2021W7 - WTF has happened in bitcoin this week?

Bitcoin is an insurance against depreciating currencies

TLDR: Bitcoin just reached $ 1 Trillion dollars in Market Capitalization.

Bitcoin has finally surpassed the mental resistance of $50 thousand dollars. Not only that, as we write, it is currently trading at ~$55,000.00. The year has had a phenomenal start in terms of fundamentals for bitcoin, but the price isn’t lagging one bit. Last week in WTFBitcoin, we stated that it was probably the most bullish week so far, but this one does not disappoint.

The week started by reaching a new high close to $50K, but it had not consolidated, until Michael Saylor came with his big announcement of “MicroStrategy Announcing Pricing of Offering of Convertible Senior Notes”, with the intention of buying bitcoin [1].

In easy terms, Saylor is requesting a loan from investors at a 0% interest rate, offering them the possibility to convert the notes into MSTR stock. And the story went down like this:

- Feb 16, Bitcoin trading between $47K-50K:

“Hey guys, I am raising $600 Million. Yup, to buy Bitcoin.” - Michael

- Feb 17, Bitcoin trading between $49K-52K:

“Guys, seems like you don’t understand the gravity of this, ok lets make it $900M” - Michael

- Feb 19, Bitcoin starting the day in $52K-53K:

“Ok people, you had your chance, we collected $1.05 billion, which will be straight up used to purchase bitcoin for our MicroStrategy’s reserves”

Bitcoin price soars and close the day oscillating between $55-56K.

Ok this is clearly not what Michael explicitly said, but let us be honest here. Michael is offering us a de-risked bitcoin purchase opportunity for the second time (we thought this was once in a lifetime, but second chances exists). This basically means, you know in advance the amount of capital which would be injected into the bitcoin network and you are having the opportunity to front-run him. He has said it before, He wants all of us to get rich together.

And this is how this crazy week started:

1. MicroStrategy proposed private offering of $600 Million of convertible senior notes with the intention of purchasing bitcoin. The following day, the proposal was raised to $900Million. On Friday 19th of February, Michael announces that the offering was completed for the amount of $1.05 Billion.

2. MicroStrategy is hiring talent for a Bitcoin Data Product. The BI company is starting to drive some focus into the bitcoin network, not only as a treasury and a store of value but finding new business opportunities to develop.

The team will be “building an analytics platform with advanced metrics and insights for Bitcoin.”

3. Beşiktaş JK Men's Basketball A-Team, from Turkey, received 42 Bitcoins as a sponsorship from ICRYPEX, a Turkish bitcoin exchange. The current value of this grant is approximately $2.3 million.

4. SynBiotic SE (Frankfurt Xetra L3D:GR) just became the first publicly traded company in Germany to add Bitcoin on its balance sheet as a hedge against Euro devaluation.

5. The Motley Fool announces $5 million investment in bitcoin. Interestingly how a company which had a definite biased against bitcoin in the past, now changes its mind. They went from advising against it, to adopting it, and now recommending it in a short matter of time.

“It is wise and better to change your mind rather later, than to live a long life in denial” – Bam

6. BlackRock, the world’s largest asset manager confirms to be looking into bitcoin. Without confirming whether they will actually purchase, they stated that it would made sense to hold some portion of bitcoin since they have a lot of cash, and interest rates are not working as a hedge.

7. The canton of Zug, in Switzerland, announced to have started accepting bitcoin for tax payments. “As the home of the Crypto Valley, it is important to us to further promote and simplify the use of cryptocurrencies in everyday life” – Heinz Tannler, Zug’s finance director.

8. A second Bitcoin ETF gets approved in Canada. EBIT will directly hold Bitcoin in its cold wallets and conduct daily valuations of bitcoin based on CF Benchmarks Bitcoin Reference Rate.

9. ECB Christine Lagarde says “It is out of the question that central banks would hold bitcoin”. Well Christine, speak for yourself and the ECB. Swiss National Bank holds companies with big exposure to bitcoin, specifically MicroStrategy (MSTR).

FUNDAMENTALS

Is bitcoin still a good investment today? This is a personal question that you must ask yourself. Here in WTFBitcoin ,we give you the best tools to take your decision. For us, it is looking still more than promising long term, it is a matter of perspective.

10. Saifedean shares with us a logarithmic chart of bitcoin’s price with its yearly returns. While bitcoin has been volatile and been called a “bubble” by “some experts”, it has proven a solid record of its NgU technology. Scarcity has value, and one can’t manipulate bitcoin’s monetary policy.

“Intellectuals can argue until they're blue in the face that bitcoin fails to fulfill their theoretical expectations of it.

There are no right and wrong answers in theoretical masturbation.

There are only consequences” - Saifedean

11. The rich people seem to be desperate for buying your bitcoins. Do not sell them, and if you do, don’t do it this cheap! BTC_Archive shares this visual where we can see 94,000 addresses holding $1 million dollars in bitcoin, and the number of addresses has been rising since surpassing $20,000.

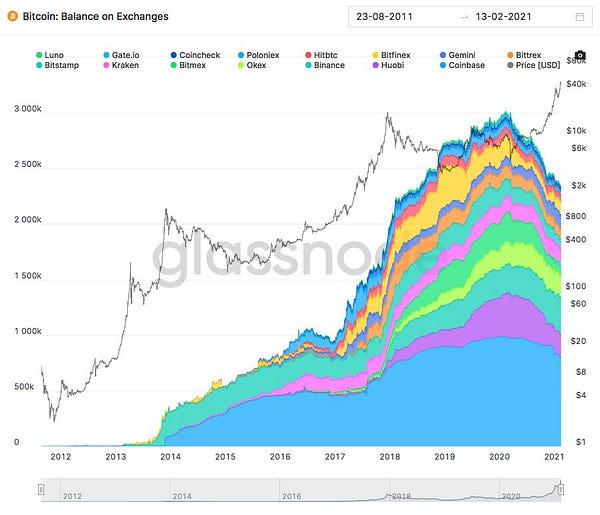

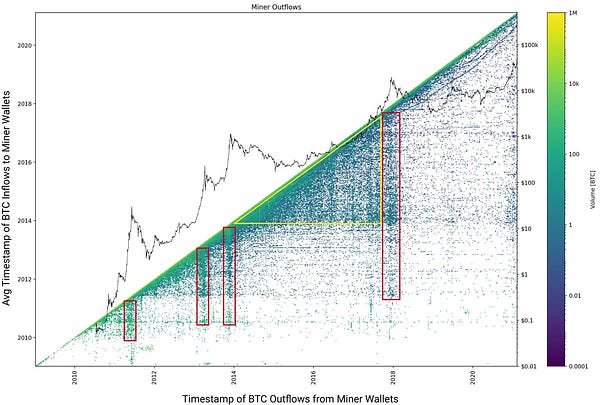

12. Glassnode shares with us an update of the Bitcoin outflows. In the analysis it is showed how these outflows hasn’t increased compared to previous bull cycles’ last months. This could give the indication that people are buying at these prices instead of selling.

13. This can be corroborated by the chart shared by CitizenBitcoin, where we see the availability of bitcoin in exchanges to continue decreasing. In previous tops, it was clear that bitcoins were entering exchanges with a raising trend. How long can the price run up still?

As a summary note…

Yet another intense week. Bitcoin continues with its de-risking process, by being the best risk-adjusted return asset we have seen in a long time. The Bitcoin network is now worth over $1 trillion of market capitalization for the first time. Some could say we are finding a “top”, but the truth is, this opens doors for bitcoin to being viewed as an investable asset for many other Hedge funds or even Pension funds.

Regarding where we go from here? It is a matter of perspective, in the long term, it looks promising, in the short term, we could argue the same ‘bullishness’ but the truth is that anything can happen. Hence why we must focus on the long picture. We have said it before in a previous issue, it matters more the time in the market, than timing the market.

The truth is that the trend is clear, throughout this year 2021, every single week we can find a big company announcing a relatively big investment of their balance sheet into bitcoin, banks starting to adopt the technology, and governments to regulate it and accept it.

Well, not all governments, Nigeria banned bitcoin this week, but what happened? The price spiked.

All in all, we continue with our mindset that bitcoin is artificially designed to appreciate forever. So, take these news and fundamentals as your edge, and front-run the companies and millionaires who are about to get themselves some bitcoin.

Stay humble & stack sats.

…

You want to contribute to WTFBitcoin?

Feel free to donate.

Extra: This interview of Matt Odell and Anthony Scaramucci, is the recipe for conviction. They basically explain why bitcoin at this price feels safer for institutions, than at 400usd. The insight they portray is basically: “This is only the beginning.”

References:

1.

2.https://www.coindesk.com/microstrategy-bitcoin-data-product

3.https://news.bitcoin.com/ecb-christine-lagarde-central-banks-hold-bitcoin/

5.https://www.fool.com/investing/2021/02/17/the-motley-fool-announces-5-million-investment-in/

8.https://decrypt.co/57887/a-second-bitcoin-etf-gets-approved-in-canada

9.https://news.bitcoin.com/ecb-christine-lagarde-central-banks-hold-bitcoin/

10.

11.

12.

13.