WTFBitcoin Week 47,2022

Bitcoiners are accumulating and claiming self responsibility.

TLDR: Volcano bonds are closer. Proof Of Reserves happens in your own wallet. Ark Investment continues to bet big on Bitcoin. Plebs are stacking as never before.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

While the world is in chaos and people criticise “bitcoin’s death” because of the whole FTX fiasco, bitcoin goes on.

On one side we have Wall Street and Mainstream media, talking about bitcoin from an investment perspective and exchanges starting to publitize how many coins they have and how “safe” they are.

For instance Brian Armstrong, CEO of Coinbase says shows their financials, holding around ~2 million coins. In my opinion, this is ~2 million more coins than they should be holding on other people’s behalf.

“We hold ~2M BTC. ~$39.9B worth as of 9/30 (see our 10Q)” – Brian

Naturally, the whole intention is to not trigger a “bank run” as no one can guarantee they have a liquid balance sheet, as they SHOULD.. Since those coins are supposed to have owners who are not Coinbase. Some people even find comfort in the movement “Proof of Reserves”, where exchanges display the addresses of where the coins are being held.

But this doesn’t guarantee the coins are safe. Exchanges could be hacked, could become reckless and can even go bankrupt. Or just think of the scenario where the government decides to impose a sanction on them and seize the coins. So if you want proof of reserves? Then take off all your Bitcoin from the exchanges.

On the other and brighter side, we have developing countries shows us the path to bitcoin adoption through education. Bitcoiners continue to empower communities and teach them about the benefits of using bitcoin. It might not be clear for first world countries, where people have access to bank accounts and a stable currency, but for ones who have experienced their own banks and governments seizing their funds, or devaluing their savings, the use case of self sovereign new kind of money, hard to confiscate and to debase, is an easy one to understand.

THE NEWS!

1. El Salvador's Minister of Economy Maria Luisa Hayem Brevé has submitted a digital asset issuance bill to the country assembly, making progress towards the launching of its bitcoin-backed "volcano" bonds.

$1 billion in bonds would be issued on the Liquid Network. The proceedings would be split with $500 million being allocated directly to bitcoin, and the rest going to the building out of energy and bitcoin mining infrastructure in the region.

2. Guatemala adoption at Lake Bitcoin, is ramping up. Following the steps from Bitcoin Beach in El Salvador, many passionate bitcoiners are joining forces and making it happen.

3. Strike makes bitcoin accessible to everyone allowing users to buy as little as €0.01, and can programatically set it to buy every hour.

4. WooCommerce, E-commerce plugin, now lets its over 4 million merchants accept bitcoin lightning payments.

5. ZEBEDEE and Bitrefill partner to create a complete circular economy with ZEBEDEE, integrating ZBD into bitrefill's services allowing users to spend the Bitcoin they earn playing games on gift cards without leaving the app.

6. Lightning network solved scalability. By assuming a throughput of 4 max payments per second per node:

Lightning scales to 16,265 payments per second (2.2x Visa’s 2021 numbers)

Lightning's average transaction fee is 13 times less than Visa's - 0.1% vs 1.29%

7. BTCPay Server released an update version 1.7.0 with a unified QR code for on-chain and lightning. Now customers will see a single QR code, while their wallet does the magic.

8. Ark Invest buys $1.5 million in Grayscale Bitcoin Trust Shares (GBTC). The firm now holds 6.4 million shares worth $53 million. The company has also bought more than 1.3 million shares of Coinbase since the start of November.

9. Matthew Ferranti, a researcher from Harvard published a paper arguing central banks should hold Bitcoin.

“This paper explores the potential for Bitcoin to serve as an alternative hedging asset. I describe a dynamic Bayesian copula model to simulate the joint returns of Bitcoin and other reserve assets under a wide range of plausible sanctions probabilities.” – Abstract

10. An entire lightning node was run inside of a phone browser.

FUNDAMENTALS

This week we have several historical metrics. In summary, while even long term holders appear to be underwater with their investment, a great number of bitcoin is leaving exchanges, long term holders continue accumulating, but a massive amount of small wallets captures the bitcoin discount as never before.

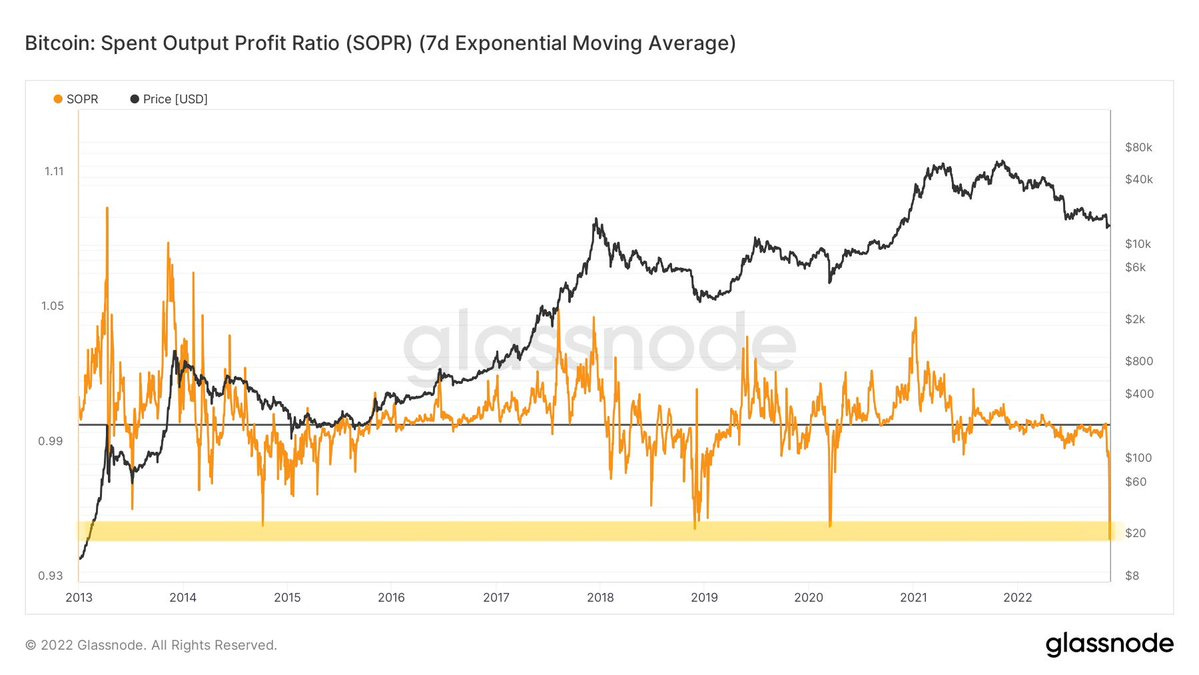

Bitcoin Spent Output Profit Ratio 7dEMA prints a historical capitulation, implying losses are being realised and/or profitable coins are not being spent.

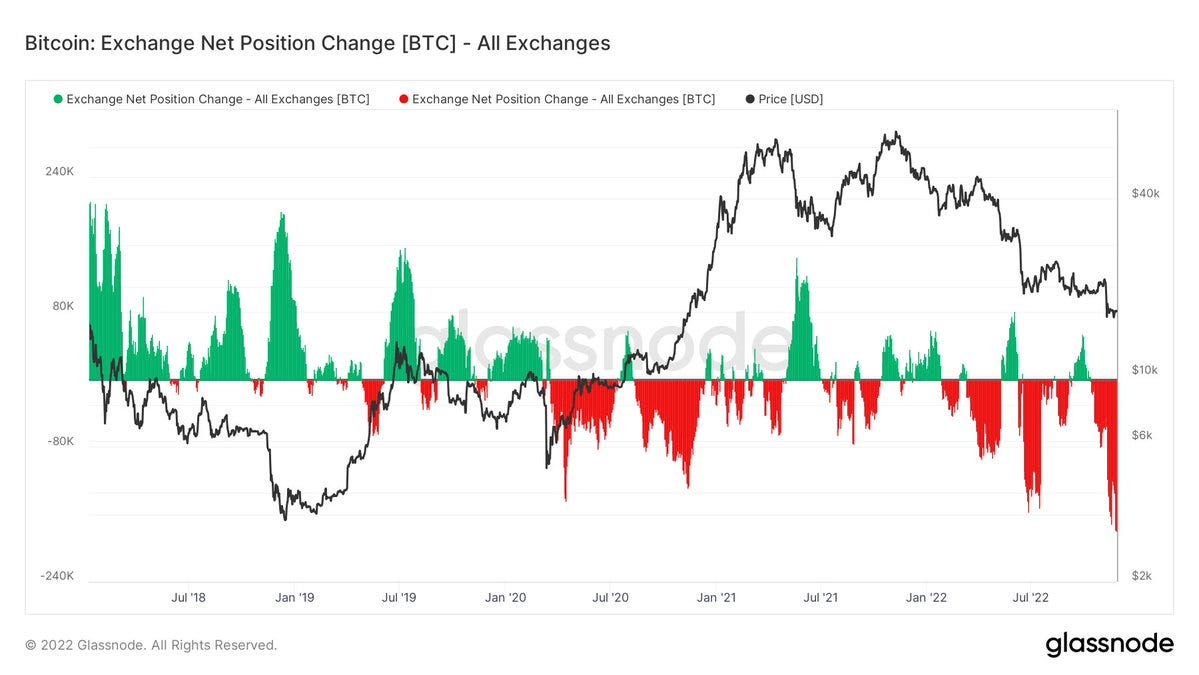

179,250 bitcoin have been withdrawn from global exchanges over the last 30-days.

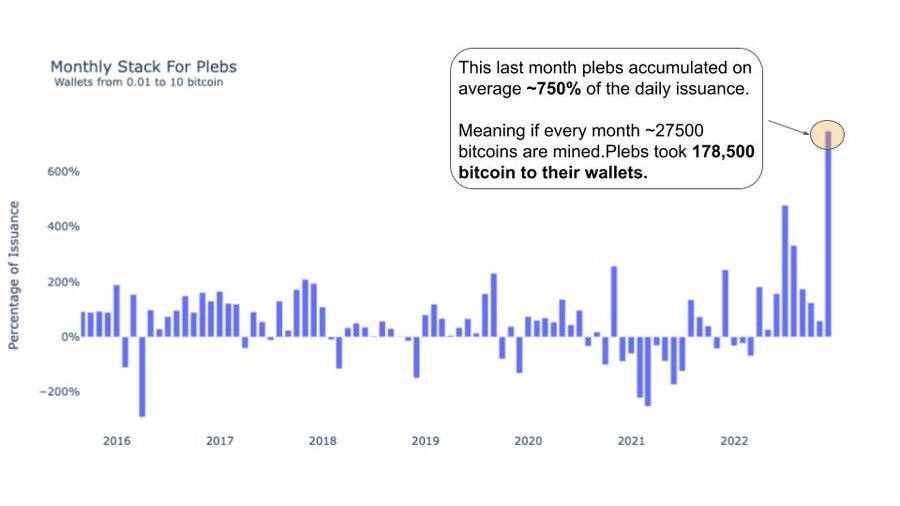

In the last month The “plebs”, or wallets from 0.01 to 10 bitcoin, have accumulated 178,500 bitcoin in the last 30 days. An equivalent of the mined supply for 7.5 months.

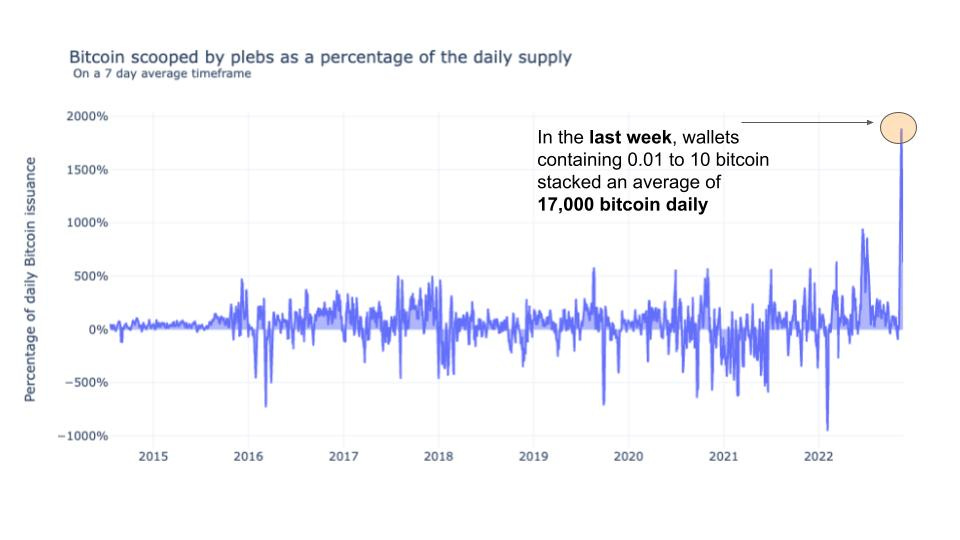

One of these weeks, an incredible amount of ~17,000 bitcoin per day changed hands directly to pleb wallets.

Have a great weekend niblings.

Stay humble & stack sats.

Want to learn how to buy bitcoin?

If you are in Europe, I made a pretty simple guide with 3 steps, which avoids you having to set up an account on an exchange, give them all of your personal information, plus custody of your funds.

Did you find value on this? You want to contribute to Uncle Bam?

Then feel free to donate, a cup of coffee would be highly appreciated.

But more importantly, share this with your friends and family..

Lightning Address: rustybeam47@walletofsatoshi.com