2021W36 - WTF has happened in bitcoin this week?

Bitcoin is legal tender.

TLDR: Bitcoin becomes legal tender, Brazil supports the decision, McDonalds, Starbucks and Zara are accepting bitcoin in El Salvador, Ukraine legalizes Bitcoin, Investors are accumulating Bitcoin, Price expected to reach $100,000 by asset managers.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

Bitcoin becomes legal tender

A week to remember. On September 7, 2021, the Bitcoin law came into effect in El Salvador, recognizing the best money humanity has ever seen as a real currency. What started as magic internet money, has now been recognized by a nation as a monetary good. The beautiful thing comes in the method of its implementation;

The purchaser has the freedom of choice of paying with dollar or bitcoin, while the seller doesn’t have to worry about the purchaser's decision, as the seller also has the freedom to receive the currency of choice — in this way, bitcoin brings empowerment and inclusion to society.

Why is bitcoin good for El Salvador and the world?

One of the biggest misunderstandings, is how bitcoin helps 360,000 households in the country, who frequently receive remittances. According to the media, they portray that Money service providers could lose $400 million a year on fees, but forget to mention the beautiful part: Families in El Salvador, could save up to $400 million a year.

Steve Hanke, economist form John Hopkins University would be trying to advocate against bitcoin without really inquiring the population with messages like these.

While the reality is this:

Sending $100 from New York to El Zonte, the recipient would get only $92. (8% fee.) Not taking into account the queue, or the day or two of having to wait for the transfer to arrive

With Bitcoin: the sender could easily send $20 to a Chivo ATM, and only pay $0.22 in fees for the person to receive $20 dollar bill (1% fee)

Or even better, why not directly paying an invoice from a Big Mac? This is just an example but all needed from anyone, regardless of the location, is a Lightning Wallet, and the fees could be negligible. (~0.01% fee)

And this is how the week started.

0. Bitcoin became legal tender in El Salvador, and the country bought 550 bitcoin, diversified in 3 entry points, to add onto their balance sheet. They bought the dip.

1. Money services providers, like Western Union, could lose $400 million a year in commissions for remittances thanks to bitcoin, increasing Salvadorans’ money.

2. Starbucks expanded its payment services to include bitcoin in El Salvador on Tuesday, at the same time the country became the first to adopt Bitcoin as legal tender.

3. Fast food giant McDonald'sbegan accepting Bitcoin payments in El Salvador on Tuesday.

4. Zara, global retail giant, now accepts bitcoin in El Salvador. Bitcoin is not only for buying coffee.

4. Adopting Bitcoin — A Lightning Summit in El Salvador, hosted by Galoy, will be held in San Salvador and El Zonte from November 16 to 18, 2021.

5. The Ukrainian Parliament passed a law that legalized and regulated Bitcoin in the country, providing official clarity on the asset which was not previously clear.

6. Bull Bitcoin, a canadian exchange, is integrating the Lightning Network to its non-custodial services.

7. Edward Snowden, the whistleblower, has highlighted how El Salvador's "pawn to e4" move will pressure other nations to adopt bitcoin.

8. Union Investment, Frankfurt-based $500 billion asset manager, is testing a pilot program with Bitcoin exposure certificates.

9. Blockstream partners with Macquarie, leading investor in renewable infrastructure with $428 billion in assets under management, to collaborate and explore carbon-neutral alternatives for their joint investment in bitcoin mining.

10. Miami Mayor Francis Suarez concluded his speech by challenging the audience to “Go out there and elect the next President of the United States to be a pro Bitcoin president.”

11. Robinhood announced the launch of dollar cost averaging (DCA) for its Bitcoin derivative product. Friendly reminder that this is not the real asset, only an IOU, or exposure to the asset.

12. Poll: US Young adults strongly support the idea of making bitcoin legal tender in the United States at 44%, while baby boomers think it’s a bad idea at 43%.

13. Brazilians were the biggest supporters of El Salvador's move among all countries surveyed: 48% of Brazilians want to make Bitcoin a Legal Currency.

FUNDAMENTALS

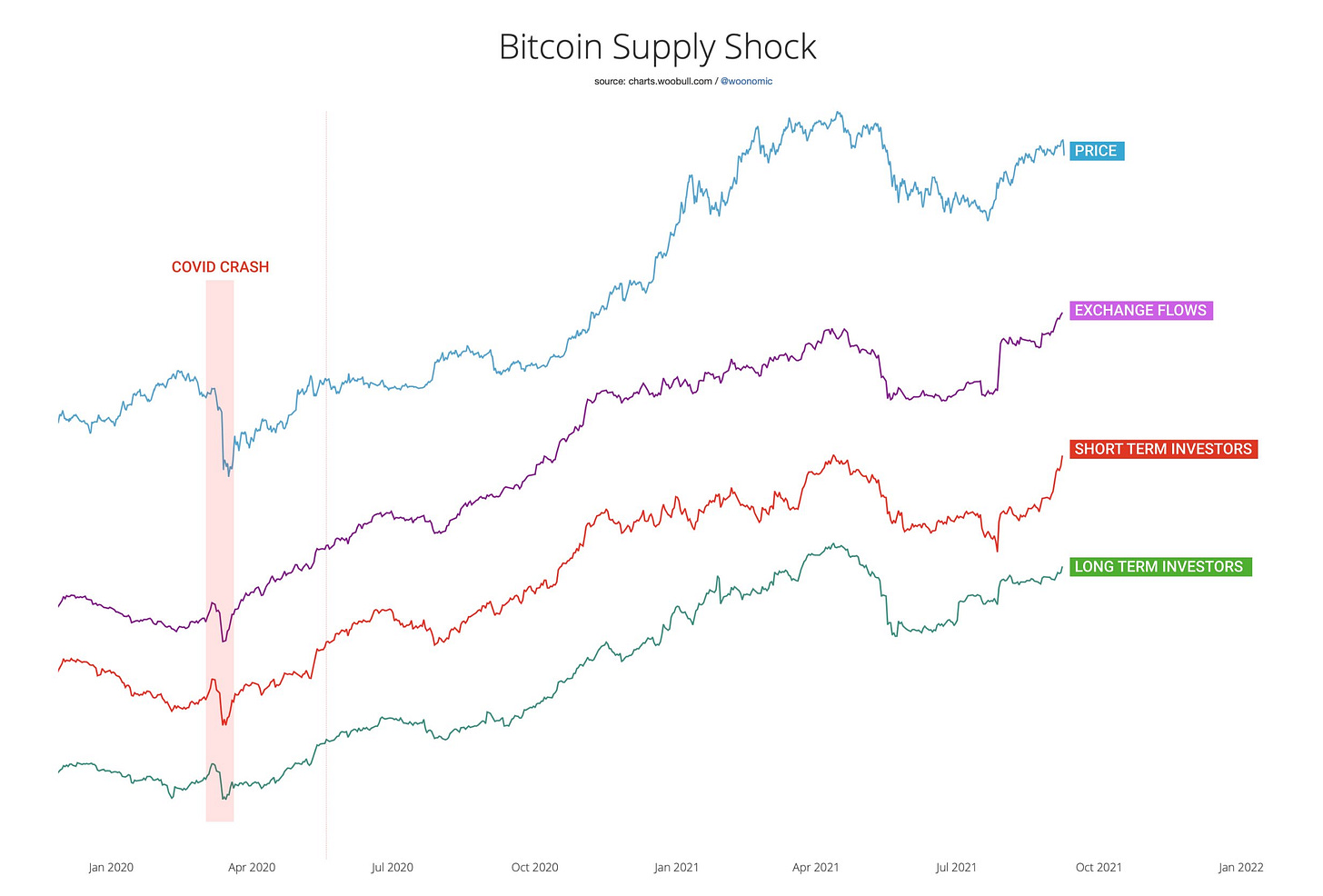

Willy Woo shares with us his Bitcoin Supply Shock chart where we can find the following things.

The price is not at its maximum, but shows sign of recovery. All of these while:

Exchanges are having the most outflows ever (people accumulating.)

Short term investors, having the most bitcoin ever. (People becoming longterm investors)

Long term investors are increasing rapidly, chasing the all time highs.

Only a matter of time before the price reflects the market’s massive accumulation.

As a summary note..

Some people still have in their minds the infamous “China Ban”. In a conversation with a colleague, he mention this was one of the causes of worry for bitcoin’s appreciation long term, since it shows that a country could excerpt a big influence on it. Well it seems that Bitcoin does not care, and the market will find a way to go around authoritarian regulations.

“Without any central authority the Bitcoin hashrate recovered in record time proving the resilience of the network and the irresistible incentives.” - Nico

Bitcoin is really the currency of freedom.

Have a great weekend niblings.

Stay humble & stack sats.

You want to contribute to WTFBitcoin?

Please don’t donate too much.

More importantly, share this with your friends and family..

Thanks as ever, I enjoy these and please keep em coming