TLDR: Bitcoin ETF filings recognized by SEC. Bitcoin ETFs in Europe and Australia, Vanguard increases their stake on public Miners, Nostr continues to grow & more.

Hey there niblings, it’s uncle Bam again, I’ve been away vacationing and resting, but you know who doesn't take holidays and is always reliable, unlike the banks? That's right... Bitcoin."s? That’s right.. Bitcoin.

Lately it feels that months happen within few weeks in the bitcoin space. Even though it’s summer, there are a continuous flow of news, developments and emerging projects in the bitcoin, lightning & even nostr communities. Considering it’s summer I would be lying if I didn’t admit it has been making me feel real bullish.

It is my belief and impression that the narrative is changing, and it just so happens to coincide with BlackRock's application for a Bitcoin Spot ETF.

Nowadays you’ll even find positive publications even on bitcoin’s environmental impact, where a year ago or two, Bitcoin was publicly associated with “Burning the Oceans”, or increasings the earth’s temperature.

The big question is WHEN, not IF, the first spot Bitcoin ETF will get approved in the U.S., opening doors to unprecedented amounts of capital finding a better vehicle for storing value & appreciation over the long term.

And as bitcoiners, if we take two steps away and reflect on what has happened this last 4 year cycle (that is right, bitcoin’s issuance is about to cut in half in about 9 months):

MicroStrategy, adopted a bitcoin standard and became the first company to buy bitcoin for their balance sheet with their full reserve, and even used debt amassing a total of 152,333 bitcoins.

We have about 20 Bitcoin Mining Companies trading in the stock market with access to credit lines.

El Salvador made Bitcoin legal tender, and even decided to accumulate Bitcoin and started DCA’ing 1 bitcoin a day.v(

and Now the 3rd presidential candidate is going to eliminate capital gains and put bitcoin on the U.S. balance sheet..

and yet, we still have people thinking bitcoin has no chance..

Do you see the trend, anon? Maybe just before we get on all the bullish news, let’s take a deep breath and a little glimpse of the bitcoin’s price on a 3 year moving average..

But now, lets catch up with what has happened lately .. 🗞️

THE NEWS

1. SEC has acknowledged the Bitcoin ETF applications for BlackRock, Vaneck, Invesco, Galaxy Digital, Fidelity and Wisdom Tree.

2. Europe’s first bitcoin exchange traded fund (ETF) is expected to be publicly listed this month.

“Demand has shifted since last summer” – Jacobi Asset Management

3. Australia to launch spot Bitcoin ETF on the national stock exchange, amid a wave of US filings.

4. CH4Capital, raising a $400M ClimateTech Fund, to reduce landfill methane emissions using Bitcoin mining - Forbes.

5. MIT researchers acknowledge the grid balancing, methane mitigating benefits of Bitcoin mining in new paper.

6. Binance has completed the integration of Bitcoin on the Lightning Network and deposits and withdrawals are now open.

7. Africa Bitcoin Community engaged over 1,000 high school students early July as part of our Bitcoin for Youngsters program. This program introduces young people to #bitcoin and its relevance in the local economy.

8. Bitcoin mining services company @LuxorTechTeam has just launched extended-duration contracts and faster liquidity options for the BTC mining market.

9. Both $MARA and $RIOT issued SEC filings in order to report an acquisition of shares made by a beneficial ownership with more than 5% in the company. Vanguard Group has now a stake in excess of 10.31% of Marathon and 10.24% of Riot through its investments.

Mmmh.. Are they anticipating BlackRock’s ETF? Or the Bitcoin Halving?

10. Marathon achieved 9 blocks and close to 59 BTC yesterday. Have they increased their hashrate significantly after Vanguard entered the game? 👀

11. Phoenix Wallet introduced a 3rd generation self-custodial Lightning wallet by adding Splicing.

Splicing changes the game: single dynamic channel, no more 1% fee on inbound liquidity, better predictability and control, trustless swaps. - Phoenix

12. Primal, an emerging player in the Nostr industry, has secured $1 million in funding from Ten31, Hivemind Ventures, and others, making it the first venture capital-backed startup solely dedicated to developing bitcoin-infused Nostr applications.

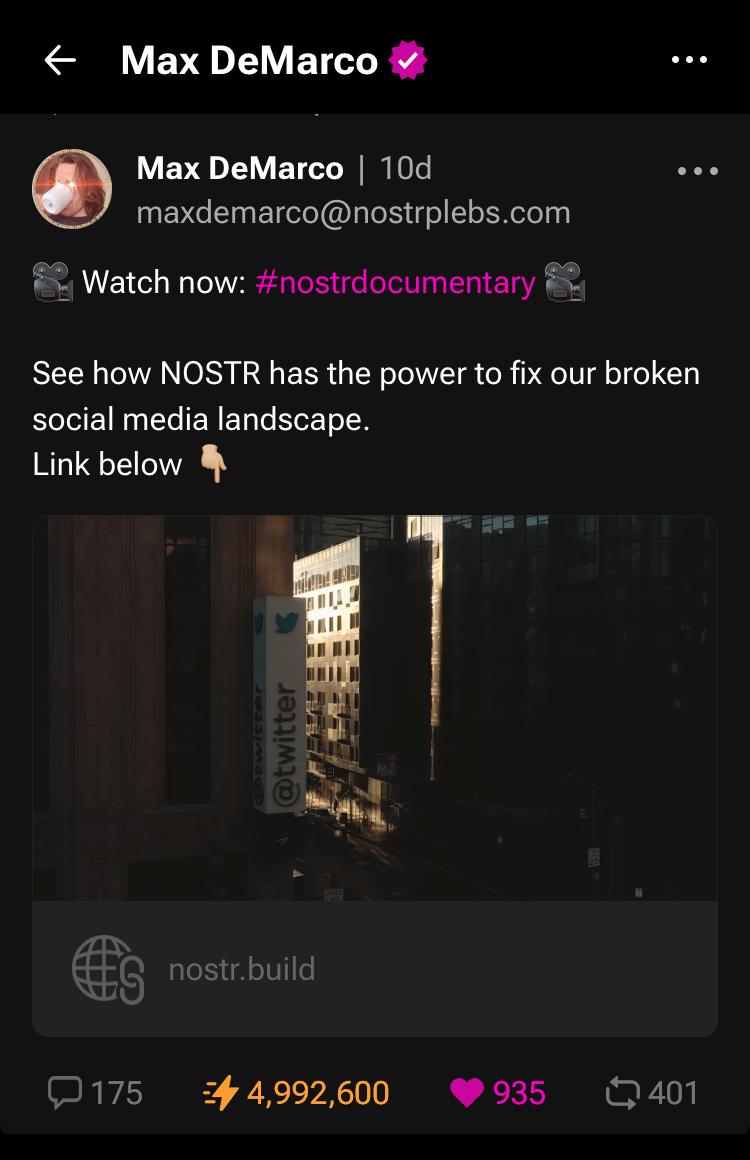

13. Nostr documentary by Max DeMarco was aired, showcasing the power to fix the broken social media landscape.

Different than in Twitter, Nostr allows you to “ZAP” posts, which essentially means sending some sats via lightning. The author of the documentary received close to 5 million sats of appreciation from the community in a peer-to-peer fashion.

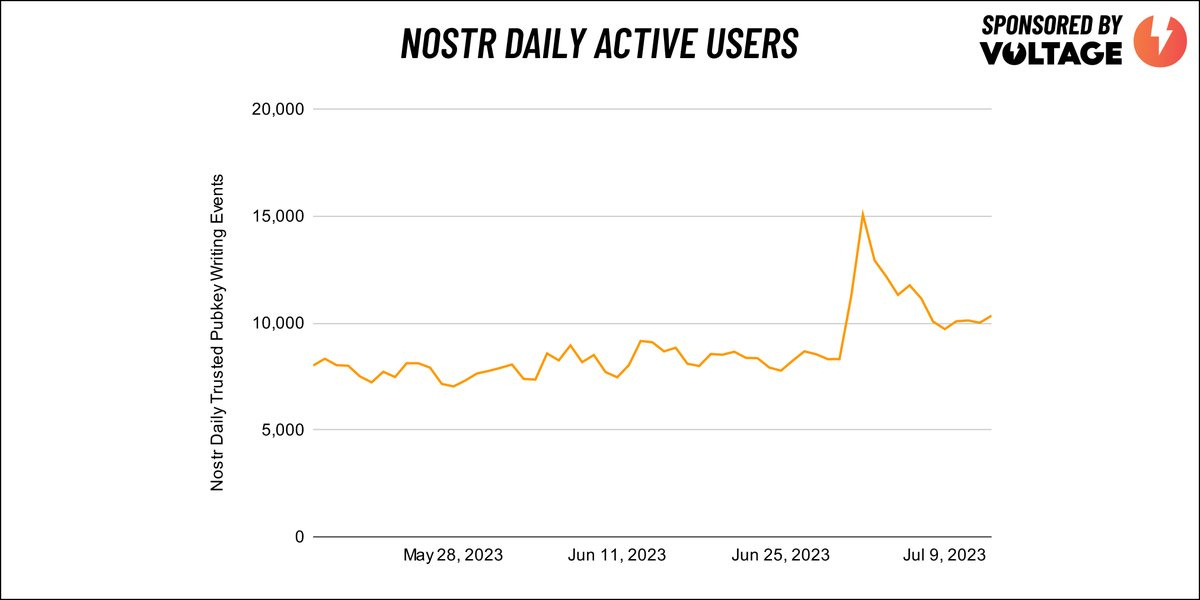

Nostr's daily active users almost doubled in a couple of days from Twitter’s rate-limiting feature.

14. Galoy’s team aims to become more efficient in the onchain footprint of their products, and they released a 10 million sats bounty for a Payjoin integration.

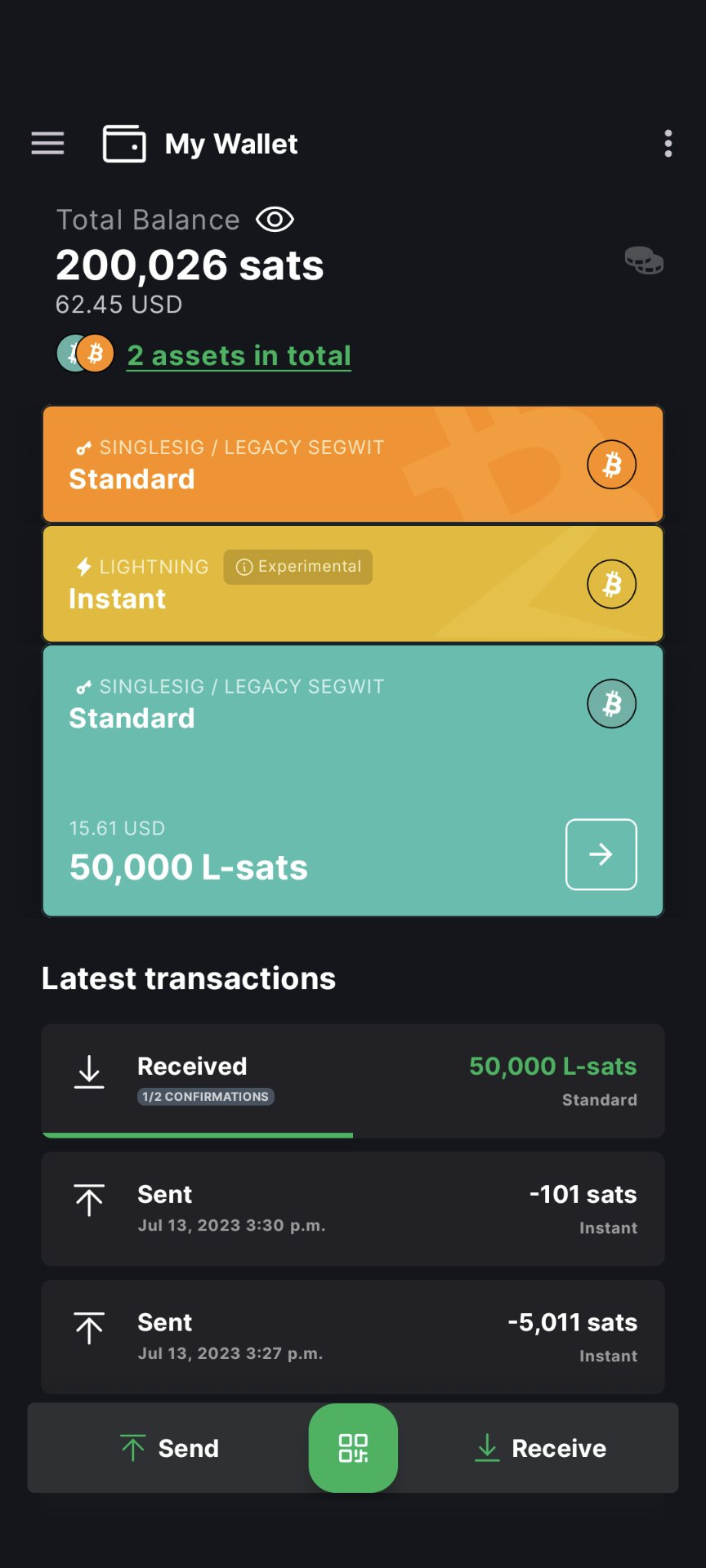

15. BTCSession shared a preview of Blockstreams Green wallet showing balances for Bitcoin, Lightning and Liquid, showing the industry’s attempt to simplify the user experience.

16. Buying beer for Bitcoin in Bologna with Laura.

17. Did you know Lugano has ~270 merchants accepting Bitcoin for payment? @BTC_Culture shares an enlightening thread with the city’s Bitcoin experience.

18. People are using Fold App to stack sats as they go on with their daily expenses by just using their rewards program. Mel shows how she has earned over 12 million sats! (If this applies in your jurisdiction, don’t let this opportunity slide.)

Wasabi Wallet enabled a supercoinjoin. In one single coinjoin, 33.31069655 BTC were made fungible. That's over $1 million of bitcoin made private for hundreds of different users.

“I do believe a lot of crypto is gonna be, is an international asset. It has a differentiating value versus other asset classes. But more importantly, because it's so international, it's going to transcend any one currency and currency valuation." -Larry Fink, on his 14-July-2023 CNBC interview as he couldn’t talk about Bitcoin because of the ETF filing.

Rev.Hodl reports on using a bitcoin miner instead of the heating element to dry laundry. The mining space continue to innovate to reduce their mining bill.

Tesla added Bitcoin back into their code for payments on their website.

“The Kennedy administration will begin to back the U.S. dollar with real, finite assets such as gold, silver, platinum & Bitcoin.” - RFL Jr.

FUNDAMENTALS

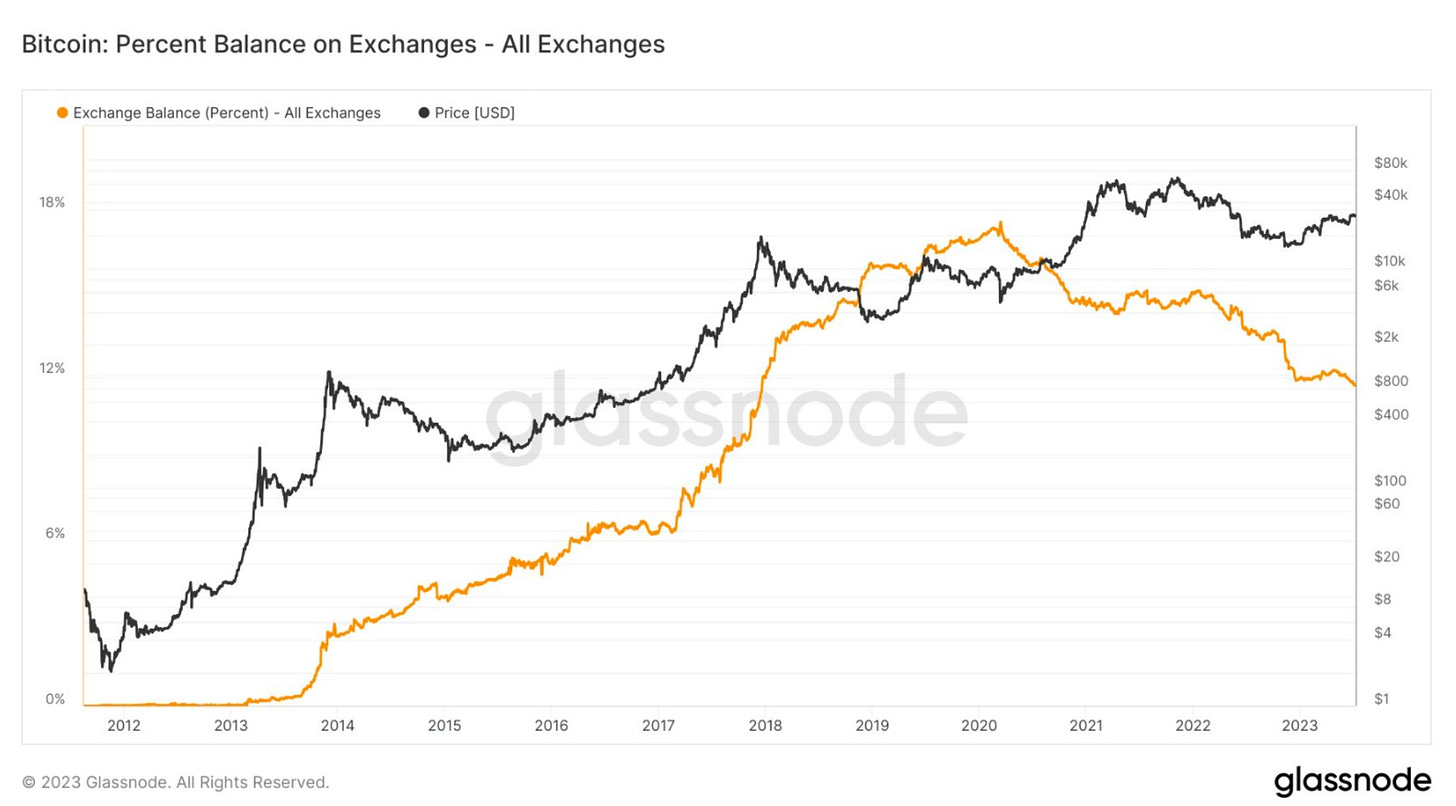

Coins available for sale on exchanges, any potential downward pressure on price should theoretically be stickier while upward pressure will be more exaggerated. The institutions are coming for our Bitcoin, but mine aren’t for sale.

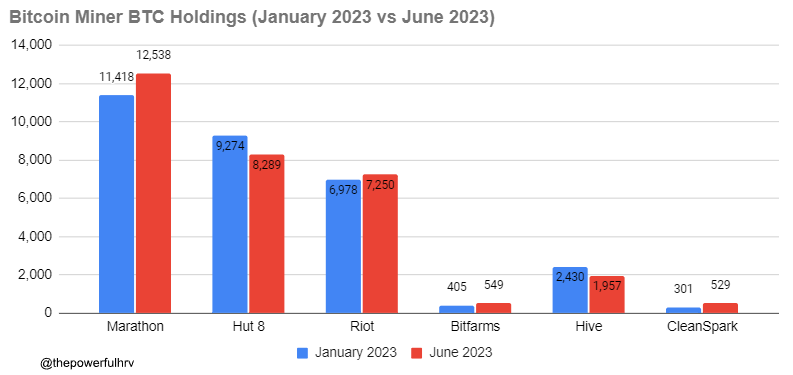

Miners had added more Bitcoin to their balance sheet throughout the year. Choosing to stack and HODL instead of selling is one of the most sincere displays of conviction in the asset.

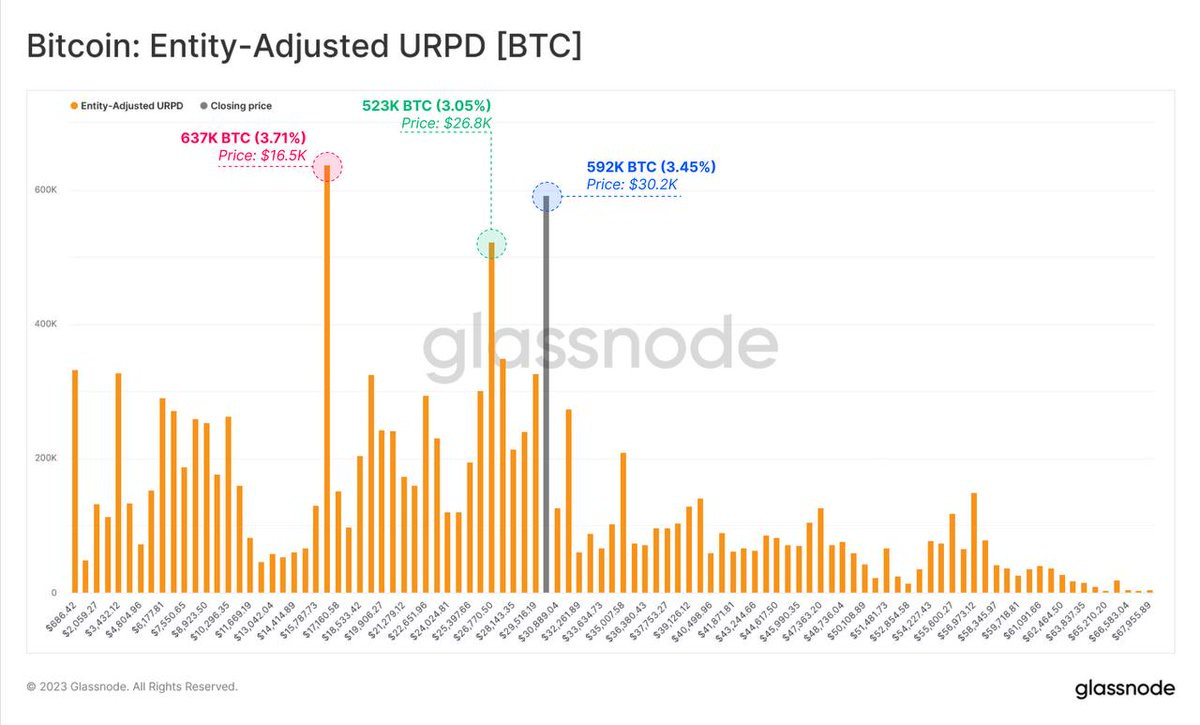

Around 592k of #Bitcoin was accumulated at $30.2k at the spot price. This is the second largest accumulation after $16.5k, which clearly marked the bottom of this bear market. The current massive accumulation could be a signal of the price finding its bottom and preparing for ripping higher.

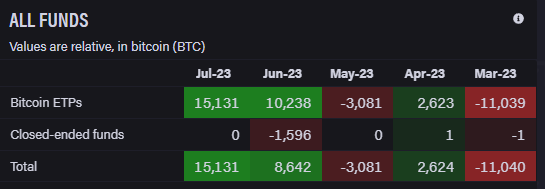

Bitcoin ETPs also have signal massive accumulation with over $140 million worth of bitcoin in the first half of July.

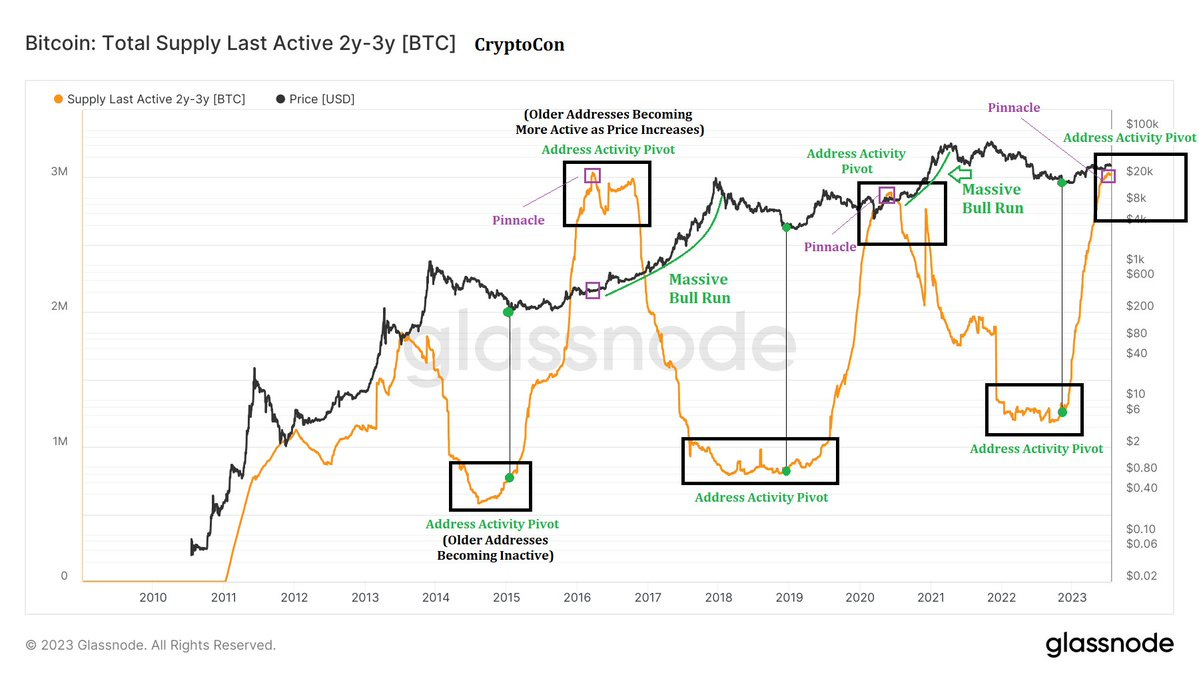

So is the bull market here? Well some might say it is, and a hint could be given out by the activity of 2-3 year last active supply which is now pivoting..

“It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self fulfilling prophecy.”

— Satoshi Nakamoto

Have a great weekend niblings.

With love, Bam.

Share some love with Uncle Bam for cup of coffee ☕ or a nice ribeye 🥩 <3

But more importantly, help spread the word and definitely buy some sats for yourself.

Bullish