bitcoiner while throwing out some lazer eyes in his twitter profile picture. Later on, disappointing many by setting up an NFT company.

Hungary is going to cut the tax rates on crypto earnings by 50% starting next year in a bid to boost crypto adoption and use in the country.

Tokyo Metropolitan Assembly member, Yuu Ito, has submitted a proposal to lower the local Bitcoin tax rate to 0%. He stated that Bitcoin should be seen as "a growth strategy" to “generate wealth” for the Japanese capital.

Other countries should be taking note on these important decisions.Palantir, a public traded company, released their earning call and confirmed they now accept bitcoin as payment. They also are considering adding bitcoin to their balance sheet.

Texas House of Representatives just passed bill 4474, that helps better define the legal status of Bitcoin as property! It moves next to the state Senate and Greg Abbott, who has already publicly supported the favorable legislation.

Newsweek reported the results of a survey conducted by NYDIG, where about 46 million Americans now own at least a share of Bitcoin. That amounts to more than 22% of the population above 18 years old.

This was number was about 5% about 2 years ago.Cathie Wood's, from Ark Investments, expects Bitcoin to rival gold.

Papa Johns pizza shops in the U.K. are giving away bitcoin with every purchase over £30.

MoneyGram, with 22,464 locations in the United States, will now allow users buy and sell bitcoin. They plan to expand their bitcoin service internationally this year, to their 350,000 locations.

Norges Bank vice chair says "A complete annihilation of the Norwegian crown is unlikely, but if money such as Bitcoin or Diem become more dominating here at home, we will be moving towards a new financial system".

"We can imagine an intermediate solution where the state continues to spend kroner, while the private sector prefers one or more cryptocurrencies" - The Central Bank of Norway

The Bitcoin mining firm Argo Blockchain announced to have purchased two data centers, both almost entirely powered by hydroelectricity. They will produce 20 megawatts of renewable energy for mining.

Jack Dorsey and his company Square, are hopeful on bitcoin.

Stan Druckenmiller, American investor and previously hedge fund manager was interviewed on CNBC stating declaring Bitcoin as a solution to central banks. "5 years ago I said crypto was a solution in search of a problem.. Well, now the problem has been clearly identified. It's Jerome Powell and the rest of the world's central bankers. There's a lack of trust." - Stan

As a summary note..

People are scared the bull market is over. But we just have seen the reported CPI in the United States of 4.2%, as the fastest increase rate since September 2008. This not only means the average person should be earning an extra 4.2% of salary to afford the same goods as last year, but also people are seeing their savings depreciate by that amount.

This CPI number might even be higher in many other smaller countries, and this is why we have Bitcoin as an insurance. It is true that we might fall into the speculation game, of how high would it go, and when, but ultimately is about having a more secure manner of storing our wealth, in a way that can’t be confiscated via inflation.

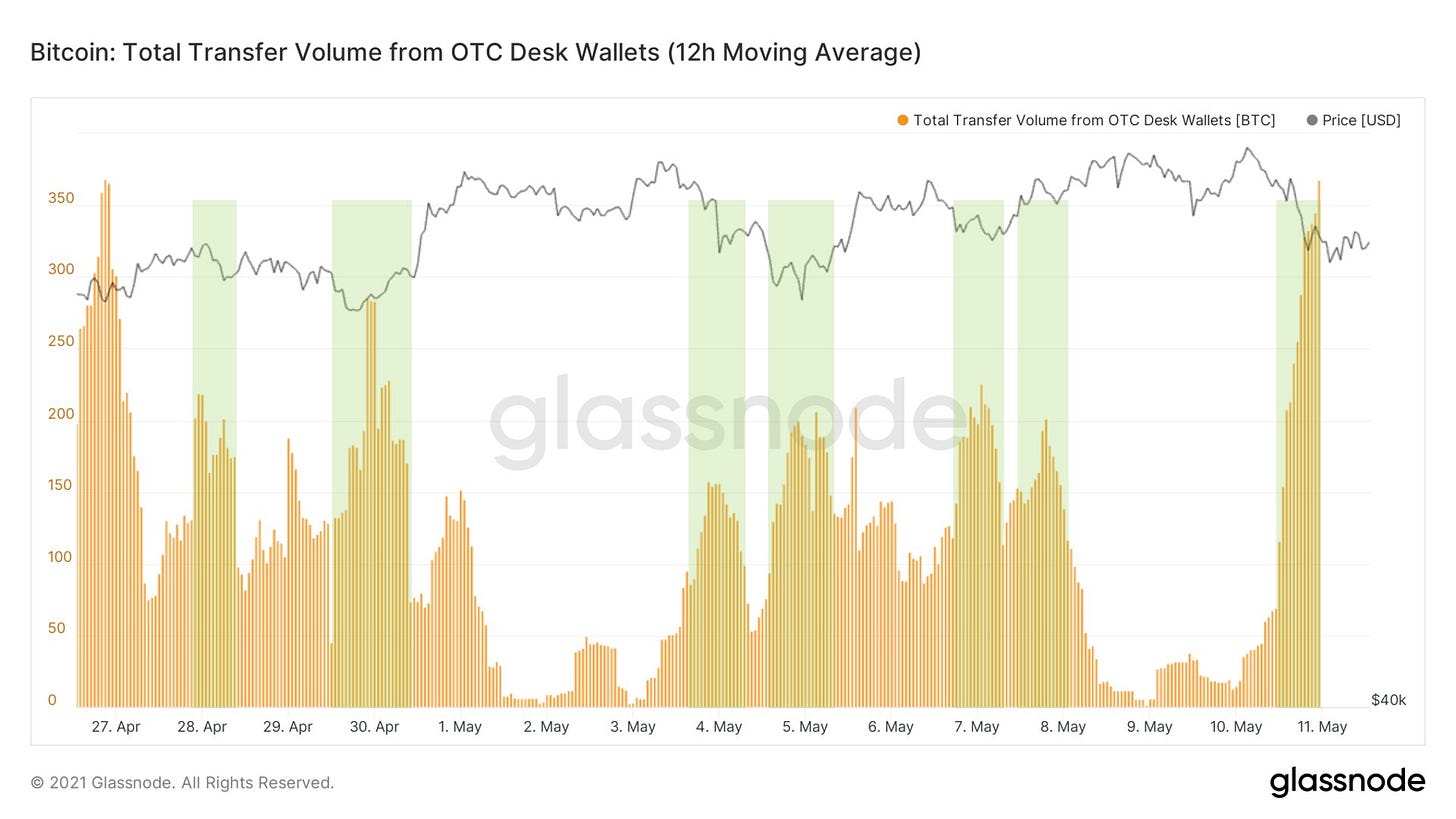

So is the bull market over? I doubt it. OTC Desk Wallets have been moving bitcoin to private customers, likely institutions.

by William Clemente

If bitcoin was done for this cycle, we would not see a big consolidation as we have. We would also see alt coins dropping together with bitcoin. But we haven’t because it is likely that this bull market is not over. Just be careful not falling into the alt coin trap, at the end of the day, most of them want to trade their coins for bitcoin, for your bitcoin. The best strategy is to keep accumulating and thing lower our time preference. Accumulate all the bitcoin you possibly can today, because in terms of technology, “Bitcoin is design to pump forever.” -Matt Odell

Have a great weekend niblings.

Stay humble & stack sats.

You want to contribute to WTFBitcoin?

Feel free to donate. But more importantly, share this with your friends and family..

Reference:

0.

1.https://www.bloomberg.com/news/articles/2021-05-10/ubs-exploring-ways-to-offer-crypto-investments-to-rich-clients

2.https://financialpost.com/fp-finance/cryptocurrency/canadian-issuer-is-making-its-bitcoin-etf-carbon-neutral

3.

4.

5.https://coingape.com/just-in-hungary-to-reduce-tax-on-crypto-gains-by-50/

6.https://news.yahoo.co.jp/articles/c60a3509be7fe54a82171ec32b085de0d5ad3b07?page=1

7.https://news.bitcoin.com/palantir-to-accept-bitcoin-for-services-considers-keeping-btc-on-its-balance-sheet/

8.https://capitol.texas.gov/tlodocs/87R/billtext/pdf/HB04474I.pdf#navpanes=0

9.https://www.newsweek.com/46-million-americans-now-own-bitcoin-crypto-goes-mainstream-1590639

10.https://www.bloomberg.com/news/articles/2021-05-12/ark-s-crypto-expert-sees-dogecoin-washout-bitcoin-rivaling-gold?cmpid%3D=socialflow-twitter-markets&utm_source=twitter&utm_medium=social&utm_campaign=socialflow-organic&utm_content=markets

11.

12. https://bitcoinmagazine.com/business/moneygram-coinme-sell-bitcoin-for-fiat

13. https://e24.no/boers-og-finans/i/WOEArL/norges-bank-tror-ikke-krypto-erstatter-kronen-lite-sannsynlig

14.https://bitcoinmagazine.com/business/argo-blockchain-buys-hydro-data-centers

15.

16.