2021W16 - WTF has happened in bitcoin this week?

Bitcoin is accessible

TLDR: Bitcoin nose dives below $50,000, more than 77 million get access to bitcoin through Venmo, OKEx adds bitcoin lightning support, We are still bullish.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

Last week, minutes after publishing WTFBitcoin2021W15 issue, your dose of weekly bullish news, everything was looking optimistic. We had consolidated around $60,000, to suddenly start dropping and reaching “low” prices close to $47,000.

So what happen?

First of all it is important to mention that every bitcoin bull market, has had corrections. In the previous runs, we have seen anything from 15% to 40%. This time was no different. The only thing we can do, is take our must educated guess on what could have caused it.

Our main guess is two main reasons, even though at the end of the day the reason is simple, more sellers than buyers:

A drop on hash rate around 20% or slightly higher.

A total of $10.1 billion liquidations on Sunday.

The first point was due to a blackout in China which caused miners to be turned off

The interesting thing is that many of these sellers, did not want to sell, but they were forced to. They had irresponsible long positions, which basically means they are borrowing money from an exchange in order to buy bitcoin, with the hopes of selling it for a higher price, and banking the profit. The horrible part happens when their exposure was too big, and a little dip takes a huge impact in their portfolio being forced to sell bitcoin and their collateral to pay back the debt to the exchange. This in turns generates a chain reaction of undesired sells. In addition there could be whales selling, and of course, or beloved peers new into bitcoin getting shake out of their positions due to fear.

This does not necessarily means we are bearish, in fact, your uncle Bam explains in this thread why the future is still looking bright.

And this is how the week started.

Your uncle Bam bought the dip. Sorry not sorry.

Li Bo, deputy governor of the Central Bank of China, said that crypto assets such as Bitcoin should be used as investment tools or alternative investments.

Bill Miller, value investor legend, fund manager, philanthropist, calls himself a Bitcoin maximalist.

In an interview of Bank of America, 16% of these bankers do not believe bitcoin in a bubble, this outstanding at these prices, specially if we contrast with some time ago, when 100% of bankers believes this was “funny money, with no intrinsic value”.

Time magazine has now began to accept bitcoin for subscriptions in United States and Canada.

The bitcoin exchange OKEx has integrated the Lightning Network for withdrawals and deposits.

The average cost of bitcoin transactions will come down to "less than 0.01 cents" and time to "1-3 seconds".

“Institutional investors are buying bitcoin in the dip.” -NYDIG.

This suggest an increasing comfort with Bitcoin ’s volatility. We start to see institutions behaving like “stackers”, just accumulating with conviction.Venmo’s 77 million users can now buy, hold, and sell bitcoin with as little as $1.

WeWork will begin accepting payment in bitcoin and hold it on its balance sheet.

Starting the 23rd of April, online music store Beatport will start accepting bitcoin as payment for songs.

The Mayor, Scott Conger, from the city of Jackson, Tennessee is now considering mining bitcoin and adding it to their public balance sheet.

“Bitcoin mining could encourage investment in solar systems, enabling renewables to generate a higher percentage of grid power with no change in the cost of electricity" - ARK Investments.

Ark Investment in conjunction with Square Crypto had publish a white paper, arguing that bitcoin is a key driver for renewable energy’s future.

Gemini users can now buy bitcoin with Apple Pay and Google Pay.

FUNDAMENTALS

I understand this could have been a hard week for many, but it is important to reiterate that nothing has changed regarding bitcoin, and this is a good thing. I am sure many would be wondering “So where do we go next? What happens now with bitcoin?”

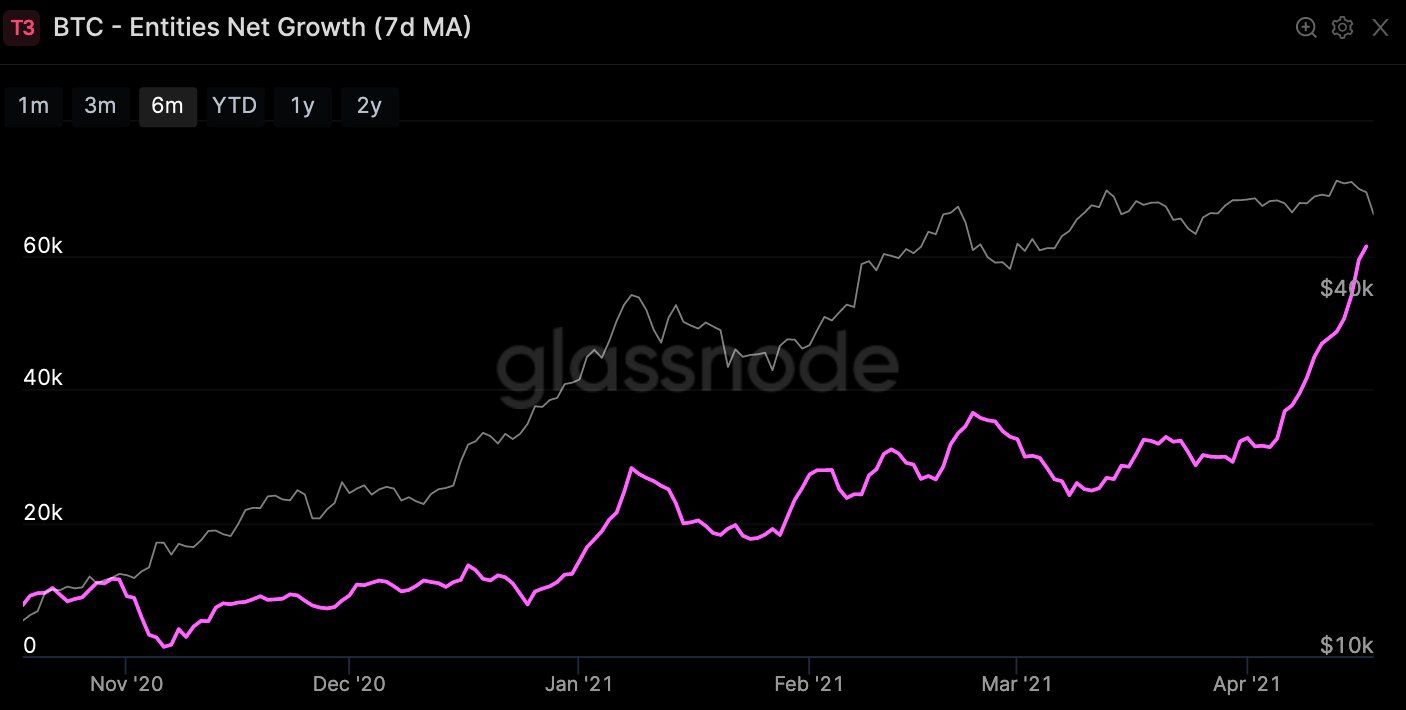

Willy Woo shares an image showing us the unprecedented growth of new users arriving onto the network daily.

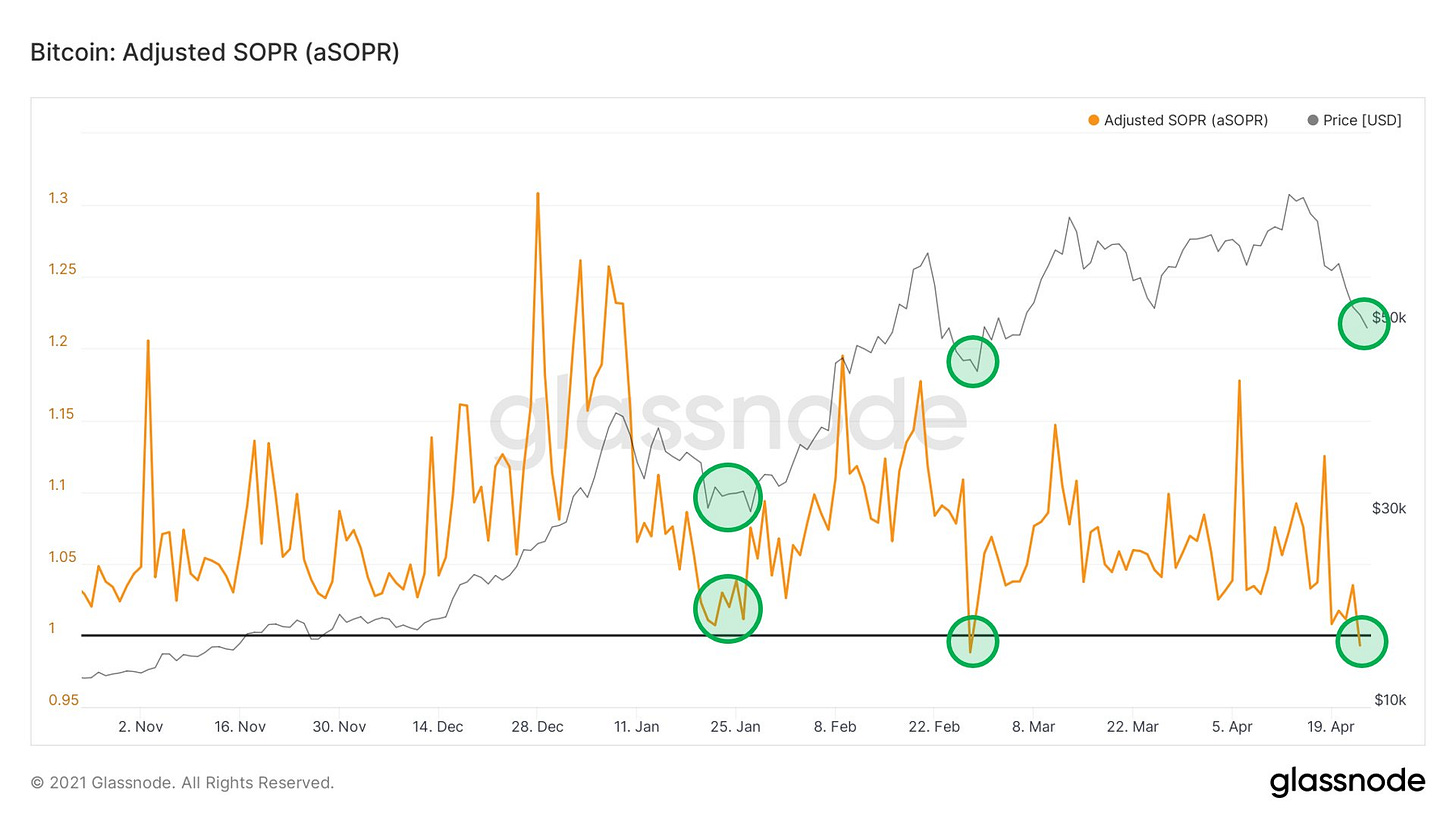

William Clemente shared with us an update of the adjusted SOPR (spent output profit ratio), where it shows a retraction to sub 1. This indicates market participants are in a net loss. While in a bull market, the SOPR metric usually stays above 1, and when it comes back to these area, it normally means we are due for a massive appreciation.

Additionally, we can see the technical metric, RSI (Relative Strength Index). This metric is used to see if an asset is overbought or oversold. At the moment, is about to indicate oversold, and it has come to levels not seen since March 12, when we had a 50% plunge. This is another “buy” signal for many.

As a summary note..

Everything is running smoothly. Bitcoin is resilient, it can’t be stopped. It moves freely up and down discovering it’s worth in the free market. Some days it will fill us with excitement, and some others it could dread us with fear. The most important thing is to do our own research and have the knowledge of what we own; an unconfiscatable, decentralized and censorship resistant digital asset, sound money.

You know what they say, whenever in doubt, just zoom out. Well niblings, uncle Bam comes now another one to remember, when confidence lacks, remember who stacked.

just as Micro Strategy, Rai Dalio, WeWork, ME, hopefully YOU, and the list just goes on and on. Getting nervous when you are holding an investment that sees a wild swing, is normal. And this is why Uncle Bam is here, to bring you conviction. To remind you, that the best strategy and mindset to have in Bitcoin, is the famous phrase “stay humble & stack sats”. This is a simple DCA (Dollar cost average) strategy to even out the purchase price, and do not worry about the actual price. At the end of the day, bitcoin is artificially designed to appreciate forever.

Have a great weekend niblings.

Stay humble & stack sats.

You want to contribute to WTFBitcoin?

Feel free to donate. But more importantly, share this with your friends and family..

Reference:

In thread.

https://www.cnbc.com/2021/04/13/bitcoin-is-a-bubble-say-74percent-of-bank-of-america-survey-respondents.html

https://www.theblockcrypto.com/linked/102166/time-magazine-bitcoin-digital-subscription-payments

https://www.theblockcrypto.com/linked/102140/bitcoin-lightning-network-okex-goes-live

https://www.coindesk.com/institutional-investors-bitcoin-buy-the-dip-nydig

https://www.prnewswire.com/news-releases/introducing-crypto-on-venmo-301272010.html

https://decrypt.co/68480/wework-now-accepting-bitcoin-and-other-cryptocurrencies?amp=1

https://www.beatportal.com/news/beatport-to-accept-bitcoin-announces-first-ever-nft-audio-visual-collection/

Our research suggests Bitcoin is key to an abundant, clean energy future. Don't miss this white paper and open-source model from the ARK research team and @Square!⬇️If bitcoin needs anything, it’s more white papers. In this one, @Square and @ARKInvest team up to argue for bitcoin as a key driver of renewable energy’s future: https://t.co/UmayxNtCFJ Hate reading? Here’s the nutshell version:

Our research suggests Bitcoin is key to an abundant, clean energy future. Don't miss this white paper and open-source model from the ARK research team and @Square!⬇️If bitcoin needs anything, it’s more white papers. In this one, @Square and @ARKInvest team up to argue for bitcoin as a key driver of renewable energy’s future: https://t.co/UmayxNtCFJ Hate reading? Here’s the nutshell version: Square Crypto @sqcrypto

Square Crypto @sqcryptohttps://www.investing.com/news/cryptocurrency-news/gemini-users-can-now-buy-bitcoin-with-apple-pay-and-google-pay-2484039