2021W24- WTF has happened in bitcoin this week?

Bitcoin fixes monetary debasement

TLDR: Bitcoin as an insurance against inflation, Latin American adoption, MicroStrategy to sell stocks for more bitcoin, Hodlers accumulating.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

In these last days there were two events that sparked my interest:

The Federal Open Market Commitee (FOMC)

Paul Tudor Jones interview with CNBC

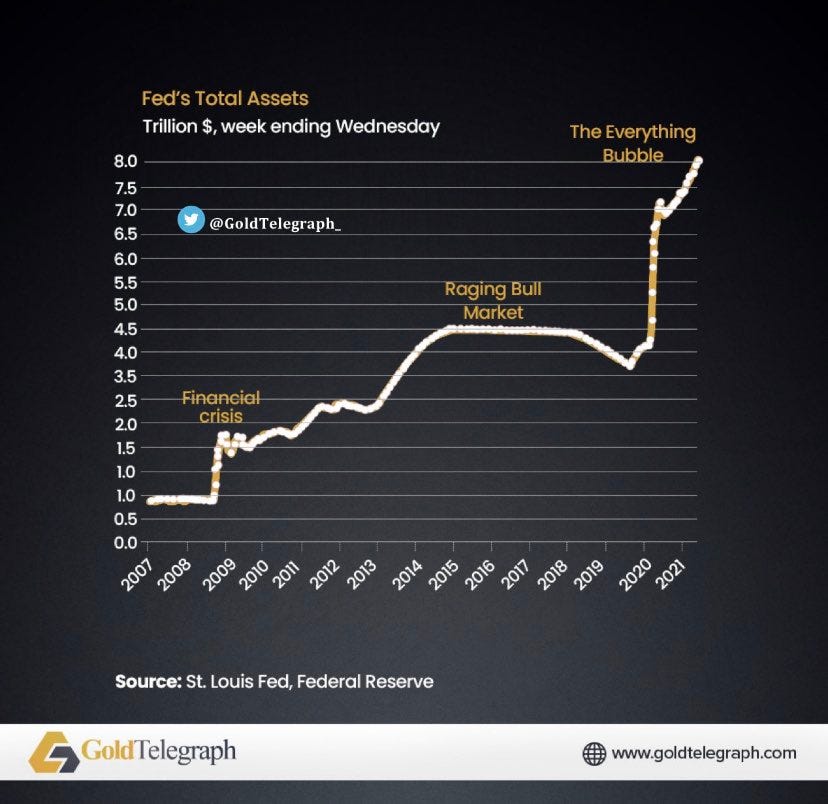

What is interesting to me is the contrast we can find on both of these events. On the first one we have the chairman of the Federal Reserve, Jerome Powell, whom we are trusting the power of influencing the economy with the money printer, telling us that we are living unprecedented times, that there is no plan in changing the monetary policy and rates will likely increase “possibly” in 2023, meaning that borrowing is continue to be encouraged with low interest rates, and the FED will continue with its $120 billion a month asset purchase program, while reported inflation has spiked to over 5% , but “it is attributed to mainly transitory factors”.

"We have NO experience doing what we are doing" - Jerome Powell

On the second one we have a successful hedge fund manager Paul Tudor Jones, having a discussion about the possible repercussions of the actions of the FED by increasing the availability of the dollars in the system at a near zero marginal cost. He mentioned about a possibility of the FED’s credibility being at stake by keeping the monetary policy loose, which they did, and the best way he sees as a counter trade to protect against inflation, which includes a 5% position in Bitcoin. This is already 3% higher of the position he advertised over year ago, and well the circumstances are different.

“I like bitcoin as a portfolio diversifier. Everybody asks me what should I do with my bitcoin? The only thing I know for certain, I want 5% in gold, 5% in bitcoin, 5% in cash, 5% in commodities. At this point in time, I don’t know what I want to do with the other 80% until I see what the Fed is going to do” - Paul Tudor Jones

Now you might think, what is the objective of telling us all this Uncle Bam?

The way I see it is simple, I am not saying that the FED has evil intentions on performing their massive monetary easing, but adding a big percentage of money to compete for the same amount of goods, leads to increase in prices. On one end, I see our leaders telling us, buckle up, “its transitory”.. as if companies might decrease their prices in the future.. where on the other hand they offer a solution, a hedge, even in these uncertain times.

Bitcoin is the strongest monetary asset ever existed, specially because of its property of having a limited supply, being scarce. Even with the uneventful price action of the last couple of weeks, Bitcoin is the only asset within reach of a majority of the worlds population to insure themselves against inflation. Bitcoin is our insurance.

And this is how the week started.

1. The President of the Central American Bank, with $13.5 billion in assets, ran a press conference where they stated their support to El Salvador’s Bitcoin Law.

2. MicroStrategy launches “At the Market” Securities Offering. The company announced their intention to sell up to $1 billion of their Class A Common Stock over time with the possibility of buying bitcoin.

3. Elon Musk announces that Tesla will once again accept bitcoin for vehicle purchases if miners confirm reasonable (~50%) clean energy usage.

4. President Samia Suluhu Hassan called on the Tanzanian Central Bank Sunday to begin “working on” facilitating widespread use of Bitcoin and cryptocurrencies in the East African nation.

5. Saxo Bank to become the first bank in Denmark to enable the bank's customers to buy bitcoin.

6. Global investment funds now hold more than $43 billion worth of bitcoin on behalf of their clients. Meanwhile, corporate bitcoin holdings have reached a total of $6.5 billion.

7. GoldConnect, a Latin America telecommunications company, started accepting bitcoin as a means of payment.

8. Carlos Rejala, politician from Paraguay, announces that the country will legislate Bitcoin this following July. He has been saying that good news are coming on the bitcoin adoption front ever since El Salvador announced it as legal tender.

9. Relai, a Switzerland-based app designed to make bitcoin investing simple in Europe, has announced a raise of ~$2.778 million) in series A funding.

10. Spain's bank BBVA is opening Bitcoin trading and custody to all private banking clients in Switzerland.

11. Neil Patrick Harris, widely known as Barney Stinson from tv series “How I met your mother” says he's been holding bitcoin for a while and his goal is to let everyone know how easy and accessible it is to invest in.

FUNDAMENTALS

The total amount bitcoin held by “long-term holders” continues to increase. This figure, shows how many bitcoins are sitting on addresses not being moved for about half a year. Seemingly long term players started taking profit since early november, but now we can see an exponential accumulation from the beginning of April. Important to notice that these could represent players who started accumulating strongly about half a year ago, but have not sold.

As a summary note..

Bitcoin incentivizes renewable energies, we have said it before and we say it again. It is the buyer of energy of last resort, and it creates an incentive for investment on remote power-plants to capture stranded energy. The following is a great example shared by Alex Gladstein where one could use the famous phrase “Bitcoin fixes this”.

A 37MW geothermal power plant facility has been found abandoned in Apas Kiri, Tawau. They probably abandoned it because the investment needed to be able to leverage the energy was exceeding their possible return by providing it to the population, as energy is still not easy to transport in big amounts and big distances.

The incentive to have power plants on remote places changes with Bitcoin. By only installing some bitcoin miners and internet access, they could immediately monetize the energy by selling it to the Bitcoin Network, while parallel working on connecting it to the grid and prepare the infrastructure to benefit the local communities.

Have a great weekend niblings.

Stay humble & stack sats.

You want to contribute to WTFBitcoin?

Feel free to donate. But more importantly, share this with your friends and family..

Reference:

1.

2.https://www.microstrategy.com/en/investor-relations/financial-documents/microstrategy-launches-at-the-market-securities-offering-for-flexibility-to-sell-up-to-1b-of-its-class-a-common-stock-over-time_06-14-2021

3.https://www.btctimes.com/news/tesla-to-resume-bitcoin-transactions

4.https://www.forbes.com/sites/roberthart/2021/06/14/tanzania-considers-crypto-and-boosts-bitcoin-as-nations-line-up-behind-el-salvador-to-embrace-decentralized-finance/?sh=17bc573c4fc3

5.https://ekstrabladet.dk/forbrug/dinepenge/foerste-bank-i-danmark-nu-kan-du-koebe-krytpovaluta-her/8641281

6. https://bitcoinmagazine.com/markets/global-funds-hold-43-billion-in-bitcoin

7.https://www.diariobitcoin.com/mercados/bitcoin-mercados/empresa-de-telecomunicaciones-goldconnect-incorpora-pagos-con-bitcoin/

8.

9. https://bitcoinmagazine.com/business/bitcoin-app-relai-raises-2-7-million

10.https://bitcoinmagazine.com/business/swiss-bbva-offering-bitcoin-services

11.https://news.bitcoin.com/neil-patrick-harris-hodls-bitcoin-partners-cryptocurrency-atm-operator/