2022W4 - WTF happened in Bitcoin this week?

Bitcoin gains traction within governments.

TLDR: Arizona proposes Bitcoin as legal tender, Russia, Thailand and Belarus see benefits and want to regulate bitcoin, Rumors of Latin American country to adopt bitcoin as legal tender, People continue to accumulate

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

This week we come with some BREAKING NEWS!!!!!

The IMF urged El Salvador to remove bitcoin as legal tender, claiming it could bring instability and inflation to the impoverished Latin American country. They also have previously told Bukele that this actions could prevent the country from getting a loan from the institution.

Well well well, lets talk about fear.. The IMF, has seen the power of open monetary networks, and are now attempting to stop the momentum. As we have mentioned before, it seems El Salvador doesn’t need the coercive loans from the IMF any longer, as they innovated by issuing the Bitcoin Bond, in order to raise funds and set up a big mining infrastructure which gives them access to not waste the potential geothermal energy of their volcano. Additionally, other countries seem to consider the possibility of adopting friendlier regulations towards bitcoin. Just this week, rumors started to spread about Max Keiser, knowing which is the next country to adopt Bitcoin as legal tender, apparently Honduras, but this can’t be confirmed for now. In any case Arizona, U.S. has moved forward and put forward a bill to make it legal tender within the state. One can’t argue against the network effect.

This is how the week started..

1. Vladimir Putin says Russia has advantages in bitcoin mining, and asked the central bank and the government to come to a consensus on bitcoin regulation. This happened just after the Central Bank suggested a national ban on cryptocurrencies.

2. IMF urges El Salvador to ditch bitcoin as legal tender.

3. Wendy Rogers, senator from Arizona, puts forward a bill to make Bitcoin legal tender within the state.

4. Belarus’ regulator says it doesn’t want additional restrictions as the Russian Ministry of Finance calls for bitcoin regulation.

5. Brussels member of parliament to take full 2022 salary in bitcoin.

6. Thailand will regulate Bitcoin as a payment method.

7. Dave Portnoy, founder of media giant Barstool Sports, just bought 29 bitcoin worth over $1 million

8. BlackRock, investment firm with $10 trillion assets under management, filed for Blockchain ETF

9. Valkyrie files to list Bitcoin mining ETF on NASDAQ exchange.

10. Ratiopharm Ulm, top ranked German basketball team, now accepts bitcoin for merchandise using Breeze Point-of-Sale technology.

11. Robinhood kickstarted the beta phase of its bitcoin wallet feature, enabling a subset of users to self-custody their coins.

12. Flushing Bank customers will be able to buy, sell, and hold bitcoin starting in Q1 2022.

13. Satoshi Energy raises 60 bitcoin to allow them to build a market leading strategy for bitcoin miners to produce low cost renewable power.

14. Zimbabwe farming collective raises $1.4 million to mine Bitcoin with solar power.

15. Bitcoin Miner CleanSpark reaches 2 Exahashes (EH/s) enabling to produce ~10 bitcoin per day.

16. Solo Bitcoin miner with only 86 TH finds valid block, taking home over $215 000.

17. Bitmatrix, DIGTL, GMO Coin, Mempool, Specter, and Zaprite are now part of the 63-member Liquid Federation.

FUNDAMENTALS

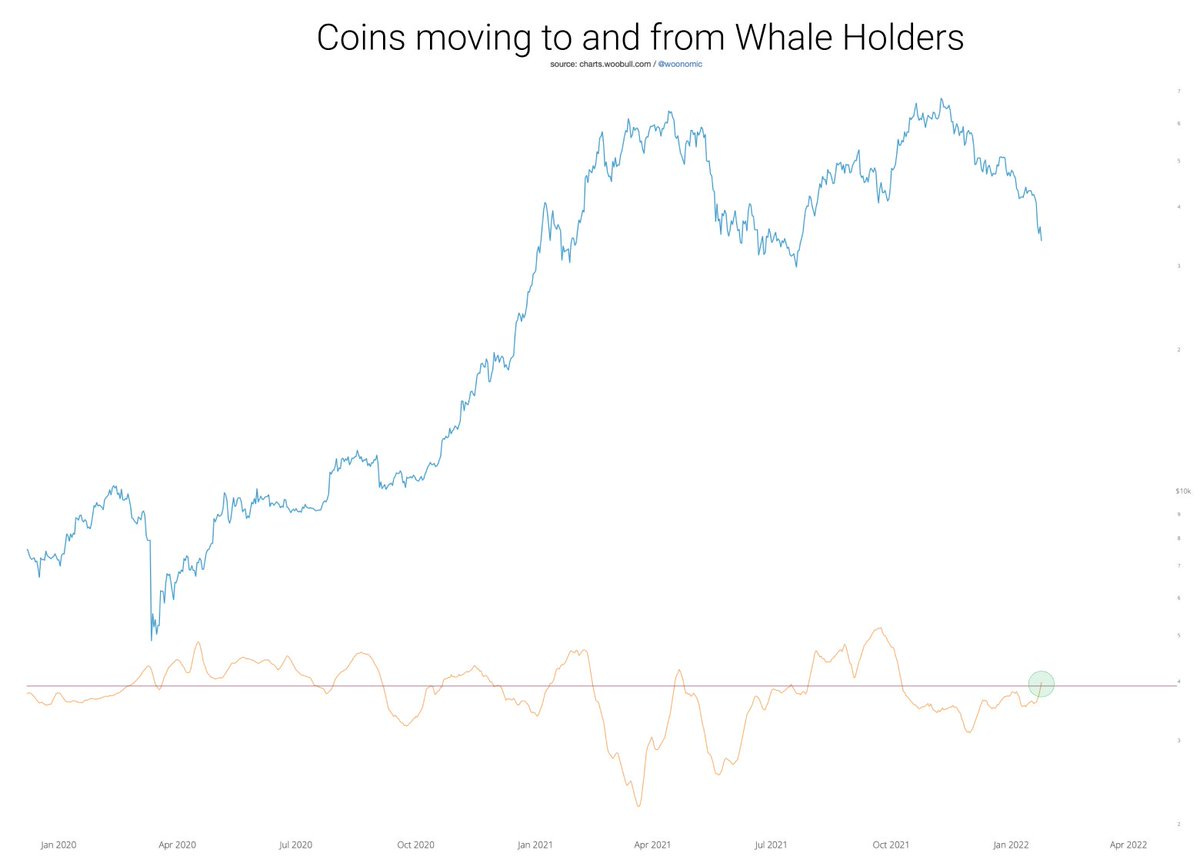

It seems that institutional money is starting to come back in.

And also the “plebs” are stacking harder and not letting pass this opportunity of a life time. It is not often one sees a 50% retracement on bitcoins price from all time highs.

Exchanges like Relai and River shared some numbers that proved people accumulated as much as possible this last Monday.

As a summary note..

The bitcoin network continues to grow and get adopted from people of every country, and every social status. There is a common criticism of bitcoin having “high fees”, but lets make a little comparison..

Apparently bitcoin settled this year more than the payments processed by the VISA network. How incredible it is, that an open source network, ruled by no one, could settle more value than a closed network (lets also note that Visa payments aren’t immediately settled).

Oh and how much was it spent on fees? Well according to ARK Investment, Visa’s fees were about 20 times the amount of fees consumed by the bitcoin network, and all of this, without taking into account the value transferred over the lightning network, almost for free.

As a recap:

- Bitcoin transferred more value than Visa

- Fees spent in bitcoin were ~5% of the ones charged by Visa.

What an exciting week. Have great weekend niblings.

Stay humble & stack sats.

Supported by:

How to buy bitcoin? (With Relai through Revolut)

If you are in Europe, I made a pretty simple guide with 3 steps, which avoids you having to set up an account on an exchange, give them all of your personal information, plus custody of your funds.

Did you find value on this? You want to contribute to Uncle Bam?

Then feel free to donate, a cup of coffee would be highly appreciated.

But more importantly, share this with your friends and family..