WTFBitcoin Week 45, 2023

High spot Bitcoin ETF expectations.

TLDR:

Bitcoin's price soared to $37,000, the highest in 18 months.

Merchant adoption of Bitcoin in El Salvador is escalating.

BlackDock is anticipating an imminent approval of its Bitcoin ETF.

Over 30 years, Bitcoin ETF fees may reduce your holdings to 54%

Welcome back to another issue of WTFBitcoin! As per time of writing, the Bitcoin price is hovering over $37,000 and it hasn’t brought us back down as many were thinking.. Could it be that people are FOMOing on what could mean a soon approval of the Bitcoin ETF? Let’s jump right in!

LATEST NEWS

Adoption:

Adopting Bitcoin, the Salvadorian conference, had more than 1,100 attendees, a third being Salvadorians, compared to zero from last year. Attendees were even paying their hotel bills with Bitcoin over the Lightning Network.

Blink Wallet announced a partnership with Distribuidora Morazán, a supplier of 40,000 merchants in El Salvador, who now can pay their bills in bitcoin with a 5% discount.

BitVM creator Robin Linus introduces BitStream, a Decentralized File Hosting Incentiviced via Bitcoin Payments, an open market for content hosting, enabling individuals to monetize excess bandwidth and storage via Lightning.

Strike announced several product updates, including unlimited wire transfers with instant withdrawals, new payment methods, and more.

Markets:

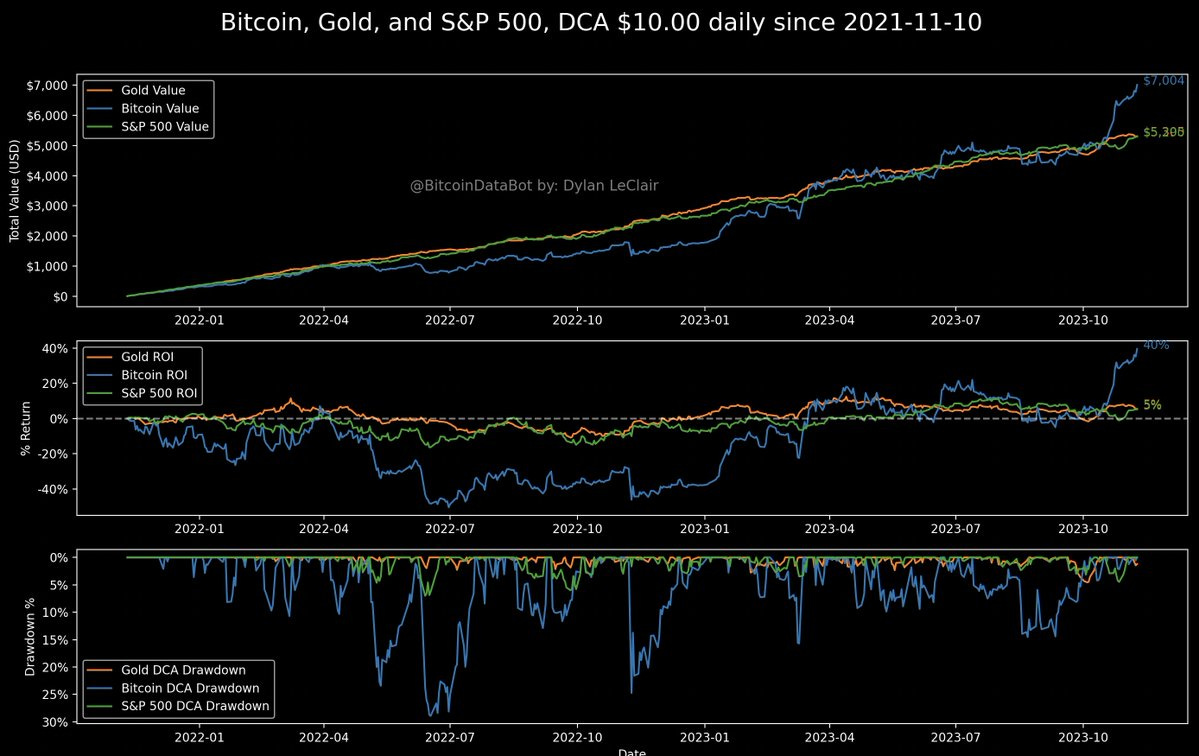

Dollar cost averaging bitcoin, stocks and gold, starting from 11/10/21, the day of the $69,000 bitcoin all time high until today, showcases and puts bitcoin as the fastest horse: Bitcoin +40%, Gold +5%, S&P +5%

Fox Business reported that according to sources, Blackrock is growing increasingly confident that the SEC will approve its Bitcoin ETF by January

Hong Kong's Securities and Futures Commission is considering the introduction of a Bitcoin spot ETF.

Fidelity, $4.5 trillion asset manager, releases report “Revisiting Persistent Bitcoin Criticisms”, dispelling the main criticisms or FUD.

WisdomTree Enhanced Commodity Strategy Fund to invest up to 5% of its net assets in #Bitcoin future contracts.

Tether just reached a new milestone of $86 Billion in USDt issued. The company is generating yield by backing it up with short term US Treasuries, and ultimately accumulating bitcoin with part of it.

A group of former Cantor Fitzgerald executives has launched a crypto lending platform, anticipating that it will cater to the operators of spot Bitcoin ETFs once they secure regulatory approval in the US

Mining:

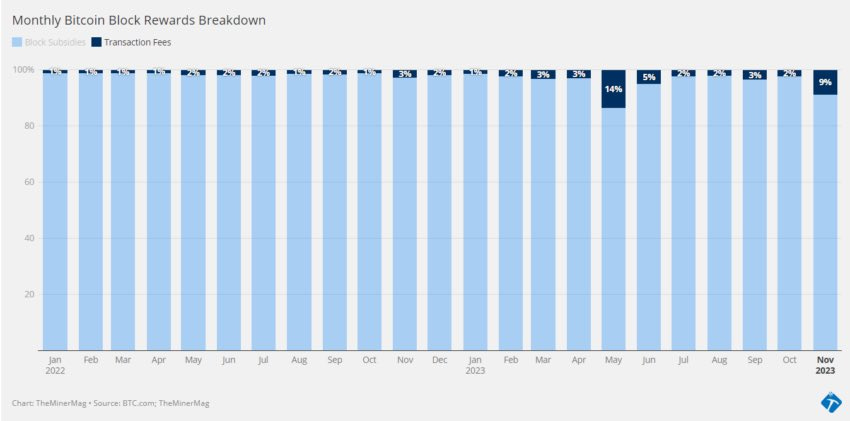

Bitcoin miners have collected approximately 830 BTC in transaction fees this month, totaling $30.7 million, comprising 9% of their monthly rewards—the highest percentage since May.

Integrating an S9 Bitcoin miner into your home can offset heating costs while making you the hardest money on Earths.

“Bitcoin mining heavyweights Marathon Digital and Riot Platforms are among the most overvalued crypto mining companies relative to their competitors” – MinerMetrics founder Jaran Mellerud

Politics:

Moody’s cuts the outlook on the US credit rating from stable to negative, citing risks to the nation’s fiscal strength

French investment bankers receive an email from BlackRock promoting a webinar for their iShares Swap ETF products on Nov. 15th (within the 8 day spot Bitcoin ETF approval window)

The US branch of Industrial and Commercial Bank of China Financial Services, world's largest bank by total assets, suffered a ransomware attack that disrupted US Treasury market activities

Fundamentals:

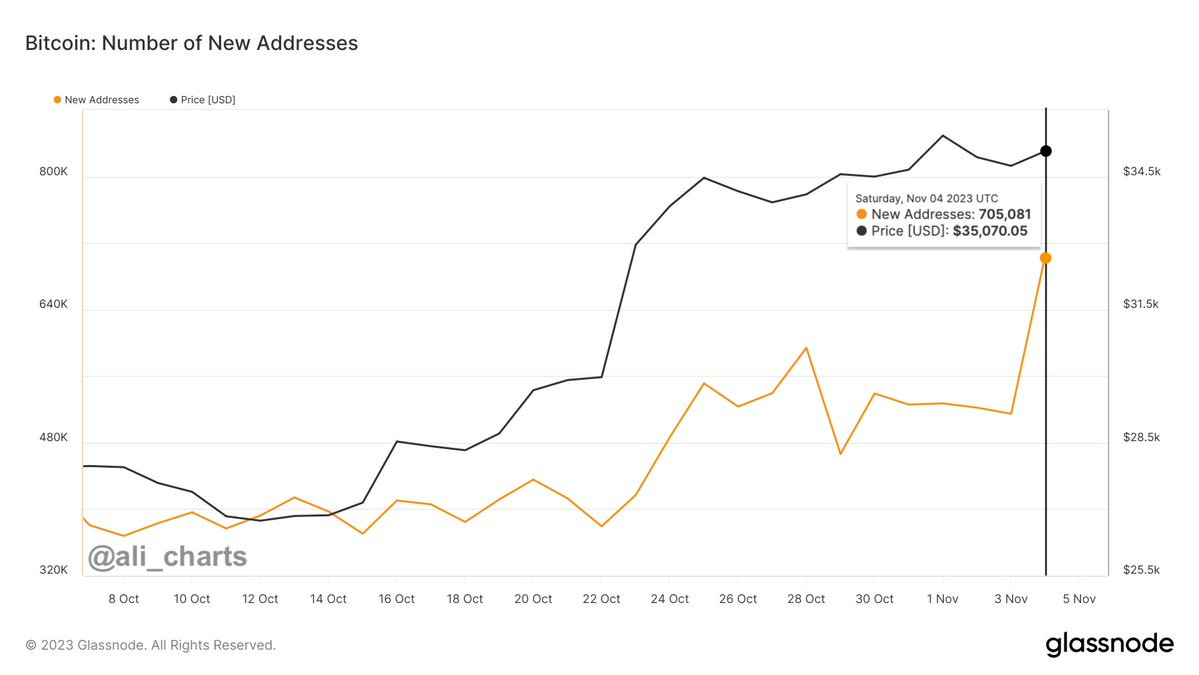

More than 700,000 new bitcoin addresses were created in November 4th only, an important milestone as the Bitcoin network growth has been one the best price predictor.

In total, more than 1 million addresses were created in November, reaching an all-time-high of 50,046,062 of addresses with a balance.

A whale was market buying $15m Bitcoin every 3 hours this week. Seems a combination of ETF approval expectations and the classic fear of missing out.

BAM’S TAKE

The expectations of a Bitcoin ETF approval are on the rise. Just this week, Bloomberg Analysts said there is an 8-day window opened the 9th of November where the SEC could approve all 12 spot ETFs at once. Regardless of this happening or not, the market is starting to react to the possibility, as an approval its said to potentially spark billions of inflows into the market capitalization of Bitcoin.

Why is the ETF so important for many?

Well, if you have been in bitcoin for a while, you probably could relate and remember how scary it was to take ownership of your own keys. On the regulatory side, there are institutions who would like to be part and have exposure to this asset class, but they are just not allowed or don’t have the competence to do so, without “incurring a high risk” of losing it.

Ultimately, an ETF increases public awareness of Bitcoin as a credible investment category. Given the current high inflation and the negative yields on US Treasuries, which are normally the safest assets, this could prompt investors to consider alternative avenues such as digital assets that are limited in quantity and secure against manipulation.

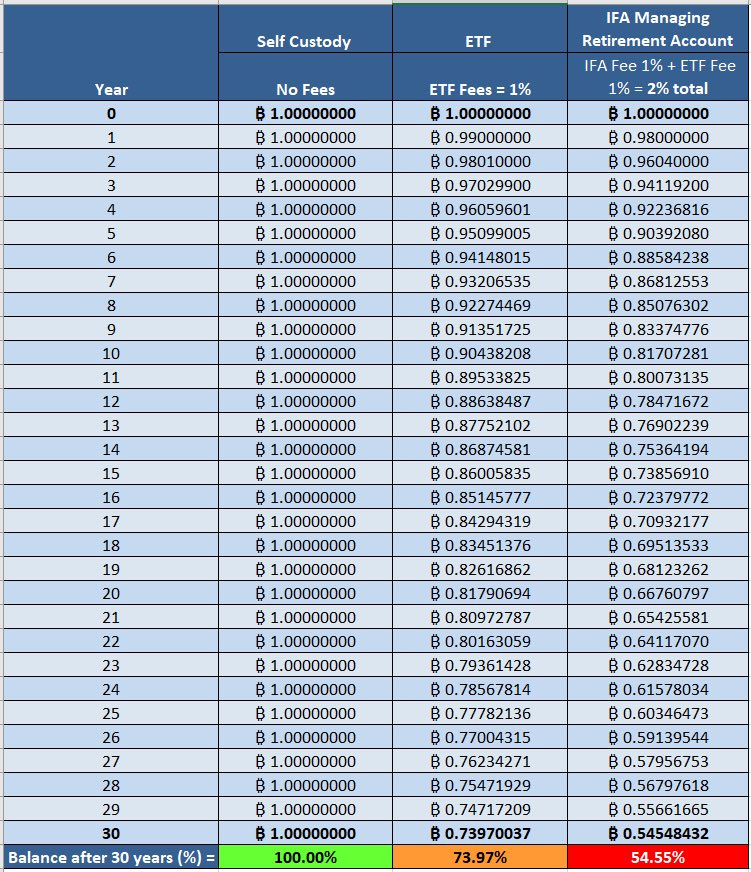

The question remains: is investing in a Bitcoin ETF worthwile? Well, it is important to remember that even low ETF fees can compount significantly over time. A 30 year period of a 1% fee would haircut your initial holdings to only 54%. Assuming massive appreciation, it naturally still is be better than fiat. While self-custody is certainly the superior option for retaining full ownership, there are undeniable advantages to having a spot ETF. It provides a way to gain exposure to Bitcoin through pension accounts, which can be beneficial despite the potential for a slight loss of value due to fees.

Have a great weekend niblings.

Stay humble & stack sats.

Share some love with Uncle Bam for cup of coffee ☕ or a nice ribeye 🥩 <3

But more importantly, buy some sats for yourself.

Lightning Address: bamthemexican@blink.sv