WTFBitcoin Week 24, 2023

TLDR: Strike launches in Mexico, BlackRock files for a Bitcoin Trust, Binance joins the Lightning Network, Long term Hodlers increase in representation, Hashrate keeps riping & more.

Bitcoin is volatile Store of Value.

The empire is falling. This week Janet Yellen, the US Secretary of Treasury warned that there would be a “slow decline” in the US dollar as a global reserve currency.

They finally they say it out loud. Everyone was trying to turn a blind eye on it and there while they gaslight us with how “US is the strongest currency, and will continue to remain strong”, there were only some few hints along the way mentioning the possibility of the US dollar losing its leadership position.

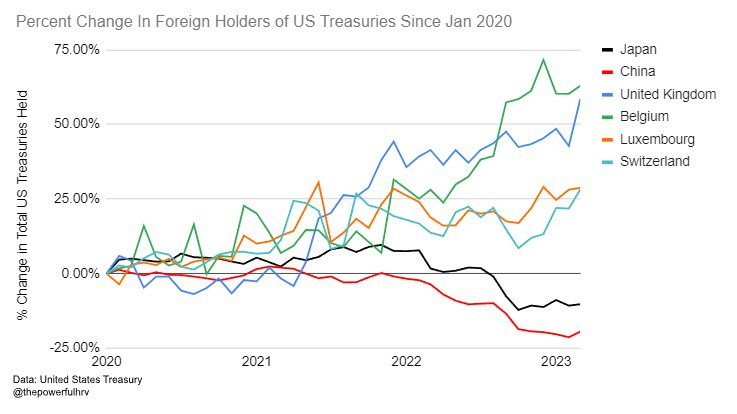

If we are being honest, it has been obvious all along though. We’ve heard China, the second largest foreign creditor of US Treasuries, has been accumulating gold in the last couple of years, and we can see & verify that they are reducing their exposure to US Treasuries, with ~859 billion dollars left.

So if the strongest currency is losing the battle, what about all of the smaller ones? Well we know those just end up losing their value at a faster pace, and we’ve seen it with news & charts shared in previous issues of WTFBitcoin, where Turkey, Lebanon, Argentina and other countries currencies rapidly depreciate against the dollar.

(Edit: Just after writing the issue, I saw this adhoc tweet from Balaji..)

Fortunately we have a way out, Bitcoin. Despite it being considered to be to volatile, I find it is useful to put a perspective on it.

I rather have a volatile appreciating monetary asset, than a stable depreciating one.

But well, let’s now go on and enjoy more of these bitcoin bullish news 🗞️🗞️!

THE NEWS

1. $10 trillion BlackRock officially files the 15th of June 2023 for spot Bitcoin Trust.

”If approved, the Bitcoin ETF would open doors to a new wave of adoption and provide investors with an unprecedented opportunity”. - Nik Hoffman

2. Blackrock had silently expressed their interest for Bitcoin in a different manner in the previous quarter, as they increased their exposure to Microstrategy by 1.85% with a total of 598,092 shares worth $156 million.

3. Strike launches instant, cheap remittances to Mexico. It now allows users to send faster and cheaper cross-border payments from U.S. to phone numbers, debit cards and bank accounts in Mexico.

“In 2022 Mexico received a record $60 billion in remittances from the US alone, making up around 95% of total remittances received from abroad” - Strike release

4. Binance joins the lightning network with a 10 bitcoin channel with Kraken and 5 bitcoin channel with OKEX. The channels came from the same address of 50 bitcoin.

(There is still a pending confirmation by Binance, but if its a troll, it might be a well capitalized one.)

5. Mutiny wallet, a Progressive Web Apps, gained popularity as Damus gets in trouble with Apple by allowing the Zap button (how users express their “likes” to other users with monetary value through bitcoin) to exists in the app without paying any dividends to them. We might see progressive apps get popular as they can’t be censored by Apple/Google, no download needed.

6. Michael Saylor’s keynote at Bitcoin Prague is out! In this talk he discusses the impact of monetary inflation on wealth preservation, the investment challenges we all face, the defects of various monetary instruments and why Bitcoin is the best global solution for those in the search of a store of value.

7. River released their report of Bitcoin vs the $156 Trillion Global Payment Industry, where it covers:

What's happening in the cross-border payments industry.

The under-discussed risks of CBDCs

The number of Bitcoin users globally

Who is using Bitcoin for payments

How Bitcoin compares to other payment methods

How to grow Bitcoin adoption & More

8. Bitcoin development nonprofit, Brink, has received a significant financial boost with a pledge of $5 million from Jack Dorsey's #startsmall organization. The pledge, totaling $1 million per year for the next five years, aims to support Brink's efforts in funding Bitcoin developers and ensuring the long-term sustainability of Bitcoin's core codebase.

9. Formosa went public on the illustrious Toptal Engineering blog. Formosa enhances crypto wallet management by leveraging easy-to-remember, themed security sentences rather than traditional and disparate recovery keywords.

10. Brinana, a forbes writer, posted an article on Nostr and shared how she received “zaps” from 47 people, earning 65100 sats. Bitcoin and Nostr are allowing content creators to work under the value for value model and to keep 100% of the contributions. Something that can’t be done in either: Twitter, Instagram, Snapchat, TikTok, Patreon, or even OnlyFans.

11. Bitcoin relative interest over time as it becomes adopted.

FUNDAMENTALS

If you are interested in Public Bitcoin Mining Companies and MicroStrategy from the stock market, perhaps it would be interesting to take a look at their bitcoin holdings as a percentage of their market capitalization. It seems Micro Strategy and Hut 8 have quite a potential to appreciate together with bitcoin.

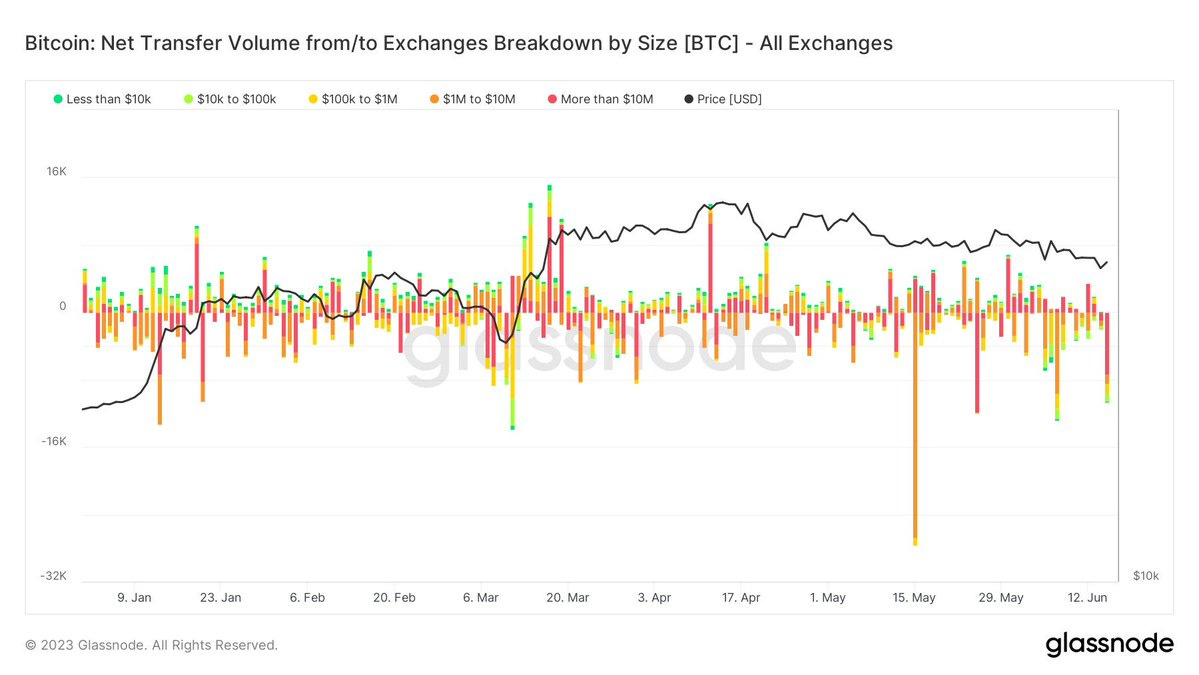

Multiple large whales withdrew big amounts of Bitcoin this Thursday. Potentially “aping” to Blackrock’s news and a higher exposure of Bitcoin to mainstream media?

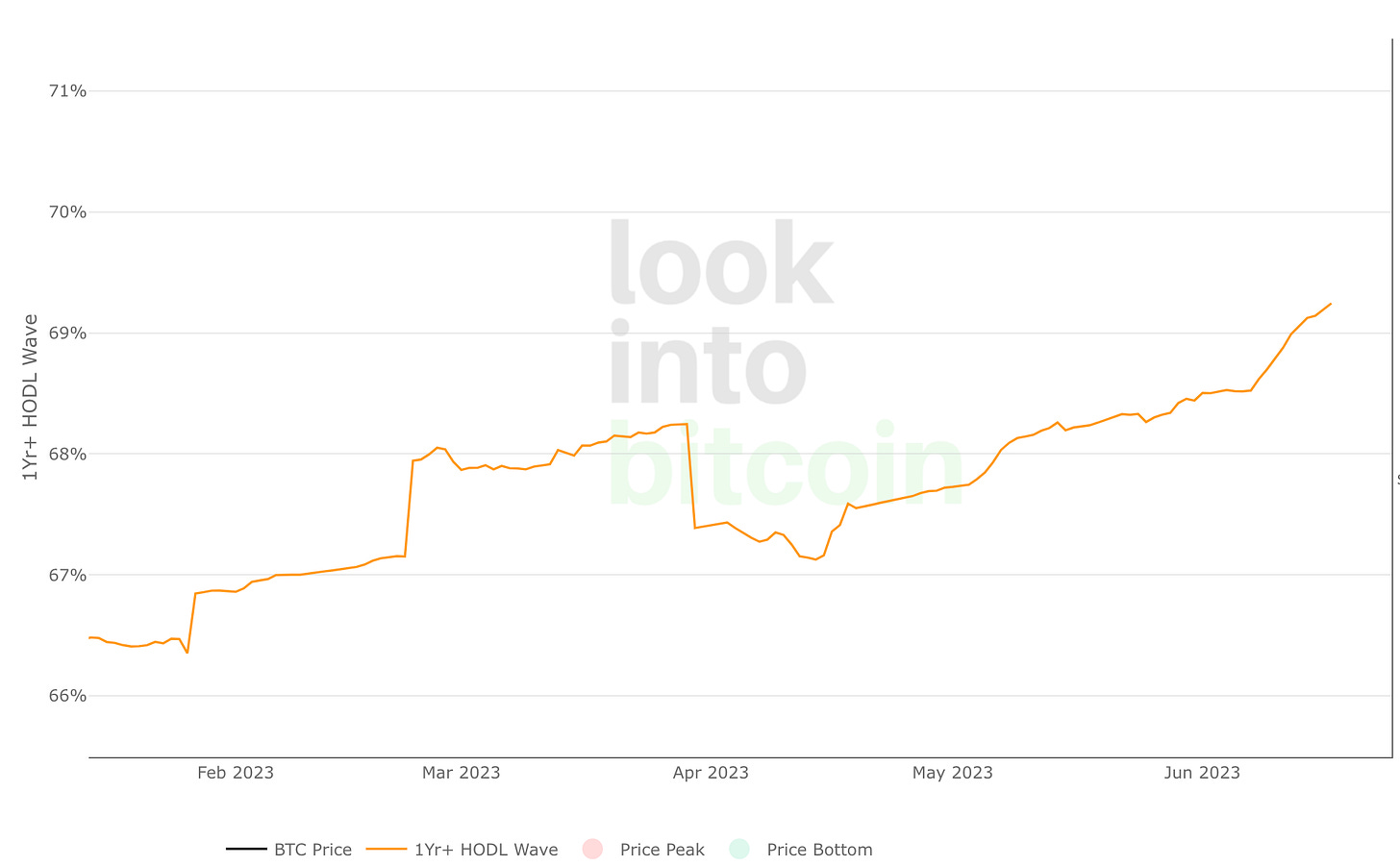

The percentage of bitcoin supply not being moved for over a year keeps hitting new highs, with 69.24% of the bitcoins being represented!

All while, bitcoin just had another positive difficulty adjustment, as it reflects higher hashrate and a growing mining industry.

Have a great weekend niblings.

Stay humble & stack sats.

Share some love with Uncle Bam for cup of coffee ☕ or a nice ribeye 🥩

Thank you to all of you who have contributed with a few sats, I truly appreciate it. ❤️

Lightning Address: rustybeam47@walletofsatoshi.com

Lightning URL: LNURL1DP68GURN8GHJ7AMPD3KX2AR0VEEKZAR0WD5XJTNRDAKJ7TNHV4KXCTTTDEHHWM30D3H82UNVWQHHYATNW3UKYETPD56RWT9G2XF

Oh baby