WTFBitcoin Week 13, 2023

Bitcoiners are not backing down.

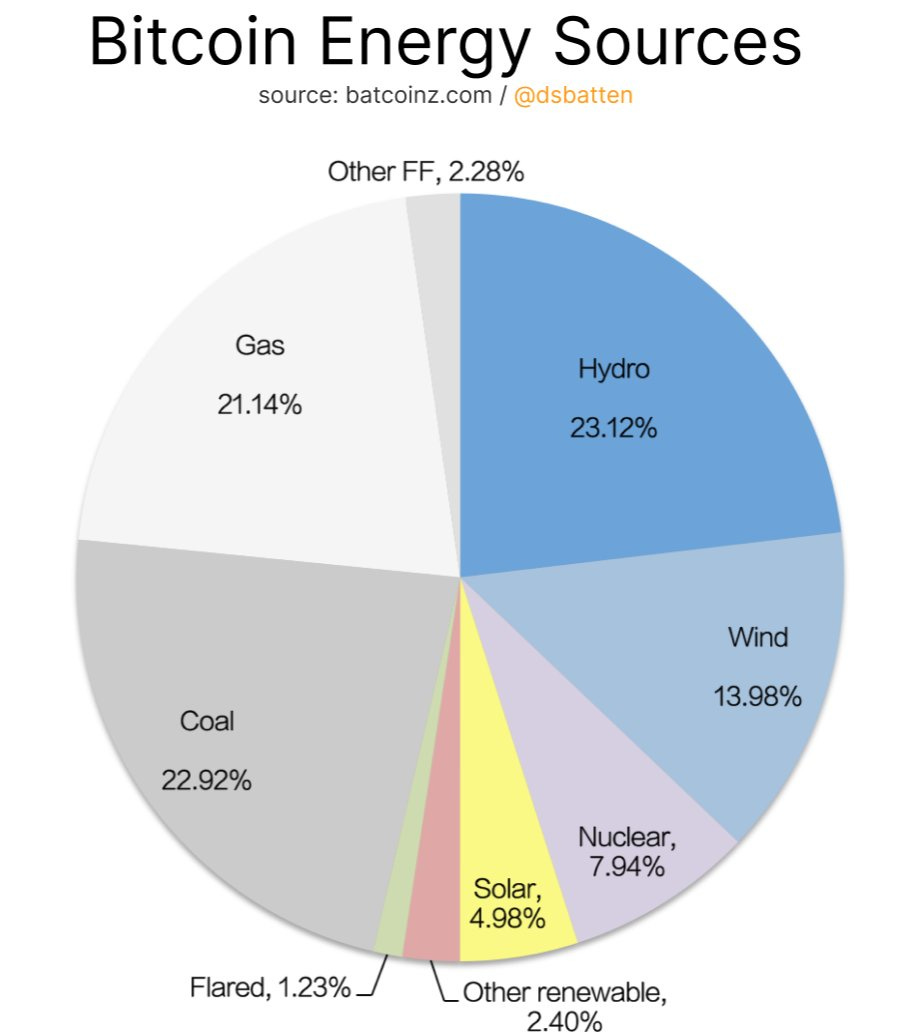

TLDR: Saylor liquidated debt and buy more bitcoin, Nostr with over 82 BTC zapped, ATH in Lightning Transactions of Wallet of Satoshi & THNDR Games, Bitcoin enhacing Portfolios by multiple Optimizations, Hydro becomes the biggest source of energy for mining.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

I must say that the moral in the bitcoin space is continuosly looking better & better. If one sees mainstream media, the collective feeling is quite doomish, from War in Ukraine, to the imminent collapse of the Banking system, a possible recession (which I believe we’ve already been on for a while), big protests in France, and now the infamous RESTRICT Act attempting to attack privacy and freedom of speech in the digital world.

On the other hand, there are great things going on in relation to Bitcoin. From accumulation and conviction of big and small bitcoin holders, an increase spike in utilization for transferring value peer-to-peer, innovative tools of harnessing energy for mining, and business owners joining the movement to accept bitcoin as payment.

This was not a slow week, I repeat, not a slow week. I’m certain that after reading today’s compilation, you’ll end up feeling bullish and wondering whether you should stack more or just go out there and share the gospel 🗞️🗞️!

THE NEWS

1. Michael Saylor reported that MicroStrategy repaid its $205M Silvergate loan at a 22% discount. Not only that, the company even decided to double down and acquired an additional ~6,455 bitcoins for ~150M at an average of ~23,238 per bitcoin.

Today, MicroStrategy owns ~138,955 bitcoin, acquired at an average price of ~$29,817.

MicroStrategy has proven to be a resilient Bitcoiner. Despite Bitcoin being down 60% from its all time high, and having invested more than their market capitalization and being on the negative, the company not only never sold, but continued lowering their entry price.

To put it into perspective, when MicroStrategy moved to a Bitcoin Standard, their equity market cap was $1 Billion. Today, their equity market cap is over $3.7 Billlion, while their bitcoin is worth ~3.95 Billion.

If this doesn’t turn you bullish, Im not sure what will.

. Nostr continues to grow, with more than 425,000 users, more than 82 BTC have been zapped.

2. Paxful announced the company’s plan to recover the users losses suffered in Paxful Earn, the earning platform exposed to Celsius. The company is taking responsibility for offering that risky product, and attempting to recover their users trust.

Bam is wondering now if Gemini will do the same with the ~$900M they owe to their users 🤔.. Not likely from the Winklevoss.

“I could not stand by and watch them suffer, so we’ve made them whole.”– Ray Youssef, CEO of Paxful

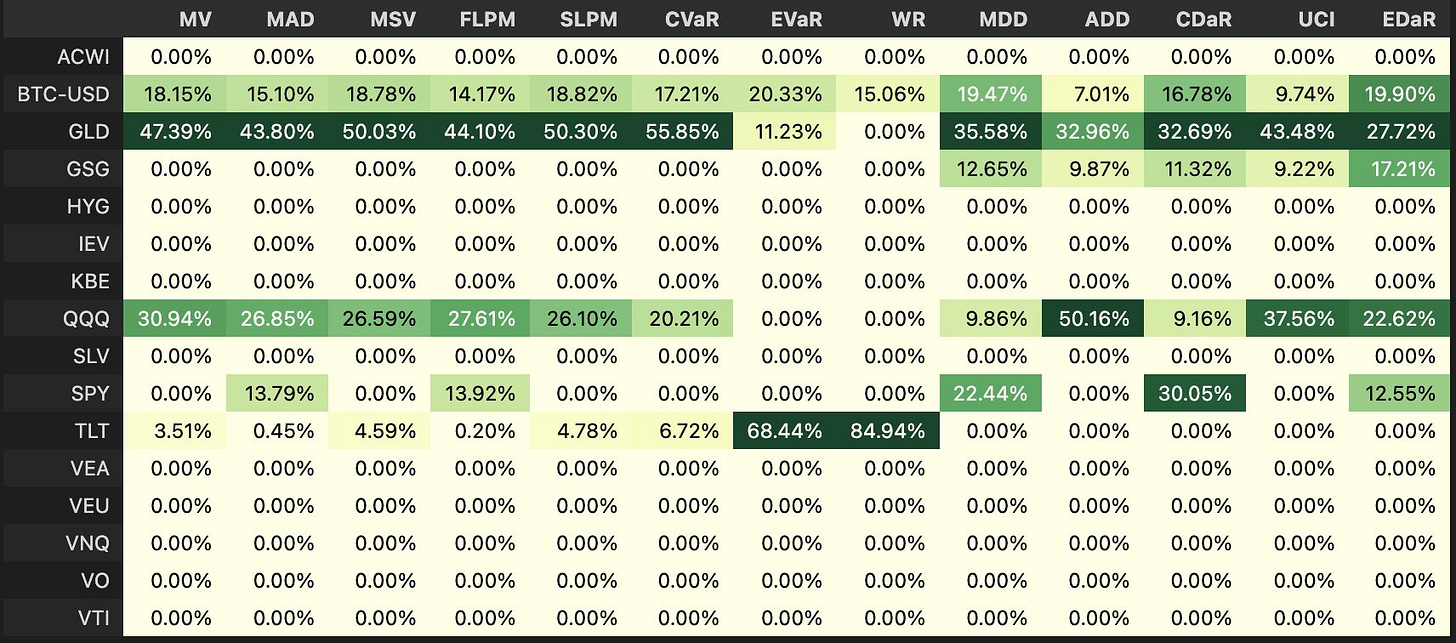

3. Alpha Zeta, calculated different Portfolio Optimization methods utilizing multiple risk measures, concluding that in ALL OF THEM, Bitcoin plays a crucial role in enhancing the portfolio results. Check out the thread.

4. Route Blinding has been merged to the Lightning spec, a technique to increase privacy of Lightning Network transactions.

5. DWPBank announced plans to integrate Bitcoin into its banking systems. The move will allow 1,200 affiliated German banks to offer their customers the ability to buy & sell bitcoin while carrying out online banking activities.

6. On request of Bitcoin Magazine, Daniel Batten ran the numbers and found out that Hydro is now the major source at 23% of energy used by the Bitcoin Network.

An interesting statistic is that Fossil fuel sources have decreased at a combined 6.2% per year since January 2020. This updated report, debunks Greenpeace’s narrative of Bitcoin utilising mostly fossil fuel sources. (Find the full report)

7. Theya, the world’s simplest Bitcoin self custody app for whole coiners, is aiming to build the simplest multisig app. The company got backing from Y combinator, which standard deals for startups are of $500,000.

8. Flow Art Academy, a school of Brasilian Jiujitsu, is now accepting Bitcoin, as bitcoiners educate them and helped them to set up their Muun Wallet.

9. The first-ever Bitcoin Film Festival, was held in Warsaw, Poland from the 24th of March to the 26th March 2023.

10. The Bitcoin Island in the Philippines held their Bitcoin Island Retreat from the 27th of March to the 29th March 2023, where people gathered for multiple workshops, talk bitcoin, and even experience a bitcoin circular economy. One could even get 2 pizzas for 50k sats, a long way since Laszlo’s pizza day on 5/22/10.

(See more pictures.)

11. An Irish Farm in Ireland is powering their Bitcoin miners with anaerobic digestion. By utilizing the cows waste, the farm helps secure the network, earn money creating bitcoin, reduce the farm’s emissions and even feed energy to the grid. (You can’t miss this documentary)

12. Strike shares an exponential looking chart on the value the company has sent abroad since December 2022. The message is that open networks win, and Lightning enables interconnectedness between different countries with different Fiat currencies.

FUNDAMENTALS

The lightning network continues to grow and reaching new highs both in public capacity, and also in number of transactions.

The Lightning Network Public Capacity just hit 5,600 bitcoins.

Wallet of Satoshi processed 905,000 Lightning payments in March, another ATH.

THNDR Games has also hit a record transactions two months in a row, with 200,000 lightning payments in February and 300,000 + lightning payments this March.

Robosats, a peer to peer (P2P) bitcoin exchange with lightning support, has grown and hit close to 1BTC of P2P Lightning trading volume per day.

LNMarkets has had their biggest trading month last February, and March was looking as a possible challenger.

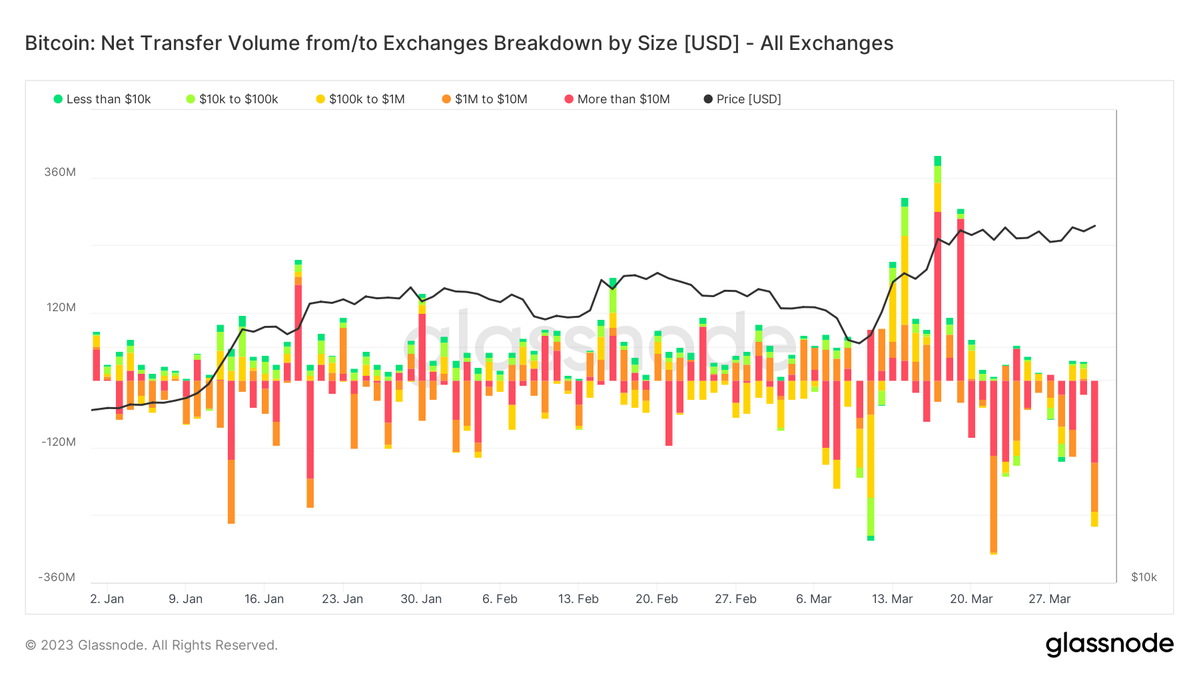

This Friday roughly $280m worth of Bitcoin was pulled from exchanges, the third largest bitcoin outflow of the year (~10k bitcoin). Even more interestingly, a total of 34k Bitcoin have been taken off exchanges in the past week. As less supply is available on exchanges, and more ‘hodlers’ pursue to increase their stack.. The pressure is getting stronger and stronger.

March also proved to be a huge month for new bitcoin addresses. A record of 1.4M new addresses have decided to hold some bitcoin in March. Would this be related to the fear of banks collapsing? Let’s see if it continues with this trend next month.

Ultimately it seems that the best portfolio to have right now, is a really diversified one:

One where you know, you have full control of your wealth, and allows you to sleep well at night.

Haha just playing.. Or.. am I? 😉

Have a great weekend niblings.

Stay humble & stack sats.

Buy Uncle Bam a cup of coffee ☕ or a nice ribeye 🥩 <3

Lightning Address: rustybeam47@walletofsatoshi.com

Lightning URL: LNURL1DP68GURN8GHJ7AMPD3KX2AR0VEEKZAR0WD5XJTNRDAKJ7TNHV4KXCTTTDEHHWM30D3H82UNVWQHHYATNW3UKYETPD56RWT9G2XF

Thanks!

Great compilation this week.

Narrator: The correct answer was stack more AND share the gospel.

My pension pot looks the same as that pie chart, my fund manager is called Saylor(d).