TLDR: Bitcoin Crosses $60,000, New Bitcoin ETF Filings, Rumors of Approving Bitcoin ETF, Miners Onwards To Increase Their Hash Rate, U.S. Becomes Bitcoin Mining Epicenter.

Hey there niblings, it’s uncle Bam again, with a summary of the most insightful events in the Bitcoin space. Back at it again digesting all the important news for you.

"I should have bought more bitcoin". - Everyone.

As the price spikes up and crosses $60,000 for the first time since April, it is hard not to feel the excitement and even the fear of missing out, even if you stacked as much as possible, the feeling is aways there.. I should have bought more. A famous thought which always comes in moments of sudden appreciation. But it is not too late, in fact we are still in the early innings of this financial revolution, and just thinking of the potential ahead of us, it blows my mind, and I keep responsibly stacking.

Bitcoin is a volatile beast, it is known, hence it is almost impossible to attribute the price action to a single event, and this is the reason why I bring you a consolidation of news every week. “Why has the price run up so much?” Well, there are certainly rumors running around about the first Bitcoin ETF in the U.S. being approved this next week. Is this good for bitcoin? Well everything is good for bitcoin, even though it is speculated that this could help Wall Street to manipulate the price of the asset, it also brings validity and acceptance of bitcoin at a mainstream level, and here my job, and yours as well, to share the education to your family and friends to take sovereignty of your money and claim your keys.

If you don’t have direct control of an asset, you don’t really own it. That is why we Bitcoin. - A bitcoiner.

While we share the excitement of the appreciation, lets take a look how our investor friends are doing:

Elon Musk’s Tesla is now over $1 billion in the green on its Bitcoin investment as the price nears $58,000 for the first time since early May.

MicroStrategy has officially doubled its money on its Bitcoin investment. The company’s $3.16 billion in Bitcoin is now worth $6.7 billion.

Jack Dorsey’s Square has officially doubled its money on its Bitcoin investment. The company’s $220,000,000 invested in Bitcoin is now worth over $470,000,000.

MassMutual, Massachusetts-based insurance company’s $100 million bitcoin purchase in December 2020 is now worth more than $300 million.

Uncle Bam, content creator from WTFBitcoin has officially become a WholeCoiner and later proceed to lost his keys in a boating accident.

El Salvador population have experienced an appreciation of 20%-45% from downloading Chivo Wallet. The country continues to have its balance sheet appreciating, and its people have started paying attention into Bitcoin, as the number goes up.

And this is how the week started.

1. BlockFi, the lending platform, filed to offer a bitcoin futures exchange traded fund (ETF).

2. Bitwise, files for physically backed Bitcoin ETF, and explained their filing's rationale, sharing that the SEC can now approve an actual Bitcoin ETF, not only futures one.

3. Purpose Investments, an institutional firm with more than $12 billion under management, on Wednesday announced the launch of mutual fund units for the world’s first ETF backed and settled by Bitcoin.

4. Miami will issue a request for proposal this month to help create the BTC payment mechanism.

5. CleanSpark, a sustainable bitcoin mining and diversified energy company, has announced their purchase of 4,500 Antminer S19 bitcoin mining machines using some of the company's bitcoin reserves. The company already hosts over 10,000 miners, and these new miners, which will be delivered next month, would be adding an extra 45% of mining capacity.

6. Stronghold Digital Assets has officially launched its Nasdaq IPO of 5,882,352 shares of Class A common stock at an anticipated price of between $16 to $18 per share. The company chose to undergo the traditional listing route, through an actual IPO and taking the ticker symbol "SDIG", instead of the popular direct listing and SPAC avenues.

7. Russian President Vladimir Putin made new comments suggesting a growing tolerance for Bitcoin and cryptocurrencies during an interview with CNBC that was posted on the Kremlin’s website Thursday.

8. Bill Miller, the billionaire investor and Miller Value Partners CFA, continued to tout Bitcoin in a new conversation with author William Green, hinting that it is less risky to invest in bitcoin at $43,000 than $300.

9. Alex Crognale, from Birmingham Legion, became the first-ever USL professional soccer player to get paid in bitcoin, as he cited concerns over the excessive money printing by central banks.

10. Bakkt, a Bitcoin and crypto marketplace and custodian, announced a partnership with Google to extend the reach and usability of digital assets to meet rapidly evolving consumer demand.

11. Bitstamp and ZEBEDEE announced a partnership that will allow customers to instantly top up their in-game ZBD wallet and use it as a lightning wallet. While Bitstamp allows customers to move bitcoin to the ZEBEDEE ecosystem, users are now able to use their bitcoin across different virtual gaming environments.

12. Stripe, payment processor company, is building a bitcoin and crypto team to help their platform “support crypto use cases.”

13. Strike, The Lightning Network payment platform, has announced its newest feature, Pay Me In Bitcoin. This new feature allows users to programmatically convert a portion of or all of their salary into bitcoin while the employer needing only their bank account and routing numbers.

People have already been sharing in Twitter, pictures of them setting up 100%

FUNDAMENTALS

PlanB, famous for his contribution to the space with the Stock2Flow model and sharing his predictions on the bitcoin price, has shared with us some wizardry a few months ago.

By describing his model of worst case scenarios, he argued back in June, as price was below $34,000 the outlook of his undisclosed model.

”Bitcoin is below $34K, triggered by Elon Musk's energy FUD and China's mining crack down. There is also a more fundamental reason that we see weakness in June, and possibly July.

My worst case scenario for 2021 (price/on-chain based):

Aug>47K, Done

Sep>43K, Done

Oct>63K, We are getting there..

Nov>98K,

Dec>135K” - PlanB

As a summary note..

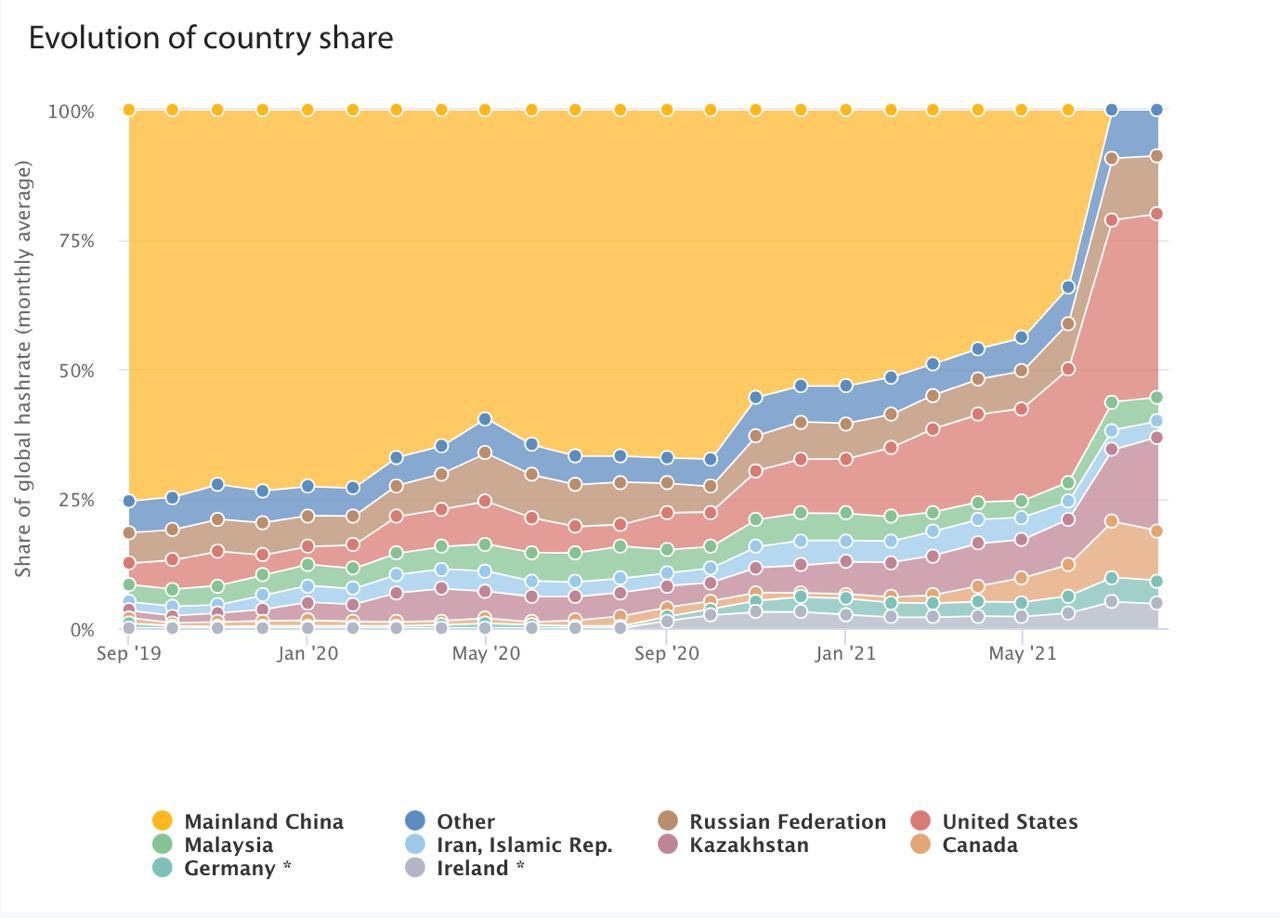

The United States has become the epicenter for Bitcoin Mining, accounting for 35.4% of the global hash rate by end of July 2021, according to a Cambridge Centre for Alternative Finance study. Only since April of this year, the mining industry took a huge turn:

U.S. increases from 17.77% to 35.4% of controlled global hash rate

China decreases from 43.98% to virtually 0% controlled hash rate

Interestingly, China had 75% of the hash rate in 2019. This will likely be a wrong geopolitical move made by China, to be spoken in history books, as they let go the leadership of Bitcoin Mining.

Have a great weekend niblings.

Stay humble & stack sats.

Did you find value on this? You want to contribute to Uncle Bam?

Then feel free to donate, a cup of coffee would be highly appreciated.

But more importantly, share this with your friends and family..