WTFBitcoin Week 49,2022

Bitcoin is the key to an energy abundant future.

TLDR: Bitcoin helps provides electricity to rural area in Kenya, Plebs continue stacking as if there was no tomorrow.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

Bitcoin adoption continues with surprises as it showcase how it can help the developing world and it seems that it is precisely them, who will be taking the lead into further the adoption and development of the ecosystem. We have previously talked how bitcoin could be in fact a good incentive for renewable energy creation, while at the same time a tool for prosperity for small towns with access to renewable but uncaptured energy, but not big enough to make a project economically viable.

Well this week Gridless, its the living proof of how bitcoin can make a hydro generator economically viable for its citizens even if the demand isn’t high enough due to the size of the population. The company provides energy to about 2000 people, powering a rural village in Kenya. Since the energy produced was more than the demand from the town, the citizens had to pay bills of up to $10 per month to have access to energy. Since using the excess hydropower to mine Bitcoin, it allows the company to give the 500 families lower rates of $4 per month, while still being profitable.

In short, bitcoin mining is taking a roll on a village prosperity by allowing to have electricity at reasonable prices and becoming energy sufficient.

THE NEWS!

1. Bitcoin in Africa is thriving, as the African Bitcoin Conference is featured on CNBC.

2. During the African Bitcoin Conference, Strike, the Lightning and Bitcoin-based payments app, announced that through a partnership with Bitnob, it can now facilitate global payments, starting with activation in Ghana, Nigeria and Kenya.

3. Gridless, a hydroelectric bitcoin mining firm focused on the East Africa region, has finished a $2 million fundraising round led by Stillmark and Block Inc., alongside an angel round led by Factor[e].

4. Demand for Bitcoin mining ASICs in Russia has "skyrocketed," says a Russian news outlet.

5. The Built With Bitcoin Foundation, led by Founders Ray Youssef and Yusuf Nessary, is set to open a new Bitcoin Technology Center in Ghana.

6. The goal of the education center, which planned on unveiling the facility on December 8, is to provide basic financial education regarding money, bitcoin and computers. Some of the courses to be covered include "Financial literacy: understanding money,” “Introduction to Bitcoin” and “Entrepreneurship.”

7. Ledger has announced a new, sleek hardware wallet called Ledger Stax.

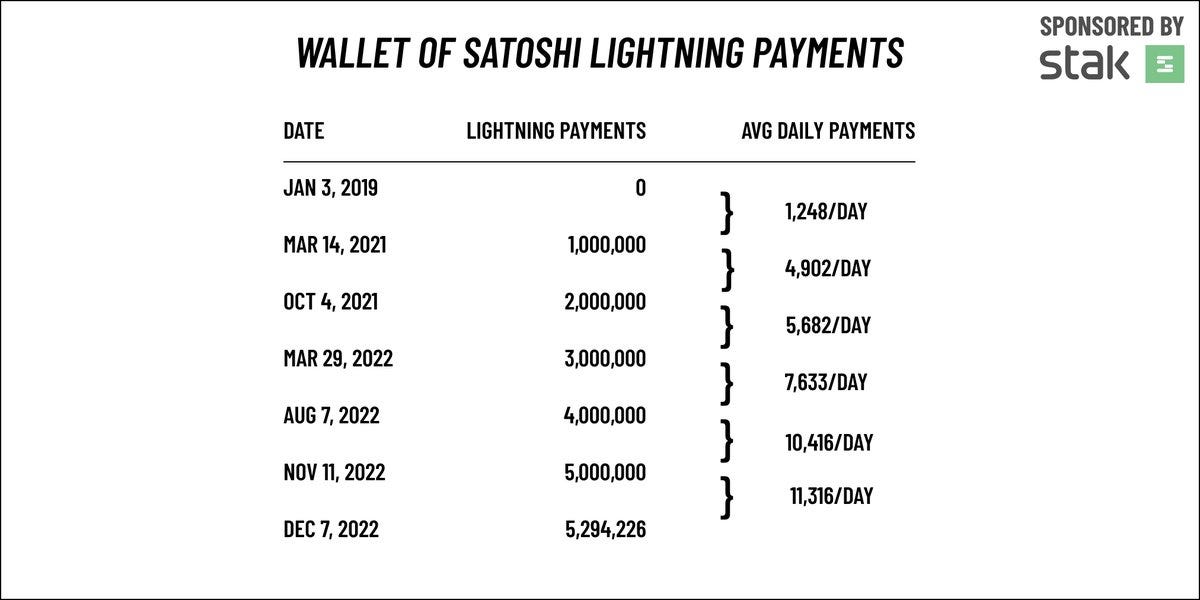

8. Lightning payments on Wallet of Satoshi have doubled in just the last year, and are now regularly topping 11,000 payments/day.

9. The OrangePill App becomes more accessible as it adds Lightning Payments for its subcription payment method. Now you can anonymously sign up and meet bitcoiners around your area.

10. Spiral announced Justin Moeller as their new Fedimint grantee. Justin will work on database integration and mitigation while helping build Fedimint’s core consensus protocol.

11. @smartmouse_ released code allowing you to run a bitcoin full node on an Android phone.

12. Cashu, a Chaumian Ecash wallet and mint with full Bitcoin support, is now available for everyone via LNbits. With it, it is now possible to have untraceable Lightning wallets for everyone.

FUNDAMENTALS

Is the bottom is near? This is a question many people have, but hopefully some on-chain metrics could give out some signal.

The rational root shared this week a chart which accounts the price where a percentage of supply was last moved. In here we can see two different prices at which 4% and almost 8% of the total supply moved which is considerably higher than any other prices, around $3,000 and $16,000 respectively. The first is in retrospect a clear display of 2018’s top, while the latter could be related to the previous market top, and the price nowadays. Interestingly 90% of the movements in this price were made in 2022.

Although this isn’t any guarantee of a market bottom, it makes us wonder what is happening at these prices? The move is clear, but where are this coins heading to? Could it be an exchange? Institutions? Or what about whales?

The next two charts might shed some more light on this topic:

In the last 30 days, the wallets containing 0.01-10 bitcoin had seen an increase approximately of 248,400 bitcoin, which amounts more than 9 times the monthly issuance. To answer the previous question more clearly, bitcoin demand has never been higher from small players or the so called “The Plebs”.

In fact, if we see the data on a yearly basis, this wallets have accumulated ~673,000 bitcoin which is just a little less compared to 2017. But let’s keep in mind that 2017’s bitcoin issuance was double, and bitcoin price was under $3000 for more than half the year. This year, the price has held over $20,000 for most part of it, meaning there is much more conviction needed for the plebs to accumulate this amount of bitcoin.

Lastly, bitcoin magazine, just reported a record low of number of bitcoin in exchanges of ~2.3M, which in a concluding way it means:

Plebs are displaying conviction and undergoing an unprecedented accumulation.

Both both plebs, and whales are taking self custody more seriously.

Bitcoin interest is not dead, and these prices are a great long term opportunity, the plebs know, uncle Bam knows, and now you know it too.

Have a great weekend niblings.

Stay humble & stack sats.

Want to learn how to buy bitcoin?

If you are in Europe, I made a pretty simple guide with 3 steps, which avoids you having to set up an account on an exchange, give them all of your personal information, plus custody of your funds.

Did you find value on this? You want to contribute to Uncle Bam?

Then feel free to donate, a cup of coffee would be highly appreciated.

But more importantly, share this with your friends and family..

Lightning Address: rustybeam47@walletofsatoshi.com

The Africa news is turning into living proof of the power of Bitcoin. The poor, the oppressed, and the plebs worldwide. Using and stacking, leading the charge.