TLDR: Betting on Lightning, MSTR uses Bitcoin as Collateral for Loan to Stack More, Terra accumulates even more bitcoin as reserves, More and more parties start accepting bitcoin.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

Bitcoin is taking over, slowly but surely. As time goes by and development continues, bitcoin penetrates more than the traditional financial world, in these last days I have seen more and more possibilities to run bets over Bitcoin network, and now over the Lightning network too.

How does this work? I am not an expert on this precise topic, but it works by utilizing Discrete Log Contracts (DLCs), which is a type of bitcoin transaction which uses an oracle to execute a smart contract. It essentially allows parties to place bets using the Bitcoin blockchain.

For a while it has been possible to do so on the Bitcoin Network, but this week we have seen an implementation shared by yuya where it is demonstrated that it is now possible to bet new Option Style DLC on the Lightning Network!

The Lightning Network is basically proving itself to be here to stay. It is allowing bitcoin to shift from a store of value to a medium of exchange, without the need of utilizing fiat currency instead. Being a programable currency or network, it allows to make a broader impact in different industries too, and now we are seeing how it could revolutionize the E-sports betting industry, as it becomes more decentralize and the need for a booking service or broker is diminished. From now on, bets could run in an independent fashion without the need of having to pay a big fee to or having your funds hosted by a third party

THE NEWS!

1. Kraken, one of the leading cryptocurrency exchanges, has just announced support for the Lightning Network for inexpensive and instant customer deposits and withdrawals of BTC.

2. MicroStrategy closes $205 million bitcoin-collateralized loan from Silvergate Bank to buy more bitcoin.

3. Terra has continued to purchase bitcoin, amassing a total amount of 30,727 bitcoin in their reserve balance sheet, worth over $1.4 billion usd.

4. CleanSpark’s power agreement with Texas-based Lancium is expected to eventually trigger a five-fold increase in its bitcoin mining hashrate capacity.

5. Seetee will be the lead investment partner of Ten31 for Bitcoin-based projects, companies and founders while the two companies continue individual investments.

6. OctaPharma Plasma, a U.S. based pharmaceutical company that collects plasma for life-saving medications, has partnered with Swan Bitcoin and Spade Payment Solutions to allow individuals to get paid in bitcoin for donating plasma.

7. ZBD Streamer by ZEBEDEE fuels the creator economy by allowing users across all streaming platforms to tip streamers in bitcoin without incurring any fees.

8. Pierre Poilivere, candidate for Prime Minister from the Conservative Party and current member of the Parliament of Canada, is seeking to gain favor in the Bitcoin space.

"Government is ruining the Canadian dollar, so Canadians should have the freedom to use other money, such as bitcoin" – Poilievre

9. Leumi will be the first Israeli bank to offer bitcoin and other cryptocurrency trading in partnership with Paxos, pending regulatory approval.

10. Bengal Energy, a Canadian oil & gas company, will mine bitcoin with stranded gas in Australia.

11. Citizen School in dubai, will accept bitcoin for tuition payments.

12. Coinbase to acquire Mercado Bitcoin, the Latin America’s largest bitcoin and crypto exchange.

13. Europe’s biggest department store group, El Corte Inglés, is launching a bitcoin and crypto exchange.

14. Italian luxury fashion label Off-White now accepts bitcoin payments in London, Paris and Milan.

FUNDAMENTALS

Canadian Bitcoin ETF, Purpose Bitcoin has seen an increase of demand from customers accumulating bitcoin.

As a summary note..

Bitcoin price is driven by supply and demand. This means that as long as people want to accumulate it, they’ll need to find some available bitcoin for sale, if this was infinte then its price would never have an upwards pressure, as anyone could find some availability. But bitcoin’s supply is limited, and its issuance is fixed and unmodifiable, decreasing at a certain rate year after year.

So what can we get from all of this? Well, on any asset we could get ourselves hyped up by the news, and emotion into predicting something is surging, without further visibility on whether it is really true, or there is an insider party undergoing some manipulation. With bitcoin this is slightly different.

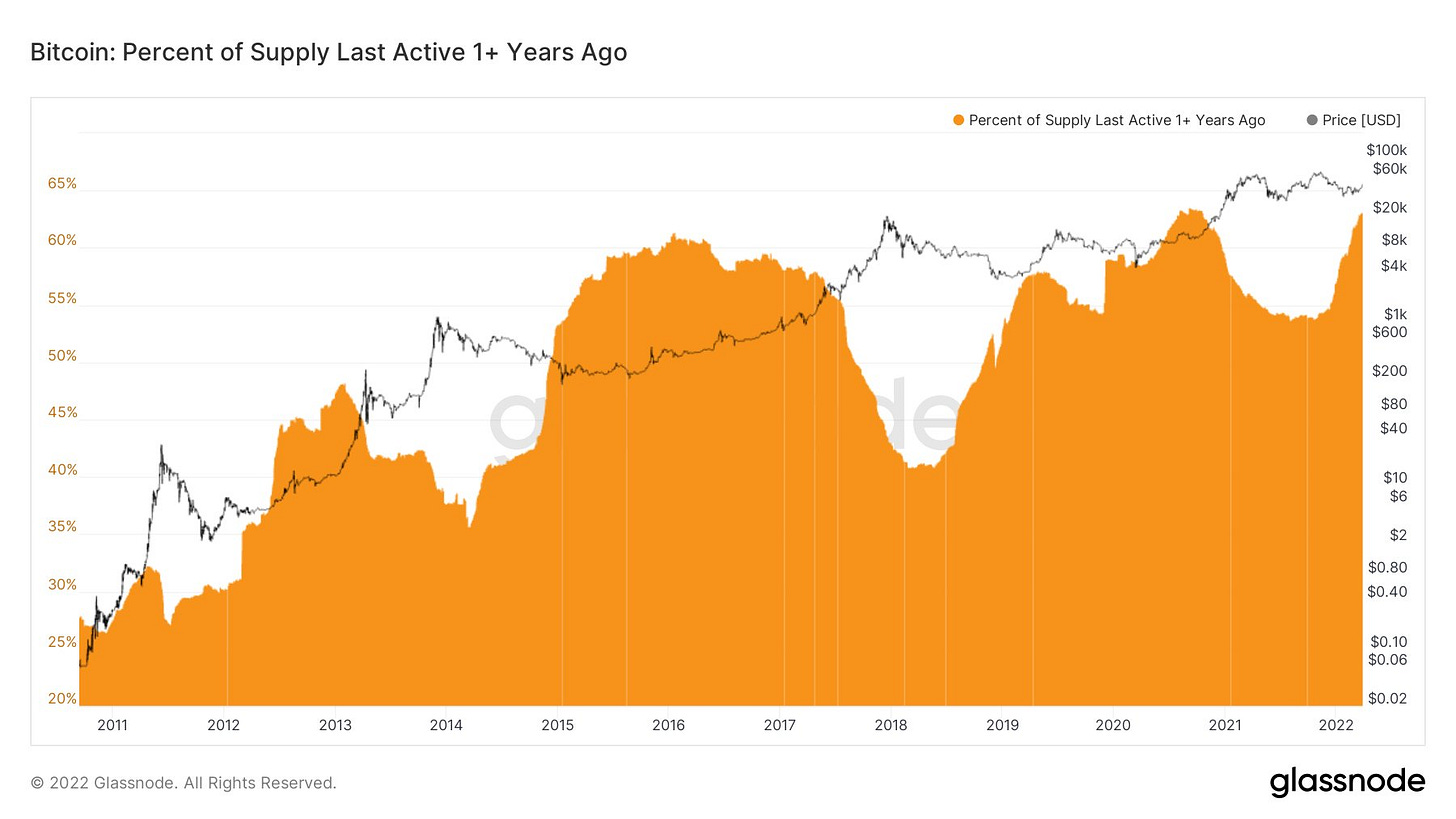

As bitcoin is an open network and a transparent ledger, one could keep track of how the addresses holding bitcoin are behaving, and here we have about ~63% of the total amount of bitcoin not being moved for more than a year.

Just think about it, more than 63% of the bitcoin’s have not moved in more than a year, plus people keep on accumulating, and as time goes by more of these addresses are taken off the market, reducing the availability of bitcoin for people to trade, resulting on a naturally appreciation of the hardest asset on earth.

Have a great weekend niblings.

Stay humble & stack sats.

Supported by:

How to buy bitcoin? (With Relai through Revolut)

If you are in Europe, I made a pretty simple guide with 3 steps, which avoids you having to set up an account on an exchange, give them all of your personal information, plus custody of your funds.

Did you find value on this? You want to contribute to Uncle Bam?

Then feel free to donate, a cup of coffee would be highly appreciated.

But more importantly, share this with your friends and family..