WTFBitcoin Week 37, 2023

Bitcoin can't be diluted.

TLDR: Cuba starts Bitcoin Grassroots movement, Another top fund files for a Bitcoin ETF, Deutsche Bank to custody Bitcoin & More.

Bitcoin is many things to many people, but to me one of its fundamental values is that there is only 21 million bitcoin. Naturally, in addition to the fact that bitcoin is decentralized, permissionless and resistant to censorship, making it the perfect set up to become the one currency for the world.

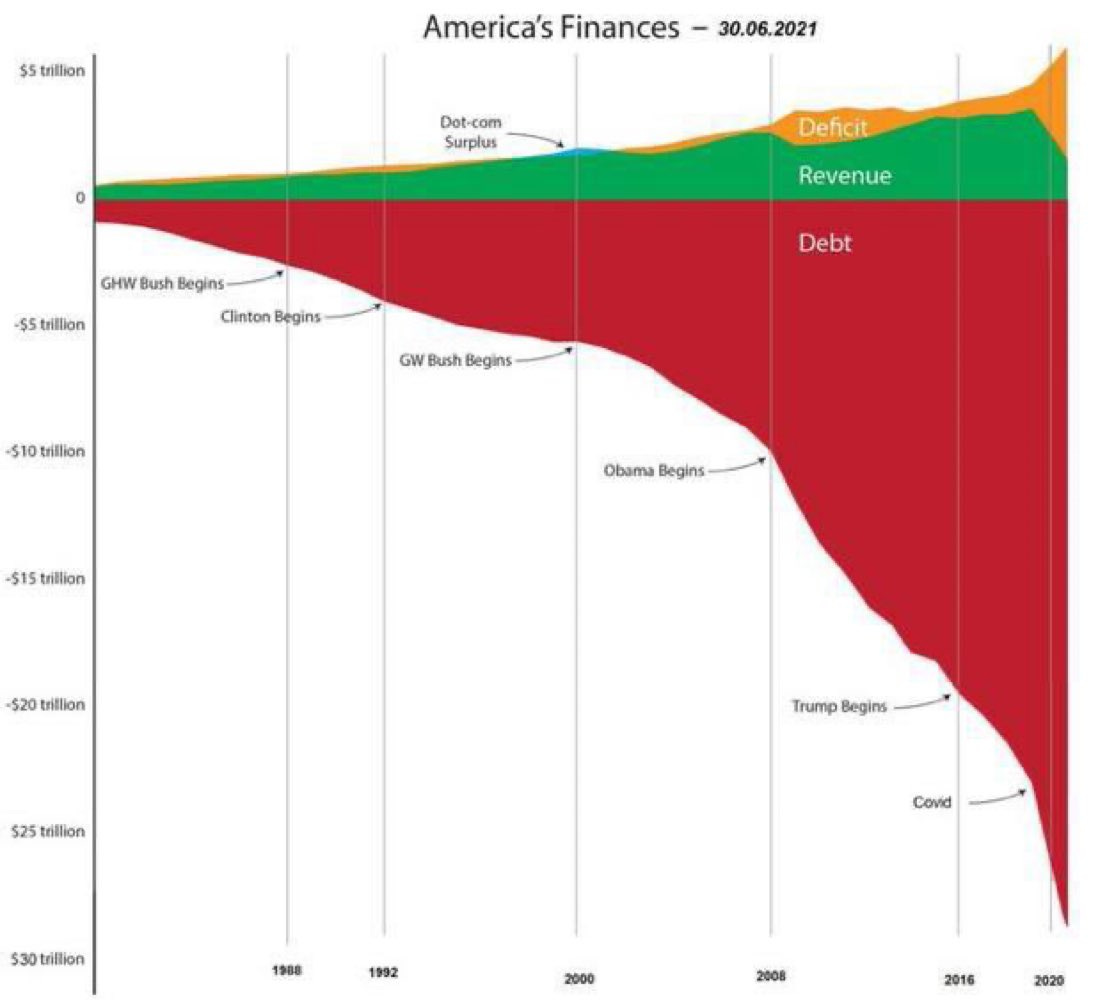

As we go through our lives our lives, we all have seen our currencies lost purchasing power, and this directly correlated, and I may say, a consequence, of our monetary supply expanding at no cost or production. The main problem, is that there is a centralized entity (call it government, or central banks to be precise) that gets the power to decide how to modify the money issuance, and with this, diluting everyone’s wealth.

It is incredible that the debt just keeps continuously increasing and even starts now to look parabolic. The problem is that deficit is just getting bigger, despite of the revenue generated. In other words, there is no real budget constraint, if there is more money, it will be printed.

“Oh Bam wait, this means if I need more money I’ll get it?”

No, only the government gets to decide where this money goes to, and it’s not you or me my friend, its THEIR FRIENDS.

The solution is clear, we must fix the money & NO ONE should have the power of printing.. But how? It seems the solution is quite simple, leave the money be issued by the free market as a form of a commodity where the cost of production will get close to its value.. Sounds like Bitcoin?

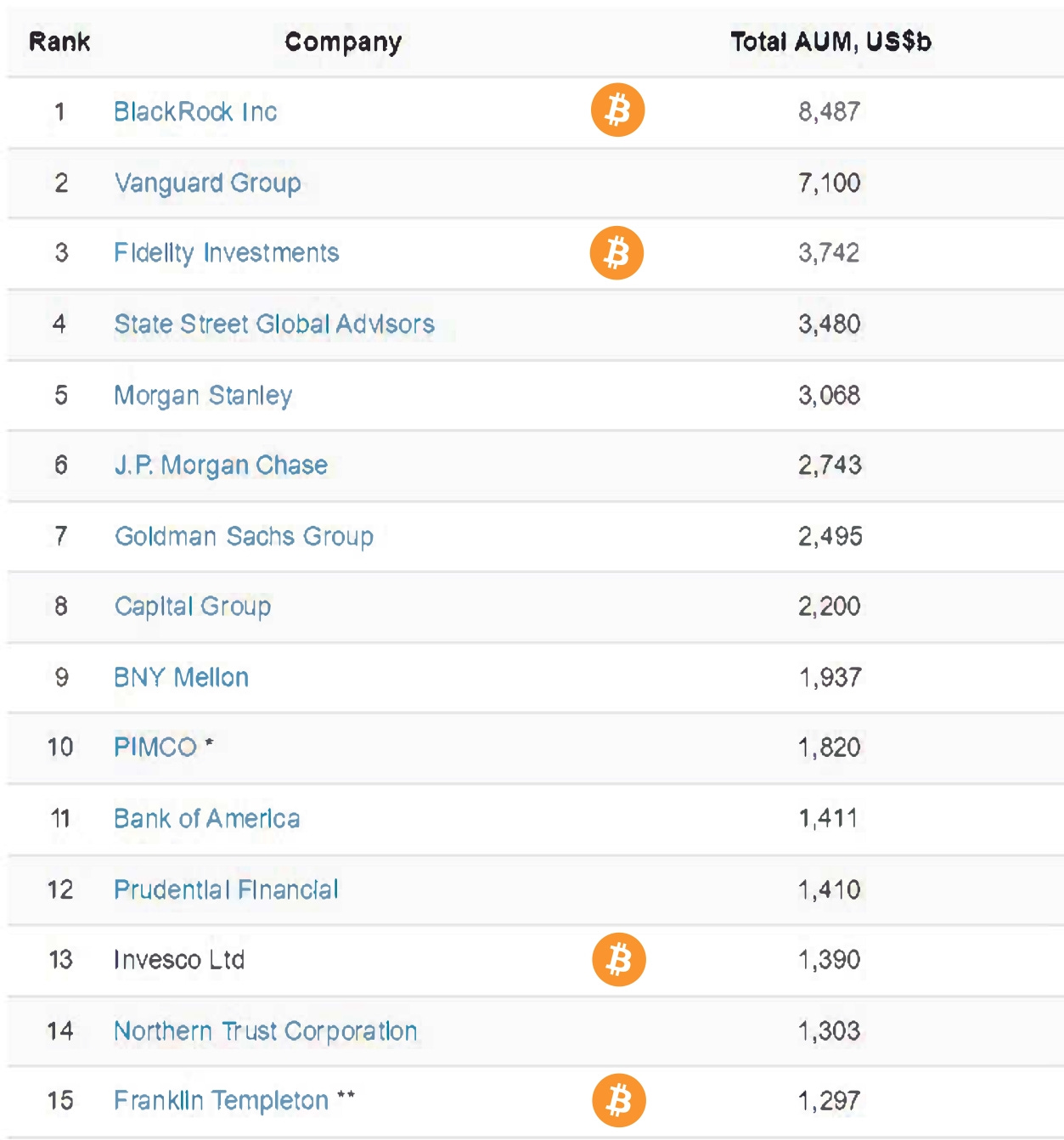

Unfortunately, not everyone sees the solution. Even after 14 years, and everyone continues to want to be the creator of this new money, and in the way give handouts to themselves and their friends. I think one picture can clearly summarize this..

Well naturally not everyone, there are some that understand the problem and are trying to accumulate through hard work and spread the word. Shoutout to all bitcoiners out there, I salute you.

Now let’s get to the news!

THE NEWS

1. Bull Bitcoin kicks off international expansion in Costa Rica in partnership with Bitcoin Jungle, allowing locals to buy bitcoin with country’s primary payment system.

2. Franklin Templeton, a $1.5 trillion asset manager, filed a regulatory Form S-1 with the U.S. Securities and Exchange Commission (SEC) on Monday, seeking approval for a spot Bitcoin ETF. This application adds up to 4 out of the 15 largest US asset managers filing for their own BitcoinETF.

3. Deutsche Bank, €1.3 trillion german banking giant, has partnered with Swiss cryptocurrency firm Taurus to offer Bitcoin and crypto custody and other related services to its institutional clients.

4. Amboss, a leading data analytics provider for the Bitcoin Lightning Network (LN), has unveiled a new subscription service called Hydro.

“Hydro is a game changer for businesses to get the benefits of the lightning network without trusted custodians, intermediaries, or the headache of channel management. As the lightning network welcomes global participation, Hydro simplifies real-time payment infrastructure to bootstrap global circular economies like we’ve seen in Costa Rica’s ‘Bitcoin Jungle’." - Jesse Shrader

5. Brian Armstrong, CEO of Coinbase, calls bitcoin ‘the most important asset in crypto’, while asserted their move to enable user access to the Bitcoin Lightning Network.

“Coinbase’s integration with Lightning will give its 100 million users an on-ramp to faster and cheaper bitcoin transactions. Hats off to Coinbase!” - Cathie Wood

6. Former PayPal President David Marcus made an appearance on CNBC’s Squawk Box and shared his vision for Bitcoin, aiming to transform it into a global payment network.d

7. A great reminder that Bitcoin is going through a good path, with this Burger King’s polemic video on their introduction of Credit Cards back in 1993.

Spoiler alert!! People thought it wouldn’t work.

8. Cuba began this Saturday with the 1st edition of My First Bitcoin, another grassroots movement teaching students about a decentralised future, with increased self sovereignty and personal responsibility.

FUNDAMENTALS

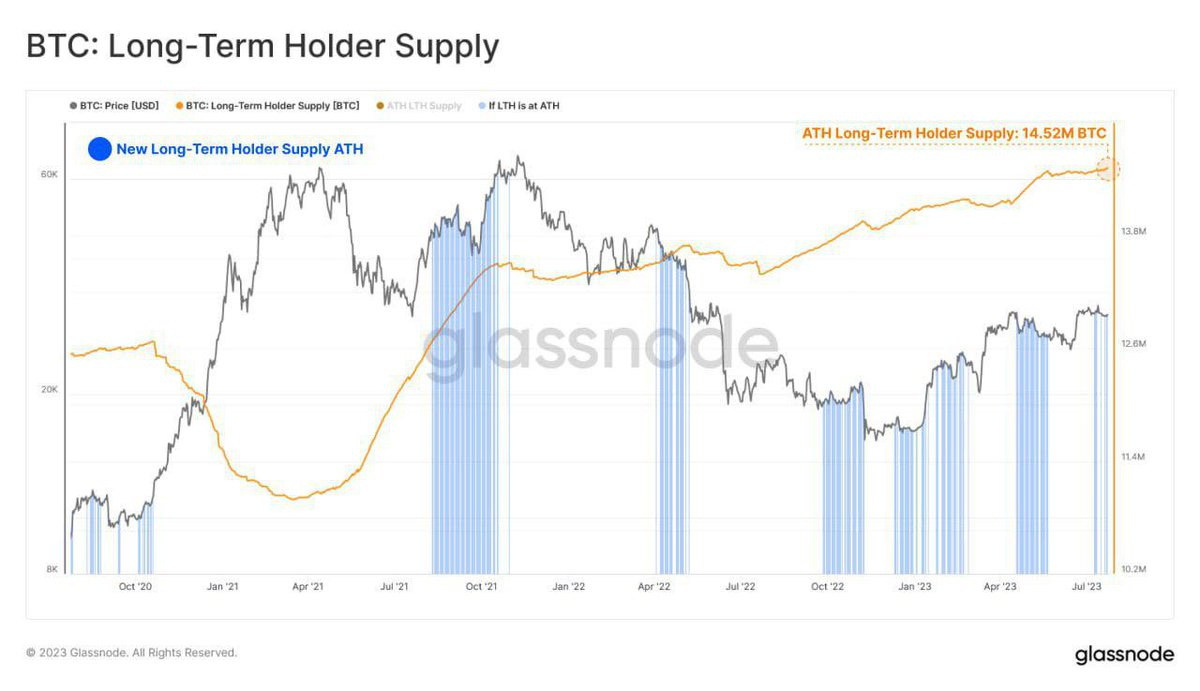

Long term holders hold 14.52 million Bitcoin, or 75% of the entire supply. These people, which I hope you are one of them, are convicted of a bright future for bitcoin, and not willing to sell at these prices.

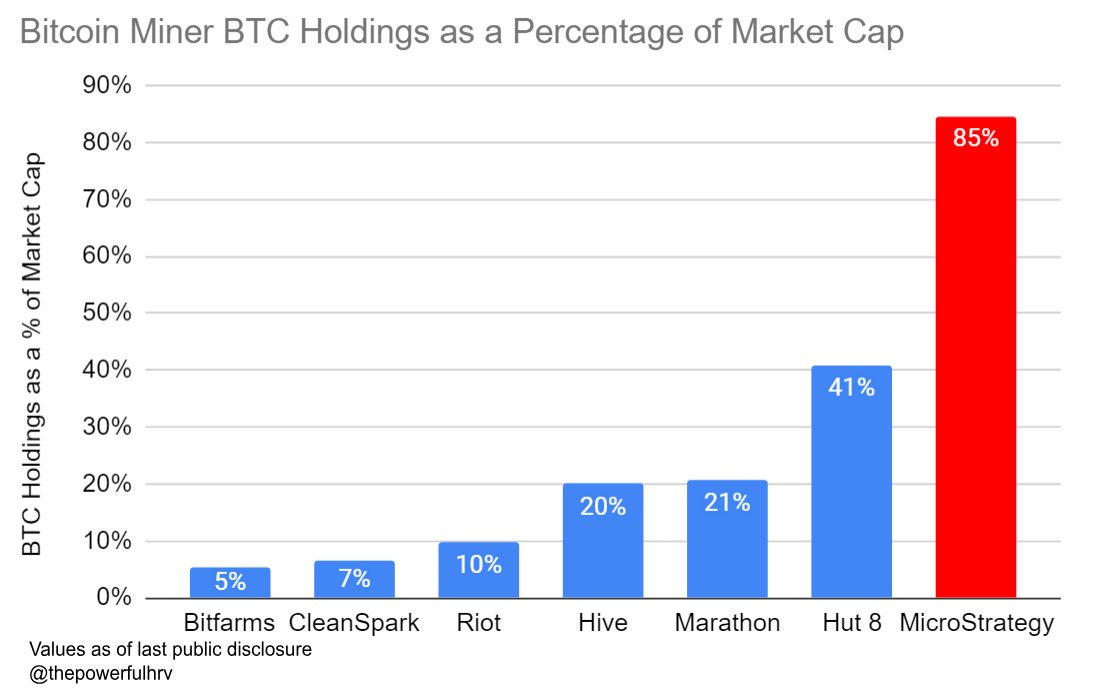

A nice chart depicts the conviction of certain companys, specifically miners, by looking at how much Bitcoin Holdings each entity has as a percentage of Market Cap.

“MicroStrategy is a synthetic Bitcoin Miner”– Mark Harvey

Lastly! Just a reminder that holding custody of your own bitcoin, means a lot of responsibility, and we should be reminded of this. It is now within our power to make the decision to do ANYTHING with our money, and this could sometimes lead to mistakes.

This week Paxos, as Paypal’s infrastructure partner, reportedly overpaid more than $500,000 . Ultimately, the money was returned as a sign of altruism, but let’s remember that we need to be conscious that there are no cash backs. With maximum freedom comes maximum responsibility.

Have a great weekend niblings.

Stay humble & stack sats.

Share some love with Uncle Bam for cup of coffee ☕ or a nice ribeye 🥩 <3

But more importantly, buy some sats for yourself.

Lightning Address: bamthemexican@noah.me