TLDR: MicroStrategy accumulates more Bitcoin, Fidelity joins on filing for an ETF, Slovakia decreases taxes for Bitcoin holders, North Carolina House explores holding bitcoin on treasury & More..

Hey there niblings, it is that time of the week again, uncle Bam’s favourite! As I get to bounce my ideas with you and share the great bullish news on bitcoin that amazingly, NEVER STOP COMING!

This is the story of the last two weeks summarised in a single picture.

The institutions are not only growing their interest in the ~$600 billion asset, but they are now making it obvious by filing ETFs and entering the trading and custody space.

If we stop for a second and think about the amount of wealth held by this corporations (> $27 trillion of assets under management), we can clearly say that bitcoin is entering a new phase, one when it becomes normalised as an asset class, as hard money.

There is naturally concerns on the effect what it might bring, such as concentrating a big portion of the wealth behind institutionalised doors, but at the same time we shall remember that holding a huge amount of bitcoin does not grant you any mechanism to change the rules.

So is all of these bullish? We already know bitcoin has a fixed supply, and a spot ETF would be needing to feed off the existing bitcoins available for sale. As we have seen, the number of participants not letting go off their bitcoin just continues to increase.

When the BlackRock ETF application was announced, the price of Bitcoin was roughly $26k and it rose to new highs above $31k.

So what will happen if the ETF gets accepted? And will it do so?

First of all, let’s remind ourselves 3 facts:

BlackRock kind of rules the world, and they have a close to perfect record on ETF approvals.

They do have an incentive of getting it approve and appreciated, since they’ve launched a Private trust giving their institutional clients exposure to spot bitcoin.

Oh and they had already bought bitcoin futures early this year holding $6.15 million in exposure..

So naturally they’d benefit of having the ETF approved and specially to have the first mover advantage.

So what if it doesn’t? Well.. Bitcoin is still limited in supply. The halving is still 10 months away. Hashrate continues rising. Long-term holders continue increasing the % owned from the network. Wholecoin addresses continue on the rise. So if it doesn’t get approved, I think we will be alright..

But well, let’s now go on and enjoy more of these bitcoin bullish news 🗞️🗞️!

THE NEWS

1. Michael Saylor is back accumulating that 🌽. MicroStrategy has acquired an additional 12,333 BTC for ~$347.0 million at an average price of $28,136 per bitcoin.

Today, the company holds 152,333 bitcoin acquired for ~$4.52 billion at an average price of $29,668 per bitcoin.

“Remember when Saylor was making fun of for having $2B unrealized loss?, well now the profit is now close to ~$100M”..

2. $4.2 trillion asset manager Fidelity files for spot Bitcoin ETF, joining peer institutions. (Now a total of seven pending applications).

3. Hong Kong’s largest bank, HSBC, to offer Bitcoin & Ethereum ETFs to customers.

4. Slovakia decreased the bitcoin capital gains tax from 39% to 7%, when held for at least one year.

5. Nebraska’s former head of Economic Development testifies bitcoin mining “lowers property taxes and helps build more renewable energy”.

North Carolina House to vote on bill directing treasury to study the process of buying and holding Bitcoin "to hedge against inflation.” Swan team quickly noticed the state’s $50K budget and offered the analysis for free so they can use that budget as their first bitcoin purchase.

6. Riot Platforms, partners with Bitcoin ASIC manufacturer MicroBT, to bring production to America.

7. Tether & Bitfinex: Signed MOU with Georgia, Launched Bitfinex P2P, Issued $100k Grant to Qubes OS

8. Amboss just launched Ambucks, a new prepaid credit system. Users can can now bootstrap your first lightning node just by making a simple credit/debit card payment!

9. Spiral Renews Developer Grant for Thunderbiscuit

10. Bitcoin ETF BITO 0.00%↑ just had its biggest weekly inflow in a year as it hits $1 billion in assets.

11. Forbes just published another Bitcoin piece titled: “Human Rights And Electricity, 2 Reasons Why Africans Are Turning To Bitcoin”

Little by little, mainstream media changes to a more positive outlook about Bitcoin.

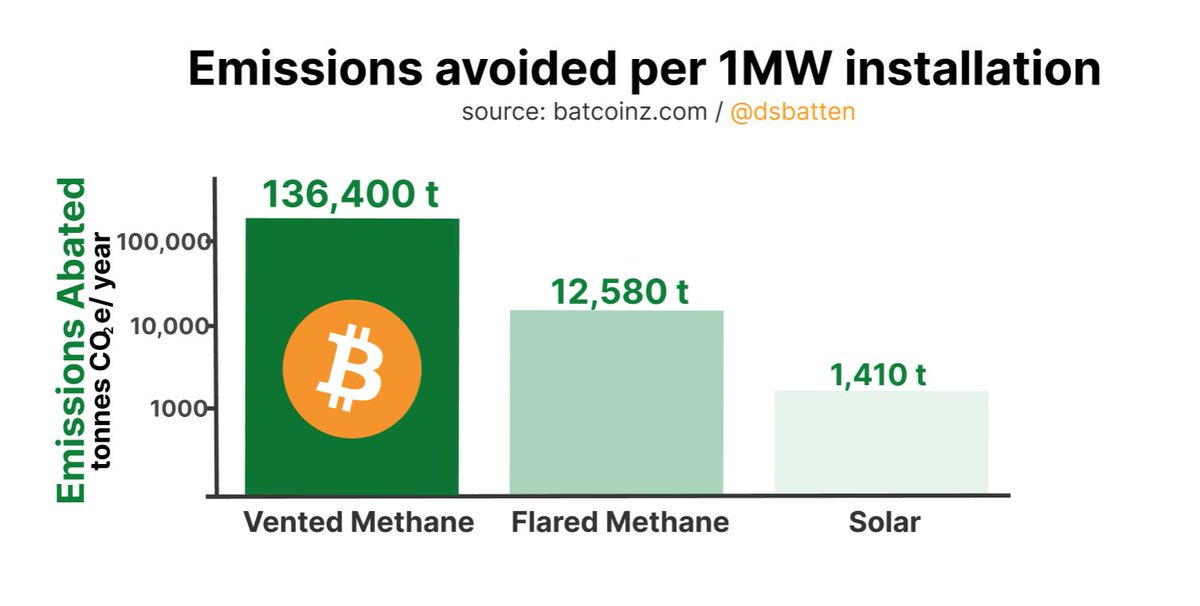

12. Based on energy, using vented methane to power Bitcoin mining reduces 96.5x more emissions than utility scale solar.

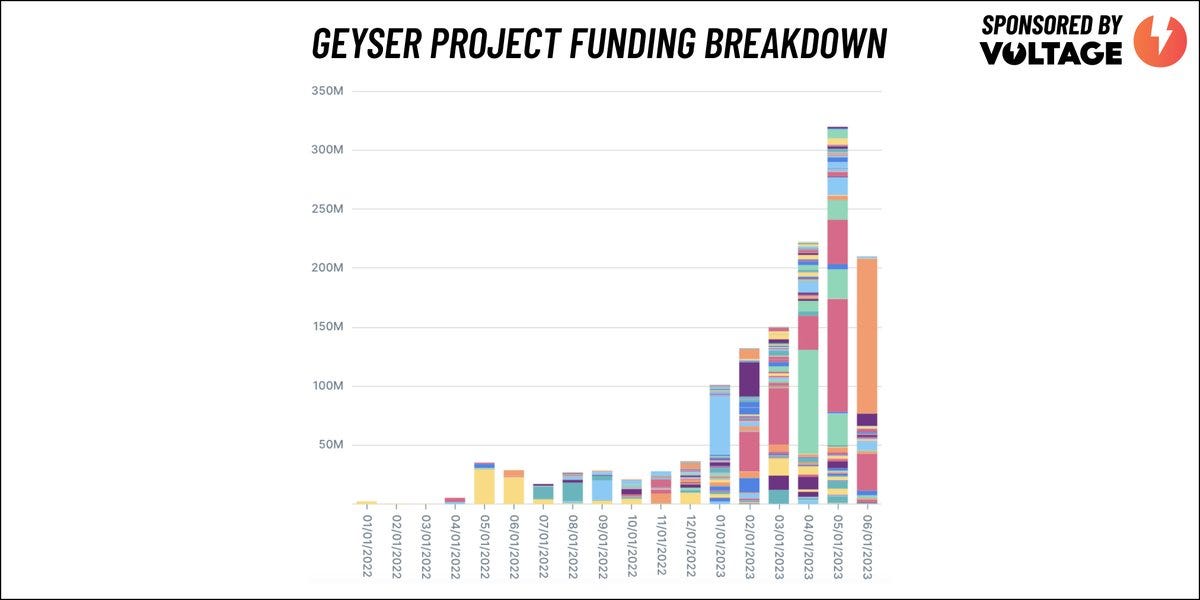

13. Geyser projects were on pace for another big month of Lightning payments, with over 200M sats raised in June, with Bitcoin Beach Brazil being the first project raising over 100M sats in a single month.

14. CoinCorner showcase how revolutionary is the Lightning network as payment rails when transferring from 🇬🇧 Bank Account to 🇺🇸 Bank Account within 2 minutes.UK

Bank -> @CoinCorner -> Lightning -> @ln_strike -> US Ban

FUNDAMENTALS

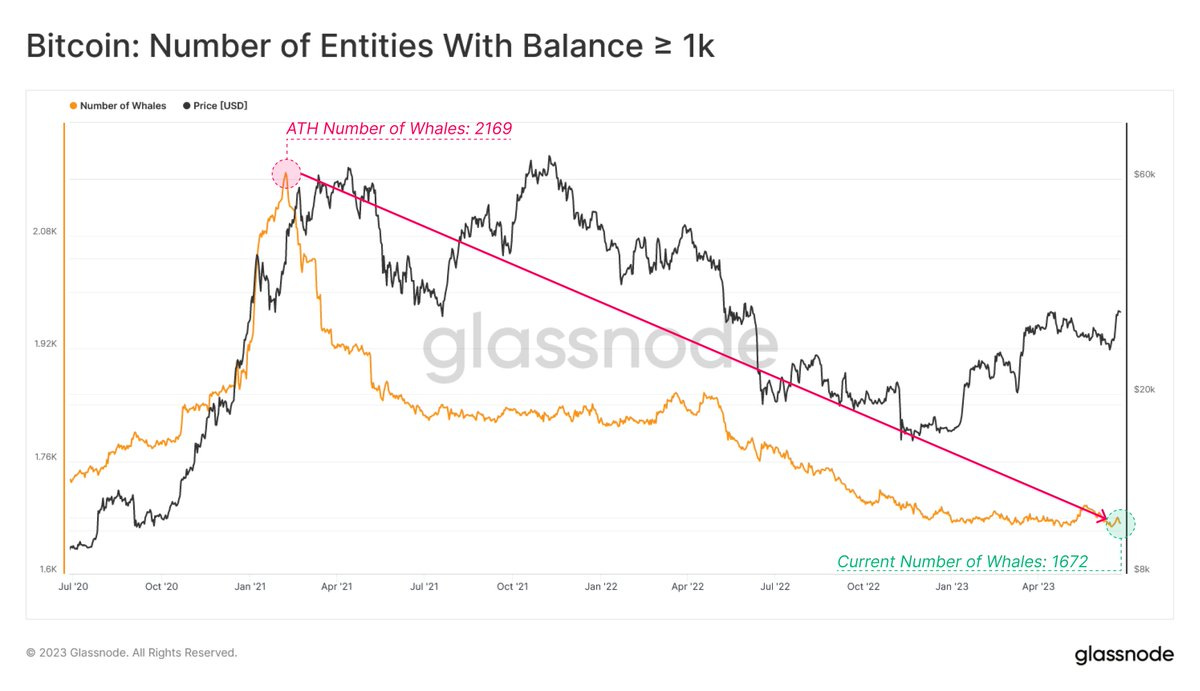

The Number of Whales (≥1K BTC) on the #Bitcoin network has experienced a perpetual decline.

As the number of whales hit ATH in 2021 with 2169 entities.

Once you sell bitcoin, you cant print more.

Have a great weekend niblings.

Stay humble & stack sats.

Share some love with Uncle Bam for cup of coffee ☕ or a nice ribeye 🥩 <3

But more importantly, buy some sats for yourself.

Lightning Address: bamthemexican@noah.me