TLDR: Bitcoin transforming countries, Banks consider bitcoin more than a hedge against inflation, Bitcoin becomes collateral for credits.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

We are back again experiencing the volatility of the known bitcoin beast. As the price oscillates around $55,000 at the time of writing, people are feeling the FOMO of not being able to “buy enough bitcoin” before the price ramps up even higher. Hard truth to be told is that: “One never has enough bitcoin” and we should make peace with it.

The sudden appreciation comes with bright news. In less than a month, El Salvador has successfully onboarded over 3 million users to the government owned Chivo Wallet app. In a country where 70% of the population is unbanked, bitcoin offered a new alternative way to become included in the financial system to almost 50% of the population.

Since the announcement of bitcoin becoming legal tender 4 months ago, Bukele has achieved:

Make bitcoin legal tender.

Onboard and giveaway of $30 dollars worth of bitcoin to 3 million users.

Amassed 700 Bitcoin for the country's reserves.

Country begins to mine using %100 renewable geothermal energy

And just this weekend, Nayib Bukele reported the country to have experience a $4 million surplus on their balance sheet due to bitcoin appreciation, allowing them to invest the full amount, for which will be used to build an Animal Hospital, without the need of selling any bitcoin, as they will use the funds stored in U.S dollar.

The appreciation not only benefitted the country’s balance sheet, but also all bitcoin holders of the network, which comes to remind us that the country gave $30 dollars worth of bitcoin to every citizen by downloading the Chivo Wallet App.

Depending on when the users installed the wallet, some have experienced 10%, 20% and even 35% appreciation, given that the bitcoin was held and not changed for dollars. But in any scenario, we can be sure that more people is paying attention and wondering what bitcoin is, and why it is experiencing this appreciating volatility.

Bitcoin changes lives, and also nations.

And this is how the week started.

1. Bitcoin set to become legal payment in Brazil.

2. After a 4 month ban, Iran has decided to lift the restrictions instituted in May on bitcoin mining, meaning licensed farms can come back online. It is said that the country hosts around 4.6% of the global miners, which likely has led to an influence on the recent spike in hash rate seen over previous weekend.

3. The Financial Accounting Standards Board received hundreds of letters inspired by MicroStrategy that urge U.S. accounting standards be reconsidered to accommodate companies that hold bitcoin.

4. The fifth biggest retail bank in the nation with $8.6 trillion assets under management, U.S. Bank, announced that its Bitcoin custody services are available to fund managers. Throughout a partnership with NYDIG, the bank will be able to offer custody services by using mutlisignature Bitcoin private key solution.

“Our clients are getting very serious about the potential of cryptocurrency as a diversified asset class.. I don’t believe there’s a single asset manager that isn’t thinking about it right now.” - Gunjan Kedia, Vice Chair of the Bank's Wealth Management

5. Dawn Fitzpatrick, CEO of Soros Fund with $6 billion of assets under management, says that Bitcoin is more than an inflation hedge. “I think it’s crossed the chasm to mainstream” - Fitzpatrick

6. UFC legend Jorge Masvidal’s bareknuckle MMA promotion Gamebred Fighting Championship has partnered with Legacy Records to award fighters with Bitcoin.

7. JPMorgan Institutional investors are favoring Bitcoin over Gold as an inflation gedge.

8. Marathon Digital Holdings has published updates to its production and miner installation for September, and announced a new $100 million revolving line of credit with Silvergate, which is secured by bitcoin, making Marathon the first publicly traded Bitcoin miner borrowing against their bitcoin holdings.

9. Bitfarms, the bitcoin miner, announced that it signed contracts and started constructing a 210 megawatt farm in Argentina.

10. Hodl Hodl, the p2p bitcoin trading and lending platform has successfully closed a Series B funding round of an undisclosed amount.

11. The 501(c)3 organization has begun accepting bitcoin and cryptocurrency donations through a partnership with The Giving Block.

12. Greg Foss shares the intrinsic value of Bitcoin calculated using Sovereign Credit Default Swaps. Considering only the U.S. debt to insure, Foss' model indicates that bitcoin should be worth today about $1.33 to $1.9 trillion, or around $70,000 - $100,000 per coin.

13. Kraken announced earlier this summer a $150,000 grant to Black Bitcoin Billionaire, an organization focused on promoting inclusion and diversity in the Bitcoin space. The grant was commissioned in bitcoin, amounting to 4.5 Bitcoin, giving the grant a value of over $245,000 today.

14. Public.com, the investing platform operated by Public Holdings Inc., is rolling out bitcoin trading to its more than one million customers, which now will be able to purchase and hold stocks, ETFs and cryptocurrencies.

FUNDAMENTALS

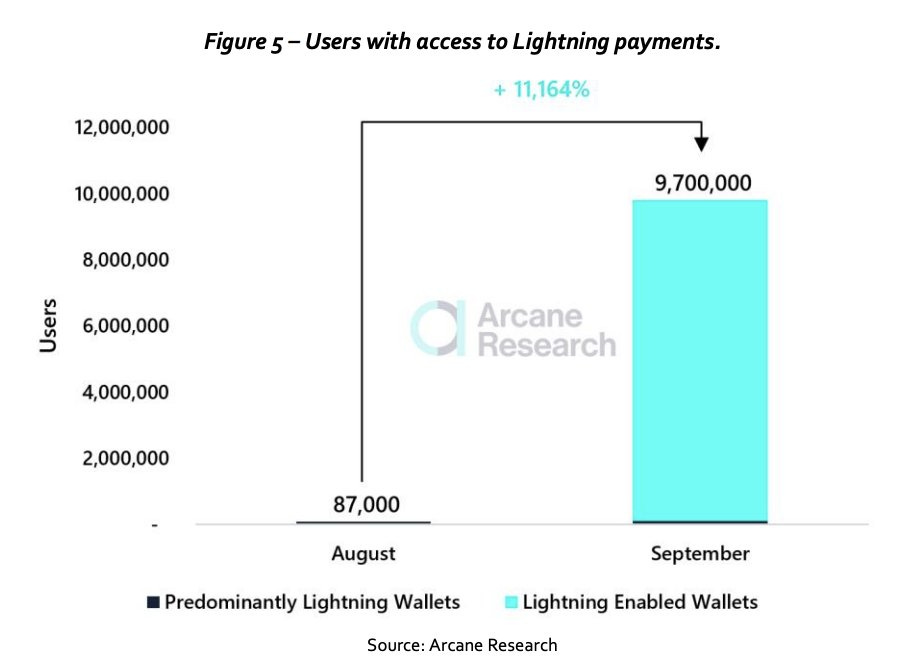

15. The Lightning Network gains popularity as it becomes adopted nationwide. With 3,000 bitcoin offering liquidity to more than 77,000 channels, the network capacity has more than doubled since June, while the channels nearly tripled since the beginning of the year.

The number of wallets has increased in an exponential manner, with more people using or at least exploring the technology.

As a summary note..

Adoption has a snowball effect. In the case of money a store of value and medium of exchange, starts by the individual and as it becomes widely accepted, the incentives of adoption only to increase more rapidly.

I often talk about El Salvador’s situation with respect to bitcoin, as it is an example of success, progress and fast paced adoption, which shows what could and most probably will happen in many other countries, as people realize the benefits of open monetary networks, and many are included in the global financial system for the first time.

In less than a month, small businesses across the country have adapted and started using bitcoin as marketing to attract customers.

With only a mobile phone, people like Cristina, can quickly become part of the global economy, being able to make business with anyone in the world, and has had access to the kindness of people of donating some sats directly into her wallet, proving the case that the banking model is outdated, there is no third party needed in order to transfer value between two persons, and a reminder that open monetary networks always win.

Have a great weekend niblings.

Stay humble & stack sats.

Did you find value on this? You want to contribute to Uncle Bam?

Then feel free to donate, a cup of coffee would be highly appreciated.

But more importantly, share this with your friends and family..

An action packed week! Thanks