TLDR: Bitcoin had a volatile week, accumulation continues, even Elon Musk has a positive view out of it.

Yet another intense week in bitcoin. This week the price has been volatile, as it has been said on the previous issue: Bitcoin is a volatile beast. These price swings, may come with multiple set of emotions. ‘Should I buy, will I miss out?”, “Oh my god, it dropped so much, maybe I should sell..”, “Could I get a better entry price?”..

It is important to distinguish the signal from the noise, this week gave us something special, validation. Bitcoin has been validated by the richest person in the world, Elon Musk, by him saying “it is inevitable”, and placing #bitcoin beneath his twitter handle.

So lets not trust but verify the current bitcoin validation, by finding out some of the most relevant news in the space:

1. Marathon Patent Group, Inc. (NASDAQ:MARA) announced a purchase of 4,812.66 bitcoins in an aggregate price of $150 million. Yet another public company adopting bitcoin as a treasury reserve asset.

2. Not only institutions are buying bitcoin for their balance sheet, but also Ivy League universities have been silently buying for their endowments. According to Coindesk, Harvard and Yale have been buying directly from Coinbase.

3. The city of Miami is putting big efforts into turning themselves into a Hub for ‘crypto innovation’. They even are hosting the Bitcoin’s Whitepaper on their government site. Being the first government to do so.

4. Bridgewater Associates founder Ray Dalio published a piece titled “What I think of bitcoin”. Here he describes bitcoin as “one hell of an invention”. According to bloomberg, he is now considering cryptocurrencies as investments for new funds offering clients protection against the debasement of fiat money.

It may be important to mention that Ray Dalio, being the founder of Bridgewater, an investment firm with $101Billion in assets under management, has disregarded bitcoin for the past years. Apparently he has changed his mind.

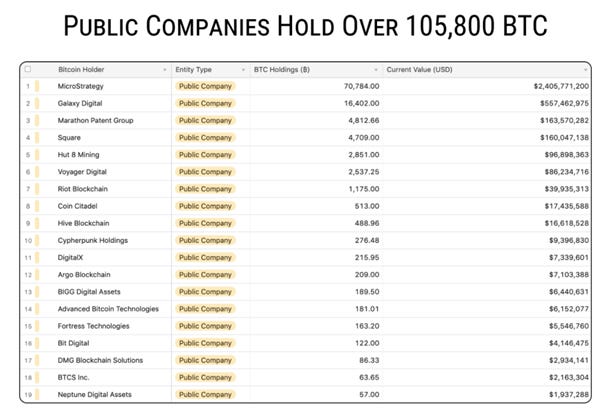

5. A total of 105,837 bitcoins are being held by public companies on their balance sheets. These are valued over $3.6B. Only these 19 public companies have an ownership of 0.5% of the network.

Photo by Kevin Rooke

6. Grayscale continues to accumulate more bitcoin than the current supply. In the first month of 2021, about 26,000BTC were mined, while Grayscale accumulated more than 40,000 BTC in the same time frame.

7. The number of whales (people with over 1000BTC) keeps on increasing week by week. Willy Woo gives us an update of the Bitcoin Whale Count.

As a summary note…

Bitcoin is normalizing in our society. Every week we hear of a new public company, or public figure warming up to the idea or even using it as their treasury reserve asset.

It is normal to feel insecure of the value proposition when you start to buy bitcoin, but you do not have to do it alone. Bitcoin has value because of the immense network behind it, because of millions of users that believes in it and decide to store their wealth on it.. Money is just that, a belief system. And up to today, I do not know any other monetary network that would be defended until the very end, as the bitcoiners defend the bitcoin network.

Now ask yourself… Who believes in bitcoin?

As an additional note: If the majority is not yet in, then we are still early, and the reward seems still promising.

Stay humble & stack sats.

Reference:

1. https://ir.marathonpg.com/press-releases/detail/1224/marathon-invests-150-million-in-bitcoin

3.

5.

6.

7.