TLDR: Larry Fink vouches for Bitcoin, Shrimps & Crabs are accumulating at 200% of the monthly issuance, AI will now be able to use bitcoin, & more.

Hey there niblings, it’s uncle Bam again with the bullish dose you need!

Not so long ago, the mainstream media was gaslighting us with the Debt Ceiling being about to be reached.

“OH MAI GAAD!.. Will the treasury decide to raise it?.. Will the dollar default?.. What does it means for interest rates?“

Well it all appears to be a never- ending reality show where us, the citizens, are meant just to be entertained, or better said distracted. It doesn’t matter what they had told us, history has shown time and time again that the “cap” is merely a fictional or arbitrary number, which they get to decide, while us citizens get no vote..

Not so long ago it was supposedly capped at $31.4 Trillion. But what does it mean “capped”, and does it matter anyway, if it always ends up being lifted?

Today we are already well over $1 Trillion of new Federal debt issued in just about a month!

Of course it matters, it matters because the increasing accumulated debt or wealth is not counting asset productivity. In other words, if we imagine all the money in the world being a big pie, we are owning less and less percentage of that pie.

This is exactly why bitcoin is beautifully designed! With a limit of only 21 million and an engineered issuance, regardless of its demand, the production of it will be determined by the protocol. In other words, the piece of the pie you own doesn’t change, as no one can create it out of thin air while debasing everyone else in the system.

But well, let’s now go on and enjoy more of these bitcoin bullish news 🗞️🗞️!

THE NEWS

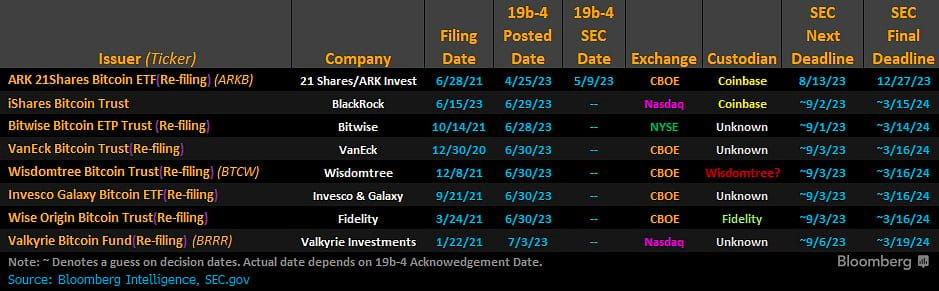

1. All of the spot Bitcoin ETF filings have been resubmitted. The sentiment is quite positive. Bernstein, $650 billion asset manager, says SEC is likely to approve a spot Bitcoin ETF.

2. Larry Fink, BlackRock CEO, publicly says that Bitcoin will revolutionize finance, that it is an international asset and the technology is fantastic.

.3 Bitcoin Depot, world's biggest Bitcoin ATM company, got listed on the Nasdaq.

4. Bitfinex announces return of assets to Recovery Right Tokens holders. The company has received assets from US Homeland Security that were stolen during the security breach in 2016.

5. Steven Lubka, Head of Private Clients & Family Office for Swan, reports that High Net Worth bitcoin buying has been ramping up. An assumption that price appreciation comes from healthy spot activity.

Not trust, verify you say?..

6. The Old Taylor, reported “smash buying bitcoin“ close to 1 bitcoin in Swan for her mom, as she desires to escape from the USD being inflated away. (Picture in the link!)

7. Better Beer launches a bitcoin treasure hunt, giving the customers the chance to win one of three bitcoins!

8. Scott Adams, american author and twitter profile with 996.7k followers, admits to owning bitcoin on Twitter spaces.

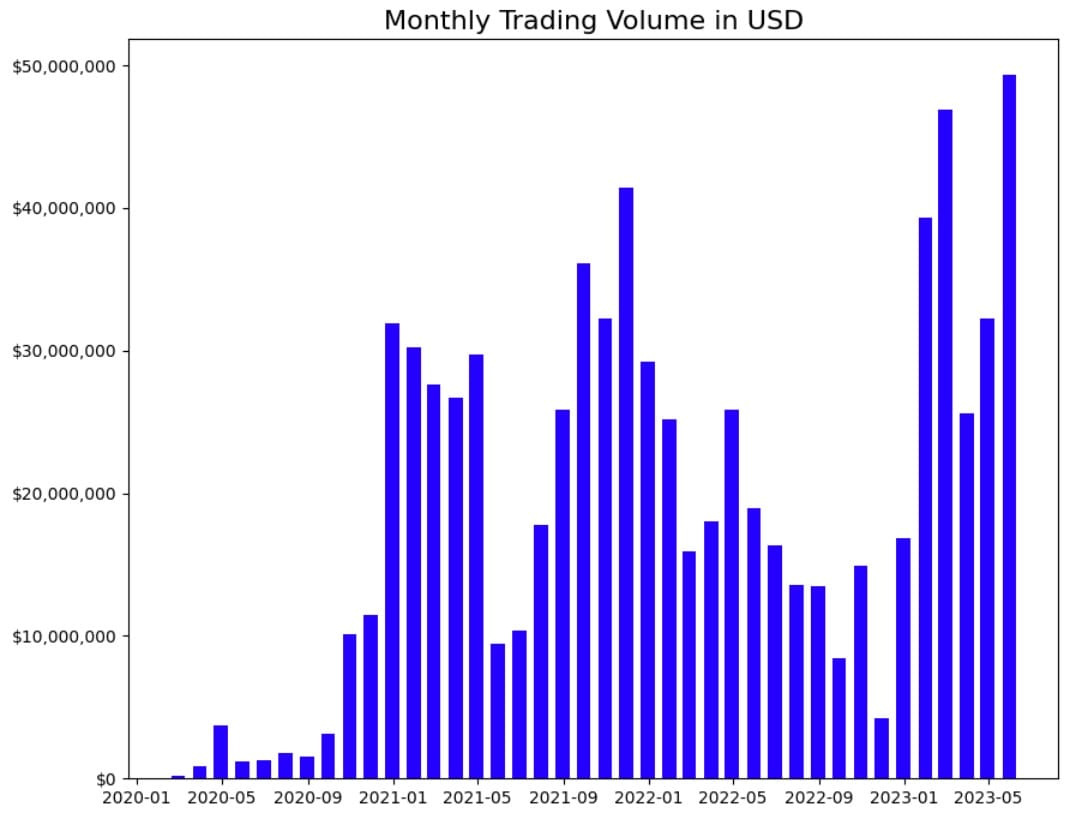

9. LN Markets hits an all-time high of $50 million monthly trading volume in June.

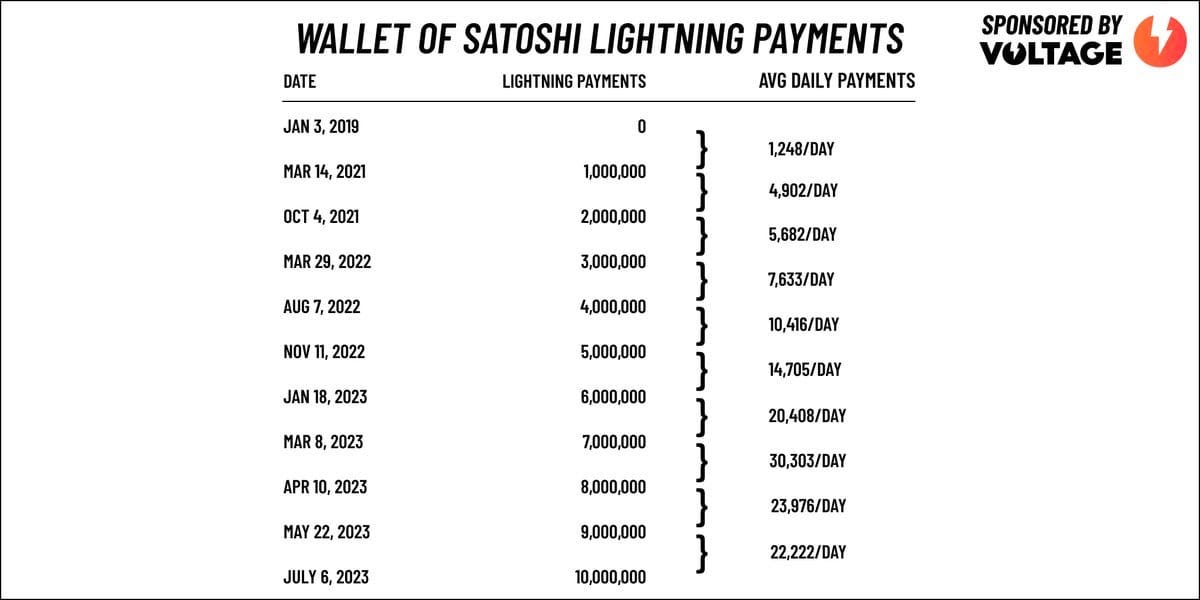

10. Wallet of Satoshi crossed over the 10 million cumulative Lightning payment mark.

11. Lightning Labs developers are releasing LLM Agent BitcoinTools that create AI agents that can hold a Bitcoin balance (on-chain and Lightning), send/receive #Bitcoin on Lightning, and also directly drive with a LND node. Bolt Card point of sale app for apple devices released.

12. A clever tutorial by Valentino, on how to set up a 2-2 multisignature wallet with Coldcard to manage inheritance.

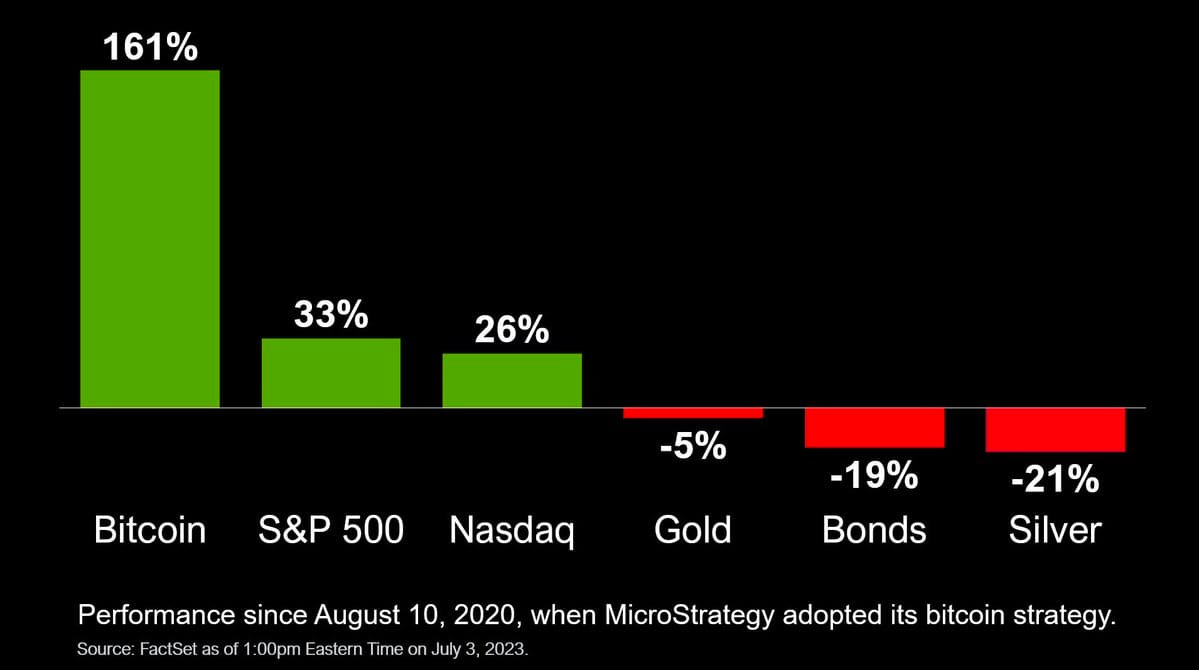

13. A friendly reminder that bitcoin is winning, using as a reference the time when bitcoin was first included in a private company’s balance sheet back in August 10, 2020.

by Saylor

FUNDAMENTALS

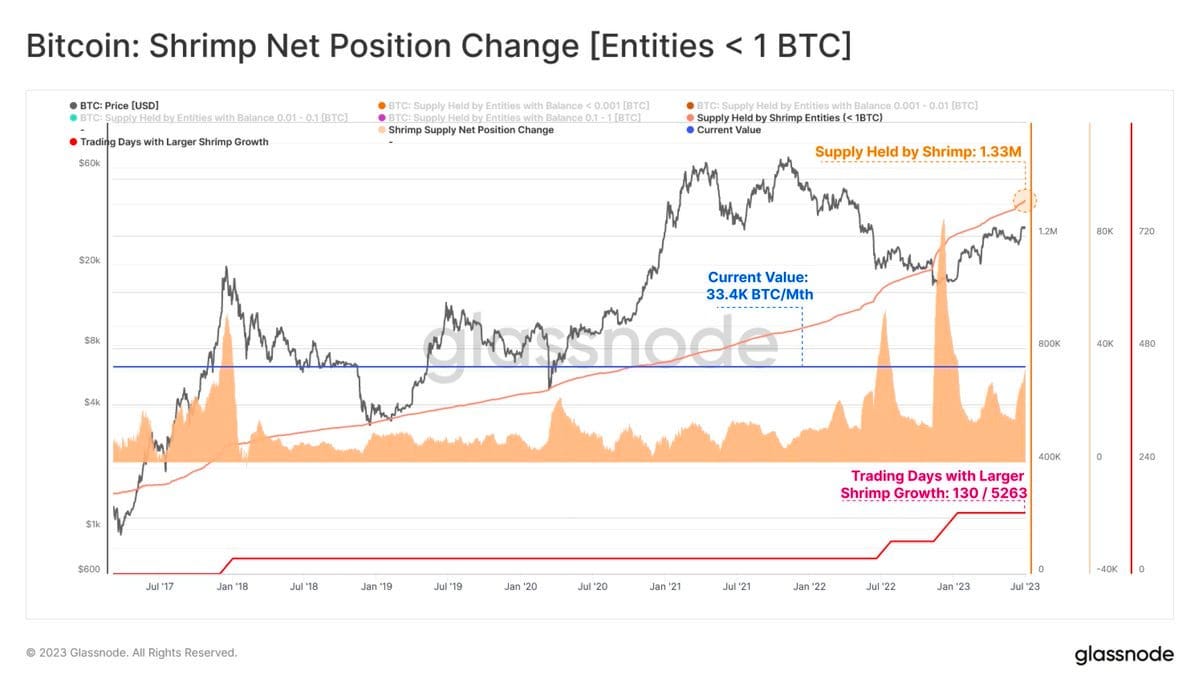

The Shrimp cohort, or bitcoin addresses with less than 1 bitcoin, have aggressively accumulated bitcoin at a rate of +33.4K bitcoin per month. This is more than 25% above the monthly scheduled issuance.

For every 1 new coin, a shrimps are taking 1.25 off the market.

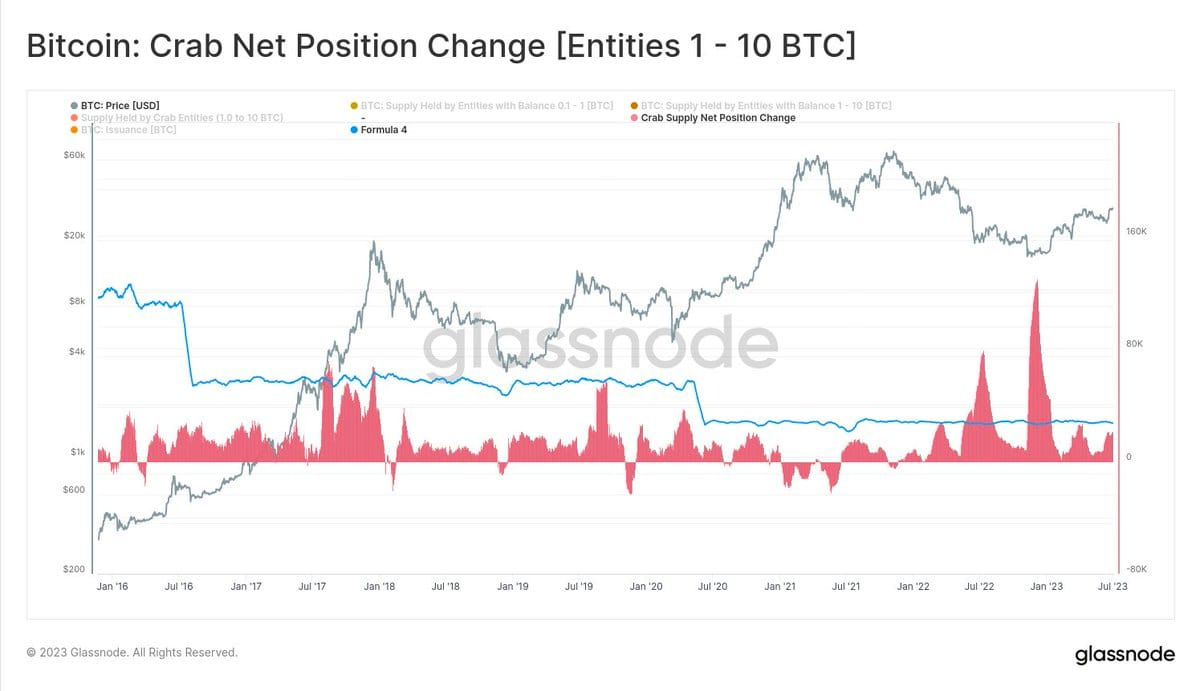

What about Crabs? Well they are taking an additional 22.4K bitcoin per month, or 83% of the mined supply.

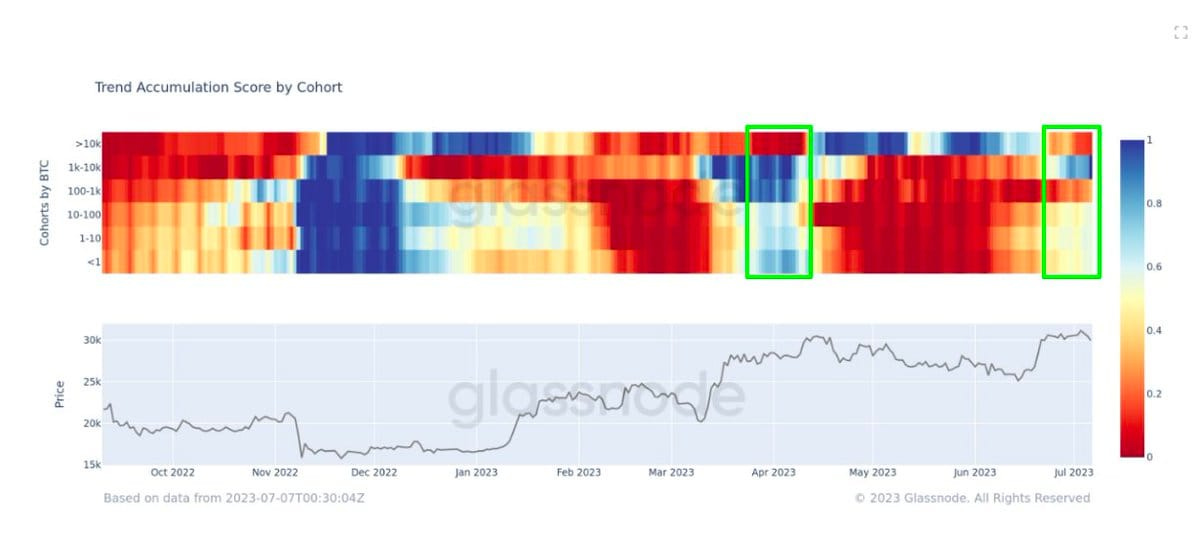

And everyone else in general? It does seem that we are entering in a similar accumulation structure to the one that happened right after the Silicon Valley Bank collapse.

You better get some of those sats, they ain’t making more than 21 million. 😆

Have a great weekend niblings.

Stay humble & stack sats.

Share some love with Uncle Bam for cup of coffee ☕ or a nice ribeye 🥩 <3

But more importantly, buy some sats for yourself.

Lightning Address: bamthemexican@noah.me