WTFBitcoin Week 25, 2023

Bitcoin is entering in an Institution's Rush.

TLDR: Institutions rush on filing Bitcoin Spot ETFs, Binance announces its Working on Implementing Lightning, First Bitcoin Futures Leverage approved by SEC, Santander publishes an article about Bitcoin.

Just as BlackRock, the biggest asset manager in the world, applied last week for a spot Bitcoin ETF (or to be precise an exchange traded Trust), the price quickly ran back up to $28K and as we know see this week, it didn’t stop there it continued to hit prices up to ~$31,400, and even over $100,000 in Binance US. But for all we know, it might be insider trading, or someone got extremely lucky.

In any case, this week was full of news of big financial institutions rushing to join the ETF train. Before BlackRock submitted its application, ARK Invest and 21Shares filed theirs around April, but now suddenly we have multiple asset managers hoping in the train right after BlackRock, why? Let’s dive in and speculate.

The ETF play is a first mover advantage kind of game. When an ETF is approved, the first player gets most of the addressable market, specially if it’s allowed to spend some time in the market being the only one.

BlackRock’s track record of 575-1 in favour of approval is a well known one. It is natural to speculate that they wouldn’t have applied, if they weren’t sure their likelyhood of getting an approval being high.

This naturally caused a rush of competitors submitting their own, with the expectations that if Blackrock’s filing gets approved, others will.

What does this mean for the price?

Being a spot trust and not a futures one, it will definitely allow a big pool of new capital to enter the space, potentially triggering Bitcoin to reach new highs. However, this development does not come without risks of potential manipulations.

To benefit from this and mitigate any risks as Bitcoin enthusiasts, we should follow these simple steps:

Buy Bitcoin

Hold your own keys

Spend & Replace

Grow the Community

As individuals increasingly gain a larger share of the Bitcoin ecosystem compared to institutions, and as circular economies grow, the potential attack vectors can be minimised. Ultimately, the end goal is to have money that cannot be tampered with.

Is it possible that it doesn’t get approved? Definitely but well, we might have to wait and see.. For now let’s go on and enjoy more of these bitcoin bullish news 🗞️🗞️!

THE NEWS

1. Binance officially announce they are working on integrating Bitcoin’s Lightning Network for deposits and withdrawals.

“Some eagle-eyed users spotted our new lightning nodes recently. Yes- That’s us!” – Binance

2. Additionally another 5 Bitcoin Channel was opened from Binance towards Kraken.

3. Deutsche Bank, $1.4 trillion banking giant, and biggest german bank, applied to offer digital asset custody.

4.Financial giants Fidelity, Charles Schwab and Citadel launch EDX Markets, a Bitcoin and crypto exchange.

5. WisdomTree, with $87 billion in assets under management, officially files for spot Bitcoin ETF.

6. Invesco, with $1.49 trillion in assets under management, officially files for spot Bitcoin ETF.

7. Valkyrie Investment joins on the rush and files for a spot Bitcoin ETF, and get the ticker BRRR.

8. The SEC approves the first leveraged Bitcoin Futures ETF. allowing investors to get 2x exposure starting Tuesday 27th.

9. Santander, one of the largest banks in the world, features an article on Bitcoin 's Lightning Network on their website.

10. Grayscale Bitcoin Trust discount began to close. People hit it could be a takeover. Fidelity?

11. Spiral's Bitcoin Lightning Development Kit announces the LDK Node, new Lightning library aims to simplify running a node.

12. Brink renews Sebastian Falbesoner's Grant for his work on BIP-324.

13. Venmo now allows its users to withdraw their Bitcoin.

(Funnily enough, many of us thought these companies would never enable such things. It might be game theory in play, or the team has some real bitcoiners.)

14. The lightning network is closely approaching All Time High levels at 5,608 BTC on the network. This capacity is used for near-instant settlement, which is a different use case than "locked" assets on other blockchains.

France's 3rd biggest bank Credit Agricole to offer Bitcoin custody.

”Two years ago the director of Credit Agricole said Bitcoin would be worth less than a dollar by 2025. Today his bank received approval to custody Bitcoin for their clients.”Brazil's largest bank, $2 trillion Itaú Unibanco joins national association to defend Bitcoin and crypto.

"We will actively contribute to its development"

Over a million bitcoin transactions have been sent by Nostr users .

FUNDAMENTALS

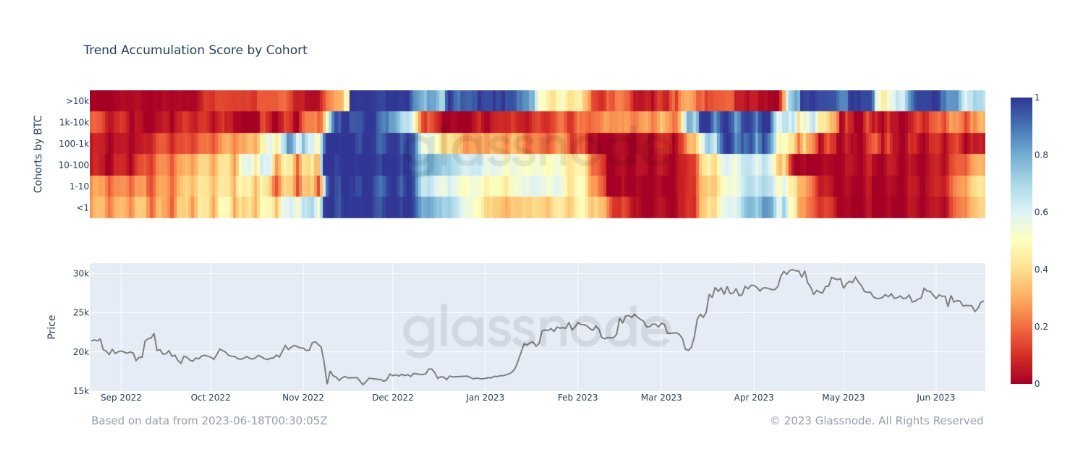

The BlackRock Bitcoin Trust seem to have just ignited the start of the accumulation. Almost all cohorts are off-distribution and entering light accumulation once again.

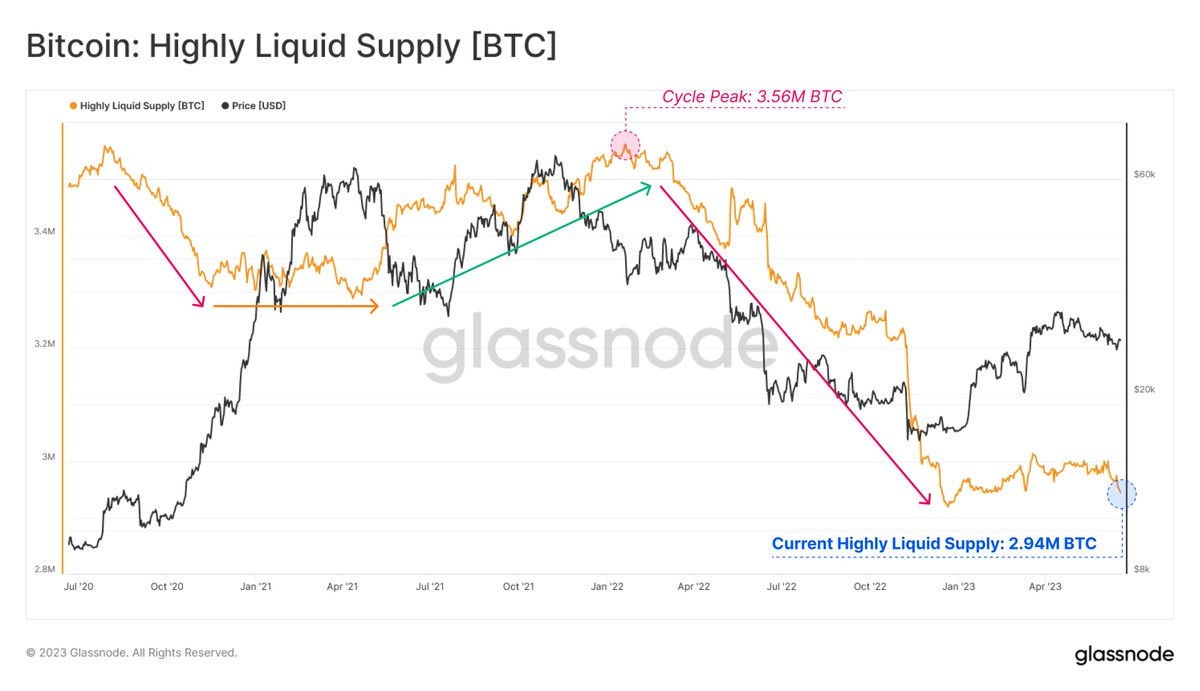

As the price continues its rise on a path back to all time highs, the liquid supply continues recording a decline, in other words people are not ready to take profits. Perhaps they know something about this asset..

Contrary to popular claims in mainstream media, more Bitcoin is currently held by on-chain entities with less than 10 Bitcoin than ever before and climbing rapidly.

According to Ki Young Ju, the short squeeze hasn’t happened. The current price surge was just someone(s) buying a lot of Bitcoin.

Well to be fair, I would say the time is looking great to stack as much as possible when you consider the buying power of the institutions showing interest, and the fact that the bitcoin halving is about 10 months ahead of us.

It kind of reminds me to the times when Michael Saylor officially announced MicroStrategy first purchase of Bitcoin back in August 2019.

Are you going to let this one slip? Or will you continue stacking with me nibblings?

I thought so..

Ultimately, we just got a friendly reminder that Not Your Keys, Not Your Coins, as the Romanian authorities allegedly seized $560K of Bitcoin from the Tate Brothers, as they continue their legal battle.

Whether they are guilty or not, everyone deserves the right to have private property which can’t be easily seized, and bitcoin fixes this.

Have a great weekend niblings.

Stay humble & stack sats.

Share some love with Uncle Bam for cup of coffee ☕ or a nice ribeye 🥩 <3

But more importantly, buy some sats for yourself.

Lightning Address: bamthemexican@noah.me

Bullish!! 🚀🌕

Yes! Too many people forget that they can spend their precious coins… and replace them!