TLDR: Bitcoin and Lightning Network growing exponentially, Institutions loading up on GBTC, Banks offering bitcoin to retail clients.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

Another volatile week, filled with emotions for many, but unfelt by others. As we ramp up in price having touched lows close to $29,000 and boosting all the way through $34,500 (at time of writing), lets remind ourselves that Bitcoin is a marathon, and the short term volatility is the price to pay for an appreciating asset with a compound annual growth over 100%. So with price pumping and a smile on your faces lets get on it!

Last week we talked about Lightning Networks adoption, the case for donations and its exponential growth. As a bitcoin user and “evangelist”, specially in developed countries, one of the first questions they ask you is: “Who is using it?”, “No, but I mean here, where someone pay with bitcoin?”

Last week I had a chat with one of the owners of a famous bar Curfew Cocktail Bar, which officially has been accepting bitcoin for 3 weeks now, and last weekend, they had their first customer paying with bitcoin through the Lightning Network, using their own payment infrastructure with BTCPay.

The customer who paid was apparently an international regular from San Francisco. He paid by using Strike, where by having dollars, he was able to pay a bitcoin invoice due to Strike’s interoperability with the Bitcoin Network without having to either have bitcoin, or get the local currency from the country (danish crowns). This is the future, interoperability in finance with immediate settlement by using the Bitcoin’s infrastructure.

At the moment, according to the owner, it may be the only bar in Denmark that currently accepts Bitcoin, but said they are working with many other restaurants to help them with the implementation.

In the near future, one would be able to go around traveling throughout the world, with confidence that there is no need of dependance of any financial institution, only a bitcoin wallet.

No more:

My card got blocked

My card got cloned

My card got stolen what should I do now?

If your phone gets stolen, one could basically get access to a temporary one, get a back-up, and ready to go. Problem solved.

And this is how the week started.

1. Ark Investment :

- Purchase 225,937 Square shares after Jack Dorsey announcement Square new venture aimed at decentralized finance services.

- Added 310,000 Grayscale shares, worth almost $8 million, to ARKW ETF on Monday.

- Added 140,000 Grayscale shares on Tuesday

2. Rothschild Investment Corp. tripled its Bitcoin position by adding over 100,000 Grayscale shares.

3. Core Scientific, one of the largest North American Bitcoin Mining companies, is going public at a valuation of $4.3 billion, via a SPAC.

4. JPMorgan just became the first U.S. big bank to give retail clients access to Bitcoin exposure, not only for wealthy ones.

"A lot of our clients are saying that's an asset class and I want to invest" - JP Morgan's Wealth Management CEO, Mary Callahan Erdoes

5. BNY Mellon joined six banks in backing the new Bitcoin exchange Pure Digital. The first trade is scheduled to take place within a week.

6. Goldman Sachs Survey: Nearly 50% of family office clients are interested in bitcoin and 15% of these are already invested in cryptocurrencies.

7. Edge Wealth Management LLC increased its exposure to Bitcoin by over 40% in Q2. The company disclosed ownership of 54,135 shares of GBTC.

8. New Jersey’s State Pension Fund holds over $7 million of the Bitcoin Mining stocks $RIOT and $MARA

9. Elon Musk reiterates at “The B Word” conference, that Tesla, SpaceX and himself own bitcoin and are not selling any. This was the first time SpaceX exposure to the asset is officially disclosed.

10. Global X, ETF provider and Mirae Asset subsidiary has filed for a bitcoin ETF with the SEC, heating up the competitive race in the U.S.

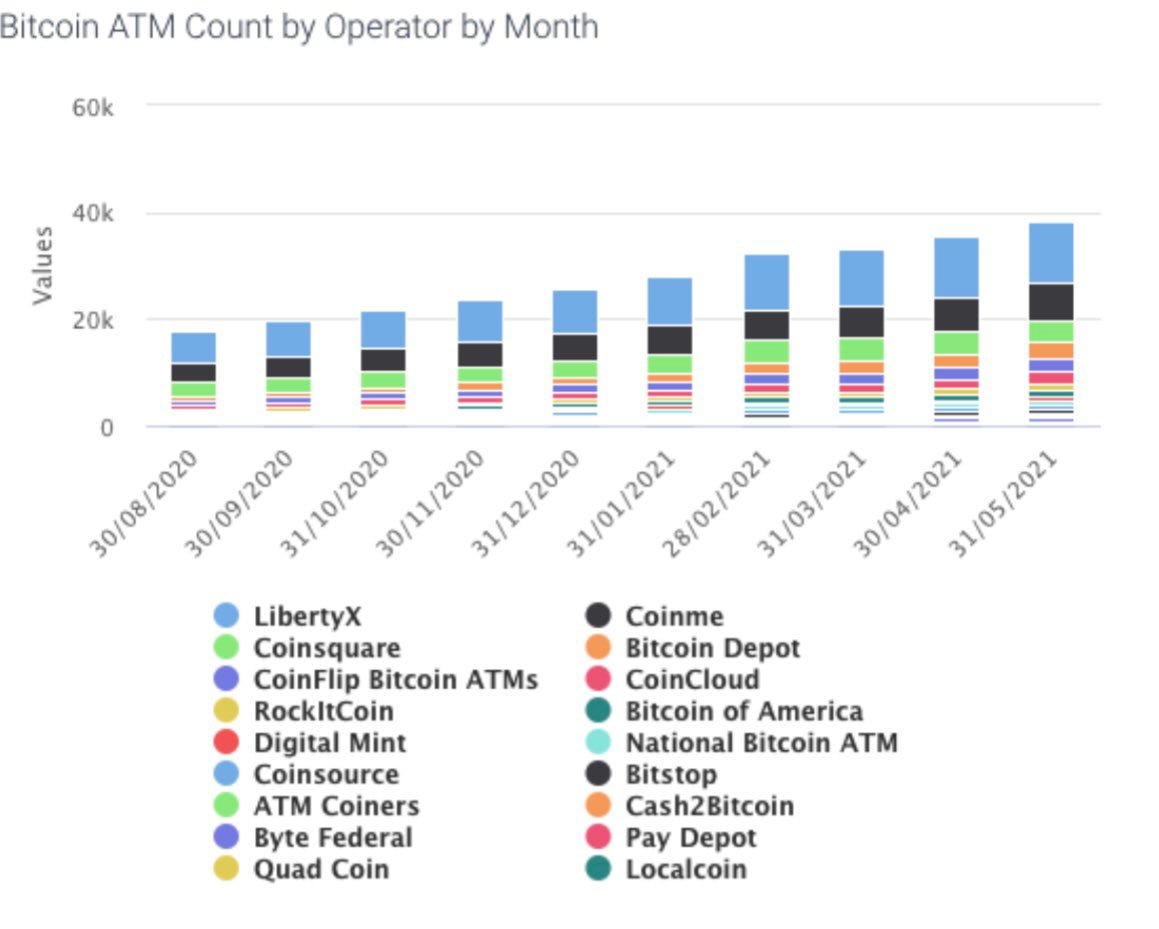

10. Circle K, convenience store chain, partners with Bitcoin Depot to bring bitcoin ATMs to its stores, with over 700 machines already installed.

11. Viridi funds has announced the launch of RIGZ, the firm’s new clean energy Bitcoin mining ETF that goes beyond just miners.

12. Bitcoin ATMs in the US see a surge in mainstream adoption. There are over 38,000 Bitcoin ATMs deployed in the country.

FUNDAMENTALS

The adoption on Bitcoin’s Protocol is clearly growing in an exponential manner, and the number of daily new addresses has hit all time high this week. Now this does not mean they are 47,126 new users, since hodlers normally use a new address every time they send funds out of the exchange. It just means that the adoption is unharmed, even after a 50% price retracement.

As a summary note..

Last week your beloved Uncle Bam showed you the growth of the Lightning Network Capacity, having passed 1,800 bitcoin. Well, the progress in only this last week is paramount! More than 150 bitcoin were added to the Lightning Network, this is more than 8% in just a week.

If the trend continues, we might see bitcoin integrated in the mainstream financial system as a rail of immediate settlement. Remember niblings, the trend is your friend, when looking at bitcoin, one should focus on the fundamentals and growth trend, because the price is volatile short term and could give false interpretations. When in doubt, zoom out.

This is bullish.

Have a great weekend niblings.

Stay humble & stack sats.

You want to contribute to WTFBitcoin?

Feel free to donate.

But more importantly, share this with your friends and family..