TLDR: Bitcoin education in public schools in El Salvador, FASB votes will enable corporations to adopt Bitcoin, Miners share very bullish august production numbers.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you. Ever week I go through the hustle of bringing you all the alpha I can find out there.

Please subscribe & share it with friends, it goes a long way!

Bitcoin is a bubble. Is a statement we often hear and perhaps we, as bitcoin enthusiast and hard money lovers, immediately want to disprove it because “well bubbles don’t come back up and create new highs huh?”.. “you just wait after the halving!”..

The truth is that even though the asset might not be a bubble in terms of appreciation, it is still true that the ecosystem is still kind of a bubble. I recently saw this commentary by Edward Snowden and couldn’t argue he was wrong.

Even though bitcoin has been continuously growing over the last years, and the lightning network, once a scary creature on top of bitcoin which was only accessible through the VERY DIFFICULT ACTION OF SETTING UP YOUR OWN NODE (..not), its becoming normalized.

Interacting with the lightning network and being able to pay invoices in the internet or now even “zapping” in NOSTR, has become increasingly easy, and yet when Bitcoin comes to a conversation with a “normie”, they still have the same opinions they’ve once heard or even experienced as they “did their own research” back in the hype of 2017.

As you read these words, think about what can you do for bitcoin. Perhaps you can showcase the new capabilities to friends & family to send bitcoin through lightning network, or to teach them about bitcoin’s interoperability with the current financial system and its potential as a tool for remittance, or even just by sharing this newsletter. (HA! got you there)

In any case, if we want the bitcoin ecosystem to grow, not only in price but tools and development, it is key to aid its adoption. The bigger the network is, the more valuable it becomes, and a perfect way to get there is through education.

Bitcoin education is one of the key drivers for the oncoming – Danny Scott

But now, its time to read some bullish bitcoin news!🗞️🗞️

THE NEWS

1. El Salvador’s Mi Primer Bitcoin to bring Bitcoin education in public schools as part of curriculum in 2024.

"The Bitcoin diploma program will be taught to 150 public school teachers from 75 schools to provide them with a “base knowledge” of Bitcoin."

2. FASB votes to introduce new fair value accounting rules for Bitcoin.

“This upgrade to FASB accounting rules eliminates a major impediment to corporate adoption of $BTC as a treasury asset.” - Michael Saylor

3. Btrust, the Bitcoin non-profit founded by Jack Dorsey and Jay-Z, acquires Qala - the African Bitcoin and Lightning engineering training organization.

4. With inflation spiking, Turkey's swift move to Bitcoin might hint at a worldwide financial shift. KuCoin reports a jump from 40% adoption in 2021 to 52% in 2023.

71% prefer #Bitcoin, especially as the lira drops 50% against the dollar. Notably, women now account for 47% of young Turkish #Bitcoin enthusiasts.s.

5. Mexican billionaire Ricardo Salinas shares his liquid portfolio as of 2023:

1. Bitcoin, 2. MicroStrategy, 3. 5 Bitcoin Miners, 4. Oil Companies, 5. Gold Miners.

6. Spiral and LDK teamed up with BTCPay Server to bring out the BTCPay App aiming to replicate the success of the server but focusing to e-commerce payments in a non-custodial and user-friendly manner.

7. Samara Asset gifts $10,000 in BTC to Bitcoin DADA, championing Bitcoin education for African women.

MINERS!

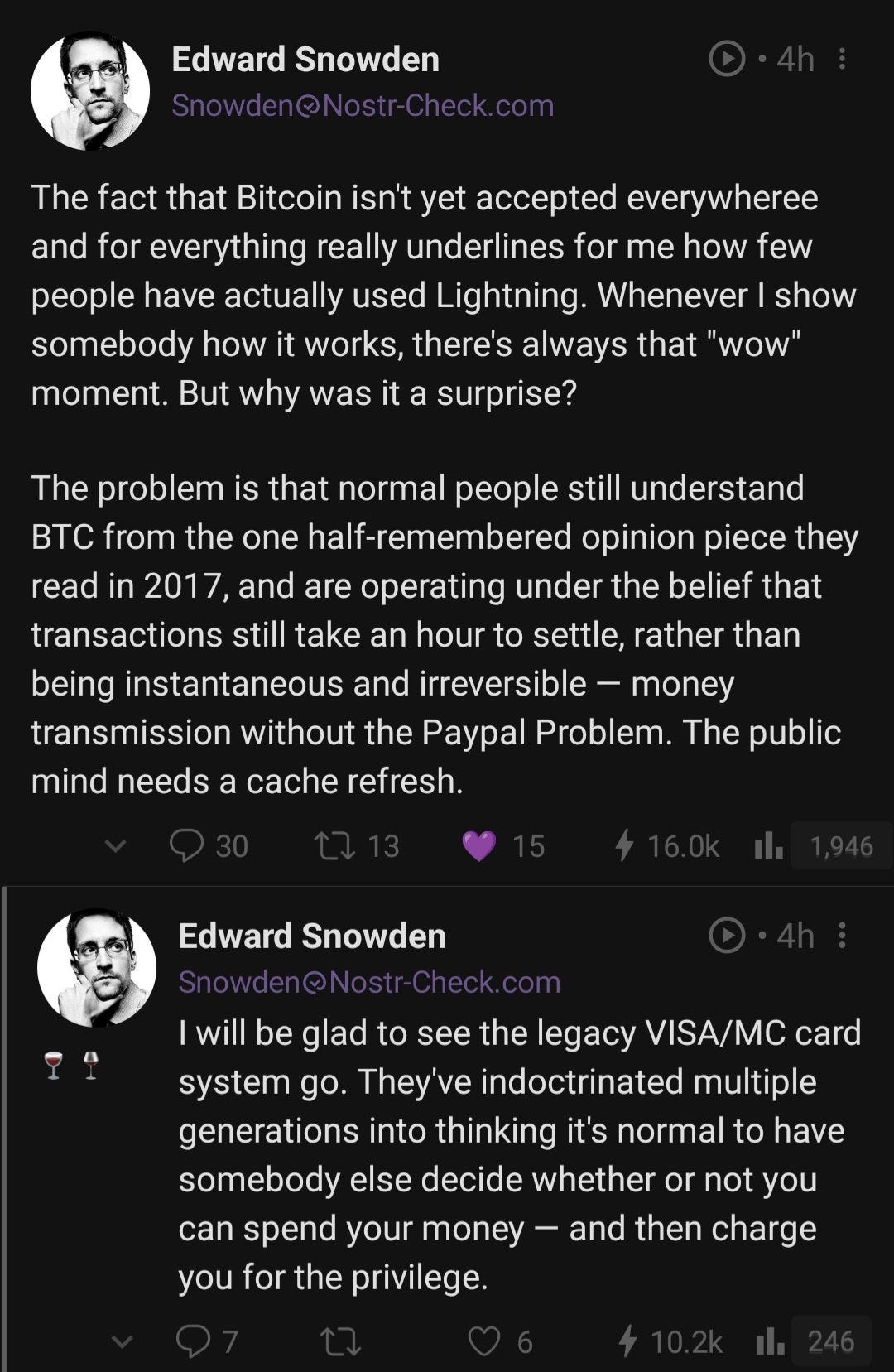

Public Bitcoin Miners have released their monthly operational updates and the numbers look quite promising for several of them in terms of accumulation and growth, despite the approaching bitcoin’s issuance halving.

8. Marathon Digital mined 1072 bitcoin, sold 750, holds 13,286 bitcoin in balance sheet, deployed 5 EH/s of new hash rate, and holds $105 million in unrestricted cash.

9. RIOT mined 333 bitcoin, sold 300 for $8.6m, holds 7309 bitcoin in balance sheet and deployed 10.7EH/s of new hash rate. The company received 24.2 million in power credits and $7.4 million in demand response credits.

In simple terms, RIOT didn't pay for any energy in August for mining 333 BTC. They have also had the highest mining margins of all the public miners over the last 18 months.

10. Iris Energy announced $56K mining profit per Bitcoin in August. The company mined 410 bitcoin with an average cost of $10,586 per coin. The company was paid ~$28k per Bitcoin to take power at Childress and generated further ~$28k per Bitcoin in mining revenue.

LIGHTNING

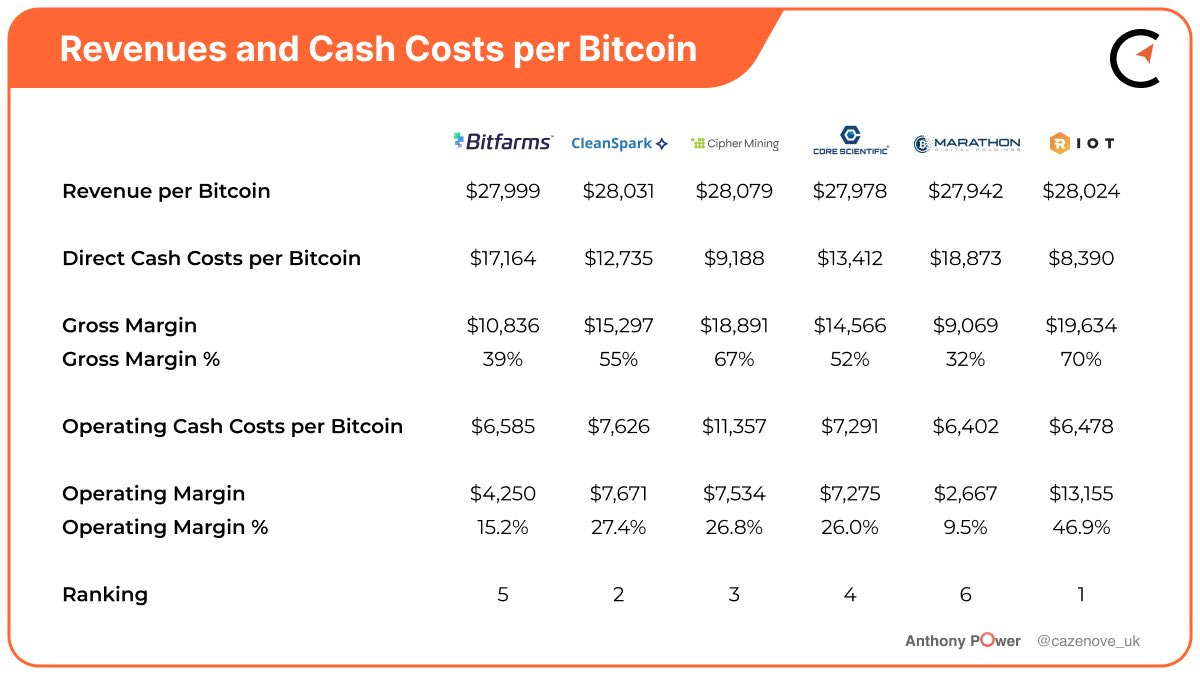

11. Lightning usage has gone up at least 37% despite price having decreased ~40%. Nostr has been a big player on this growth as people begin to harness the power of the decentralized social network.

For instance, Alby users made more than 1 million lightning payments in August. For comparison, Wallet of Satoshi users make 600k-700k payments each month.

FUNDAMENTALS

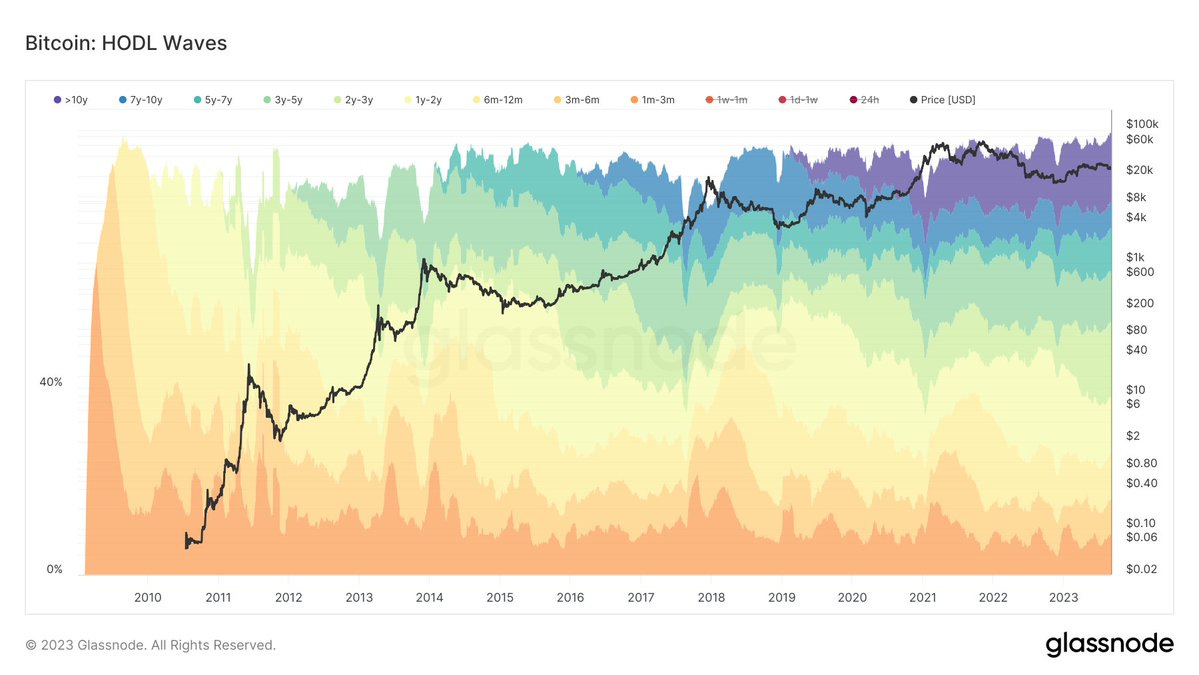

The bitcoin price has been behaving quite boringly for the last couple of weeks. The volatility might even seen lower than the big tech stocks. Some days ago Joe Burnett reported that 94.6% of all bitcoin had not moved in the last 30 days.

This naturally coincides with the low hype and/or low volatility the market has had displayed lately. But if we think it through, and we combine this information with the increasing number of low amount addresses, we could assume that any spark of demand can serve as a catalyst for the next parabolic expansion of the bitcoin’s price, the next bull market.

One way to interpret the growth and momentum that bitcoin is experiencing at these “stagnated” prices, is the amount of new addresses created. Just in 8 days of September, there are more addresses created than in August. And in a way, the last couple of months show higher growth than all year with March and May as an exception.

Not only plebs are taking seizing the opportunity, even even whales have been going hard according to recent data from intotheblock indicating Bitcoin whales have added a whopping $1.5 Billion to their holdings.

Well if these recap doesn’t make you bullish, I honestly don’t know what will.

With love,

Bam

Share some love with Uncle Bam for cup of coffee ☕ or a nice ribeye 🥩 <3

But more importantly, buy some sats for yourself.

Lightning Address: bamthemexican@noah.me