2022W30- WTF happened in Bitcoin this week?

Bitcoin has the strongest network effect.

TLDR: Hodlers stronger than ever, Price sees a recovery & development continues.

This week there is two main events which make uncle Bam get into deep thoughts. If you have been reading my newsletter for the last months, or year, you’ll already have found out by now that I am sort of in the “permabull” camp. I understand the inevitability of bitcoin, as I see a place and need for digital private property in the world, but it doesn’t mean the price has to go up in the short term.

So the two main things that grabbed my attention where:

The Fed raised rates by 0.75%, the highest back-to-back since the 80s.

Bitcoin went on a relief rally reaching highs of around $24,600 yesterday.

So despite bitcoin being inevitable, it is part of the broader economy, and many macro experts say that it is still categorised as a risk asset and prone to be sold off in need of liquidity. In a way this is what institutions & investors do with their assets, navigate the markets and develop strategies to make the highest return in USD.

But in my humble opinion, many seem to forget that bitcoin is money, and money has a network effect, which basically means that its value is grows exponential compared to the number of participants.

So why do I bring this topic?

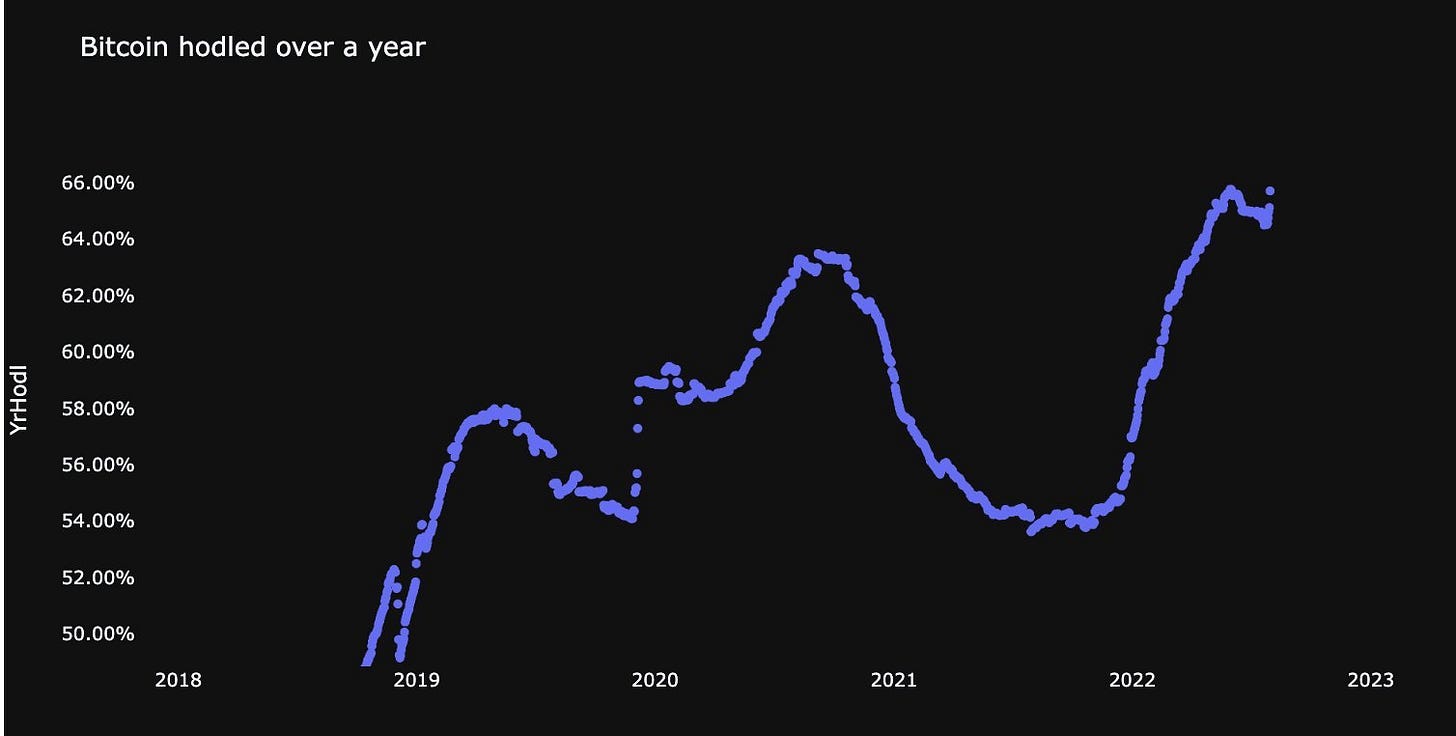

Well it just happens that 65.7% of the bitcoin have been held and not moved for over a year, and the metric continues to rise.

Lets keep in mind, that these hodlers:

Saw bitcoin recover to $69K, from mid $30Ks

Then come back down to low $30s

Back up again to ~$47K

Down to under ~$18K

And are still here..

These hodlers saw:

Covid strip of liberties and property from even western countries.

War from Russia & Ukraine

High inflation

Raising interest rates

Even big companies and miners liquidating portion of their bitcoin

And are still here..

Despite every chaotic event happening in the world lately, people continue to get educated and to accumulate the hardest money there has ever existed..

THE NEWS!

1. The Virtual Currency Tax Fairness Act was introduced this week U.S. senators with the aim of providing tax exemption for bitcoin transactions up to $50 or trades which net a gain up to $50.

2. El Salavdor’s finance minister affirm’s the country’s bitcoin strategy is a working, and the country is willing to push further with it, as draws tourism into the country and prepares them for a digitalised future. – Bloomberg

3. XP Inc., Brazil's largest investment broker, to offer bitcoin trading services leveraging cold storage custody solutions on a new platform.

4. pLN is a new wallet project that aims to make it easy for users to make bitcoin payments privately on Lightning.

5. Keet, the new P2P video and chat app, offers private and secure communications, with Bitcoin payments on Lightning on its roadmap.

7. ZEBEDEE partnered with mobile game developer VIKER to enable play-to-earn bitcoin rewards on three classic video games: Solitaire, Sudoku and Missing Letters.

8. Rio de Janerio's secretary of finance and planning commented on the city’s plans to put a percentage of the treasury into bitcoin. Brazil has tax breaks for bitcoin miners.

9. Relai, the bitcoin-only European investment app, now enables users to purchase bitcoin within seconds with SEPA instant payments.

10. The joint venture by Japan’s largest investment bank Nomura, CoinShares and Ledger will offer institutional services for bitcoin and other digital assets.

11. Foundry launches logistics arm for bitcoin mining equipment, providing domestic and international logistic solutions for the acquisition and delivery of bitcoin mining infrastructure with a streamlined process.

12. Miami hosted the Mining Distrupt conference this July 26-28. where innovations and exhibitions regarding the mining industry were displayed.

Such as.. a mining backpack, by Braiins!

13. Lightning appears to defeat Mastercard in a race of speed.

14. Bitcoin Valley Hub launches in Hounduras. The private initiative launched in the town of Santa Lucia, Honduras, aims to spur bitcoin adoption and invite more tourism to the region.

15. ASIC manufacturer Canaan is set to launch bitcoin mining operations in the U.S. The company recently started self-mining in Kazakhstan where it has deployed over 10,000 miners.

As a summary note..

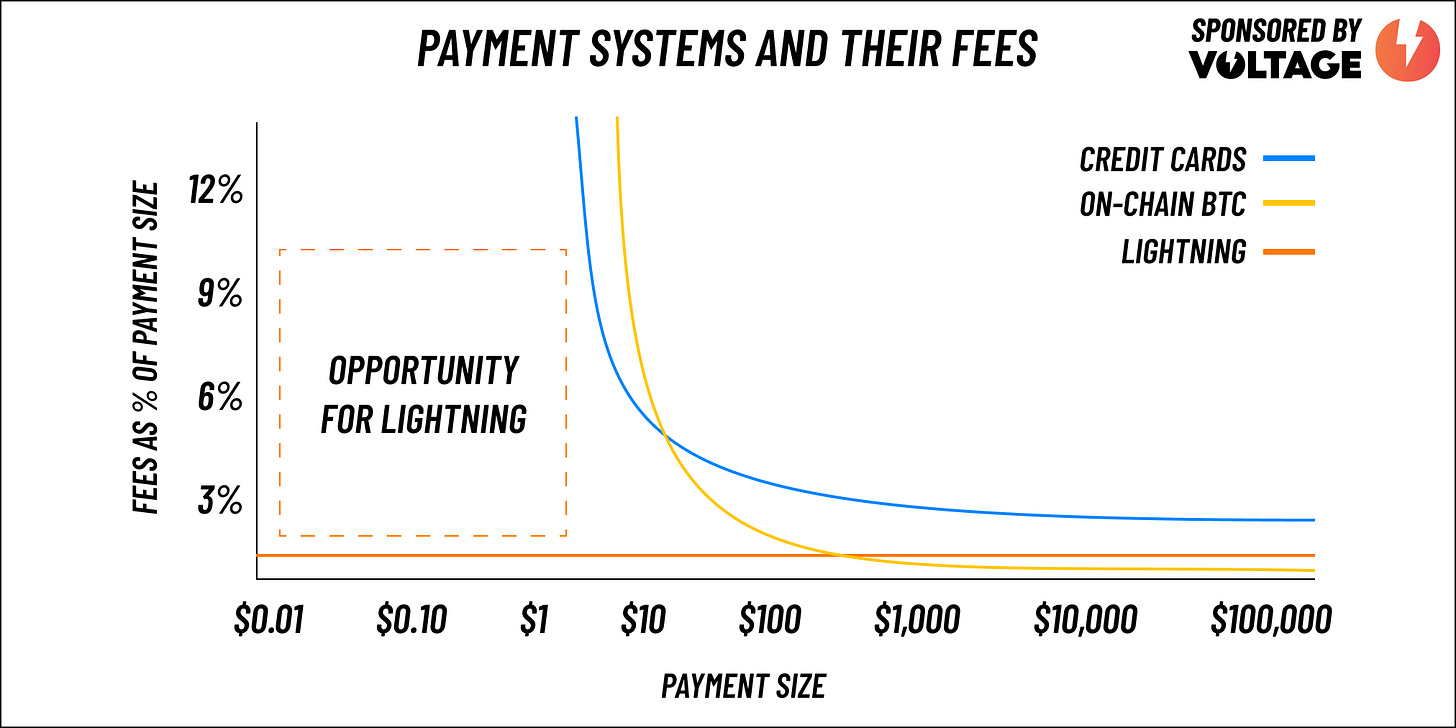

The entire ecosystem is growing, and bitcoin payments seem to become more popular by the day. We have seen that lightning can potentially outperform Visa & MasterCard in terms of speed, but fees is also a topic worthy to discuss.

Some people often think that fees in bitcoin are high, but in reality it is not the case.

Bitcoin wins in terms of fees when the payments are too big, as the fee becomes basically negligible.

And it also wins in all micropayment transactions as while fees are small, the traditional banking system can’t even support it.

Have a great weekend niblings.

Stay humble & stack sats.

Supported by:

How to buy bitcoin? (With Relai through Revolut)

If you are in Europe, I made a pretty simple guide with 3 steps, which avoids you having to set up an account on an exchange, give them all of your personal information, plus custody of your funds.

Did you find value on this? You want to contribute to Uncle Bam?

Then feel free to donate, a cup of coffee would be highly appreciated.

But more importantly, share this with your friends and family..

Lightning Address:

cherryskate01@walletofsatoshi.com

Thanks my dude