2021W37 - WTF has happened in bitcoin this week?

Bitcoin in its race for adoption.

TLDR: Nation’s race to adoption, Tax excemptions, Corporate accumulation, Miners growth.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

Incredible to think how far we’ve gone in just over a year. From bitcoin being consider a high risk investment, to now being considered an interesting/must have asset according to the latest interviews in the financial industry. Starting from being a currency/asset which people desire on ‘hodling’, to institutions undergoing a race of accumulation, such as MicroStrategy which owns more than 114,000 bitcoins while ~400 days ago, they had none.

If you think about it, the company, which describes bitcoin as the ultimate private property, went from 0 to 114,000 bitcoin in the last 400 days, this is effectively purchasing 11.88 bitcoin per hour, or 1 bitcoin every 5 minutes for 400 consecutive days.

And now? The race of nations has just begun. Starting with El Salvador, a country which is heavily reliant on remittances, where 70% of the population is unbanked already declared bitcoin legal tender. Countries start to follow up, such as Panama, and Ukraine passing legalization laws; Laos, changing their official policies and opening up to allow bitcoin mining utilizing excess of hydro power, and now Hungary setting up a tribute statue to Satoshi Nakamoto.

Bitcoin is winning, providing hope to millions of people, coming back to El Salvador’s example, 1.1 million of El Salvadorans are now utilizing the newly released government app with access to BTC/USD interoperability. Within two weeks of launching, the new app already allowed 17% of the population to integrate to the local and global economy without the need of visiting a local bank. From now on, only downloading an open source bitcoin wallet, will allow you to communicate with the whole country, no need to show ID, a passport, or fill multiple forms to be included as in the legacy financial system.

There is no alternative.

And this is how the week started.

0. MicroStrategy CEO Michael Saylor announced that the firm purchased an additional 5,050 bitcoin for ~$242.9 million in cash during the third quarter period. With an investment approximating $3.16 billion, MicroStrategy is the owner of ~114,042 bitcoin, totaling an average purchase price of ~$27,713 per bitcoin.

1. Rick Rieder, CIO of BlackRock, said on CNBC’s Squawk Box that he owns Bitcoin and that he believes its price could go up “significantly” in the future.

2. El Salvador to exempt foreigner investors from tax on Bitcoin price gains or income.

We know tax on appreciation of bitcoin isn’t tax as it is legal tender, just another currency.

The exempt means, if you move to El Salvador, and you receive your salary directly in bitcoin, there won’t be taxes to pay. A beautiful incentive to attract talent from abroad. It might not last forever, but as we know, bitcoiners are mobile.

3. The state-owned Chivo Wallet has over half a million users, 200 ATMs in El Salvador, 50 ATMs in the U.S.

4. Ark Investment updated its prospectus and can now invest in Canadian bitcoin ETFs while the SEC doesn't approve one in the U.S. Cathie Wood, the CEO, said she expects Bitcoin to soar to $500,000 in five years time during an interview at the SALT Conference on Monday.

5. Paxful, the peer-to-peer bitcoin trading platform, will now enable its over seven million users to cheaply and quickly transact BTC by integrating Lightning.

6. Bitrefill partners with El Salvador's Hugo App, The platform will launch Hugo gift cards for Salvadorans to access dozens of products and services with Bitcoin.

7. Cleanspark announces $145 million in Capital — the bitcoin miner is working with public-private initiatives to create jobs and benefit community members in Gwinnett County, Georgia.

8. Hungary becomes the first country to honor Bitcoin creator Satoshi Nakamoto with a public statue.

9. Laos, the Southeast Asian nation, changed its official policy, authorizing six companies to trade and mine Bitcoin with excess hydro power, while the government begins to draft regulations about its use.

10. Greenidge Generation, a vertically integrated bitcoin mining and energy generation company, announced its successful merger with Support.com to have its class A common stock trade on the Nasdaq Global Select Market. The next day they released a statment on their order of 10,000 S19j Pro bitcoin mining rigs from Bitmain, to expand the company's fleet.

11. Revolut, $33 billion fintech start-up, is paying WeWork for office space using Bitcoin to save on international remittance fees.

“We are a strong believer in crypto having real-life use cases in the future of payments. The advantage of paying in crypto is the ability to make nearly instant payments without middlemen who charge large international remittance fees” - Revolut team

FUNDAMENTALS

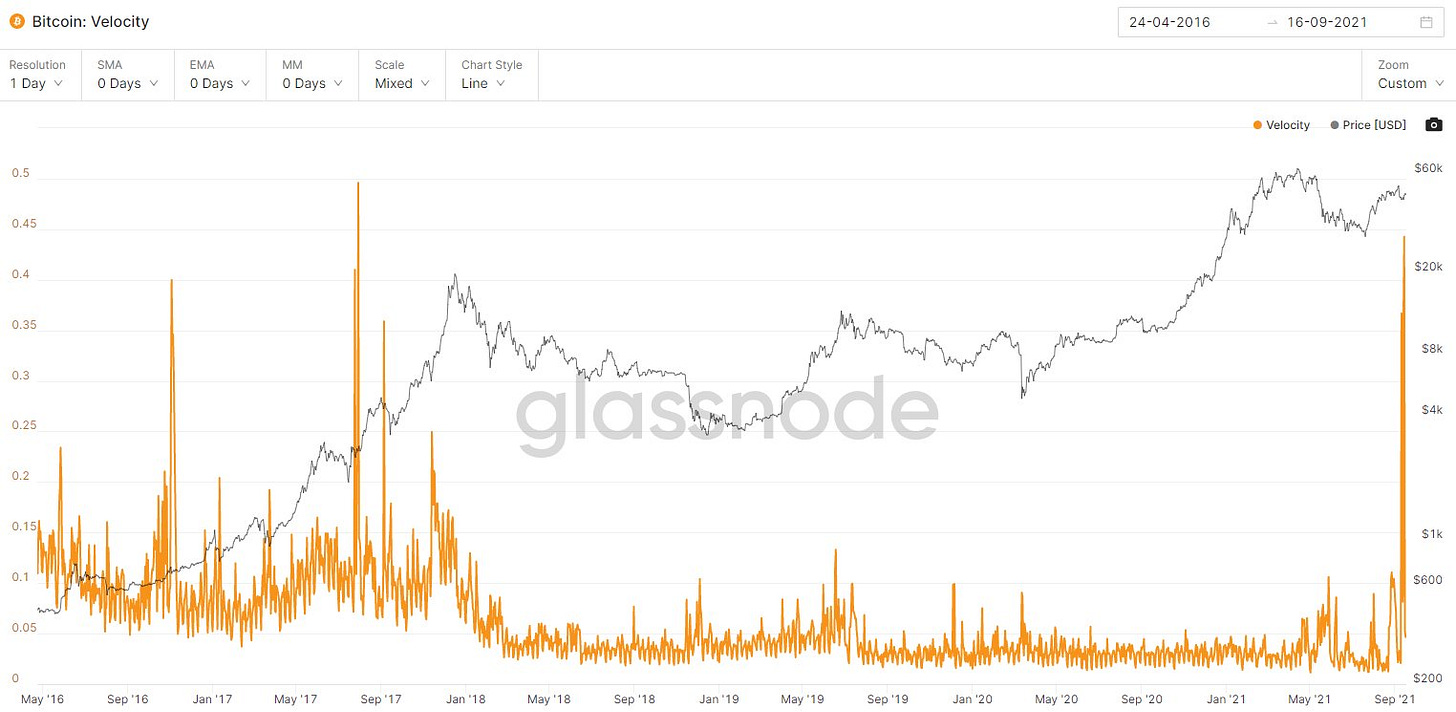

Bitcoin Velocity has had a huge spike this week, the metric is a representation of Volume USD / MarketCap USD. This basically means that the transacting volume in exchanges is spiking while the price has not change on a significant level. Historically we have seen price appreciation in the following months of these sudden spikes, only time will tell, but the fundamentals seem better and better to own bitcoin. Every day it goes by, every 10 minutes, is another block being produced, proving that our funds are safe in the strongest network ever existed.

As a summary note..

I’ve always admired Ray Dalio on his vision of the macro markets and wide understanding of how money works. In a recent interview with CNBC this week, he mentioned he owns some Bitcoin, a small percentage compared to his gold, which is a small percentage compared to his other financial investments. What astonishes me is his little understanding and great momentum it has had, he says it is not to be trusted, as it can be controlled, and governments will not allow it to become bigger.

He completely dismissed the fact that El Salvador considers it now an official currency, yeah something Christine Lagard, ECB President, remarked in her latest appearance as saying “it is not a currency, full stop”.

We all know governments stopped the use of gold in the past, but we are not living in the same era. Bitcoin is digital, easy to move around, harder to censor or confiscate. In the cusp of the biggest wealth transfer from the traditional financial system into bitcoin, the incentives are clear, get ahold of more bitcoin, and we have seen this happening even inside the political space of the U.S. Or just take a look on Florida, Texas, or Wyoming’s take regarding bitcoin.

If I was a politician, and owned some bitcoin, I would do everything in my possibilities to stack more, and have the best kind of regulations for it, and share the ‘gospel’ to my colleagues, because it would be the best insurance I could possibly have. Who knows maybe we see bitcoin becoming legal tender.

I don’t know about you, but I am stacking, there is just too much signal out there.

Have a great weekend niblings.

Stay humble & stack sats.

You want to contribute to WTFBitcoin?

Feel free to donate. But more importantly, share this with your friends and family..