2021W3 - WTF has happened in bitcoin this week?

In times like these, we need conviction

TLDR: Bitcoin dumps 30%, but nothing changes, institutions continue accumulating.

This third week of 2021, has been intense. There are many people entering the space in pursuit of bitcoin’s NgU Technology (Number goes up). In times like these, conviction is important. We just have seen bitcoin kiss $42K and coming back down to bounce off of $28.8K. These movements, which are considered ‘normal’, in the bitcoin space could easily provoke people to sell their investments at a loss.

Volatility is a beast, and it is natural in an emergent asset class. No one complains when we experience the volatility upwards, but when things go the other way, and we see our investments losing value at a fast pace, is certainly painful. The only way to ease it down, is by having ‘strong hands’, certainty of the decision taken, conviction.

So lets build up on this conviction, and find out some of the most relevant news in the space, to find out that bitcoin is working perfectly fine, and the space and adoption, looks healthy as ever.

1. Goldman Sachs, one of the largest investment banking enterprises in the world, explores digital asset custody.

2. Bitcoin exploring ATHs. A simple and beautiful chart telling us how many days bitcoin has been exploring new highs (The more days in a row, the lighter the color). If this is a bull market, as many of us think. Then it’s no way this is over so soon. It may just be the beginning.

by Niko

3. Larry Summers, former Treasury Secretary from Clinton’s administration, says that bitcoin is here to stay. “Some institutions like it. I think it’s here to stay. It looks much more resilient, therefore think people are going to move towards it, and as people move towards it, given the finiteness of its supply, that is going to be a factor for it to raise in price”.

4. Stephen Harper, 22nd prime minister of Canada, explains the need of an alternative world reserve currency in case the U.S. dollar collapses. The problem relies basically on trust, and therefore he sees value in bitcoin as a contender.

“In the short-medium term its hard to see, what the alternative is to the US dollar as the world’s major reserve currency, other than gold, bitcoin, or a whole basket of it.” – Stephen.

5. Grayscale started the year by raising more than $ 700M in one day and purchasing 16244 bitcoins, to add to their fund, this is basically 18 days worth of bitcoin supply, in one single day. This amount adds up to more than 630K Bitcoin and an approximately 22B in assets under management.

* The daily supply of bitcoin is 900, as of 20201.

6. BlackRock, the world’s largest asset manager with $7.8 T in AUM, prepares to enter the Bitcoin space, with two prospectus filings, mentioning the possibility of using bitcoin derivatives/futures. BlackRock’s CEO Larry Fink, has previously suggested that bitcoin “could evolve into a global market asset”.

7. We see again another ATH of addresses with more than 1000 bitcoins.

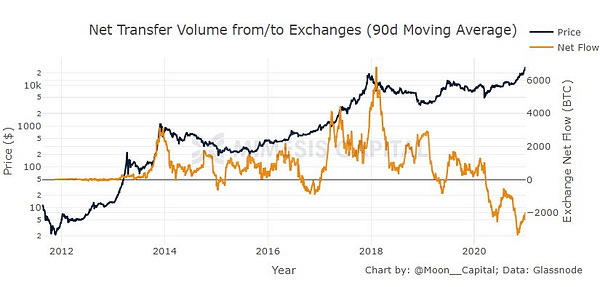

8. The amount of bitcoin moving out of exchanges is still bigger than the amount being sent into them. The outflow is on an ATH, and the trend does not seem to have change just yet. This is an indication of a reduction of bitcoin availability for purchase. Also the amount of “illiquid bitcoin” seems to be increasing, these are basically the amount of addresses that receive bitcoin and do not spend them. To learn more about bitcoin liquidity metric, follow Glassnode’s piece: “78% of the Bitcoin Supply is Not Liquid”.

9. So what should we do of all this? “Buy the fucking dip?” (BTFD). The CTO from Glassnode, Rafael Schultze-Kraft, suggest that this move might be normal, and the retracement could even continue until the Spent Output Profit Ratio (SOPR), normalizes. (It did on 22-Jan-21).

10. Michael Saylor announced MicroStrategy’s purchase of 314 Bitcoin for $10M at an average price of $31.8K. With this addition, the company holds a total of 70,784 bitcoins with an average price of ~$16,035 per coin, inclusive of fees and expenses.

Podcast of the week:

Lyn Alden has a special way of teaching summarizing the reason why we live with the US Dollar as a reserve currency.

End Game - Lyn Alden and Jeff Booth - Swan Signal Live E45 episode of Swan Signal - A Bitcoin Podcast

As a summary note…

It is these moments which test our conviction, our strength to hold dear to our investment thesis. The news talk for itself. On-chain analysis tells us two big things. People purchases are mainly on profit, and big players are not selling but accumulating.

” It is not about timing the market, but time in the market .”

Stay humble & stack sats.

Reference:

1.https://finance.yahoo.com/news/goldman-sachs-enter-crypto-market-214659079.html

2.

3.

4.

5.

6.

7.

8.

9.

10.

Podcast:

?si=phbSxE4OSDCTBXbKd1i9cg