TLDR: Nation State stacks sats. Ark Investment buys Bitcoin through Grayscale. Bitcoiners are draining exchanges, stacking & claiming back their keys.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

The importance of owning your own keys, has been downplayed by many, with the lazy argument of “it is too difficult”, or “i’m not a technologist”, etc. Even company owners such as Celsius, would have told you that holding your keys is too difficult and it is better to trust a centralized company (“them of course”), to hold them for you, and even generate you some YIELD! Well, naturally they have an incentive to do so, and let me tell you something, holding your own keys is not hard at all!

This week a continuation to the contagion of FTX collapse, led to Genesis a cryptocurrency lender with over $2.8 billion in active loans, pausing withdrawals and loan applications. This revealed how interconnected these centralized crypto companies are as each of them have exposure on another one and then another one. Of course it didn’t stop here, right after Genesis, Gemini Earn announced to stop withdrawals too, as their “YiElD EaRniNg” product, had exposure to Genesis, which had exposure to FTX. Funny right? Well not for people with funds in them..

So you see how this is?

If you don’t know where the yield is coming from, then you are the yield.

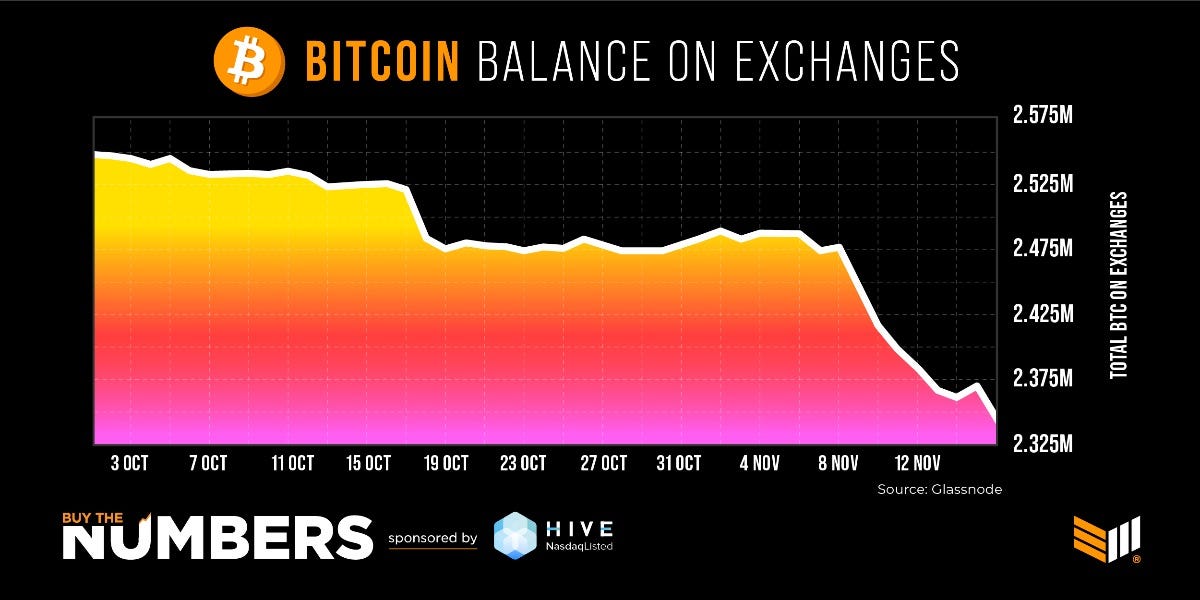

Bitcoiners have been advocating non-stop about the importance of holding your own keys. And it seems that people are starting to pay attention. Bitcoin Magazine just shared the infographic where 150,000 bitcoin have been removed from exchanges since the FTX scandal started.

So if you have bitcoin on any exchange, think about taking its custody. The more people withdraw their bitcoin from exchanges, the more riskier it gets for the ones who continue having their bitcoins hosted in a third party, since it leads to the possibility of the third party getting caught running a fractional reserve.

Just as FTX ended up with 1.4 billion on Bitcoin liabilities and no actual holdings of the “user’s bitcoin”.

So before the news, let me remind you that a mobile phone bitcoin wallet, is still safer than an exchange. Just make sure to have a proper back up!

THE NEWS!

1. Nayib Buekele announced that the country would be purchasing one bitcoin every day effectively starting last Thursday November 17th.

Everything / 21 million.

2. Cathie Wood's Ark Invest just bought $2.8m of Grayscale Bitcoin Trust (GBTC).

GBTC is supposed to be backed 1 to 1 by bitcoin, but trading at ~41% discount this past week. Just a reminder that there is no proof of reserves from Grayscale, or any way whatsoever to validate their holdings. Oh right, and there won’t be, per ‘security concerns’. One must trust, and can’t verify. Even though theres no reason to doubt them, we have seen the dangers of this throughout the year with institutions falling one after another. (Celsius, Voyager, FTX..)

Hey but.. don’t trust, verify.

3. The Bitcoin Policy Institute has released a new report discussing proof-of-reserves (PoR) in the bitcoin and cryptocurrency ecosystem following the FTX collapse

4. Compass Coffee, a cafe company based in Washington DC, has partnered with the Embassy of El Salvador to launch the Bitcoin Blend, a limited-edition roast dedicated to the farmers of El Salvador.

5. The new BLIP app promises secure and private communication leveraging Bitcoin’s Lightning Network and a novel encryption method, Hexum.

6. Scarce.City launches bitcoin ecommerce platform Satscrap where it lets users buy and list any legal products in return for bitcoin and is running a holiday promotion until November 28.

7. BitMEX renews Rene Pickhardt’s Bitcoin Developer Grant until May 2023.

8. Edward Snowden sees the potential value on the current depressed price of bitcoin, just as he once did in March 2020.

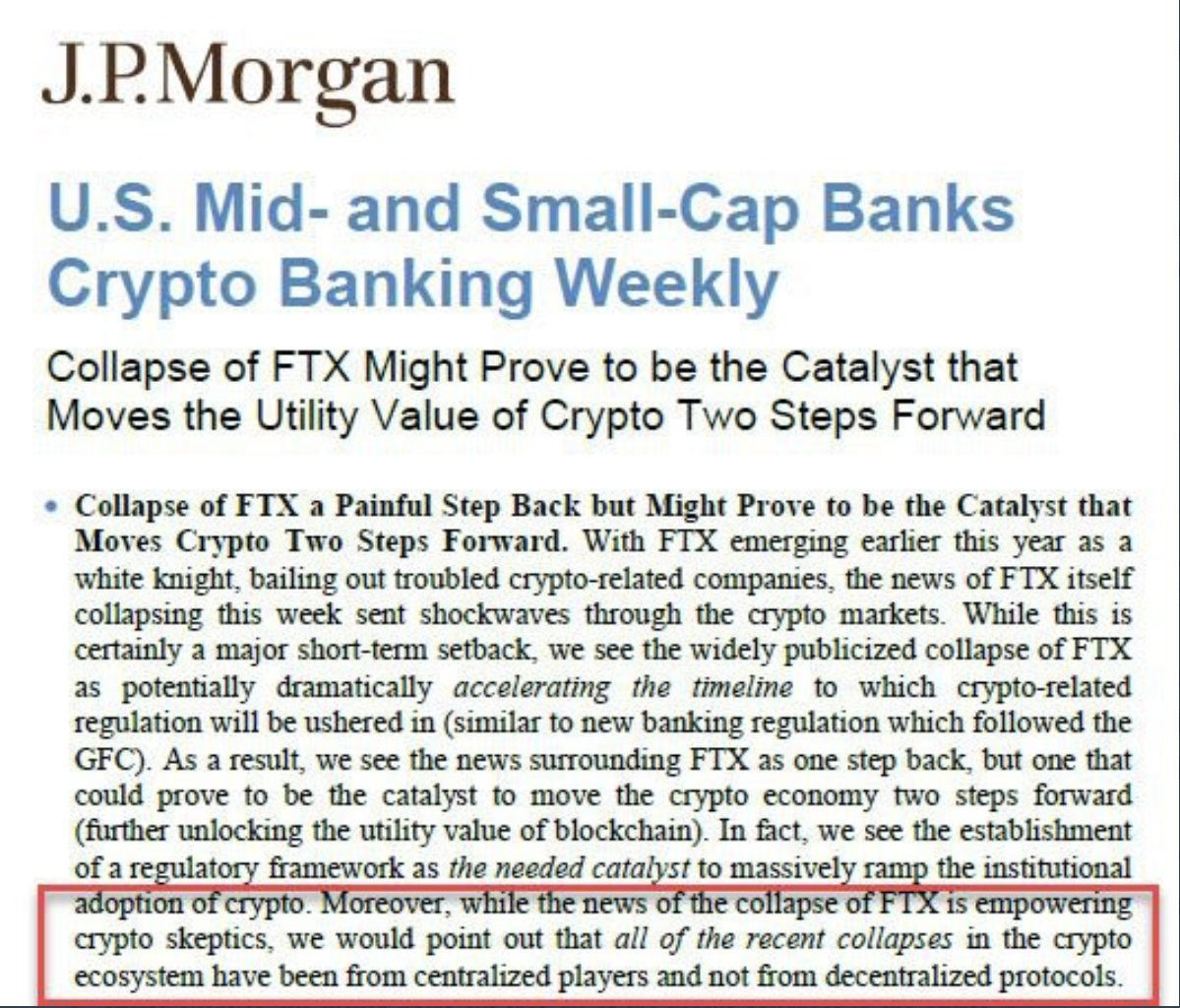

9. J.P. Morgan reminds us that all recent collapses in the crypto ecosystem has been from centralized players, and not decentralized protocols.

A caveat they forgot, is that Bitcoin is the only truly decentralized protocol. 😆

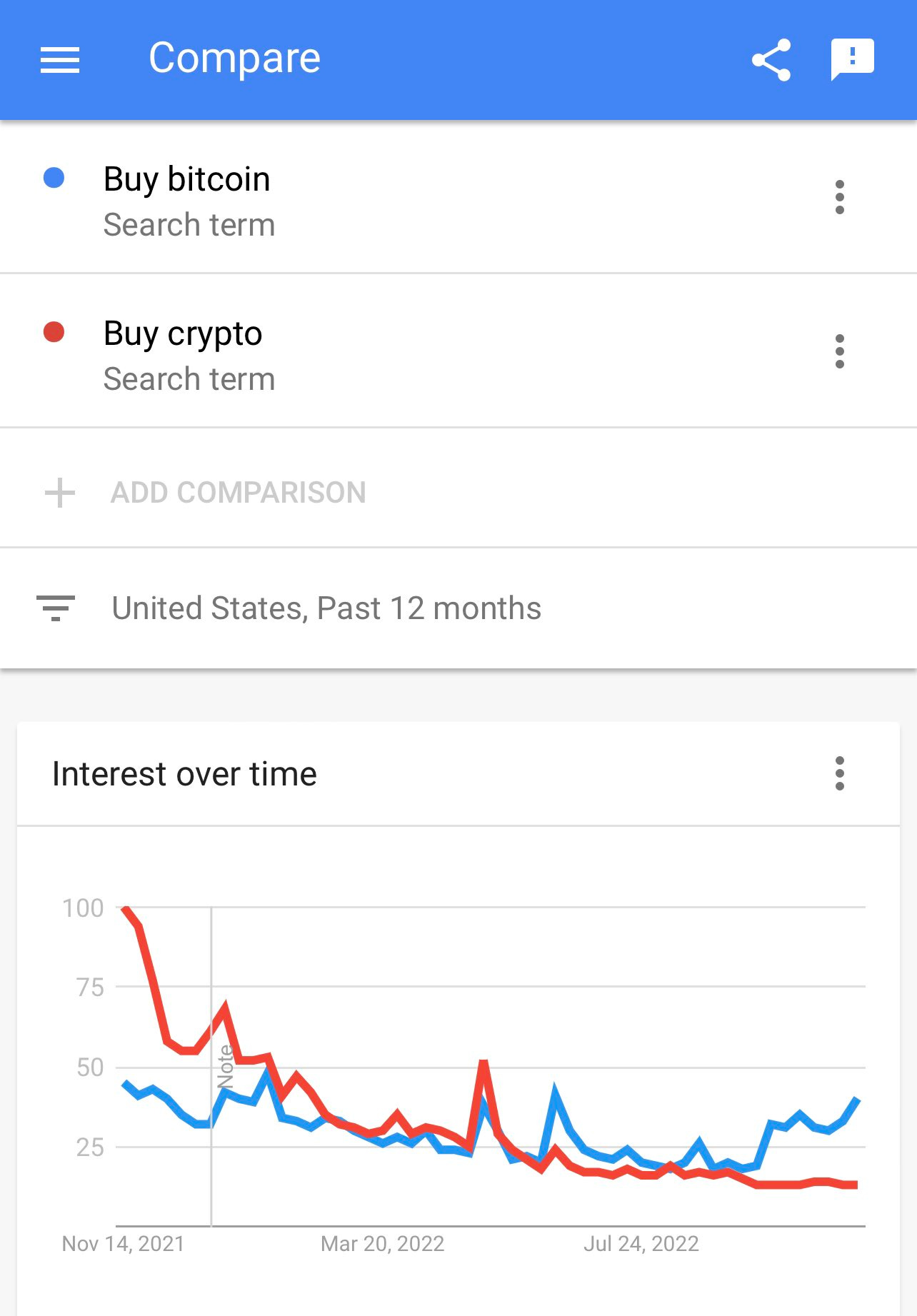

10. The crypto craze might have come to a natural end, and the search for sound money seems to begin ramping up in the United States.

11. Hut 8 just revealed their finances, and Jaran Mellerud shares a great thread pointing some of the most important information:

Solid balance sheet with minimal debt.

Tremendous liquidity. $33 million of cash and 8,676 bitcoin.

100% Hodl strategy.

Diversification into high-performance computing.

FUNDAMENTALS

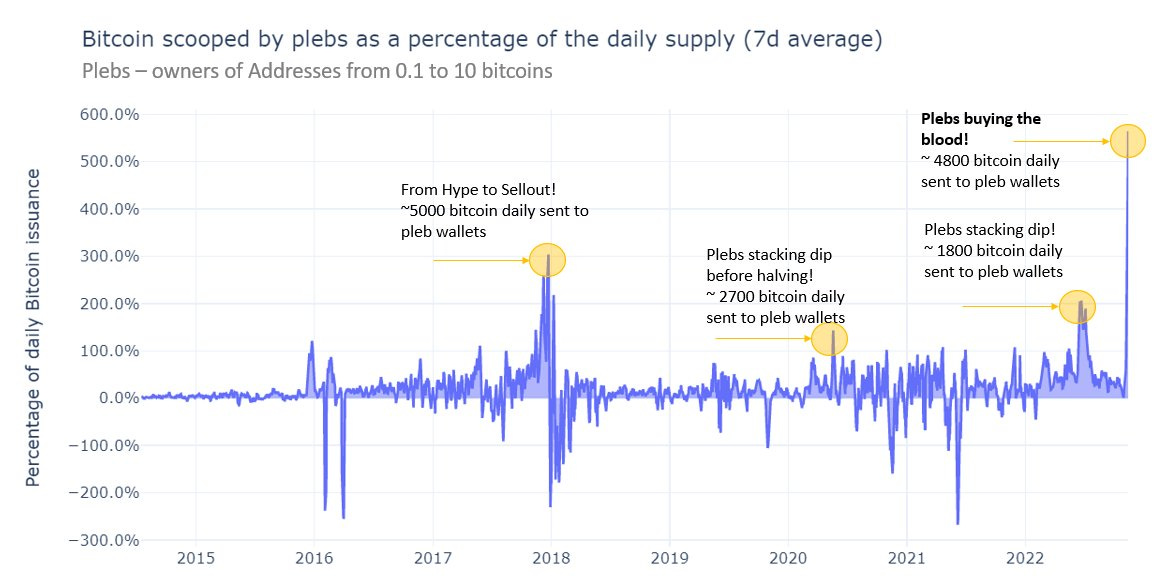

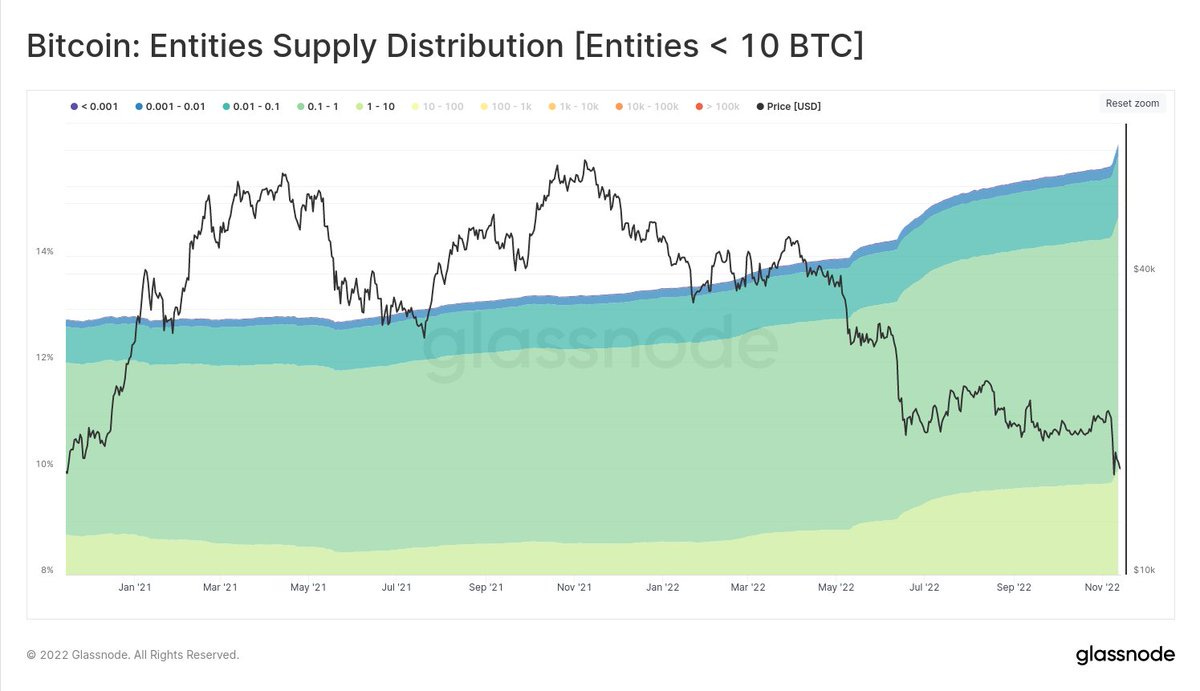

Bitcoins have been taken out of exchanges in an unprecedented manner. In the last week, small wallets have accumulated about 4,800 bitcoin daily, about 5 times the daily supply.

This is exactly the “psycopathic conviction” that some people refer to, when they talk about the relentless attitude of bitcoiners stacking sats. Once a bitcoin falls deep into the rabbit hole and understands the potential value of a neutral & decentralized currency with fix supply, there is no going back.

It is indeed nice to see that small players, or individuals and not institutions, have continued increasing their percentage of ownership in the network. With wallets with less than 10 bitcoin holding up ~15.9% of the circulating supply, a new all time high.

Bitcoin is not a sprint, but a marathon.

Have a great weekend niblings.

Stay humble & stack sats.

Want to learn how to buy bitcoin?

If you are in Europe, With 3 simple steps, buy bitcoin straight to your wallet with Relai. Referral: BAM

Did you find value on this? You want to contribute to Uncle Bam?

Then feel free to donate, a cup of coffee would be highly appreciated.

But more importantly, help me by shareing this with your friends and family..

Lightning Address: rustybeam47@walletofsatoshi.com