TLDR: Ukraine uses bitcoin to receive donations & operate, Finance World dips a toe in bitcoin, Mining Companies announce their production.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

Another weird week in our beautiful world. As the Russian-Ukraine war continues, and many other countries show support for Ukraine by applying sanctions to Russia, it is of my opinion that many of the sanctions close to no sense as they affect the citizens rather than the real target if I assume the target is the oligarchs and Putin’s government. It seems there is a coordination on the acts and while I hope it is not intended, the result seems to be a marginalization of the Russian population and a disconnection from all of the western world services as Apple Pay and Google Pay stops providing services to Russian people. As Visa, MasterCard stop providing services to Russians.

Even if one might think. “Oh well but, you know, we have to do something to punish Putin and the Oligarchs!” Well you know who most likely has a double passport & facilities to continue with these services? Right probably Oligarchs as passports often come as a grant with big investments in other countries.

And who might end up ultimately being affected by such sanctions? Many innocent Russian citizens. Oh but all of these is happening while governments keep on buying Oil & Gas from Russia, a little bit of hypocrisy here, or just double standards.

But hey, uncle Bam is not here to provide an opinion on the geopolitical problems the world is undergoing, I am always going to vouch for the citizens, as in my opinion, we tend to forget that citizens are not the government, or at least we could agree that many wouldn’t feel represented by many of their actions regarding monetary policy and wars. Luckily we have bitcoin, the money for the people, and with it, a growing industry where companies try to live by its ethos. Even though cryptocurrency exchanges are still vulnerable and must ultimately follow the regulations, even if unfair, it seems some are playing their part and drawing these distinction, until mandated.

Just remember:

The money in your bank account, stocks, bonds and life insurance are IOUs.

Real estate property: Is easy to seize and can’t be moved.

Cash: Devalues into nothing.

Bitcoin: Is un-censorable, unstoppable, limited in supply & increasing in demand.

And as a reminder, bitcoin in an exchange, is also an IOU. Claim your keys

And this is how the week started.

1. Ukraine has raised more than $54 million in Bitcoin and crypto donations.

"We are able to operate internationally because of Bitcoin & crypto” — Deputy Minister

2. Lugano, Switzerland, announced that bitcoin will become legal tender in the municipality and citizens will be free to pay for public service fees or taxes using it.

3. EU Parliament scraps 'Proof-of-Work' Bitcoin mining ban after backlash.

4. BRAIINS, bitcoin mioning pool launches Ukranian hashrate donation. The company initiated the movement by donating 10 bitcoin and 2.5 petahashes of their own mining capacity. A couple of days ago Bitcoin Magazine reported that more than 109 bitcoin in total were donated to the organization.

5. Bitcoin demand booms in Ukraine and Russia - The Wall Street Journal.

6. Bank of America sees no crypto winter given user adoption and developer activity growth.

“It will be difficult for the crypto market to break out of the recent trading range until concerns about a potential recession are discounted, according to the bank.” — BoA.

7. Morgan Stanley's asset management arm bought millions of shares of Grayscale Bitcoin Trust in 2021.

8. BNY Mellon, $46 trillion bank, to launch a bitcoin custody platform for institutional clients this year.

9. Blockchain Commons, a not-for-profit benefit corporation focused on Bitcoin, have recently announced an opening for their internship program to be held remotely this summer.

10. ZEBEDEE is rebranding its ZBD Wallet app to create a one-stop shop for all things Bitcoin gaming.

11. CleanSpark announced their BTC production for 2022, producing 581 bitcoin, and an investment in sustainable mining Norcross facility.

12. Gem Mining announces: 14,000 miner deployment before end of 2022, an actual of 18,065 active miners and its year to date production with a current 1% of current global hash-rate. The company produced 423 bitcoin year to date.

13. Riot produced 436 BTC in February 2022, it holds approximately 5,783 bitcoin all produced by company’s self mining operation, and has deployed a fleet of 38,310 miners, expecting to have 120,000 deployed ASICs by January 2023.

FUNDAMENTALS

The Bitcoin Network settled on March 1st almost $9B in change-adjusted volume within a single block.

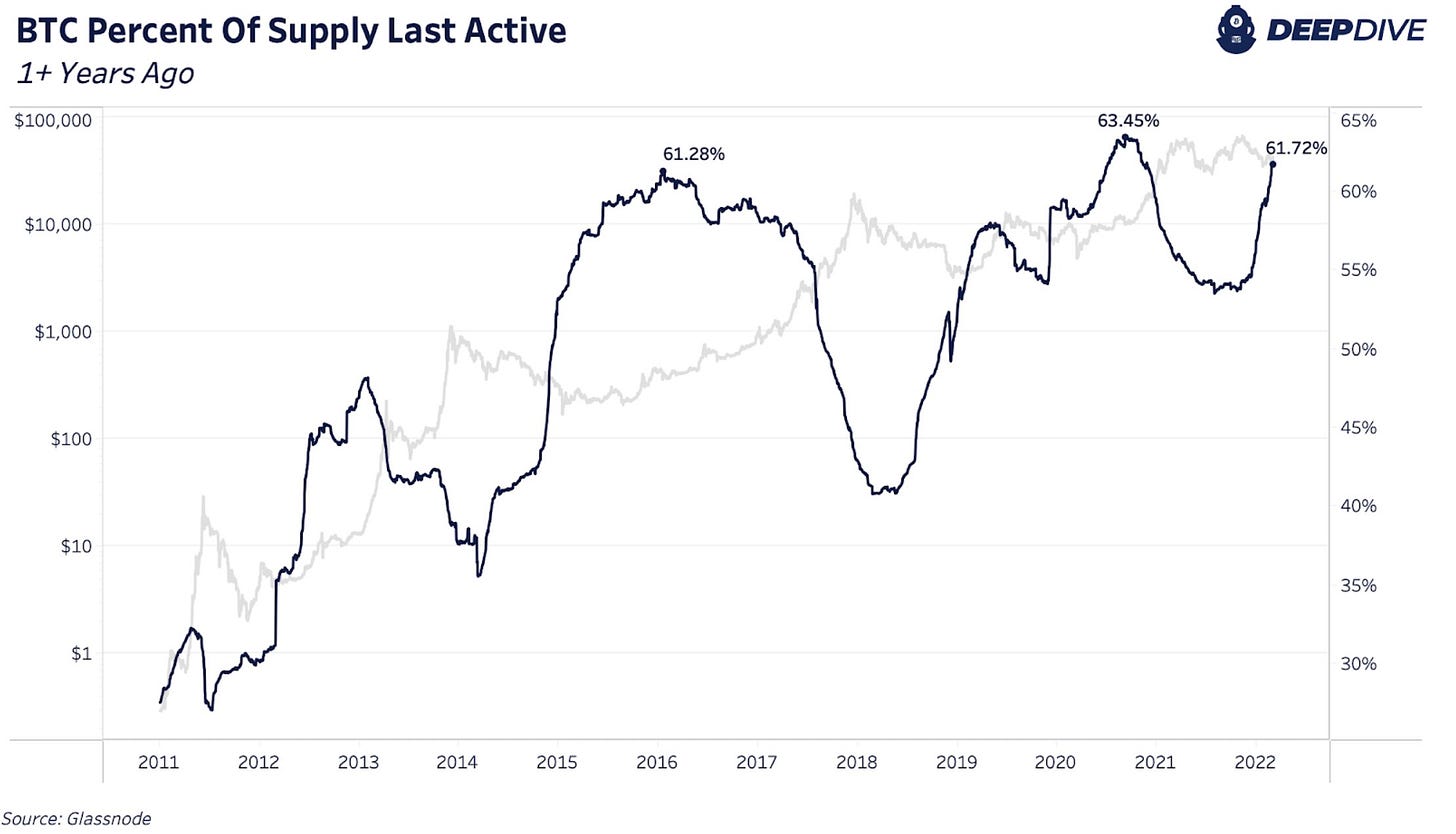

At the same time 61% of the bitcoin circulating supply has not moved in over one years time. These could be interpreted as bitcoin holders are using it as a store of value and expect higher prices in the long term.

As a summary note..

I am quite bullish of human ingenuity and home miners. It gives me hope to see so many people innovating with regards to their mining set up and utilizing the energy from their racks to heat up their homes, pools, and even to invest in renewable energy personal set ups.

Here is a beautiful thread full of many set ups!

Bitcoin demonstrates that the incentives align for people to protect the network, and humanity will always innovate when there is a clear possibility of personal benefit. In this case bitcoin aligns personal benefit with the network’s benefit.

Have a great weekend niblings.

Stay humble & stack sats.

Supported by:

How to buy bitcoin? (With Relai through Revolut)

If you are in Europe, I made a pretty simple guide with 3 steps, which avoids you having to set up an account on an exchange, give them all of your personal information, plus custody of your funds.

Did you find value on this? You want to contribute to Uncle Bam?

Then feel free to donate, a cup of coffee would be highly appreciated.

But more importantly, share this with your friends and family..