2022W15 - WTF happened in Bitcoin this week?

Bitcoin does not care

TLDR: Terra buys more bitcoin, Exchanges get dried out of bitcoin, Bitcoiners are not psychopaths but altruistic.

Hey there my lovely psychopaths, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

This week Mainstream Media has given us the label of psychopaths, who would have thought right? But nothing to worry about with a little fix we can find the signal between the noise, and that is right.. bitcoin does not care.

Independently of what bitcoin media has to say on regards to bitcoin, the community keeps on building, growing and more importantly giving too. This week I stumbled upon a really nice video from a journalist who was visiting the Bitcoin 2022 Conference in Miami who decided to try and send some sats to a Ukrainian lady in Poland. Within minutes, we can see the empowerment that bitcoin provides by allowing someone across the world to receive value instantly and convert it into the local currency within minutes, for little to no fees.

This is the real potential of bitcoin, by interoperating with the current financial system, and combining the hard monetary properties of bitcoin the asset, with the current usability of the legacy system, people are and will be able to have a better space to store value, which is permission-less and hard to confiscate, but at the same time having the possibility to use it on a daily basis.

On the other hand, I guess bitcoiners are not such evil individuals who only care about themselves right? ;) .

THE NEWS!

1. Terra has bought 2633 bitcoins since last week’s report, amassing a total of 42,630.82 bitcoins.

2. From Nasdaq survey of 500 financial advisors, 72% would invest more heavily into the space if a Bitcoin ETF was to be approved. Additionally, 86% of the advisors who pre-allocated to bitcoin, plan to increase the allocation over the next 12 months.

3. Grayscale CEO announced they are working closely with SEC to convert the Grayscale Bitcoin Trust into a Bitcoin ETF

4. 41% of crypto owners purchased crypto for the first time during 2021, according to Gemini.

5. KuCoin released Into The Cryptoverse, a report showing 35% of Nigerians aged 18-60 are invested in or trading bitcoin and other cryptocurrencies.

6. ASIC manufacturer Canaan announced a brand new mining machine in addition to green mining standards for energy, mining and infrastructure.

7. Ubersmith, a New York based software company that provides open, scalable and integrated solutions for billing, infrastructure and ticketing, has announced BitPay integration, allowing Bitcoin payments.

8. Brazil is favoring a single Bitcoin and cryptocurrency legislation in an effort to enact it by the first half of 2022.

9. The world’s largest processing and payments company FIS has partnered with Fireblocks to allow institutional access to Bitcoin and other cryptocurrencies.

10. Nexo, a lending services provider, has partnered with Mastercard and DiPocket to offer Nexo Card, a credit card backed by bitcoin or other cryptocurrencies.

11. ZEBEDEE, a bitcoin-only gaming fintech company partners with mobile gaming studio Fumb Gaming to release “Bitcoin Miner,” a bitcoin mining simulator.

12. Bitrefill partners with Spencer Dinwiddie to launch a smart sneaker capable of displaying the BTC price in real time with a node built into the shoe box.

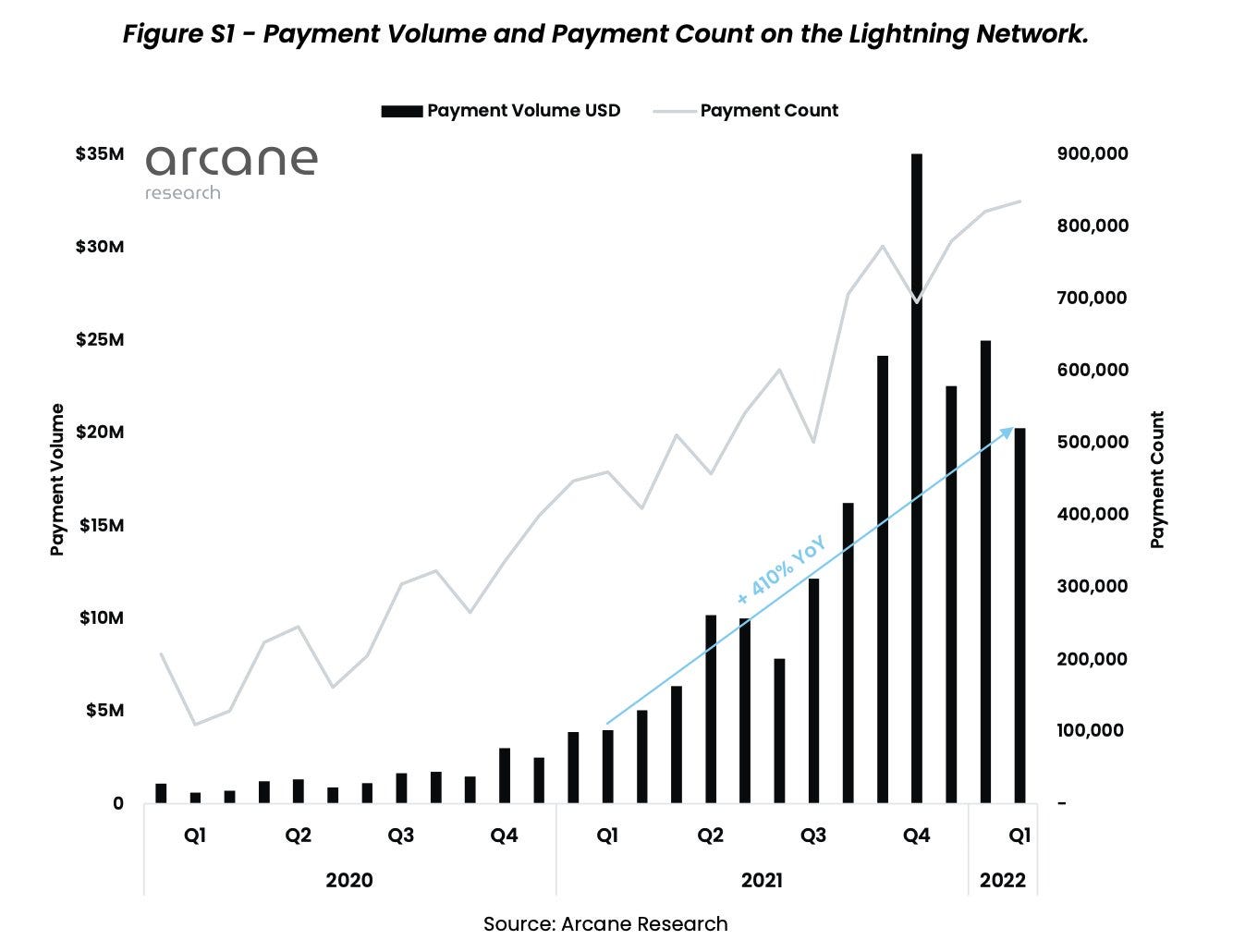

13. Arcane Crypto and Opennode teamed up to release a Bitcoin Lightning Network research paper detailing growth in the network, adoption and plateaus.

14. Invity.io, operator of the Trezor wallet app, has partnered with Swan to add recurring, straight-to-self-custody bitcoin purchases for users.

FUNDAMENTALS

In Arcane’s report, some of the findings are:

The number of payments roughly doubled in the past year

Value of payments in USD increased by ~400%.

Adoption increases faster than public indicators suggest.

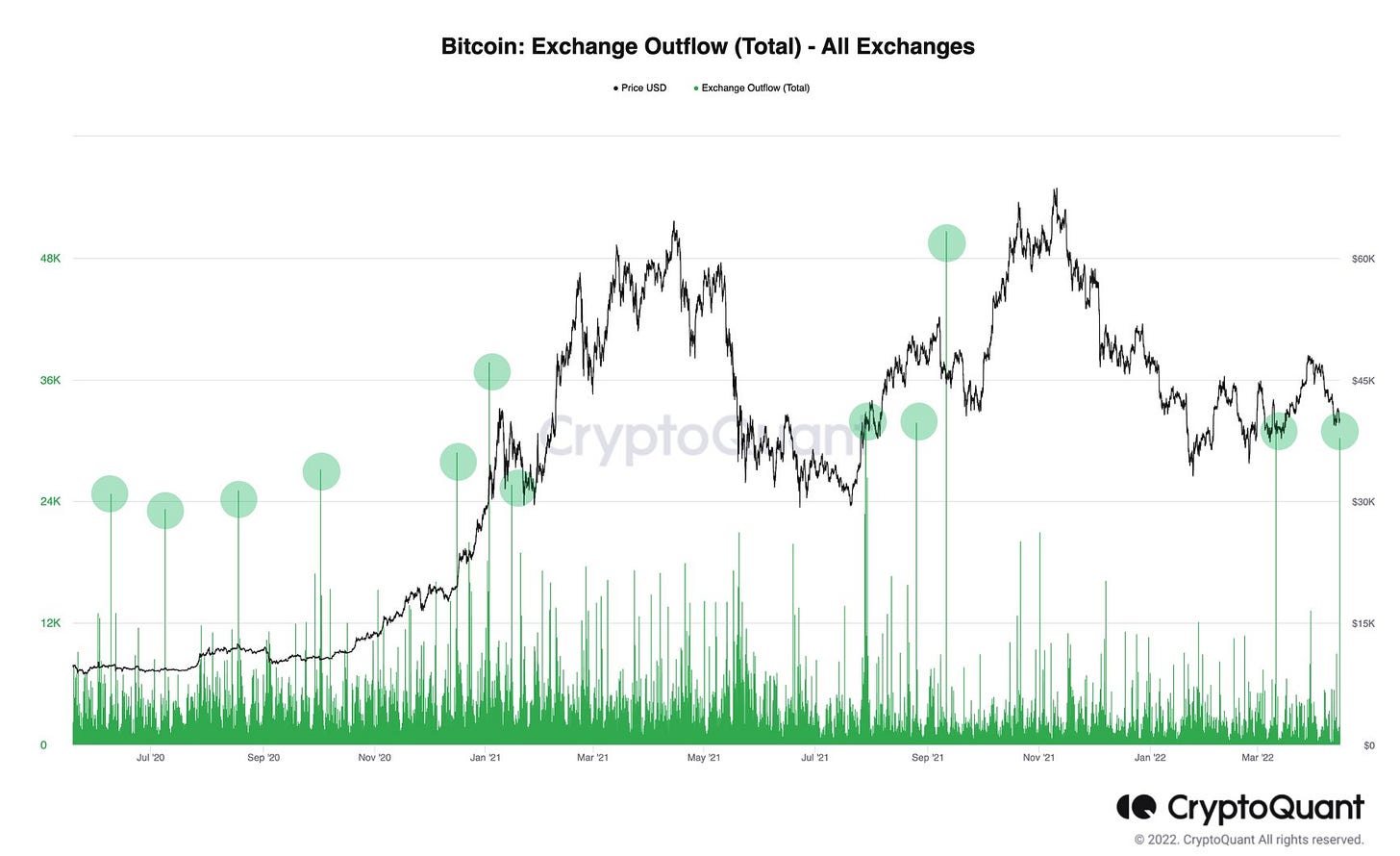

Even though that the price seems suppressed or stable, it seems that just this week there was a big outfow of bitcoin from all exchanges, as some entity retrieved ~30,000 bitcoin from Coinbase. Could it be that the institutional interest is spiking?

As a summary note..

Greed could harm bitcoin on the short term. It is precisely greed what drives the feeling of wanting to get something from nothing, and the same nihilism that lures people into trading, margin trading and even gambling into altcoins.

Bitcoin is simple, and if we were all playing on the same team instead of getting lured by the “prisoners dilemma” into attempting to sell and buy lower, or wait and buy lower (and failing to do so), if we all just methodically used bitcoin as a savings technology and committed to stack every single day, week or month, then price would have nowhere else to go, but upwards.

Stacking sats is a cooperation game. If people would coordinate and DCA, bitcoin’s appreciation and adoption would skyrocket while benefitting every participant of the network.

Maybe this could be a way for our world to enter into a new phase of prosperity, by adopting a hard money standard, instead of continuing into this fiat Cantillion never ending effect, where few prosper at the expense of everyone else.

”Long term winning strategies seem to be based on cooperation” – The Price Of Tomorrow.

Have a great weekend niblings.

Stay humble & stack sats.

Supported by:

How to buy bitcoin? (With Relai through Revolut)

If you are in Europe, I made a pretty simple guide with 3 steps, which avoids you having to set up an account on an exchange, give them all of your personal information, plus custody of your funds.

Did you find value on this? You want to contribute to Uncle Bam?

Then feel free to donate, a cup of coffee would be highly appreciated.

But more importantly, share this with your friends and family..

Lightning Address:

cherryskate01@walletofsatoshi.com