WTFBitcoin Week 2, 2023

Is the bitcoin bottom in?

TLDR: El Salvador is ready for Volcano Bonds, Circular economy continues to grow in Texas, Hong Kong wants a bitcoin ETF, Miners are accumulating again.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

Third week into the year, and there is some enthusiast that one can even smell in the air, as bitcoin pushes through $20,000 for the first time in a couple of months. Throughout the last year, we’ve been experiencing non stop downward movements of bitcoin price, which makes it hard to see the light at the end of the tunnel.

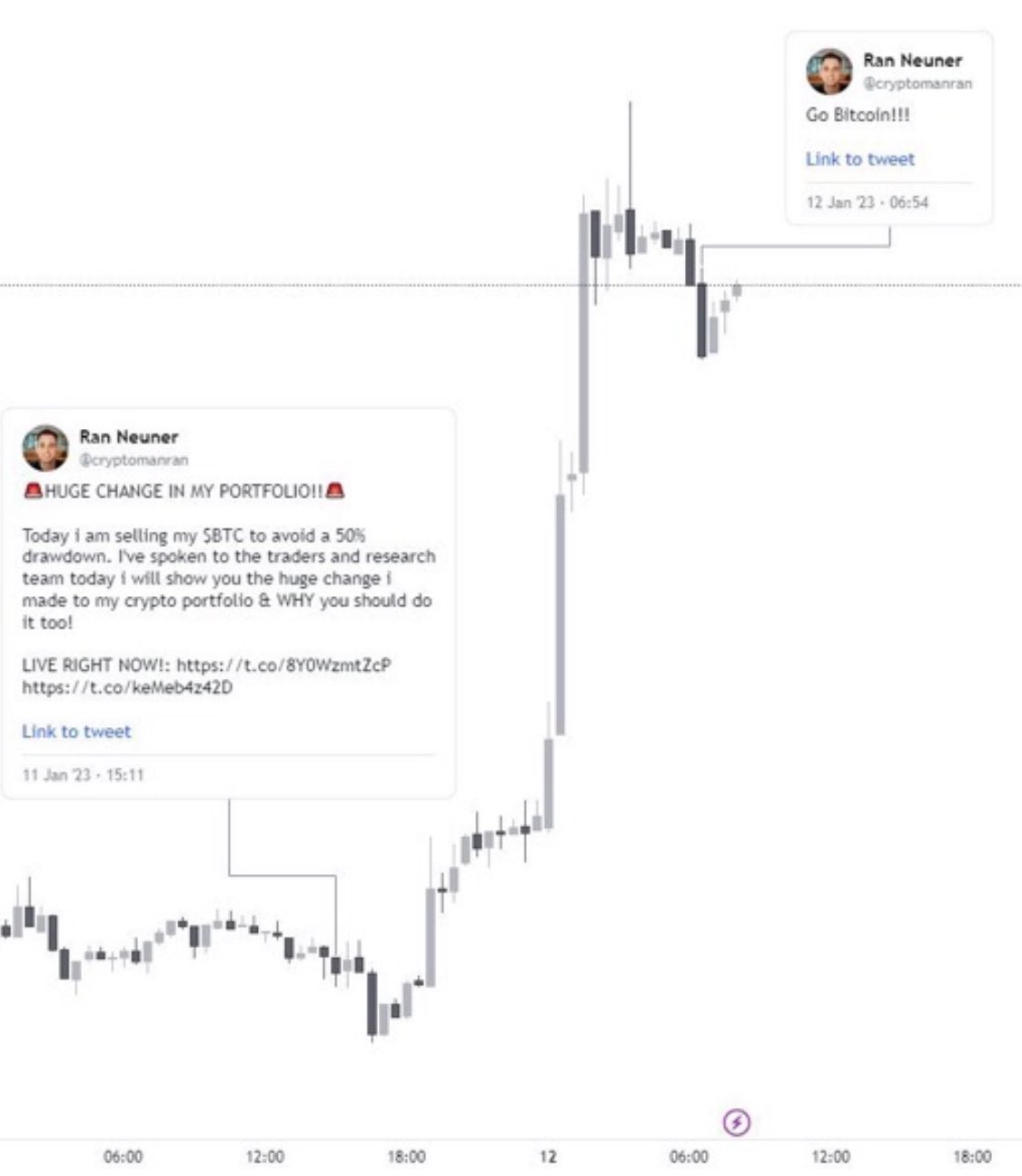

The price remained stable around ~$16,800, in fact 2023 started even lower than this, and it seemed the vast majority was, and maybe still is expecting lower prices around the $10,000 - $12,000 arena. At least according to what I see on twitter.

So it begs the question: Is the bitcoin bottom in?

Uncle Bam is no magic ball to know this answer, and anyone who tells you they know, be sure they don’t. What I can tell you is two things.

1. The majority are often wrong. Remember when we were going to $100,000? Well.. So what about everyone saying $12,000?

2. The price remained so long around $17,000 that many people continued diligently, or even more intensively stacking.

Chasing a price could be a curse, it can price you out. Many people are wondering whether they should buy now or not, but it feels expensive at $21,000, when it was 21% cheaper on new year’s eve.

The problem of chasing the price, is that is an endless loop between. “you can always buy lower”, or “it is too expensive, I should have bought lower”.

So just stay humble, and stack sats.

THE NEWS!

1. El Salvador’s Legislative Assembly has just approved, by an overwhelming majority, the new Digital Securities Law! “This enables the volcano bonds, and takes El Salvador one step closer to its issuance.” - Bam

2. Samsung to launch Bitcoin ETF in Hong Kong.

3. Miners recently announced their bitcoin production, and some of them have either not stopped accumulating or starting accumulating again.

Marathon has 12,323 bitcoin on its balance sheet, taking the 3rd position on public companies holding the most bitcoin.

Hut 8 Mining, takes the 5th spot as a public company, holding 9,086 bitcoin and passing Coinbase.

Riot increases its reserves to 8,027 bitcoin and holds the 9th position on the public company bitcoin holders leaderboard.

4. Group One takes a beneficial option position to buy 1.3 million shares of MicroStrategy. “MicroStrategy is essentially at this point a leveraged trade on Bitcoin, and Wall Street knows it.” - Bam

5. Area Layer starts 2023 releasing two products:

Asgard: A Wallet for desktop using Statechain and Lightning Network, where users can make ‘swap’ between LN and Statechain.

Dagda: Platform where users have the opportunity to trade options on the Liquid Network.

6. Belgian MP Christophe De Beaukelaer, announced his intentions on taking salary in Bitcoin, saying he wants to "defend financial freedom"

7. Generation Hemp Inc., the largest mid-stream hemp processing entity in the U.S. announces a new directional focus on sustainable energy projects, with their first project involving a bitcoin mining operation in Costa Rica.

“Current mining site locations in development exceed six and include Arkansas, Kentucky, and Costa Rica.” - Gary C. Evans, Chairman and CEO of Evergreen Sustainable Enterprises

8. The new generations are entering the space, as some of this young bitcoiners begin mining bitcoin in their student dorms.

9. Circular economy is gaining traction in Texas, as ranchers have been getting onboarded with The Beef Initiative. Gradually then Suddenly.

FUNDAMENTALS

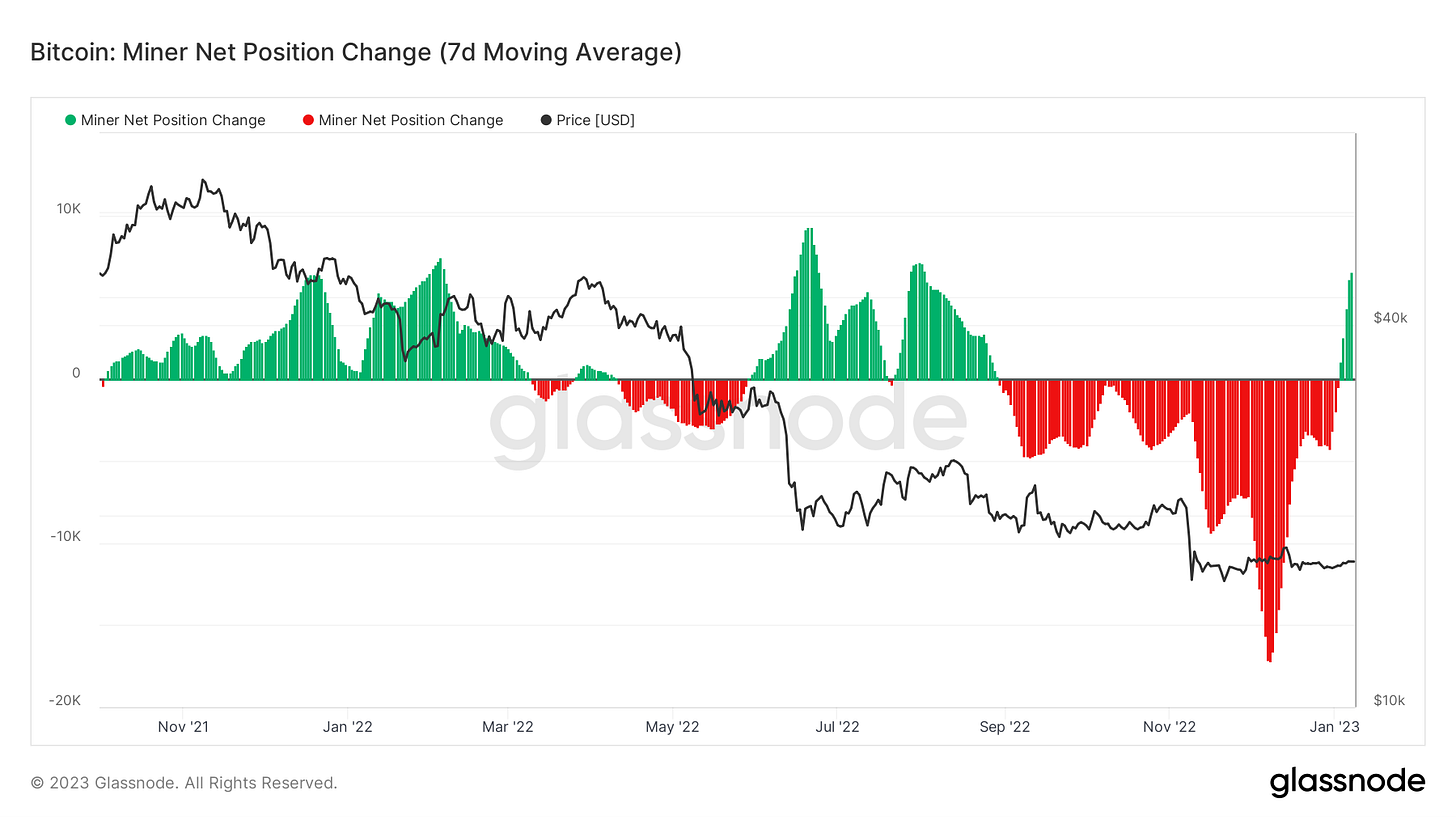

Miners have been off loading their bitcoin production and reserves for the last months. The low prices combined with the high leverage some of them had, made them unable to continue with “100% hodl” strategy that some are still trying to sustain. But recently, they’ve started to accumulate, or to be more precise, stopped selling the newly minted bitcoin, and storing them on their balance sheet.

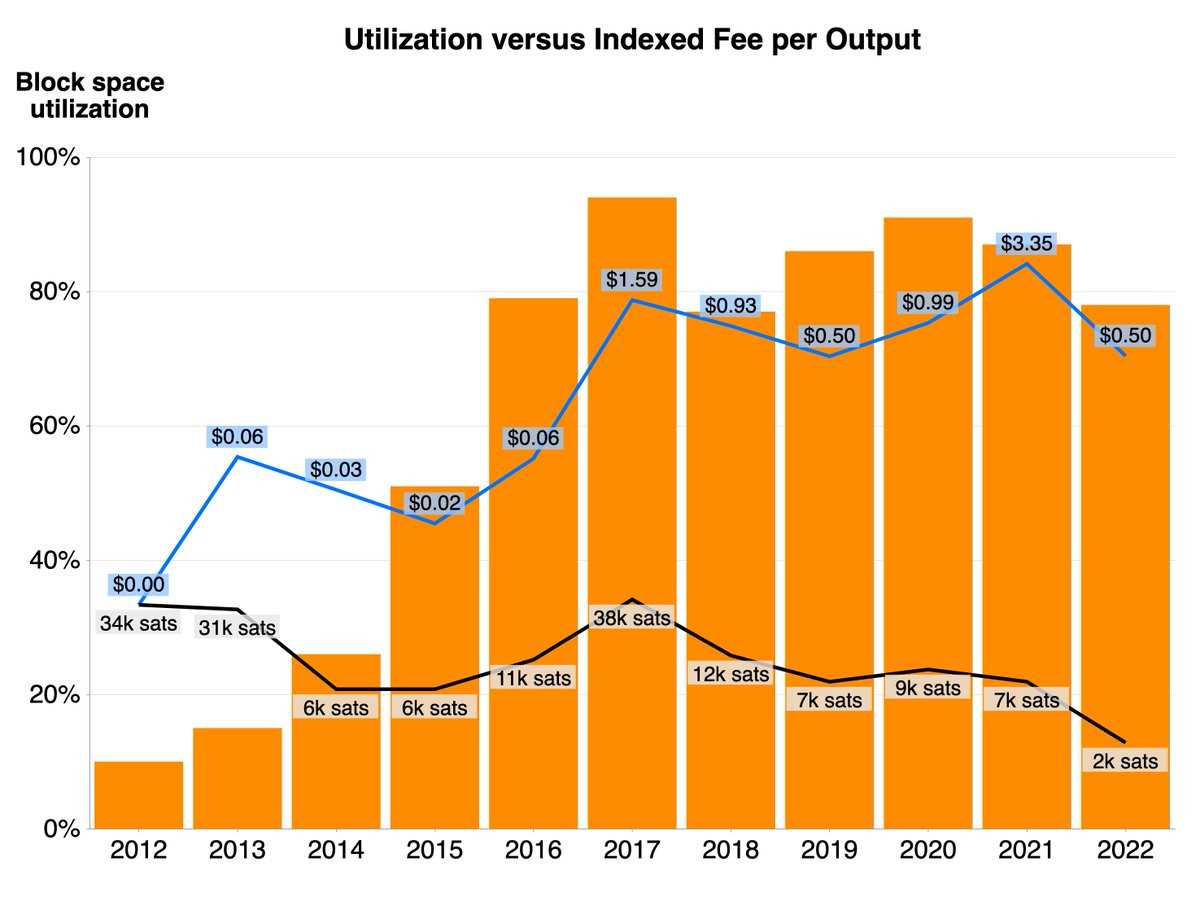

Last year, 2022, was the least expensive year to use Bitcoin Network in sats. As the network grows in value and lightning network, transaction batching and other techniques are being adopted, fees keep on getting cheaper in sats.

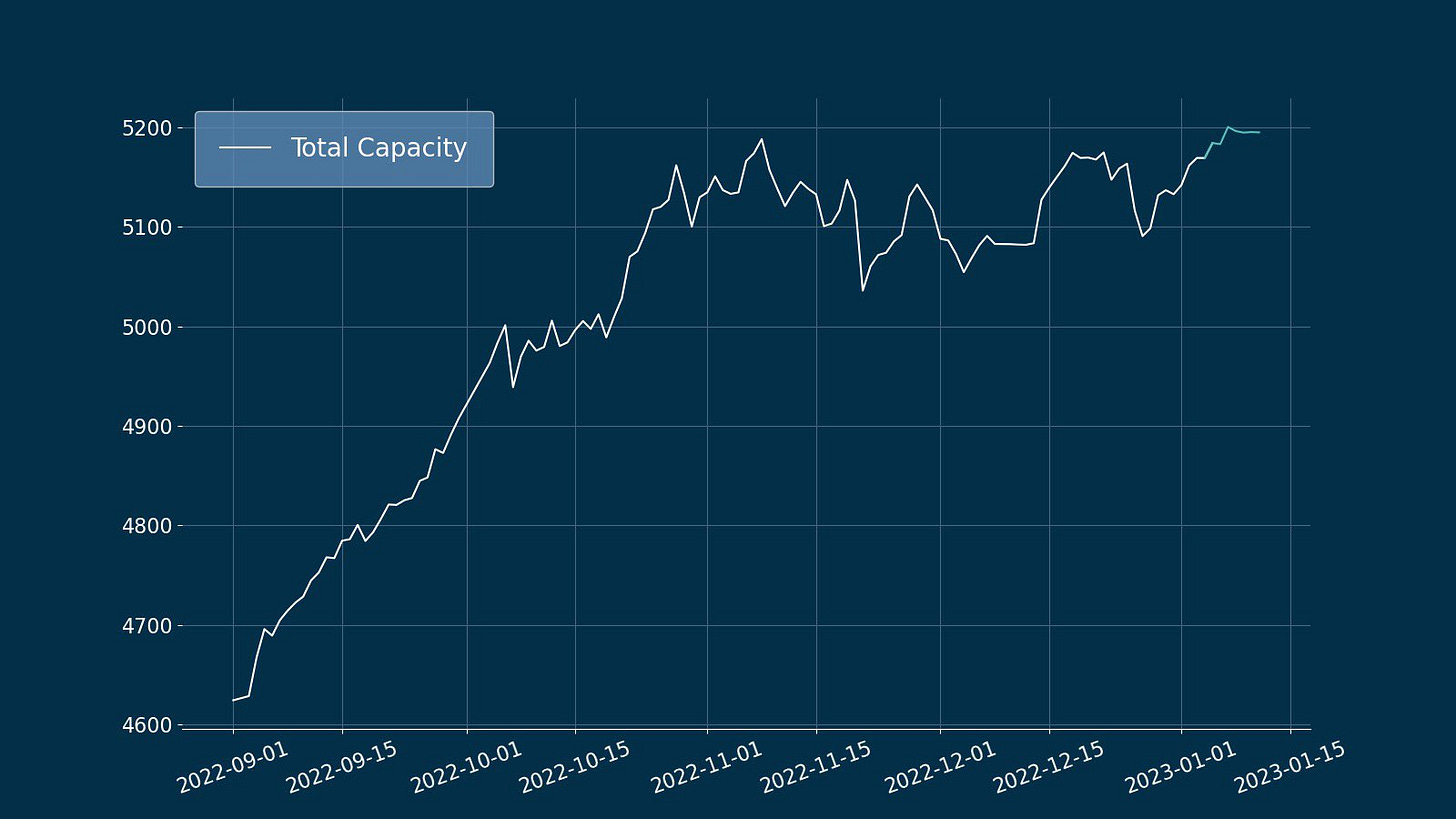

Lightning Capacity reaches a new all time high this week with more than 5,290 bitcoin available as liquidity in the Lightning Network.

EXTRA

Don’t forget to tune in for your daily Bitcoin Trivia, and test your bitcoin knowledge.

As a summary note..

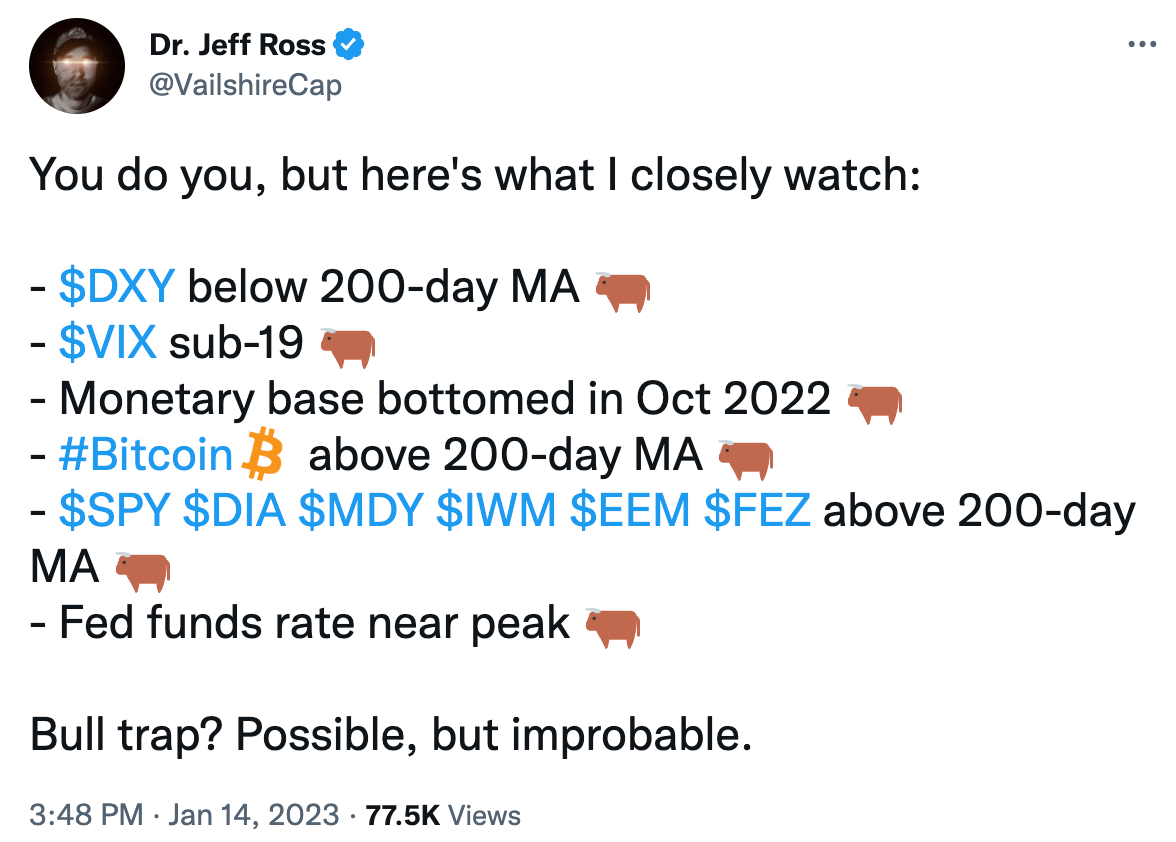

The famous bitcoin bear Dr. Jeff Ross, has changed his mind into short term bull.

All while the masses are still thinking lower prices are coming. Either wishing for bitcoin’s demise, or expecting to be more intelligent than everyone else, and catching the “real bottom”.

Just beware of the the ones advocating knowing where the price is going. Thread carefully and treat bitcoin as if there was only ever going to be 21 million coins. Hehe, you see what I did there? ;)

So is this the bottom? Only time will tell.

Have a great weekend niblings.

Stay humble & stack sats.

Buy Uncle Bam a cup of coffee <3

Lightning Address: rustybeam47@walletofsatoshi.com

This is bullish