TLDR: Sentiment turns Bullish, Investors continue accumulating, Bitcoin used as collateral for loan refinancing, Influencers join the space, Bitcoin is scalable.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

This week has been more than euphoric, truth be told uncle Bam is excited. About a week ago we were oscillating around $29,000 and all of the sudden the price has reached above $41,000 on a constant appreciation for over 10 days in a row. The sentiment turned indeed very positive as companies have announced to added allocation in their funds mainly through Grayscale’s Bitcoin Trust Fund (GBTC) and big investments in the mining space, as we have seen in the last couple of weeks.

In these moments is easy to let ourselves be driven by emotions and have the urge of buying everything we did not while the price was suppressed. The main words coming to our heads often are:

“I do not have enough bitcoin” - Every single bitcoiner

But it is a human and natural feeling. We will never have enough, not because it is the truth, but as we discover bitcoin’s potential and see it’s validation in the market, we are prone to strive for more. The proof is palpable, as even the “big players” such as Michael Saylor, keep on stacking sats.

This is why the best strategy is to Dollar Cost Average. Distribute the purchase budget on a daily/weekly/monthly basis, and you will not only make sure to get the best entry points, but to support the network.

“Bitcoin is the only network where my greed, benefits every other single individual on it” - Bam

And this is how the week started.

1. Michael Saylor has been personally accumulating bitcoin, beside his company’s holdings. He announced he was happy to have “smashed bought bitcoin on CashApp last weekend”.

2. MicroStrategy had their earnings call, where Michael Saylor announced the company is currently holding over 105,000 bitcoins, and plan to continue adding additional Bitcoin on the balance sheet, as it has proven have generated substantial value to shareholders.

“We think acquiring Bitcoin at this time is going to be a wise move. We feel like there is a land grab right now to acquire as much as we can” - Michael Saylor

This number is unmatched by any other public company and they are not stopping, are you going to stop stacking? Hope not.

3. Jasmine Telecom Systems, Thai telecom, is ambitiously planning to install 50,000 mining machines before the next bitcoin halving in 2024.

“This would bring about 5 exahashes of power onto the network, which, even by the next halving’s standards, would be an impressive percentage of global mining power."

4. Stronghold, a bitcoin mining company powered by waste coal, has filed an S-1 form with the SEC for a $100 million IPO on the Nasdaq.

5. Horizon Kinetics, $7 billion fund manager, has allocated 10% of its Paradigm fund to Grayscale Bitcoin Trust (GBTC), as a bet to hedge against inflation.

“There is no turning back after the pandemic, and globally there is a debt problem, and it means either default or currency debasement” - Doyle said.

6. Glen Oaks, one of the largest escrow companies in California has facilitated its first refinancing through a Bitcoin-backed loan.

"This marks the first time a refinancing has been completed with a buyer using Bitcoin as collateral." - Glen Oaks

7. LUXXFOLIO, vertically integrated bitcoin miner, has announced 80% of the company's first batch of rigs are up and mining. The company previously announced to install 2400 2400 Bitmain S19j Pro bitcoin miners throughout the year.

8. Seetee, Norwegian investment company focused on Bitcoin, has become the newest investor in the Bitcoin and Lightning company Breez.

9. Horizon's Paradigm fund now maintains a 5.8% allocation to GBTC, making Bitcoin exposure effectively its second largest holding.

10. Lolli, Bitcoin rewards company, closed a $10 million Series A round led by eye-catching social media influencers and celebrities.

“We believe it’s imperative to align with top creators to both educate, distribute, and amplify the power of bitcoin to the masses.” - Alex Adelman, CEO and cofounder of Lolli."

11. PayPal's launch of Bitcoin buy and sell services in the U.K. could soon allow thousands to gain exposure to the cryptocurrency's price movements.

12. GoldenTree, a $41 billion hedge fund, has added Bitcoin to its balance sheet, aiming to diversify the conservative, debt-based strategies it has used in the past. The total amount of bitcoin was not disclosed.

13. The University of Pennsylvania confirmed they still hold part of a $5 million donation it received earlier this year in Bitcoin.

FUNDAMENTALS

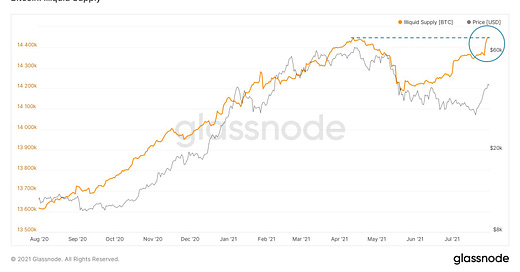

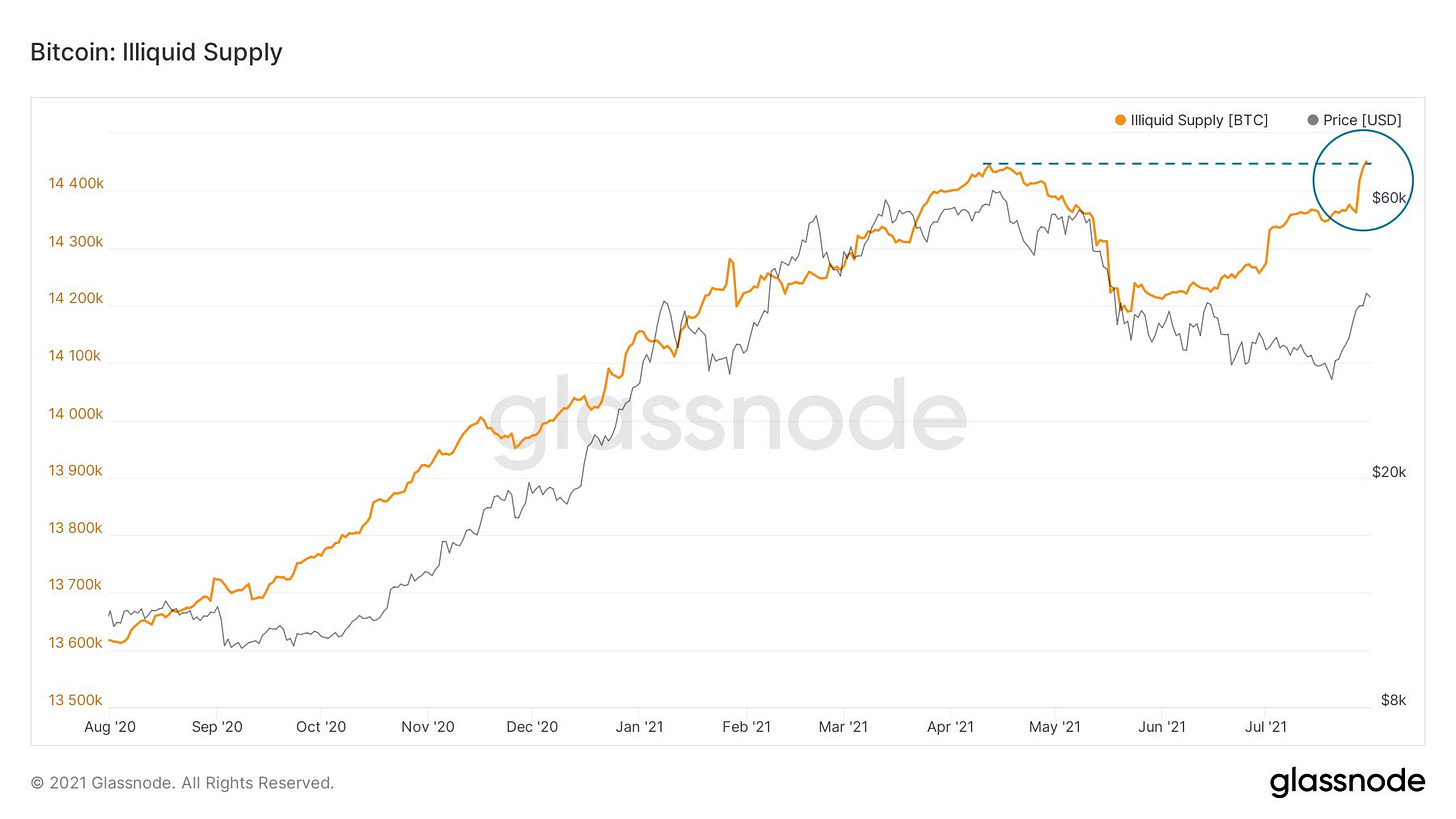

More than 14.4 million bitcoin are being held by “strong holders”, in essence those are bitcoin addresses that only receive inputs and no outputs, has again reached the level it had when the price reached all time high. This is bullish, and could be signal for a continuation phase of bitcoin’s bull run, meaning there could be a great upside ahead of us, as investors are accumulating and not selling.

by Lex

As a summary note..

Bitcoin scalability is often defined as how many transactions can be processed in an instant, which is why we often talk about the Lightning Network. But it is often forgotten that scalability also relates to the amount of value the network is able to move in a given time.

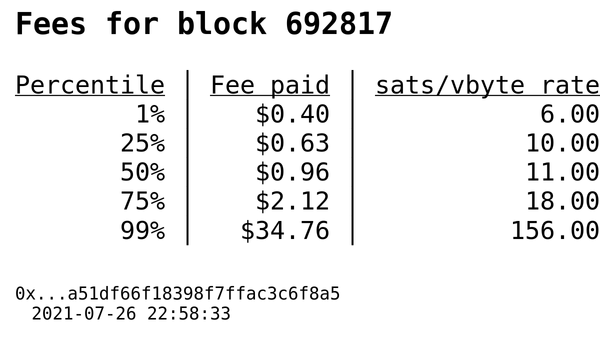

This week a special event happened, close to $8 billion were moved in a single block.

This specific block moved over 1% of the value of the entire network, all combined in a single 10 minute block conformed by 2,338 transactions. As a reference, the entire Bitcoin network was worth less than $8 billion, only five years ago. This makes bitcoin the world’s most scalable monetary system. As the price goes up, its scalability on moving value across space goes up as well.

Have a great weekend niblings.

Hoping to see the day where $1 trillion is moved in a single block.

Stay humble & stack sats.

You want to contribute to WTFBitcoin?

Feel free to donate. But more importantly, share this with your friends and family..

Enjoyed that, thank you