2022W11 - WTF happened in Bitcoin this week?

It is not too late to buy bitcoin.

TLDR: Bitcoin surging, Interest Rates Hike, Adoption continues.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

These last few weeks there has been panic in the financial markets given the expected raise of rates of the Federal Reserve. It is a bit crazy to me that everyone’s expectation is based on the actions of one man, Jerome’s Powell, decision on how to manipulate the market to increase or decrease inflation.

As inflation prints record values of about 7.9%, it is clear that people are starting to feel the impact and complain about it, so the Federal Reserve seems to take responsibility to “fix the issue” by raising rates, but of course they don’t take that same responsibility in the first place of printing money and potentially being the main cause of this inflation. No, “clearly that is Russia’s fault”.

This impacts as well the price action expectation of the people, as they’ve seen Bitcoin has been slightly correlated to the stock market, but to all of our surprises, it surged past $40,000 as the Federal Reserve hiked interest rates by 25 basis points.

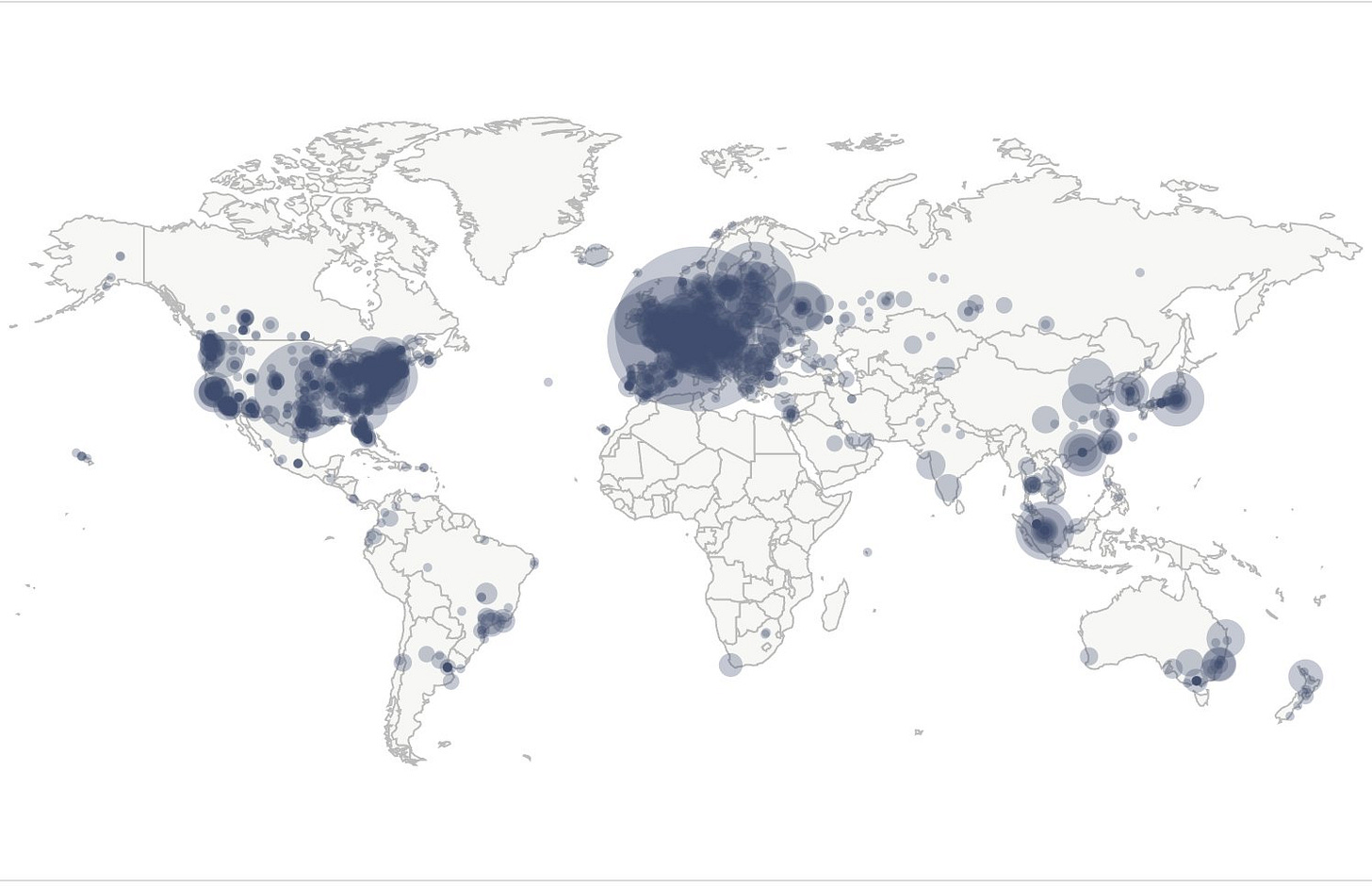

But well, now that this is off our minds, let’s continue building a stronger network, and setting up more nodes to protect it. Because if we don’t do it, no one else will.

Just looking at a livemap of bitcoin nodes around the world, doesn’t it incentivizes you to become a part of this financial revolution?

And this is how the week started.

THE NEWS

0 . Do Kwon, founder of UST/LUNA, to purchase $3 billion in bitcoin, from which most of it has not yet been purchased, per conversation in Twitter Spaces.’

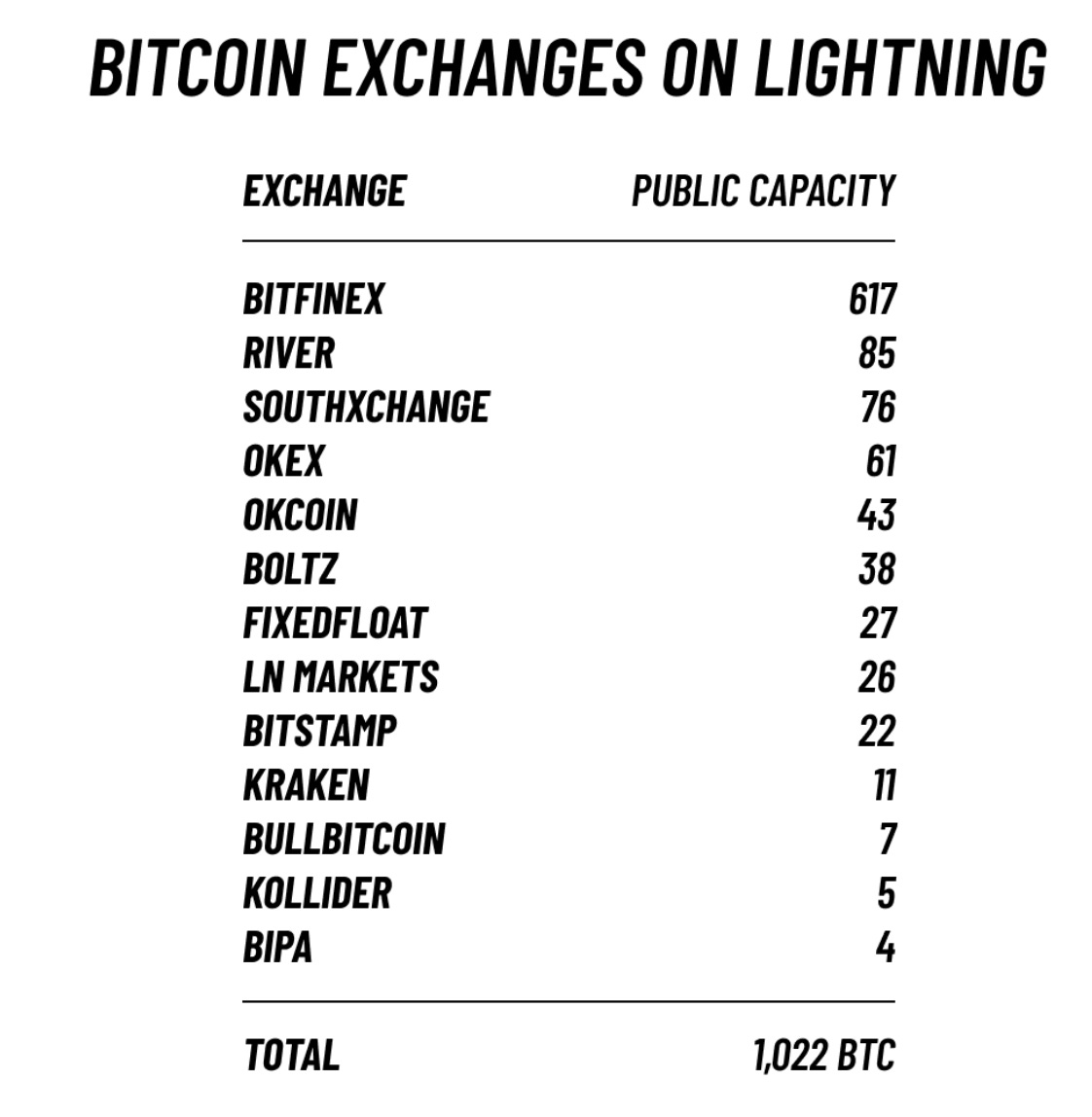

1 . Bitcoin exchanges on Lightning have now over 1,000 bitcoin of combined public capacity.

2. A group of Swiss Bitcoiners became shareholders of Swiss National Bank, and sent a formal request to prepare and invest in Bitcoin.

3. Elon Musk tweeted “I still own and won’t sell my Bitcoin,” in response to CEO Micheal Saylor, discussing the collapse of weaker currency.’’

4. DoubleLine Capital CEO says he would take bitcoin over gold.

5. Novelship, Southeast Asia's largest online marketplace, is now accepting bitcoin as payment.

6. Congressional candidate Taylor Burke discusses advocating for Bitcoin as a U.S. politician.

7. Ukrainian President Zelensky has signed a bill making bitcoin and other cryptocurrencies legal, establishing regulatory agencies and investor protections.

8. Hydrobonds emerge as an idea for Ecuador, as a way to raise capital to fund the hydroelectric projects and utilize that energy to feed the grid and mine bitcoin.

9. Relai, a bitcoin-only savings and investment app, is using a referral program to donate up to 50% of referred transactions to humanitarian organization UNICEF.

10. The Bitcoin-only fintech gaming company, ZEBEDEE, has partnered with bitcoin exchange Bipa to allow instant conversion off-ramps for Brazilian real through Lightning.

ABOUT WALLETS

11. Hexa Wallet’s pre-seed rounds of over $1 million are being used to onboard developers, designers and drive community efforts for self-custodial bitcoin apps.

12. Dorsey’s Block plans to leverage a fingerprint sensor instead of a password or seed phrase to secure your bitcoin.

13. El Salvador tapped crypto software firm AlphaPoint to fix numerous problems with its state Chivo wallet and help citizens adopt Bitcoin.

FUNDAMENTALS

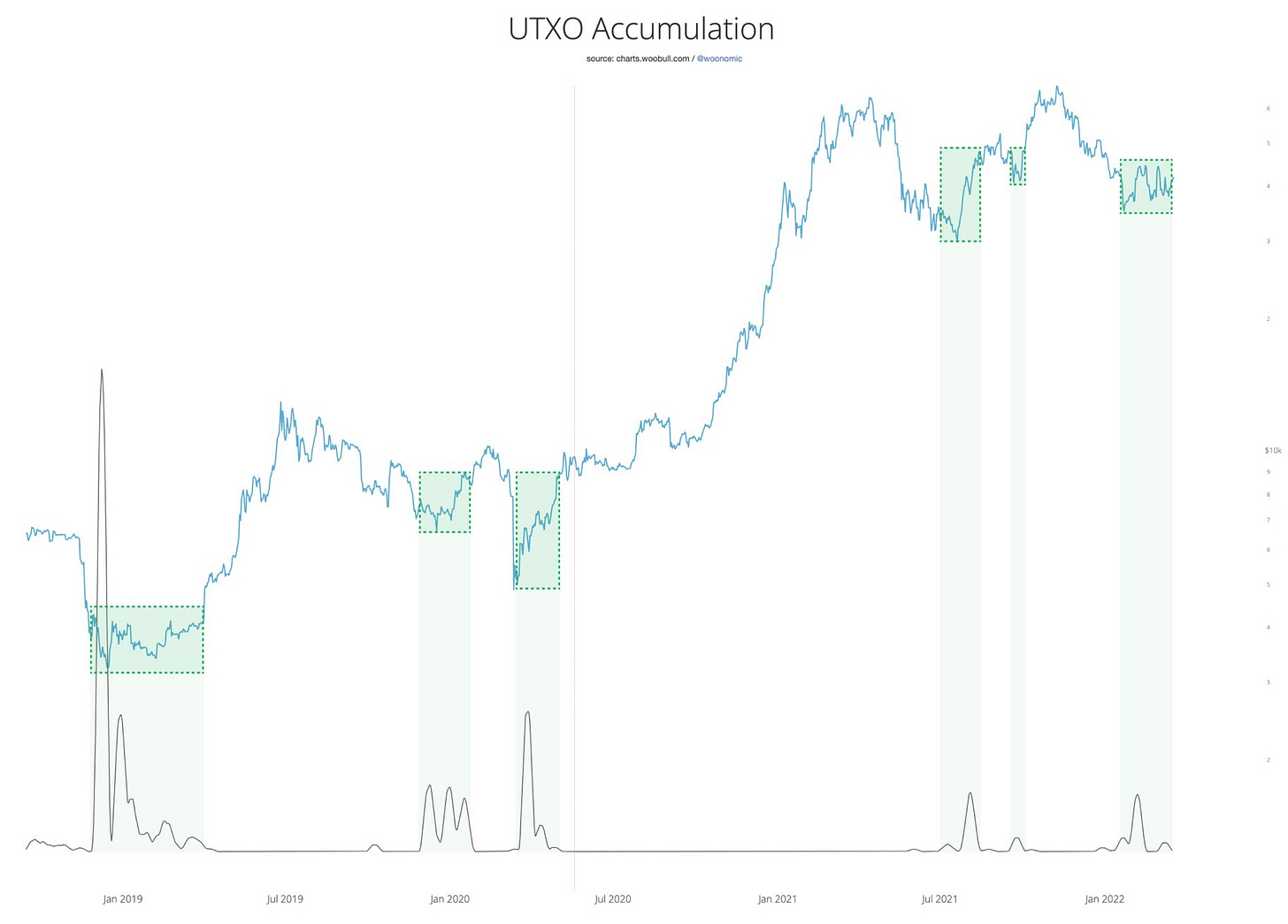

14. Ever since last retracement from bitcoin’s recent high in November, the accumulation started right as it hit values in the low $30,000s in the beginning of January. According to Willy’s chart, this is a repeated pattern before every significant appreciation phase. Although this does not mean that the price will appreciate form here, at least there is an indication of the interest of accumulating bitcoin.

“This is an on-chain algorithmic filter looking at the magnitude of coins being sold by weak investors at a loss during times of sufficient demand to mitigate downside price moves.” - Willy Woo

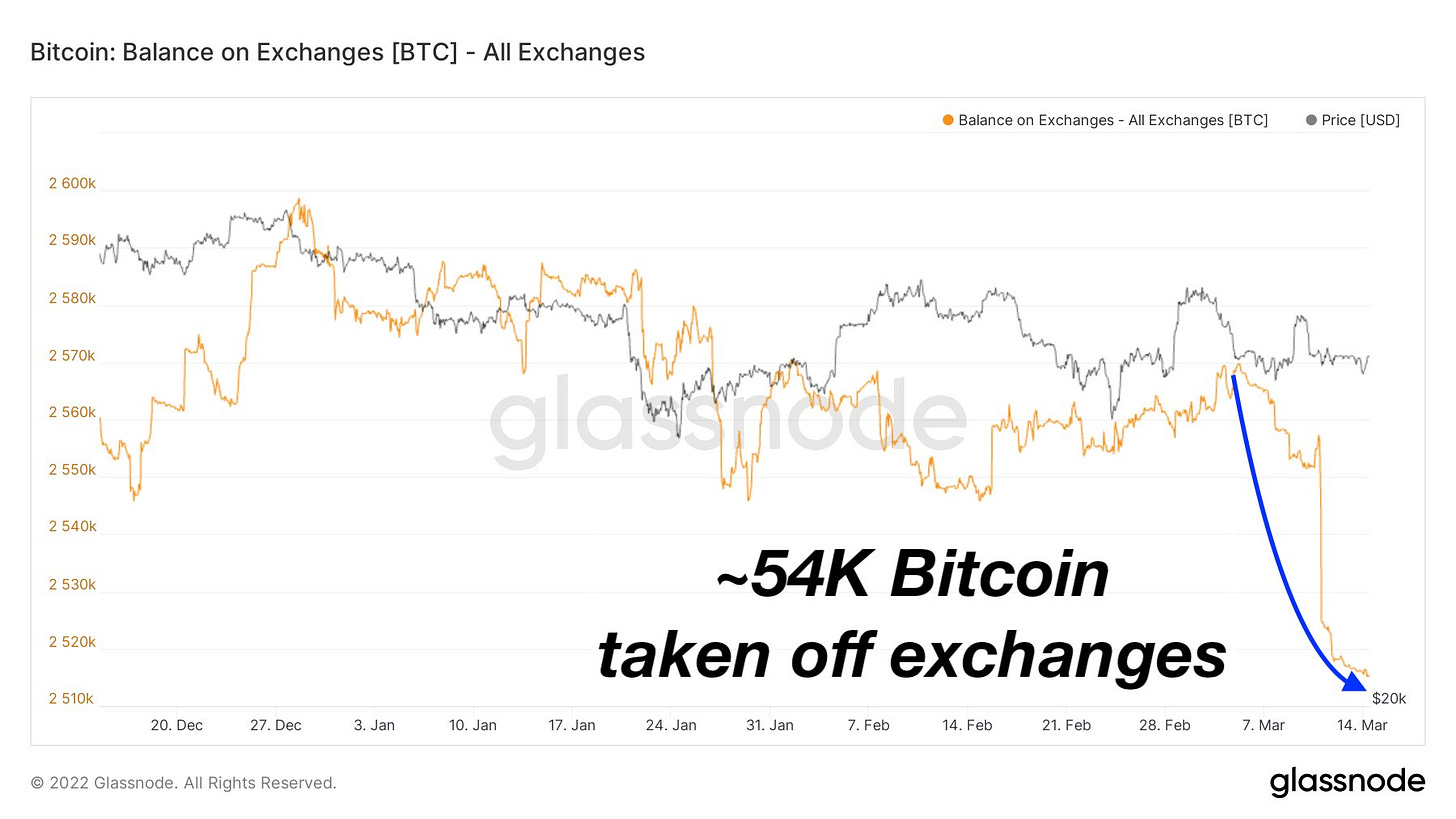

15. Bitcoin available for trade in exchanges is reaching new lows. The demand seems to be increasing.

As a summary note..

It is normal to think:

“Am I too late to buy bitcoin?”

Same question has been asked hundreds if not thousands of times along the way.

10 years ago..

8 years ago..

3 years ago..

As the potential appreciation obviously decreases along with the risk, the truth is, that it is still early. Bitcoin is programatically designed to appreciate forever as it is the scarcest asset there is.

Have a great weekend niblings.

Stay humble & stack sats.

Supported by:

How to buy bitcoin? (With Relai through Revolut)

If you are in Europe, I made a pretty simple guide with 3 steps, which avoids you having to set up an account on an exchange, give them all of your personal information, plus custody of your funds.

Did you find value on this? You want to contribute to Uncle Bam?

Then feel free to donate, a cup of coffee would be highly appreciated.

But more importantly, share this with your friends and family..