2022W3 - WTF happened in Bitcoin this week?

Bitcoin is not dead, buy the blood.

TLDR: Price plunges, El Salvador & Retail buys the dip, Intel to produce ASICS, Google partners with bitcoin companies, US mortgages backed by bitcoin..

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

It has been indeed an interesting week, as bitcoin price comes down touching values of around $35,000, the fear starts to permeate in the markets. I’ve gotten calls asking me what is going on? Why is the bitcoin price plunging so hard? What should I do?' Should I sell? Will it go up again? Should I sell and buy lower? It is known that the worse the market is, the better the opportunities are to profit.

"Buy when there's blood in the streets, even if the blood is your own." - Baron Rothschild

As humans we get easily carried away by emotions. These moments, the big dips, are important because they help built character on us. In reality this dips allows us to participate in two distinct scenarios:

Fear: Selling off my position, and will likely never come back as even if the price goes up, it will be hard to fight the ego and face the reality of ending up with less bitcoin

Excitement: Taking advantage of such a discount, knowing that bitcoin will perform long term and it coming back to its ATH offers a possibility of close to 100% appreciation on some play that could happen in the next months or 1-2 years.

Now the reality is that no one knows what will happen to the bitcoin price tomorrow, but clearly the news of adoption in the space continue to be positive. There is no indication of bitcoin “dying” or “losing steam”. And more importantly, bitcoiners are the only crazy ones that are willing to go down with the ship. It is the only asset class, where a group of people believe so much on something, that are even happy of such corrections, as they know it is an opportunity to accumulate as much as possible, as it probably wont get any cheaper. For many others, it is the only way for a future of prosperity and freedom, the only chance of separating money from state and to have censorship resistant and unconfiscatable money, real private property.

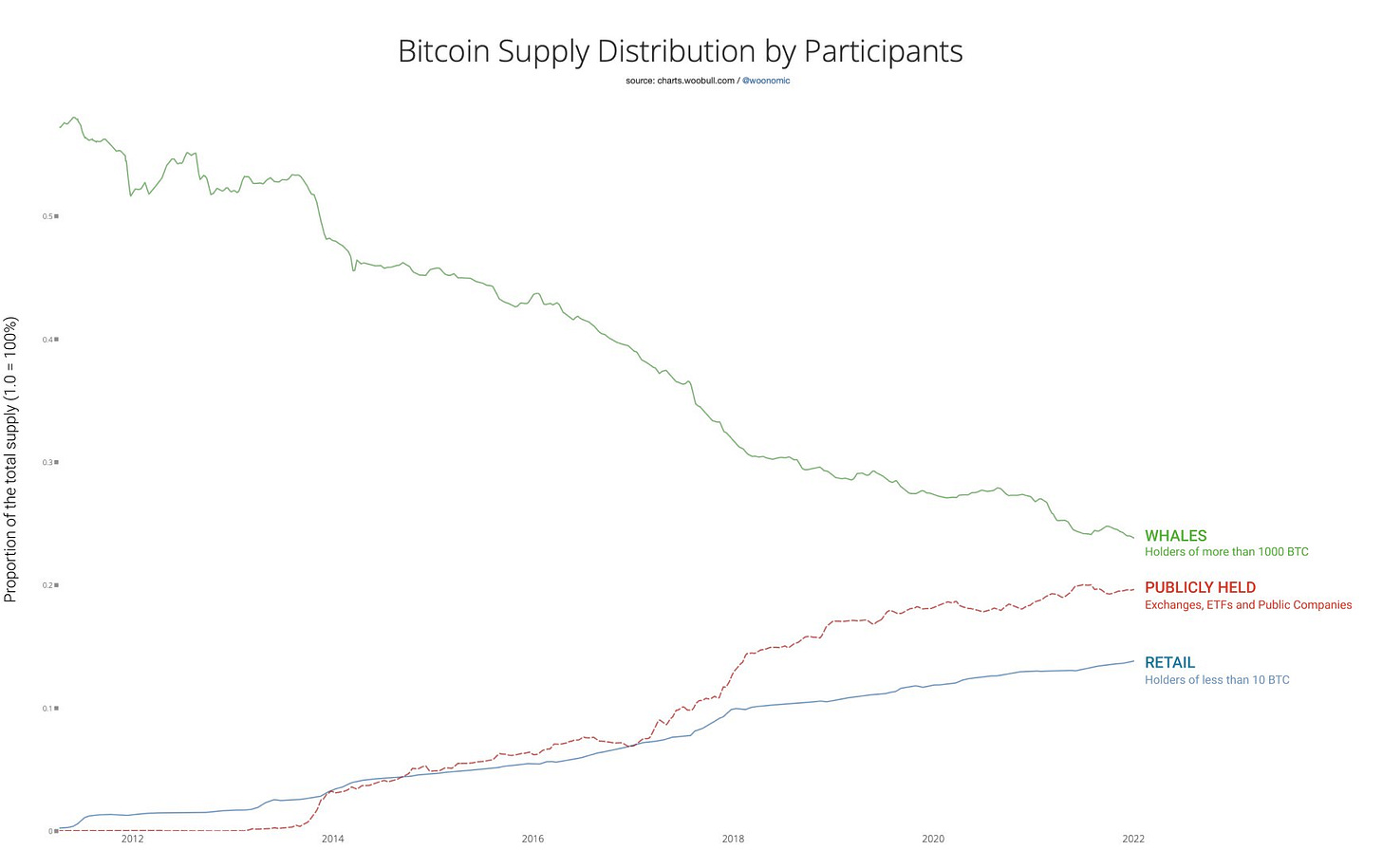

My personal hopes for this dip, is that people stack more sats at cheaper prices and prevent whales of ending up with a higher bitcoin % of the network. It is our responsibility to stack and share the gospel with friends and family, for a more distributed network.

Bitcoin is for the people, and we, as the people, are exactly the ones who are and should be leveraging up this opportunity right now.

And this is how the week started.

1. El Salvador bought the dip, accumulating 410 more bitcoin for its treasury fund for $15 million dollars. The country has a total of 1,801 bitcoin, based on announcements made by Nayib Bukele via twitter.

2. Google formed a partnership with Coinbase and BitPay, to offer digital cards that will allow users to store bitcoin and spend fiat easily.

3. San Diego State University is now accepting bitcoin donations after a former undergraduate student donated around $25,000 worth of bitcoin in October of last year, advocating for them to continue the acceptance of the only decentralized peer-to-peer money.

4. Intel, the market leader in computer chip manufacturing, announces to be working in an ultra-low-voltage energy efficient bitcoin mining ASIC, which will be presented on the upcoming International Solid-State Circuits Conference on February.

5. Bitcoin miner GRIID has already signed a purchase agreement with Intel. GRIID will be entitled to purchase at least one quarter of all qualified Intel-designed ASICs through approximately May 2025. (Assuming they work as expected)

6. BitMEX, a bitcoin exchange, to purchase on of Germany’s oldest banks, Bankhaus, as a means to establish a one-stop-shop for regulated Bitcoin products in Europe.

7. Milo, Real Estate fintech company, to launch the first US bitcoin mortgage offering, enabling customers to leverage their bitcoin holdings, to purchase properties in the country.

“Milo’s clients will be able to pledge their Bitcoin to purchase property and finally qualify for a low-interest rate 30-year crypto mortgage. This solution will allow clients to continue to own their bitcoin and diversify into real estate, all while keeping the potential price appreciation of both. Clients will be able to finance 100% of their purchase with no dollar down payments required and do this faster than a conventional mortgage". - Milo

8. The first Congressional hearing on Bitcoin Mining took place on Thursday. The witness explained to congress how bitcoin mining is an incentive for driving the adoption of renewable energies, as it has become a catalyst for renewable energy plants which are often off the grid and before couldn't be profitable due lack of demand.

"Shifting from PoW to PoS may actually undermine what has given Bitcoin its strength and growth"- John Belizaire, CEO of Soluna Computing

9. Jack Dorsey and Michael Saylor will be keynote speakers for The World Symposium 2022. The conference will explore various benefits of incorporating Bitcoin into corporate initiatives.

10. The Union Bank of the Philippines reportedly plans to offer trading and custody of bitcoin and cryptocurrency.

11. Voltage raises $6 million in seed round, they said it would leverage the round’s proceeds to fuel its next phase of growth and hiring.

12. Francis Ngannou partnered up with CashApp to take half of his UFC270 purse in bitcoin. Additionally he will be giving out $300K in bitcoin to his followers.

13. Cash App will integrate Bitcoin Lightning Network for US customers, allowing them to make free global payments.

14. LinkedIn shares that bitcoin and crypto job postings grew 395% in 2021.

15. Bitcoin community donated more than 10 million sats to the people in Tonga.

FUNDAMENTALS

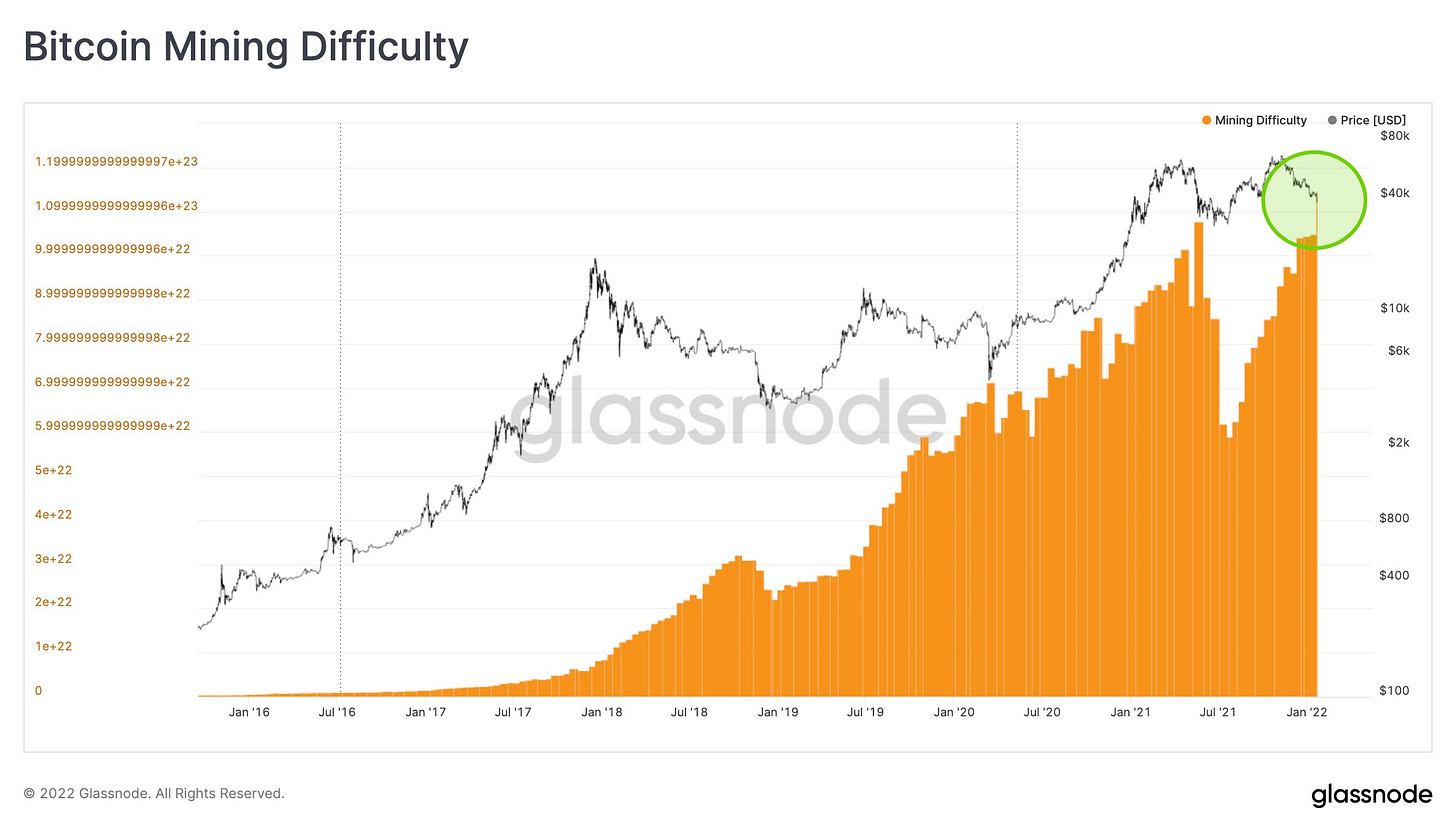

Last week Uncle Bam mentioned that Bitcoin hashrate had increase reaching a new all time high, this week the bitcoin dificulty adjustment increased 9.3% reaching the highest it has ever been. This essentially means that there is many more people around the world working together to secure the network, while attempting to win the bitcoin subsidy of 6.25 bitcoin + fees. As the number of machines increase, the network regulates its difficulty in order that the average time of finding a new block approximates to 10 minutes.

As a summary note..

Nayib Bukele, and the President of El Salvador, and Turkey’s leader Tayyip Erdogan, held meetings in Turkey with the idea of boosting mutual cooperation and investment in the Central American country.

People were speculating whether there is a possibility of Bukele planting the bitcoin seed, or as they say “orange pilling” Erdogan. If that were the case, things could get interesting on a macro perspective if Turkey decides to adopt it as legal tender, it seems bitcoin has gained popularity recently as a method of escaping the devaluating currency.

Although it is unlikely to see Turkey adopting Bitcoin as legal tender anytime soon, it is still interesting to see how the effects of this meeting evolve. At least El Salvador comes into picture for the residents of Turkey. Hopefully, it becomes an extra incentive for people to learn about Bitcoin if they find out that it became legal tender there, because let’s be honest, the majority of people still don’t know this happened.

Have a great weekend niblings.

Stay humble & stack sats.

How to buy bitcoin? (With Relai through Revolut)

If you are in Europe, I made a pretty simple guide with 3 steps, which avoids you having to set up an account on an exchange, give them all of your personal information, plus custody of your funds.

Did you find value on this? You want to contribute to Uncle Bam?

Then feel free to donate, a cup of coffee would be highly appreciated.

But more importantly, share this with your friends and family..