2021W8 - WTF has happened in bitcoin this week?

Bitcoin is finite, don’t let go off them

TLDR: Bitcoin rally might not be over, it continues to be acquired by institutions at a fast rate.

Hey there niblings, its uncle Bam again, with a summary of the most insightful events surrounding Bitcoin.

This week is a great one in my opinion. We have a dystopia, a combination of incredibly good news, with mixed feelings due to current bitcoin’s price action. If we were to focus solely on the price, I have seen doubters wondering if the “hype” or the “bubble” is over. Have we reached the top? Where do we go from here? Well uncle Bam is not a wizard but can tell you one thing: This is not over yet.

The price action was interesting, bitcoin rose last week to an ATH of ~$58,000.00, and dropped down all the way to a low point of ~$44,000.00 that is close to a ~25% volatility. Indeed, these movements can be scary at times, and could make people consider letting go of their positions. But we are here to show you the good news and fundamentals to help with conviction.

Last week in WTFBitcoin we told you that Michael Saylor announced that he raised $1.05 billion with the purpose of buying bitcoin. This week, he laid out the news making us understand:

“You really think we are done with this? You really thought this was over? We will buy all Sats off you if you let us. With ‘we’ I mean MicroStrategy, myself and fellow institutions” - Bam’s Interpretation

Correct, Saylor made a purchase of additional 19,452 bitcoins for ~1.026 billion at an average price ~$52,765 per bitcoin, adding up to a total position of 90,531 bitcoins acquired at an average price of ~$23,985 per bitcoin.

This same week Square announced their outstanding results for the 4Q of 2020, and sharing with us an outstanding increase in their bitcoin position. They purchased ~3,318 bitcoins at an aggregate purchase price of $170 million. Combined with Square’s previous purchase of $50 million in bitcoin (~4709 BTC), they hold a total of 8,027 bitcoins. Worth to note that they paid 3 times the price for less than their initial number of bitcoins acquired in November.

Two companies just took out 22,770 bitcoins out of the market, an equivalent of 0.1% of the total supply, or over 25 days of mining supply.

And this is how the f*#$ing week started:

1. MicroStrategy announced an additional purchase of ~19,452 bitcoins for ~$1.026 billion in cash at an average price of ~$52,765 per bitcoin. Holding a total of ~90,531 bitcoins acquired for ~$2.171 billion at an average price of ~$23,985 per bitcoin.

2. Square has purchased ~3,318 bitcoins at an aggregate purchase price of $170 million. Square currently holds a total of 8,027 bitcoins acquired at an average price of $27,407 per bitcoin.

3. Square reports $4.57 billion in bitcoin sales for 2020 via Cash App. Profit was only $97 million, representing a growth of over 12 times compared to previous year.

4. According to Business Insiders report, around 100 million people are currently using or have used bitcoin. Michael Saylor says we expect the number to be 1 billion in five years. This is a 10x increase and would mean ~14% of the world’s population.

5. Khurram Shroff, chairman of Dubai’s IBC Group, who is the poster child of blockchain technology in the Middle East, said he has pledged 100,000 Bitcoin - current value of $4.8 billion - to set up the Miami 2.0 Blockchain Strategy Foundation and other related joint venture projects. – Arabian Business Industries

6. The Canada Bitcoin ETF, which came public last week, has already collected $421m in assets in its first two days.

7. Sunayna Tuteja has became the Chief Innovation Officer at the Federal Reserve. Interesting to point out that she is a bitcoiner.

8. “In emerging markets that are facing a currency crisis, bitcoin prices can actually shed light on the informal market for U.S. dollars. In Argentina, Latin American crypto exchange Bitso listed the bitcoin price at 8,700,993 Argentinian pesos on Friday, which converted to a whopping $98,000 using the official exchange rate” – Coindesk

“Bitcoin is more and more being seen as an insurance against fiat currency in emerging markets.” - Bam

FUNDAMENTALS

9. Willy Woo shows us how a nice visualization setting a mark in time when US corporations, led by MicroStrategy, started buying and considering bitcoin as a treasury asset. This is compared with gold’s price simply as a reference.

10. Juan Rodriguez shares an update on the SOPR metric, referencing it as a good short/medium time indicator, showing how the number retraced back, meaning people took profits and at bitcoin price of $44.3K people, on average, would start selling at a loss. This could indicate bitcoin could be ready for another run up to the recent ATH, or could simply oscillate around $50K.

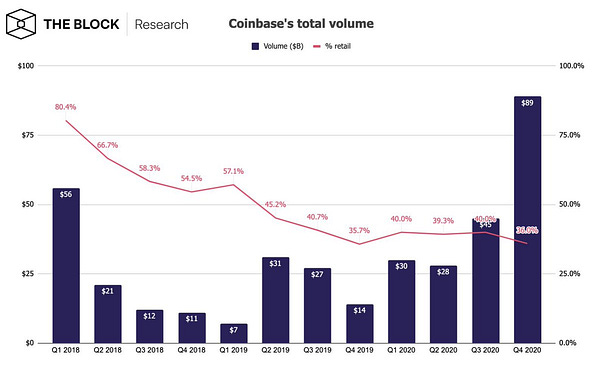

11. Finally, comes one of my favorite charts shared by THEBLOCK. This chart could indicate us that this current bull cycle has been led up by corporations. The total purchase volume has been mostly taken up by corporations compared to the end of the previous cycle. The way I think of this, is that we are not close to being in a cycle’s top. We might see retail rushing up and entering in a mania phase before we find the top of this cycle.

As a summary note…

Being involved in the space might get you wondering, How far can we go? Are we all involved yet? We just saw that 3 million people bought bitcoin in the US just this year, and 1 million new users bought bitcoin for the first time through CashApp, and yet the media shows a different picture.

It could be that the profiles interviewed for this poll come from a different segment of society, perhaps an older and more conservative generation? It could even been manipulated, but regardless, one way to interpret this is also the following:

“It is still early to get involved in bitcoin. The rally is not over yet. Institutions have come and led the run, but retail is just starting to step in.” And as we love to say in WTFBitcoin..

Bitcoin is artificially designed to appreciate forever.

Have a great weekend niblings, and don’t let go of your sats.

Stay humble & keep stacking.

…

You want to contribute to WTFBitcoin?

Feel free to donate.

References:

1.

2.

3. https://www.theblockcrypto.com/POST/95882/SQUARE-BITCOIN-2020-CASH-APP-RESULTS

4.

6.

7.

8. https://www.coindesk.com/in-nigeria-one-bitcoin-can-cost-68000-heres-why

9

10.

Much wow, very mewn! when doge, sir?