2022W25 - WTF happened in Bitcoin this week?

Bitcoin is the key to energy abundance.

TLDR: The Key of Energy Abundance, Onboarding of Merchants, Luxury items for bitcoin, Exchanges running out of bitcoin.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

When the price is suppressed and the hype is out, often are the times when real conversations happen. This week I was talking to a new friend and the energy topic came about. It is often forgotten the paramount potential that bitcoin has and could have for providing the grid.

From an energy abundant perspective, bitcoin seems to be the way forward, as it incentivises the production of renewables, which are often (or should I say always?) intermittent.

What does this mean?

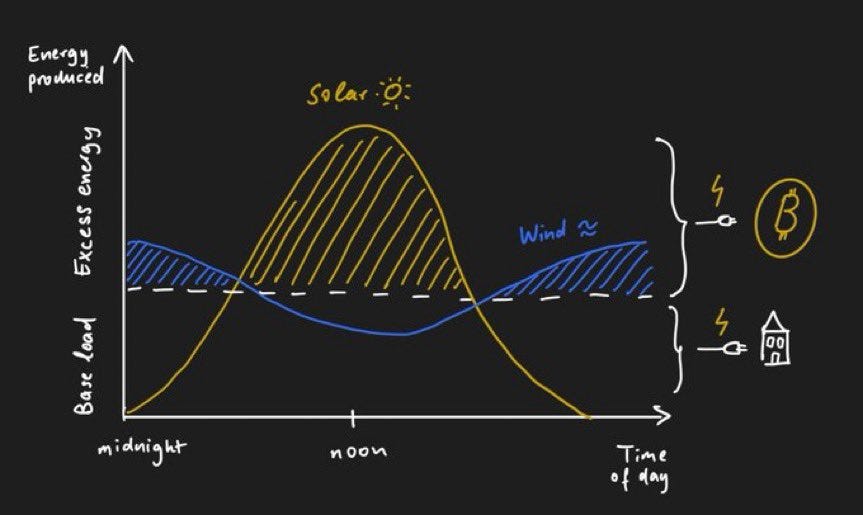

It just means that the energy provided by these sources is not a constant load. So if a society requires “X” constant amount of energy throughout the day, but Solar mostly provides energy during the day, with a strong bell shaped, and wind mostly during the evening, the only way to reach a desirable base load (white dotted line) for society to thrive, is by over producing.

Overproducing is naturally inefficient, IF the energy is wasted. Under normal circumstances, companies wouldn’t be incentivised to produce extra, if it only requires investment and the energy would go to waste. But in a bitcoin world, mining is the buyer of last resort.

Mining has the incentive to consume all the energy available at the cheapest price possible, without a restriction of location, and the ability to turn on & off the operations in a matter of seconds.

It seems that bitcoin is the key to an energy abundant future.

NEWS

1. Over 100,000 bitcoin worth $2 billion have been taken off exchanges in the past week.

2. IBEX, an infrastructure provider for Lightning, has onboarded 85 new businesses to the network enabling them to accept bitcoin as payment through their point-of-sale systems.

3. Skybridge Capital will reportedly file a spot bitcoin ETF application with the SEC again after being denied earlier this year.

4. Tim Draper's three-month program aims to support Bitcoin startups and hone their pitches in order to present to investors and get project funding.

5. Hublot, the Swiss watchmaker, is now accepting bitcoin through a partnership with BitPay, starting with the release of a collection of 200 watches.

6. Leading international consulting firm Deloitte is partnering with NYDIG to onboard businesses to Bitcoin, including Fortune 500 companies.

7. Fountain, a podcast platform for creators and consumers, now allows users to earn bitcoin while listening to shows and ads with a host of other features.

8. SOLAR, a New six-megawatts solar-powered bitcoin miner has started operation in Colorado, US.

MACRO

8. With the dip, people start to naturally critizise Bitcoin, just as the Federal Reserve decided to add it as a reference currency in their website.

“Bitcoin is an inflation hedge” they said – Peter Mallouk

And they were right.

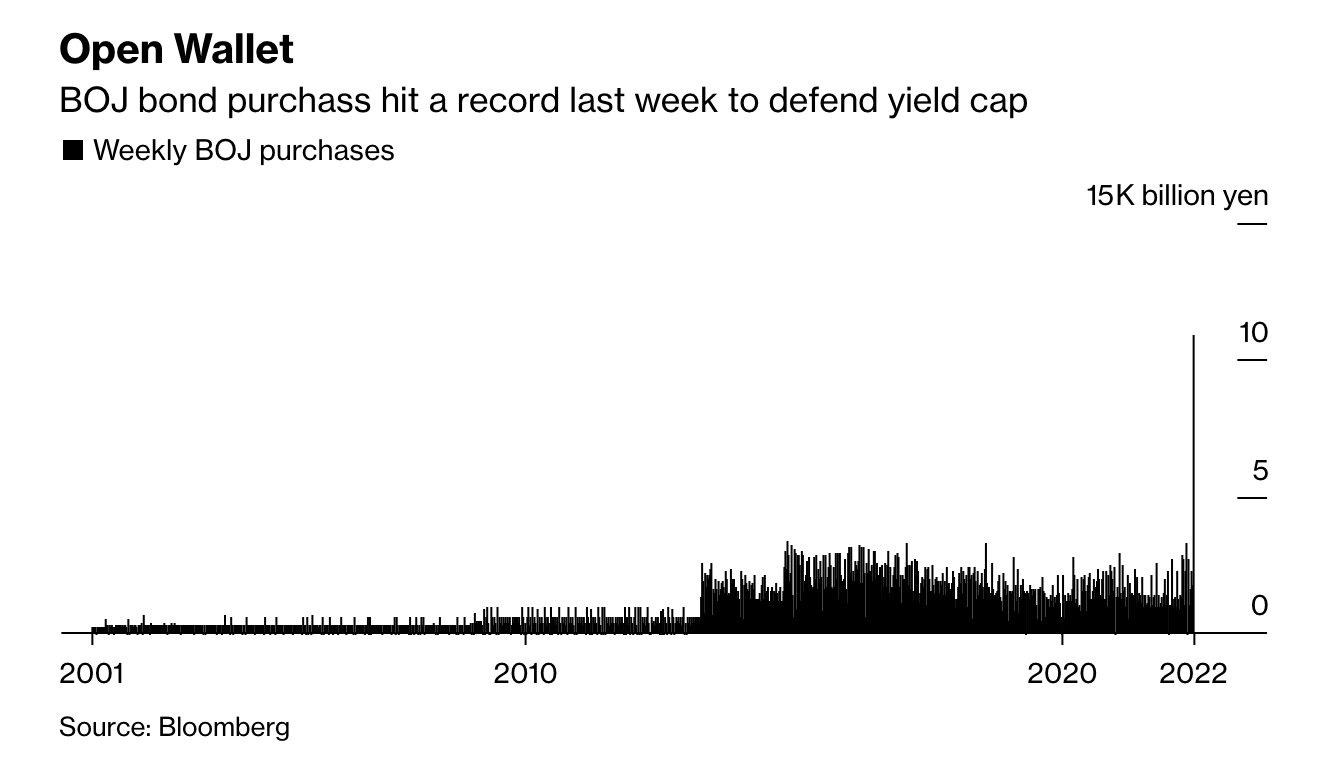

9. But somehow, central banks do not understand, they just keep printing more.

“The BOJ is buying more of its own bonds today, after buying 10.9 trillion yen ($81 billion) of JGBs last week. Relentless.” – James Lavish

Even the European Central Bank has not shown any signals of reducing the balance sheet or even stopping the printer.

ECB balance sheet hit another ATH as Lagarde keeps printing press rumbling despite record-high inflation. Total assets rose by €7bn to €8,827.9bn. ECB balance sheet now equal to 82.4% of Eurozone's GDP vs Fed's 36.6%, BoE's 39.6%, BoJ's 136.3%. – Holger

10. Central Banks wont admit it, and will go lengths to debase our currencies, as it has happened in many developing countries and seems to be happening in developing ones..

“The most entertaining sport to watch over the next 2 years will be the mental gymnastics of fiat economists explaining to you why locking people at home, banning them from work, and printing trillions of dollars are actually unrelated to price rises & economic crises.” – Saifedean

It might go without saying that.. Bitcoin Fixes This.

FUNDAMENTALS

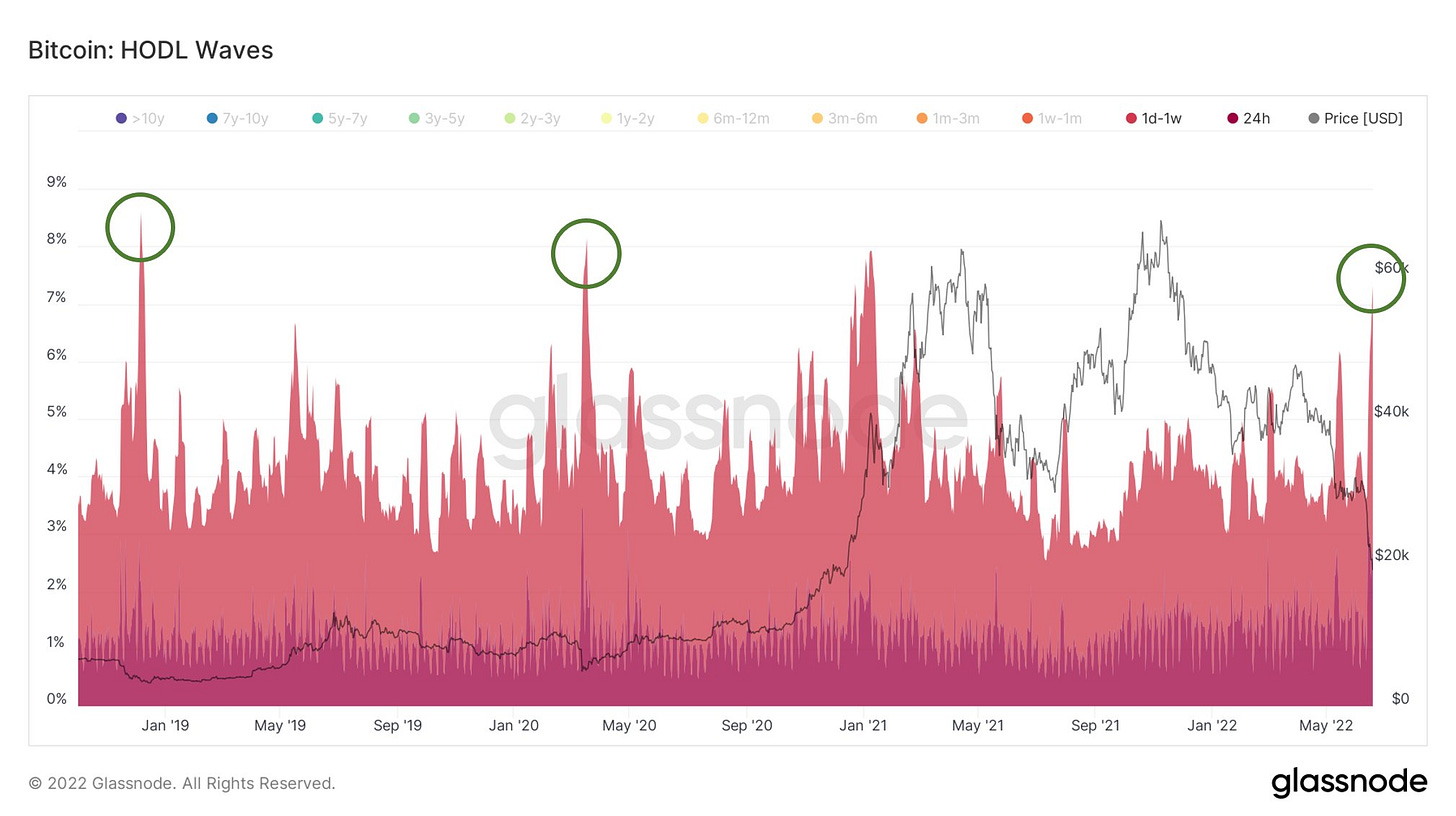

It seems that we have undergone some strong capitulation on the last days, from miners and people panic selling after the last downturn to $17.7K, is this the bottom? Only time will tell, but the adoption continues increasing, the price seems unfairly punished, and it somehow looks similar to Nov-Dec 2019, and March 2020. Seems that it is buying season.

As a summary note..

Adoption keeps ramping up.

From South Africa:

To Neatherlands:

And are you looking to spend some Bitcoin in El Salvador? This might be the place to understand how it will look like when bitcoin becomes normalized.

Its time to opt out!

Have a great weekend niblings.

Stay humble & stack sats.

With Love,

Bam

Supported by:

How to buy bitcoin? (With Relai through Revolut)

If you are in Europe, I made a pretty simple guide with 3 steps, which avoids you having to set up an account on an exchange, give them all of your personal information, plus custody of your funds.

Did you find value on this? You want to contribute to Uncle Bam?

Then feel free to donate, a cup of coffee would be highly appreciated.

But more importantly, share this with your friends and family..

Lightning Address:

cherryskate01@walletofsatoshi.com