2021W43 - WTF has happened in bitcoin this week?

Bitcoin is for everyone.

TLDR: Bitcoin becomes widely available through Banks and Retail Stores, MasterCard plans to make it easier to spend & receive, and NYDIG helps banking institutions utilize it as loan collateral.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

This week has been an amazing one, both in terms of news, and even price action. Incredibly bitcoin has stayed strong oscillating above $60,000, making a number which could have been seen out of reach a year ago, look normal and stable.

The news around the space are incredibly optimistic, with retail companies expanding the optionality for the average person to get ahold of bitcoin through ATMs, and payment processor giants such as MasterCard, researching the methods to incorporate bitcoin seamlessly into their technology.

It seems that Strike and now El Salvador has changed the game completely, being able to use bitcoin without your counter-party needing to know and being able to receive the currency of choice, while reducing costs for the payment processor provider by utilizing the bitcoin network as payment rails, it is just mesmerizing.

But what about taxes? Every time we use bitcoin should we pay taxes?

This is a question depending on each individual’s jurisdiction, but as we see the banking sector getting involved and allowing to use bitcoin as collateral for loans, the time is near when one will never need to sell their bitcoin, as the annual appreciation outpaces the interest rates charged for the loan.

And this is how the week started.

1. President Bukele, announced El Salvador has officially bought the bitcoin dip. While the price ranged around $58,000, after having touched close to $67,000, the country decided to accumulate 420 more bitcoin reaching a total of 1120 bitcoin in their balance sheet.

2. Walmart, retail giant, deploys 200 Bitcoin ATM in its stores, through a cooperation between Coinstar and Coinme.

3.Five Star Bank and UNIFY Financial Credit rolled out financial services through NYDIG, allowing customers to buy, sell and hold bitcoin.

4. Post Oak Motor Cars will be able to finance car sales through NYDIG's suite of Bitcoin services, including BTC-backed loans.

5. Mastercard plans to allow merchants to accept bitcoin payment and offer bitcoin rewards through a partnership with Bakkt.

6. Bitfarms, a bitcoin mining company, announced they are constructing two new mining farms in Sherbrooke, Quebéc, which will be likely completed in the first two quarters of 2022 housing a total of 78 megawatts of renewable power capacity.

7. Jelena Williams, FDIC Chairman, mentioned regulators are exploring how banks could hold bitcoin in custody, facilitate trading, use it as collateral for loans, or even hold them on their balance sheet.

"I think that we need to allow banks in this space, while appropriately managing and mitigating risk.. If we don't bring this activity inside the banks, it is going to develop outside of the banks...The federal regulators won't be able to regulate it." - Jelena McWilliams

8. Senator Rand Paul, said Bitcoin could become the world reserve currency, as people keep losing faith and confidence in governments and their policies

9. D.A.Davidson & Co, a leading company in wealth management and capital markets, mentioned that “Wall Street is growing more aware and interested in Bitcoin and bitcoin mining companies”.

10. Tom Brady gives a fan one full bitcoin, in exchange for his 600th touchdown ball.

11. Bitcoin exchange FTX bought an ad for the upcoming NFL Super Bowl for an undisclosed amount, said to take advantage of the game’s high viewership.

12. Voltage, the Lightning node cloud hosting platform, has announced Flow, a new interface that is to make the Lightning Pool liquidity marketplace more accessible to everyday users

FUNDAMENTALS.

New metrics analyzing the bitcoin blockchain have been published this week.

DilutionProof shared his two metrics analyzing the value of bitcoin based on Hodler behaviours:

Market-Value-to-Long-term-holder-Value (MVLV)

Market-Value-to-Illiquid-Value (MVIV)

And Yassine and David Puell just released “A Framework for Valuing BTC”, which features 5 new ARK on-chain indicators:

Investors Capitalization

Short-To-Long-Term-Realized-Value (SLRV)

Realized Profits-to-Value Ratio (RPV)

Short-Term-Holder Profit/Loss Ratio (STH P/L)

Sellers Exhaustion Constant

As a summary note..

Where are we going next? There is a lot of questions going around in the community such as:

Have we reached the top?

Will the 4th year cycle break or the top will be in December?

Will we experience another 80% correction?

Are cycles lengthening?

Is this a supercycle?

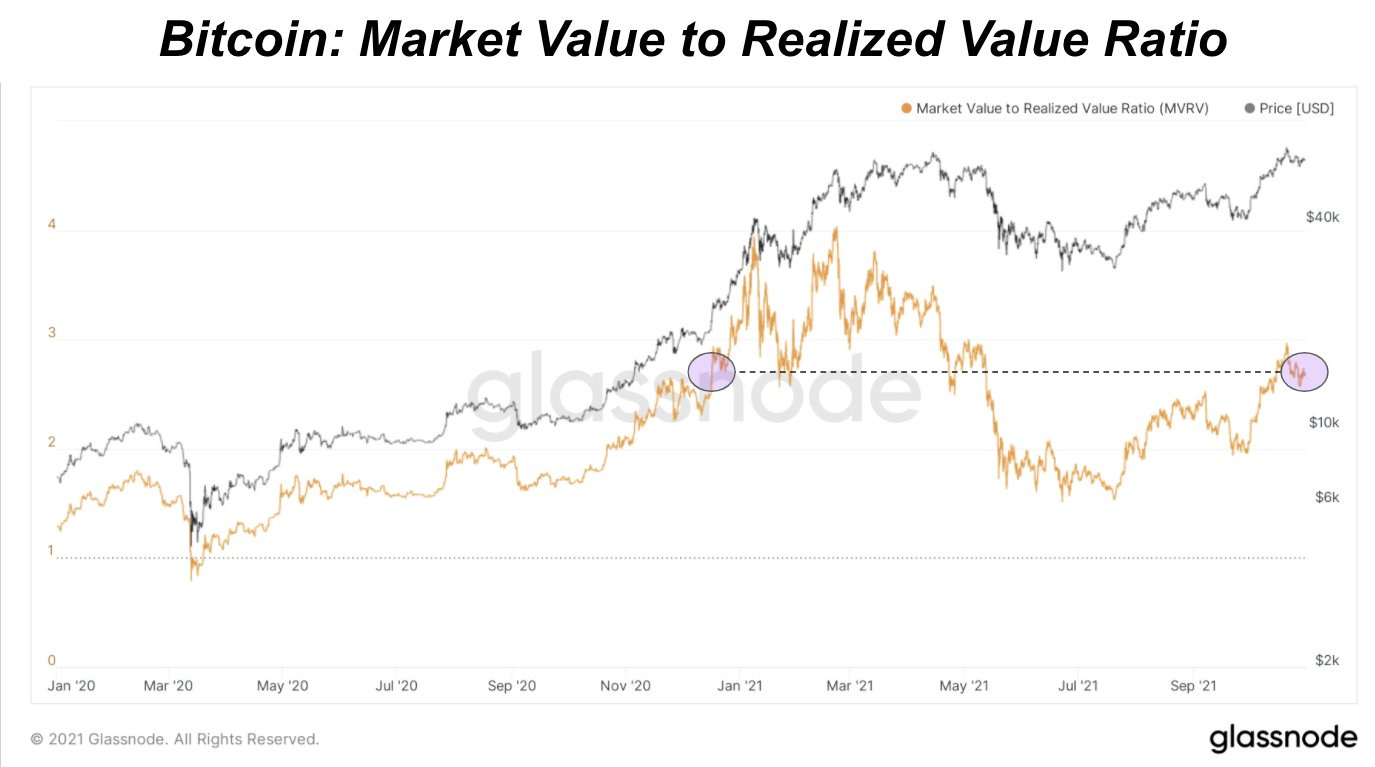

There is clearly not a straight answer for all of these, only for the first one. No we have not reached the top, there is no top long term. But lets focus on the following months ahead of us, I just took a look on the Market Value to Realized Value Ratio shared by Dylan, which basically shows us the proportion of the bitcoin price, to the price of every bitcoin on the last time they moved and it shows levels equivalent to when bitcoin hit $21,000 in December 2020.

Based on this chart, it took more than 4 months to find a new maximum to later experience a drawback of over 60%.

I think it is probable to see any of the two options, 4 year cycle, or a longer cycle, but an 80% drawback, would depend on how high the next local top. For instance if bitcoin price only was to reach $100,000 by December, it would be hard to imagine another 50% retracement, and the 4 year cycle would have break, and we might have either lengthier cycles or a super cycle, with short bear markets.

But if price starts ramping up in a strong volatile move towards above $200,000 before end of year, then it is likely to see big draw backs again. I cant say which scenario is more probable, which is why I’d recommend to stay humble and stack sats.

Remember, selling to buy back lower has higher chances of making you lose your position, as you’d have to consider paying 30% tax of the profits, meaning the drawback has to be higher than that in order to accumulate more bitcoin.

Have a great weekend niblings.

Stack Harder!

Did you find value on this? You want to contribute to Uncle Bam?

Then feel free to donate, a cup of coffee would be highly appreciated.

But more importantly, share this with your friends and family..

Another amazing week and a great write up. That ARK link looks 👌. Gonna get stuck into that today ❤️